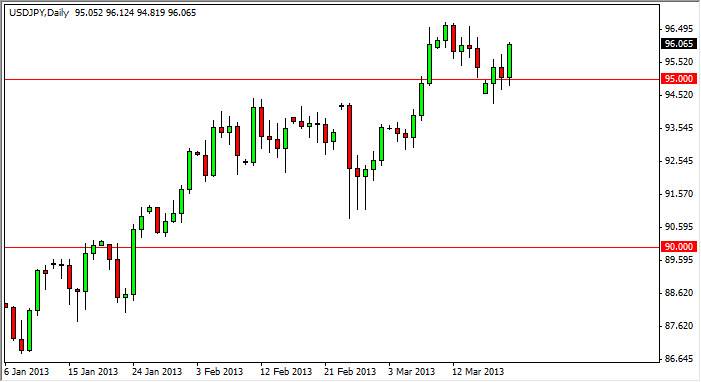

The USD/JPY pair rose during the session on Wednesday as the Federal Reserve reiterated its zero interest rate policy. It also had suggested that going forward we worn anywhere near a monetary tightening cycle, and as a result it was "risk on" yet again. In this particular scenario, quite often this pair will do fairly well. Further exacerbating the situation was the fact that a rumor was floated around the marketplace late in the American trading hours that the Bank of Japan was getting set to announce yet another massive asset purchase program.

While the market certainly would be expecting that, the rumors state that he could be in the next 24 hours or so. And on top of that, the rumor suggests that it is going to be much larger than anticipated. If that's the case, we could see continued Yen weakness going forward. Regardless, that's exactly what I expect to see anyways, so this move and/or rumor sits just fine with me.

100

I fully anticipate see this market heading towards the 100 handle in the relatively near-term. I think we will see this or the course of the next couple of months, as certainly the rate of acceleration in this pair has slowed down, but without a doubt the trend has been set. I don't think will be seen too many 200 pips days, but do see a nice slow and steady grind towards 100 seems perfectly logical to me.

In that type of market, it makes a lot of sense to continue to buy the pair every time it dips. There will be buyers stepping in this market, as they all know that the Bank of Japan will do what it can to devalue the Yen. On top of that, Mr. Bernanke has already suggested that he is perfectly fine with the Japanese work against the value of their own currency, and as such this is a one-way fight now. Previously, you could at least make an argument for the fact that the Federal Reserve was easing as well, but he has given the green light on the side of the Pacific for that move to happen.