For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

AvaTrade Editor’s Verdict

AvaTrade is a diverse and well-regulated multi-asset broker offering an extensive range of platforms, as well as a unique edge in options and futures trading. While less suited to advanced and high-frequency traders, I believe AvaTrade’s commitment to beginner education, paired with competitive spreads in a commission-free model, makes it a standout for traders seeking accessibility and simplicity.

AvaTrade Video Review

AvaTrade Overview

AvaTrade Overview - A Trusted Broker with Excellent Educational Resources

Headquarters | Ireland |

|---|---|

Regulators | ASIC, BVI, Central Bank of Ireland, FFAJ, FSCA, KNF, MiFID |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2006 |

Execution Type(s) | Market Maker |

Minimum Deposit | $100 |

Negative Balance Protection | |

Trading Platform(s) | Other, MetaTrader 4, MetaTrader 5, Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 0.9 pips |

Average Trading Cost GBP/USD | 1.5 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.29 |

Average Trading Cost Bitcoin | $39 |

Retail Loss Rate | 77.82% |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.9 pips |

Minimum Commission for Forex | Commission-free |

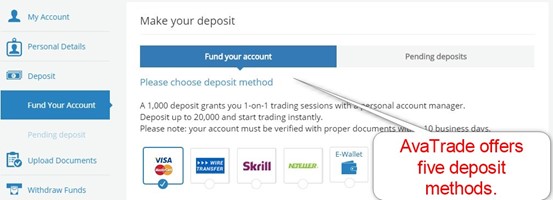

Funding Methods | 5(Bank wires, credit/debit cards, Skrill, Neteller, PayPalAvaTrade) |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

A long-established global broker, regulated across seven jurisdictions, AvaTrade offers access to a balanced portfolio of over 1,200 assets, including cryptocurrencies, stocks, options, and futures. The broker supports a broad range of trading platforms, including MetaTrader, a dedicated options trading platform, and its proprietary mobile app and social trading platform. It appeals strongly to newer traders through excellent educational resources, commission-free trading, and risk-management tools like AvaProtect.

Who Should Trade with AvaTrade?

Trader Type | Rating | Summary |

Newer Traders | 5/5 | An excellent educational hub (Ava Academy), intuitive platforms, and AvaProtect supporting risk-limited trading |

Copy Traders | 4/5 | Ava Social enables seamless copy trading but lacks the range of third-party integrations seen elsewhere |

Swing Traders | 4/5 | A wide asset selection across indices, stocks, futures, and options, ideal for swing traders |

News Traders | 3.5/5 | Trading Central integration, but no deeper macroeconomic analysis tools |

Automated Traders | 3.5/5 | MT4 and MT5 support for EAs, but no FIX API or deeper infrastructure for pro quants |

Investors | 3/5 | Futures and ETFs offer more flexibility than many brokers, but no direct share ownership |

Day Traders | 4/5 | Attractive commission-free pricing, though spreads aren’t as tight as top-tier ECN options |

Scalpers | 3.5/5 | MT5 and fast execution, but pricing and latency are not optimal for high-frequency scalping |

AvaTrade Highlights for [year]

- AvaTrade launches its dedicated futures trading service, Ava Futures

- AvaTrade expands into the UAE, making it a core growth market, and wins Most Trusted Trading Platform in UAE 2024 award and Best Trading Features UAE award for 2024.

- AvaTrade continues to promote the importance of in-depth education for beginners, where it ranks among the industry leaders.

- Investment Planning named AvaTrade the Best Broker of 2024.

- Reasonable commission-free trading fees from 0.9 pips or $9.00 per 1.0 standard round lot are offered.

- MT4 Guardian Angel plugin and the fee-based Ava Protect insurance policy, protecting against trading losses for beginners.

- Industry-leading beginner education via the Ava Academy.

- A well-balanced asset selection, including options, futures, ETFs, and cryptocurrencies.

- A high-paying partnership program featuring 70,000+ partners and $250M+ commission payouts

AvaTrade Regulation and Security

How Does AvaTrade Regulation Measure Up to the Competition?

At DailyForex we appreciate just how critical it is for you that you are placing your hard-earned cash in the hands of a well-regulated broker.

Brokers with at least one tier-1 entity will have a reputation to protect and will be more likely to provide the highest levels of oversight, transparency, and investor protection, across their entire operation.

Regulators like the FCA (UK), ASIC (Australia), or CFTC/NFA (US) impose strict rules relating to capital requirements, client fund segregation, and fair-trading practices. These are designed to minimize the risk of fraud and malpractice, while creating a trusted framework for traders. Tier-1 regulation gives you confidence that your funds are safe with a forex broker that is reliable, well-capitalized, and committed to operating under the most stringent global regulatory standards.

Number of Tier 1 Regulators:

AvaTrade | eToro | FXCM |

|---|---|---|

3 | 3 | 3 |

AvaTrade presents clients with seven well-regulated entities.

Country of the Regulator | United Arab Emirates, Australia, Ireland, Israel, Japan, British Virgin Islands, South Africa |

|---|---|

Name of the Regulator | ASIC, BVI, Central Bank of Ireland, FFAJ, FSCA, KNF, MiFID |

Regulatory License Number | C53877, SIBA/L/13/1049, 406684, 45984, 1662, 190018, 514666577 |

The regulatory environment at AvaTrade is outstanding and one of the most trusted industrywide. AvaTrade segregates client deposits from corporate funds and offers negative balance protection. Select jurisdictions also maintain an investor compensation fund.

Keep in mind that the trading environments in each of these seven jurisdictions differ greatly, as the relevant regulators have varying levels of stringency. I recommend, where possible, selecting the one that is best suited to achieving your trading goals. While most beginner traders will find each regulatory environment equally satisfactory, the British Virgin Islands or South Africa may be the best suited for committed, active traders requiring higher maximum leverage.

Does Avatrade Accept US Clients?

No, AvaTrade is not CFTC/NFA regulated and does not serve U.S. clients. North American traders may be better served with one of these US-regulated forex brokers for US citizens.

AvaTrade Fees and Commissions

How We Test Broker Fees

At DailyForex, we review broker fees by opening live accounts and trading multiple asset classes to assess spreads, commissions, and overall trading costs. We compare each broker’s fees against industry averages for major currency pairs. We also assess deposit, withdrawal, inactivity, and swap fees, rewarding price competitiveness and transparency. Learn more here.

How Do AvaTrade Fees Stack Up to Competitors?

Competitive trading costs are hugely important when choosing a forex broker, directly impacting your bottom line, especially if you are someone who trades frequently.

The EUR/USD pair is the most liquid and heavily traded currency pair, making it the best benchmark for spreads and commissions. Any forex broker that offers consistently low costs on EUR/USD will typically provide competitive pricing across other major, minor and exotic pairs as well. Lower costs mean that more of your profits stay in your pocket, and over time this can lead to significant savings, as less of your earnings are lost to fees.

Average Trading Cost EUR/USD:

AvaTrade | eToro | FXCM |

|---|---|---|

0.9 | 1.3 | 0.6 |

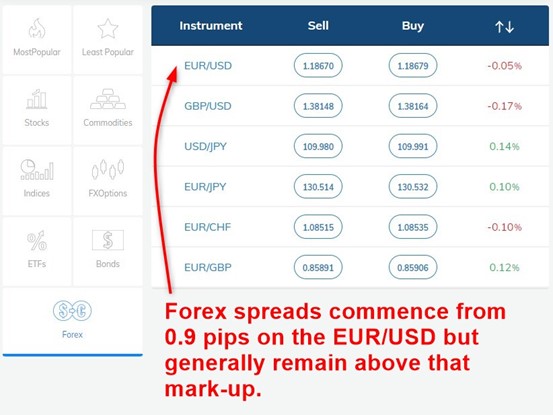

AvaTrade offers traders a commission-free pricing environment, but it comes with higher spreads. The EUR/USD starts with 0.9 pips or $9 per 1.0 standard lot.

Equity traders pay a minimum spread of 0.13%, also commission-free, and can achieve a competitive pricing environment on select assets, depending on their trading volume and duration. Index and commodity traders get the best offer, as trading costs here rank among the best industry-wide. Futures traders pay $0.75 for mini contracts and $1.75 for mini and standard contracts. An auto liquidation fee for futures of $10 per position also applies.

Average Trading Cost EUR/USD | 0.9 pips |

|---|---|

Average Trading Cost GBP/USD | 1.5 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.29 |

Average Trading Cost Bitcoin | $39 |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.9 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | $50 quarterly after 3 months |

AvaTrade Forex spreads remain relatively high compared to fully commission-based brokers.

Minimum Forex | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.9 pips (minimum) | $0.00 | $9.00 |

1.5 pips (average) | $0.00 | $15.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade and should be included when evaluating the total trading costs.

MT4/MT5 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-free AvaTrade account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.9 pips | $0.00 | -$7.58 | X | $16.58 |

0.9 pips | $0.00 | X | -$3.62 | $12.62 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.9 pips | $0.00 | -$53.06 | X | $62.06 |

0.9 pips | $0.00 | X | $25.34 | $34.34 |

Traders must consider if the product and services portfolio at AvaTrade warrants higher trading costs, which remains an individual decision. I also want to point out the recurring inactivity fee of $50 after three months of dormancy, faster than most brokers, but not an issue for active traders. After twelve months of inactivity, an administration fee of $100 applies.

AvaFutures

AvaFutures is a dedicated futures entity by well-known industry leader AvaTrade. Traders get the MT5 trading platform, which supports algorithmic trading, copy trading, and extensive customization options. Ava Futures charges $0.19 for micro and mini futures and $0.49 per standard contract, placing it among the most competitively priced futures brokers. Traders get eleven currency futures, two cryptocurrency futures, 23 commodities, energies, and metals futures, 21 index futures, and ten treasury futures. Ava Futures also pays up to 3% interest on free margin. Traders also benefit from free Level 2 data, while beginners get industry-leading educational content.

What Can I Trade on AvaTrade?

AvaTrade offers popular cryptocurrencies, like Bitcoin plus Bitcoin Cash, Litecoin, and Ethereum. The broker has 55 currency pairs, 16 cryptocurrency pairs, 27 commodities, 31 index CFDs, and 54 futures contracts. Equity traders get 614 assets and 58 ETFs, while 44 options and two bond CFDs complete the asset list. I like the asset selection as it remains a well-balanced choice of trading instruments, suitable for all traders.

Asset List and Leverage Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

AvaTrade Leverage

The leverage at AvaTrade depends on the regulatory jurisdictions. Most retail traders get a maximum of 1:30, in line with ESMA restrictions. Traders through the British Virgin Islands, South Africa, and professional clients qualify for maximum leverage up to 1:400.

AvaTrade Trading Hours (GMT)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:00 | Friday 24:00 |

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Commodities | Sunday 22:00 | Friday 20:59 |

Crude Oil | Sunday 22:00 | Friday 21:00 |

Gold | Sunday 22:00 | Friday 21:00 |

Metals | Sunday 22:00 | Friday 20:59 |

Equity Indices | Monday 07:00 | Sunday 19:59 |

Stocks | Monday 07:00 | Sunday 19:59 |

Bonds | Sunday 23:45 | Friday 20:59 |

ETFs | Monday 07:00 | Sunday 19:59 |

Futures | Sunday 24:00 | Friday 23:00 |

- Please note that equity markets open and close each trading and are not operational continuously like Forex and cryptocurrencies.

- I recommend the following step for MT4/MT5 traders to access trading hours

- 1. Right-click on the desired symbol in the Market Watch window and select Specification.

- 2. Scroll down until you see Sessions.

Account Types

I like that AvaTrade offers the same trading account to all traders. An option to qualify for a professional account exists, but the requirements remain high, per regulatory stipulations, and few traders will achieve this status. The minimum deposit is an acceptable $100, and the trading conditions warrant it. Leverage depends on the regulatory jurisdiction of the AvaTrade subsidiary, ranging between 1:30 to 1:400 for retail traders.

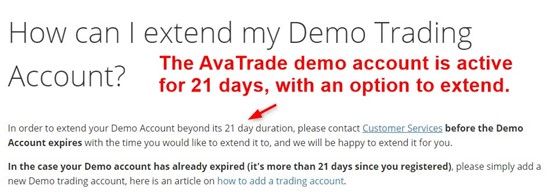

Demo Account

A demo account is available but restricted to 21 days, which is a little on the short side. However, potential clients can contact customer support to extend the trial or open a new demo account. I would like to see AvaTrade provide an unlimited demo account for beginner traders and anyone testing strategies and algorithmic trading solutions.

AvaTrade Trading Platforms

Every trader has their own style of trading and so access to a variety of trading platforms is useful because it allows you to choose the one that best fits your preferred strategies, tools, and experience level. Popular platforms like MT4, MT5, TradingView, and cTrader each offer unique features, such as advanced charting, automated trading, or social trading integrations.

In reality, each of these platforms provides all the main tools and features that most retail traders use. However, by offering a range of choices, including proprietary platforms designed in-house, a broker ensures that all different kinds of traders can benefit from a flexible and convenient trading experience. This variety and versatility allows you to switch between platforms as your strategies, capabilities, and requirements evolve.

Available Trading Platforms:

Platform | AvaTrade | eToro | FXCM |

|---|---|---|---|

MT4 | √ | x | √ |

MT5 | √ | x | x |

C Trader | x | x | x |

TradingView | x | x | √ |

Proprietary | √ | √ | √ |

AvaTrade offers traders access to MetaTrader (MT4 / MT5), a leader in algorithmic trading, equipped with an integrated copy trading platform. The broker also deploys its proprietary WebTrader and mobile app AvaTradeGO, with embedded Trading Central services, which can also be accessed via the MT4/MT5 trading platforms.

I like that AvaTrade invested in a proprietary social trading platform, Ava Social. Another nice touch is the options trading platform AvaOptions, dedicated to vanilla options trading. Futures trading is available on the MT5 trading platform in partnership with the CME Group and EUREX, with more futures exchanges coming soon.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

AvaTrade’s in-house developed risk management tool AvaProtect, insures against losing trades, for a fee, giving traders an additional way to hedge their risk.

Every asset AvaProtect covers is marked by a yellow shield, displayed between the bid and ask price.

How AvaProtect is activated:

- Select an asset covered by AvaProtect

- Click the AvaProtect icon

- Choose the duration of your protection

- Evaluate the fee and expiry date

- Execute your AvaProtect trade

The cost depends on the asset, expected volatility, and the duration of the protection. AvaTrade will display the fee, which it deducts from your account balance when you execute your trade. By taking the position, the trader agrees to the fee.

AvaProtect has 1-day and 2-day protection timeframes, with 1-hour, 3-hour, 6-hour, and 12-hour sub-periods. Traders pay a fee for the chosen protection period, and if they close their trade with a profit, they keep their earnings. Traders who close their position at a loss during the protection period get automatically reimbursed by AvaTrade but face the loss of their investment if they exit it after AvaProtect expires.

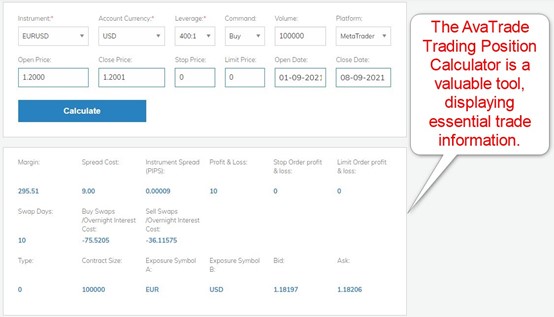

Another great feature of the AvaTrade offering is its integration of Trading Central services, ideal for beginner traders and those unable to conduct broad-based market analytics. I also like the Trading Position Calculator AvaTrade has on its website. It’s an excellent risk management tool, providing vital trading information and allowing traders to plan and maintain their portfolios.

Also worth noting is the superb transparency at AvaTrade, which ensures all necessary information for each trading instrument is publicly available on its website.

Ava Futures, which is AvaTrade’s dedicated futures trading offering on the MT5 platform, is another unique broker feature. Futures traders get 50+ contracts listed on the CME and EUREX with low contract fees between $0.75 and $1.75 per contract.

Research and Education

Quality research at AvaTrade remains limited to services by Trading Central, which I find an intelligent solution. It frees up resources and allows AvaTrade to focus on its core business while presenting clients with a trusted third-party solution. The AvaTrade blog features brief market commentary, but nothing as valuable as Trading Central.

AvaTrade shines when it comes to education and displays considerable care for beginner traders. The broker’s top-notch educational center, AvaAcademy provides a wealth of high-quality training materials, and it remains one of the best overall resources for new traders across the industry. AvaAcademy delivers approximately two dozen online trading courses, 150 lessons, and 50 quizzes, and I highly recommend beginner traders to take their time exploring this valuable resource.

(2) (1).jpg)

Customer Service

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |             |

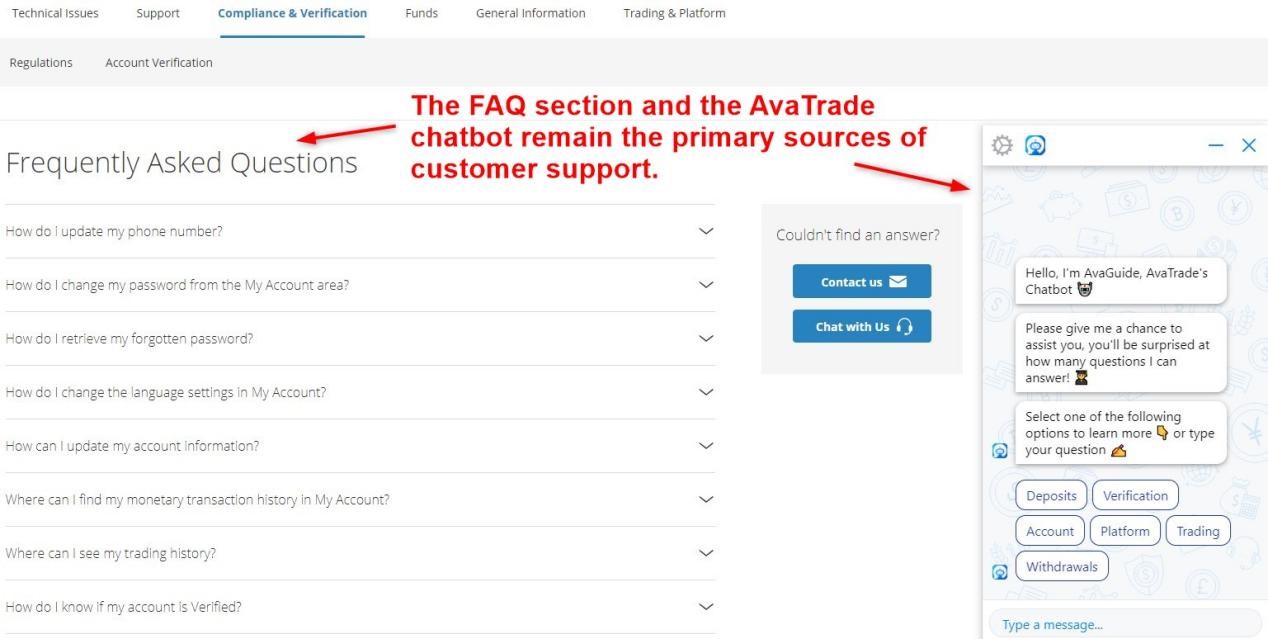

Customer support at AvaTrade consists of an FAQ section, a chatbot, email, and phone support, with the multi-lingual customer support team standing by during market hours. AvaTrade explains its products and services well, limiting the need for assistance. In cases where the need arises, AvaTrade ensures easy access to customer support.

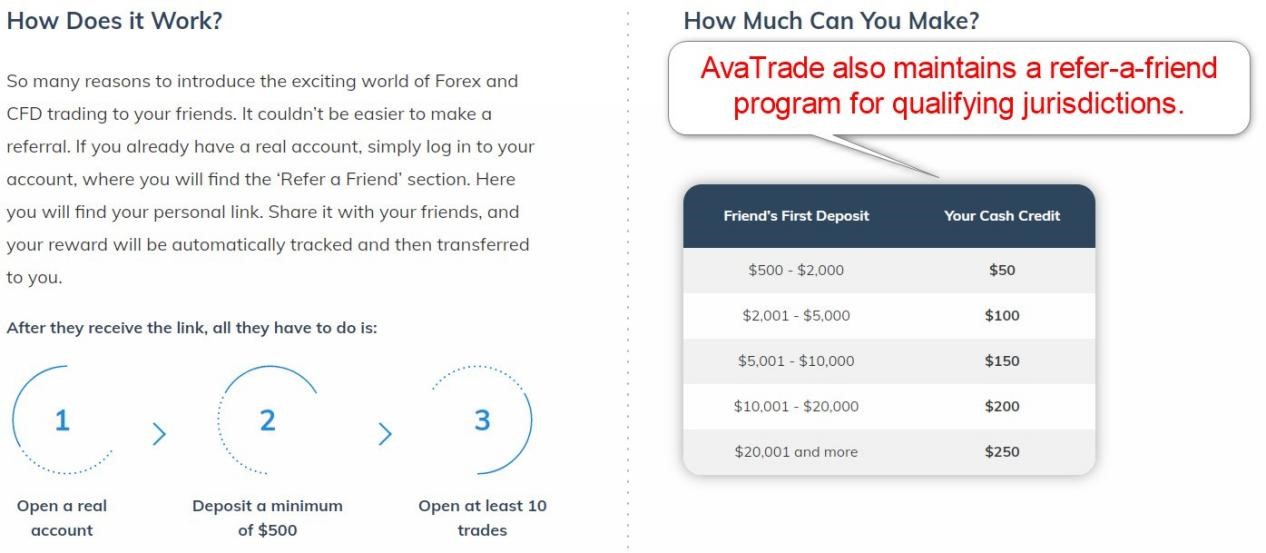

AvaTrade Bonuses

Bonuses and promotions at AvaTrade are available at select subsidiaries, depending on the regulator. Where available, AvaTrade presents traders with a deposit bonus and a refer-a-friend program. Terms and conditions apply, and I recommend traders read and understand them before requesting a bonus.

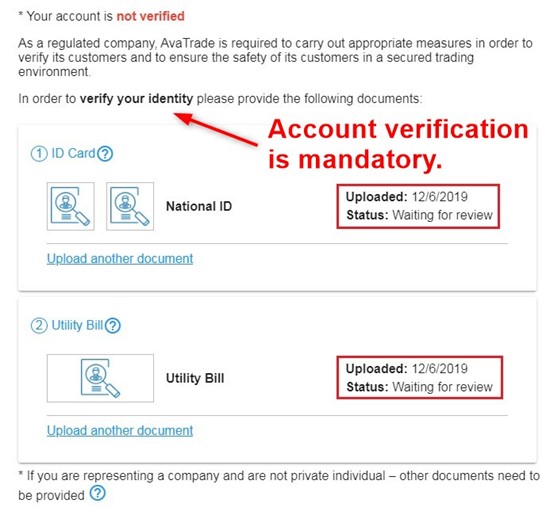

Opening Account

The account opening process at AvaTrade for international traders requires only an e-mail and password. Some jurisdictions may require additional information. As AvaTrade is a regulated broker, account verification is a mandatory final step, per AML/KYC stipulations. Most traders will be able to satisfy this requirement by sending a copy of their ID and one proof of residency document. I like the simplicity AvaTrade deploys here.

Minimum Deposit

The minimum deposit at AvaTrade is $100, a reasonable request but higher than at some other Forex brokers. I recommend depositing at least $200 to qualify for the deposit bonus and to facilitate better long-term portfolio growth.

Payment Methods

Withdrawal options |       |

|---|---|

Deposit options |       |

Supported Countries

AvaTrade caters to most international traders, including:

- UK

- South Africa

- Malaysia

- Canada

- India.

AvaTrade does not accept US traders.

AvaTrade Deposits & Withdrawals

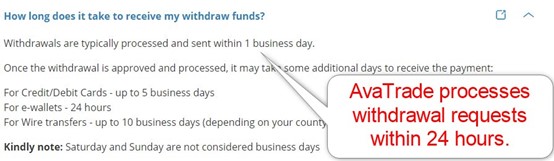

The secure back office at AvaTrade processes deposits and withdrawals. AvaTrade does not levy internal costs on transactions, but I recommend traders double-check with their preferred payment processor if third-party fees apply. While AvaTrade processes withdrawals within 24 hours, it may take up to ten business days for traders to receive their funds. The overall process remains swift, but I would like AvaTrade to add cryptocurrencies as an option.

Bottom Line

AvaTrade earns a strong recommendation for beginner to intermediate traders thanks to its diverse product range, wide selection of intuitive platforms, and education-first approach. While costs are slightly above ECN rivals, they remain very reasonable. AvaTrade also offers peace of mind with its strong, lengthy track record for transparency, regulation, and safety.

- Regulated in 7 different jurisdictions

- U.S. clients not accepted

- A wide asset selection including futures, options, and crypto

- Futures traders incur platform-specific fees

- A commission-free model that leads to slightly wider spreads

- An excellent educational suite (Ava Academy)

- AvaProtect and other value-added beginner-focused tools

How We Make Money

DailyForex generates revenue by publishing promotional materials from paying brokers and service providers, which has no impact on the objectivity of our reviews. Our mission is to offer clear, accurate, and transparent evaluations of Forex and CFD brokers, using a rigorous, data-driven approach. Our partners may be placed highly within certain areas of the site, but our broker ratings are always based on objective analysis. Find out more here.

FAQs

Is AvaTrade legitimate?

Yes, AvaTrade is legitimate. AvaTrade was founded in 2006 and became one of the most trusted and transparent Forex brokers worldwide

How long does it take to withdraw money from AvaTrade?

AvaTrade processes withdrawals within 24 hours, but it may take up to ten business days for traders to receive funds.

Is AvaTrade good for beginners?

AvaTrade is one of the best brokers for beginners due to its trading academy, SharpTrader.

Is it safe to trade with AvaTrade?

AvaTrade has seven regulators, extensive experience, and remains one of the most transparent brokers. Therefore, it is safe to trade with AvaTrade.

Which countries is AvaTrade banned in?

AvaTrade is not banned in any country but does not accept traders resident in Belgium, Cuba, Iran, Syria, the US, and New Zealand.

In which countries is AvaTrade available?

AvaTrade does not list available countries but accepts traders from 150+ countries.

Does AvaTrade need an ID?

AvaTrade complies with global AML/KYC regulations, making account verification mandatory. Therefore, after opening an account, traders must submit a copy of their ID and other verification documents, including proof of residency.

Can I deposit $10 with AvaTrade?

Yes, as the AvaTrade minimum deposit requirement is $10.

Is AvaTrade copy trading?

AvaTrade is not a copy trading service. It offers copy trading as part of its overall products and services portfolio through the in-house Ava Social and third-party copy trading providers DupliTrade and ZuluTrade.

How much is the minimum deposit at AvaTrade?

The AvaTrade minimum deposit is $100 or a currency equivalent.

Can I withdraw all my money on AvaTrade?

Traders can withdraw all their money from AvaTrade if they close all open positions, have no pending orders, and wait for trades to settle.

Is AvaTrade legal in the US?

AvaTrade does not operate in the US, has no US regulatory license, and does not accept US-resident traders.