For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

XM Review Editor’s Verdict

XM offers traders more than 1,000 competitively priced assets, excellent leverage, trading bonuses, plus a loyalty program and an upgraded MT4/MT5 trading platform. Should you take advantage of the trading environment at XM? Are there any pitfalls worth considering first? I set out a detailed researched review below to help you decide.

Overview

XM remains one of the most trusted names in Forex, with over ten million customers worldwide.

Cyprus ASIC, CySEC, DFSA, FSC Belize 2009 Market Maker $5 MetaTrader 4, MetaTrader 5, Proprietary platform 0.1 pips 0.2 pips $0.05 $0.19

XM Regulation and Security

XM Group (XM) is a group of regulated online brokers. Trading Point of Financial Instruments Ltd was established in 2009 and it is regulated by the Cyprus Securities and Exchange Commission (CySEC 120/10), Trading Point of Financial Instruments Pty Ltd was established in 2015 and it is regulated by the Australian Securities and Investments Commission (ASIC 443670), XM Global Limited was established in 2017 and is regulated by the Financial Services Commission (000261/27) and Trading Point MENA Limited was established in 2019 and is regulated by the Dubai Financial Services Authority (F003484).

XM’s regulation in Cyprus provides its clients there with a degree of investor protection, as CySEC maintains an Investor Compensation Fund which is empowered to award depositors who lose their accounts due to failure of a regulated firm an amount up to €20,000.

XM has been in operation as a brokerage since 2009, giving it a relatively long track record. Typically, it can be said that the longer a broker has been in business, the more reputable the broker should be held to be.

Like all Forex / CFD brokerages regulated in member states of the European Union like Cyprus, all clients of XM enjoy negative balance protection. This means that it is impossible for any client to lose more than the amount they have deposited with XM. The “tail risk” of an extremely large and sudden market movement, amplified by any leverage used, is borne fully by XM under this European Union regulation.

XM Fees

Average Trading Cost EUR/USD | 0.1 pips |

|---|---|

Average Trading Cost GBP/USD | 0.2 pips |

Average Trading Cost WTI Crude Oil | $0.05 |

Average Trading Cost Gold | $0.19 |

*Please note that payment methods vary between the XM entities. For further information, please visit the XM website.

The question of fees charged by a brokerage should always be paramount in the mind of anyone searching for the right Forex / CFD broker. In considering the question, all costs of doing business must be considered carefully. We can break the entirety of fees and costs into two separate sub-categories: fees which are incurred through opening and closing trades, such as spreads, commissions, and overnight financing; and incidental fees, such as charges imposed by the brokerage due to account inactivity, or transaction fees applied to deposits or withdrawals. The trading fee element is going to be most important by far so this should be examined first.

Looking at trading fees first, we begin with spreads and commissions, which should be lumped together as an all-in “round trip” cost covering the opening and closing of a trade. As XM offer a few different account types which charge slightly different fees, we will judge the trading fees of its most common account type, the Standard Account.

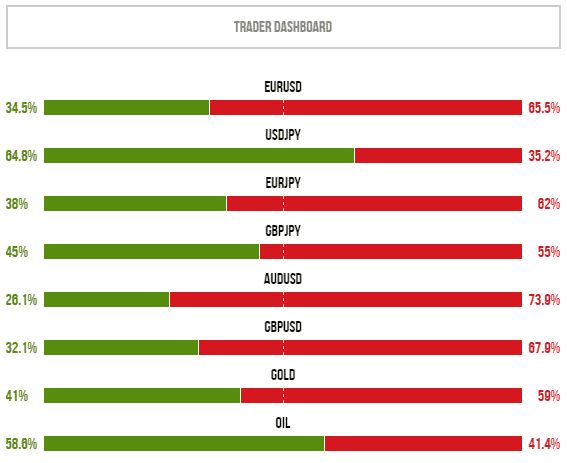

Forex Fees

XM provides commission-free Forex fees starting from spreads as low as 0.6 pips in the XM Ultra-Low Standard Account, which equals $6.00 per 1.0 standard lot, while the average is 0.8 pips or $8.00. It only applies to the EUR/USD, GBP/USD and the USD/JPY, while other currency pairs have higher mark-ups, ranging closer between 1.5 pips and 2.0 pips for the most traded currency pairs and well above that for minor and exotic ones.

Stock Fees

Trading individual stocks at XM is available with competitive to average stock fees. US shares carry a commission of $0.04 per share, twice as high better-priced options, but the minimum cost of $1 per transaction ranks among the lowest. UK and German shares show a stock fee of 0.10% with a minimum of $9 and $5 per order. The percentage-based charge is average, and the minimum cost highly competitive, especially for traders with smaller portfolios. The combination of the XM structure results in acceptable stock fees.

CFD Fees

XM provides traders with commission-free CFD trading, where all costs to XM remain included in the CFD fees. Traders should compare equity CFDs on an asset-by-asset basis with competitors to determine the total fees at XM. Given the lack of commissions, the average costs remain within a reasonable range.

Index CFDs remain reasonably priced, with the S&P 500 showing a minimum spread of 0.45 pips, placing it among the most competitive offers. Data on the lowest costs for gold and silver reveal 1.30 and 2.00 pip spreads, respectively. XM lists WTI Crude Oil with a minimum of 0.03 pips and the minimum price fluctuation as 0.01 pip or $1.00. For corn, both values are 0.01 and $0.04, respectively. Overall, XM implements an acceptable CFD fee, most favorable for traders with smaller portfolios and less trading frequency.

Non-Trading Fees

Non-trading fees at XM remain low. There are no internal deposit or withdrawal charges, but traders may face third-party costs. XM covers costs for deposits and all bank wire levies from XM banks on deposits above $200. Traders may still pay charges levied by their banks. XM also lists the potential of currency conversion fees in its terms and conditions without specifying them. It notes that it will publish any applicable costs in its Online Trading Facility in the Commission, Charges & Margin Schedule. A $10 monthly inactivity fee applies after 90 days of dormancy.

The average round trip cost of trading the benchmark EUR/USD Forex currency pair is 0.8 pips.

The average round trip costs of trading individual stocks, soft commodities, and equity indices are average for the industry.

Finally, data on the average round trip cost of trading the precious metals Gold and Silver shows that it is never below 30 cents for Gold and 3 cents for Silver.

It can be said that these levels of spreads and commissions are competitive for depositors of relatively low amounts. The minimum deposit required to open a Standard Account is only $5, so for traders depositing only a few hundred dollars or less, these fees will certainly be competitive. However, traders with considerably larger sums to deposit such as a few thousand dollars would be able to find more competitive alternative brokerage options within the industry, unless they wish to open an XM Zero account which has extremely competitive fees.

The next thing to consider as part of the fee structure is overnight financing, which is usually a net charge applied to every trade daily which is open at 5pm New York time, although it can sometimes be a payment. These fees are, at least theoretically, based upon tom/next fees applied in the intrabank market, but retail brokerages tend to offer relatively unfavorable rates which can make swing or position trading expensive, especially when buying into currencies with very low or negative interest rates. XM are open and transparent about their overnight financing rates, which is a good sign. XM state that their rates are based upon the bank market’s tom/next rates plus the XM mark-up. Comparing the rates offered at the time of review to the industry average, their overnight financing rates are relatively competitive, meaning that XM may be a good choice for traders who wish to hold positions open for periods longer than a day or two.

We end this section on fees by looking at incidental transaction fees, occurring through non-trading processes.

XM charges an account inactivity fee of $10 per month after 90 days. XM charges no additional fees on deposits or withdrawals except where an amount of less than $200 is moved by wire transfer.

Our conclusion on fees: XM’s fees are competitive for traders making deposits under $1,000 across all account types, while the XM Zero account is competitive at any deposit level.

What Can I Trade With XM?

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

*Please note that Cryptocurrencies CFDs are not available for clients registered under CySEC, ASIC, and MENA entities.

After regulation, safety, and the fee structure, the next most important element to consider when choosing a Forex / CFD brokerage is what is offered for trading on the broker’s menu. Some traders will be seeking exposure only to one asset class, such as Forex, or CFDs on individual stocks and shares, while others will be looking for diversification.

XM offer the following instruments for trading:

Forex – more than 50 currency pairs and crosses, including exotic currencies, as listed below.

Stocks – An extremely wide selection of individual stocks is available for trading, with more than 1,300 equities currently listed by XM. It is an impressive, wide range of choice offered across global equities. XM offers stocks from seventeen national equity markets, including the major markets such as the U.S.A., the U.K., Germany, Switzerland, and Australia. Otherwise, the geographical markets are entirely European. Traders interested in trading individual major market stocks should give XM serious consideration as a broker of choice.

Commodities - a decent selection of 8 soft commodities are offered, which is more than most brokerages run to. They are listed below.

Five energies, including natural gas, are available to trade.

The final element of XM’s commodities offering are precious metals, namely, gold and silver. More exotic precious metals such as platinum and palladium are not available.

Equity Indices – 18 major equity indices are on the menu, which is a decently wide-ranging selection for choice. The full list of equity indices is set out below.

My conclusion regarding XM’s offering of tradable assets is favorable, with a wide range of asset classes that should satisfy most traders. The offering is especially impressive concerning global equities, with a large amount (over 1,300) on the menu. I conclude there is a sufficiently wide range here for traders who are not particularly interested in individual stocks and shares but want to achieve reasonable diversification across major markets.

XM Trading Hours

The XM trading hours are between Sunday 22:05 UTC and Friday 21:50 UTC, with most trading opportunities from the official start of the London trading session at 08:00 UTC, until the close of the New York trading session at 22:00 UTC. The Asian trading session, led by Tokyo opening at 23:00 UTC and closing at 06:00 UTC, presents the third most liquid one. The overlap between the London and New York open, between 13:00 UTC and 16:00 UTC, is where most of the trading activity occurs. The high liquidity during the three hours results in the tightest spreads. It is a development that scalpers and other short-term traders depend on for increased profitability.

XM Account Types

XM Group offers its clients 3 types of account:

- XM Ultra Low Micro Account - allows you to operate with micro lots with a lower level of risk, and it has a minimum initial deposit of $5. The minimum spread is 0.6 pips or $6.00 per lot.

- XM Ultra Low Standard Account - allows you to operate with standard lots with a minimum initial deposit of $5. The minimum spread is 0.6 pips or $6.00 per lot.

- XM ZERO - account allows you to operate with standard lots, lower spreads starting at 0 pips, and a minimum initial deposit of $5. XM ZERO account has a $3.5 commission per $100,000 traded.

*Please note that account types vary between the XM entities. For further information, please visit the XM website.

All account types allow hedging, scalping, and automated trading via Expert Advisers.

We think that the range of account types offered are realistic, easy to use and understand, and good value. Too often in the retail Forex / CFD industry, account type classifications are made unnecessarily complex for marketing purposes. It is admirable that XM seem to have refrained from doing this and are instead looking simply to give their clients what they want and need.

XM Demo Account

Traders may use the XM forex demo account to test trading strategies or Expert Advisers at XM. Unlike many brokers who offer one fixed demo setting, XM allows traders to approach it the same way they will a live trading account. It allows for closer simulation to actual trading results from the testing of strategies. XM limits the number of demo accounts to five per client. When creating a demo account, traders can select the trading platform, MT4, MT5 or XM app, and their account type, followed by the base currency from any of the eleven supported ones. Next is the investment amount, where ten options await, and finally, the maximum leverage from 16 choices.

XM Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

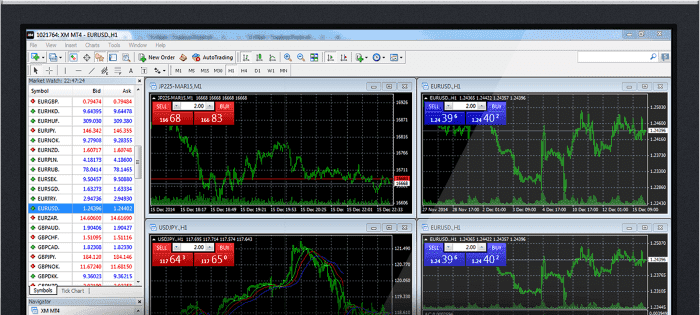

XM offers all its trader clients a choice between the use of the two most popular retail Forex trading platforms globally. Clients with any account type may choose to use either MetaTrader 4 or MetaTrader 5. Both platforms are well-known, intuitive, and easy to understand, and have been around for many years. Both platforms are also very popular with the retail trading community. Some traders may wish for a deeper choice of platform that is given here, yet a big majority of traders who find themselves considering becoming customers of XM will find the choice on offer adequate.

XM offers a range of MT4 and MT5 platforms for both Windows and Mac Operating Systems which gives traders unrestricted access to all platforms.

In addition, a range of MT4 and MT5 Mobile applications for both Apple and Android Operating Systems seamlessly allow access to an account with full account functionality from a smartphone or tablet.

MT4

XM pioneered offering an MT4 platform with trading execution quality in mind. It includes the following benefits: Over 100 Instruments including Forex, CFDs, and Futures, one login access to 8 platforms, spreads as low as 0.6 pips, full EA (Expert Advisor) functionality, one-click trading, technical analysis tools with 50 indicators and charting tools and three different chart types.

Trades can trade with the MT4 platform on their Mac as well as on mobile devices such as Androids and iPhones, iPads and tablets.

XM WebTrader 4

XM WebTrader 4 is accessible for PCs and Macs without downloading. Traders can choose from over 100 Instruments, including Forex, CFD, and Futures, with one login access to 8 Platforms, spreads as low as 0.6 pips, one-click trading, and built-in news functionality.

The MT4/MT5 WebTrader provides the same functions as the desktop client but does not require downloading a trading terminal. It is compatible with all operating systems. All trading operations are available, and the only notable difference is that the MT4/MT5 WebTrader does not support EAs or the build-in copy-trading function, which rank among the best features. Traders must use the desktop version if they require them. The MT4/MT5 WebTrader suits manual traders who seek a lightweight trading platform and traders who frequently trade from different locations and devices. For the best trading experience, there is no substitute for the MT4/MT5 desktop trading platforms.

XM MT4 Multiterminal

The XM MT4 Multiterminal platform is the ideal tool for traders wanting to handle multiple MT4 account from 1 single terminal with ease with 1 Master Login and Password.

It supports up to 128 trading accounts, has multiple order types, three allocation methods and provides management and execution in real time.

MT5

MetaTrader 5 offers a range of extra features that analyze the market and help traders trade in any style they want.

In addition to all the features of the MT4 platform, the MT5 platform also offers different order types such as 'Fill or Kill' and 'Immediate or Cancel' as well as technical and fundamental analysis using over 79 analytical tools.

Mobile Trading

The popularity of mobile trading did not go unnoticed at XM, which offers mobile apps for the MT4 and MT5 trading platforms for Android and Apple devices. They operate on mobile phones and tablets, provide full MT4/MT5 functionality, support three chart types and 30 technical indicators. Real-time interactive charts and built-in market analysis tools exist. Despite millennial traders favoring mobile trading apps, committed traders use them only to monitor portfolios. Given the limited screen space, profitable traders conduct market research, technical analysis, and portfolio management on the desktop client or the web-based alternative. XM provides the necessary links to Google Play and the App Store for the swift installation of the desired mobile trading apps.

XM Unique Features

The standout features of XM are twofold: first, its strong regulatory regime in two major industry centers (Australia and Cyprus, the latter of which gives passporting into E.U. regulation throughout the Union); secondly, its very extensive offering of individual equities listed in European countries and other major developed nations.

XM’s Zero account also has an extremely competitive fee structure at a very low minimum required deposit.

XM is proud of its history and its accomplishments. Its Milestones in our Corporate History chart goes back to 2011 and points to a background of trustworthiness and corporate involvement.

The XM management has visited over 120 cities around the world to connect with their clients and partners in order to interact with them on a face to face basis. They have hosted more than 100 seminars to educate traders, enabling them to make better trading decisions. These activities have helped XM reach the highest levels of client retention of any Forex broker, anywhere.

In fact, XM prides itself on having over 10,000,000 clients from 190 countries and over 2,400,000,000 trades executed with zero requotes, or rejections, ever.

XM Currency Converter

Finally, XM has a currency converter using live currency rates, suitable for traders who make deposits outside their account base currency. Users need to enter the currency they wish to convert from the drop-down menu under From and the currency they receive under To. The final step is selecting the amount and clicking on Calculate. The XM currency converter will display the exchange rate and the total converted currency.

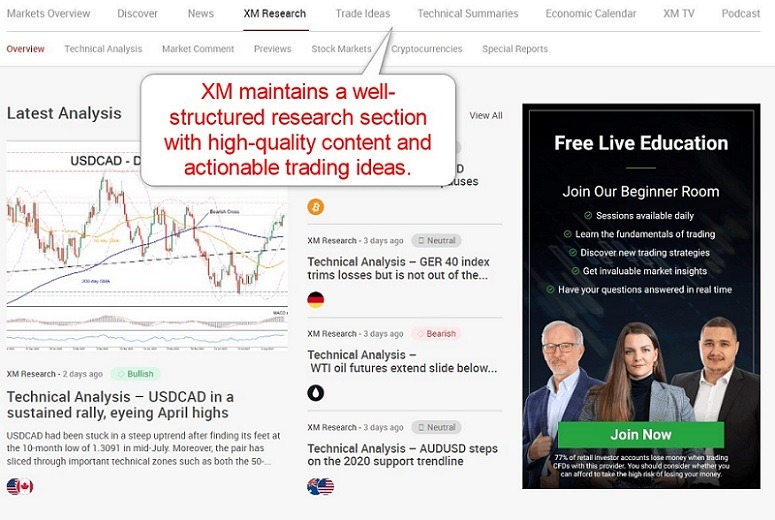

Research and Education

The XM Research & Education offering is impressive. It should be said that a Forex / CFD brokerage can offer an excellent service without providing any education or research offering at all. Brokers primarily exist to execute trades and safeguard deposits efficiently, and these core functions are what customers need and want.

All too often, substandard brokers throw together a hastily assembled collection of low-quality educational material, simply for the sake of trying to put across a good appearance. Happily, in the case of XM, the educational and research offering is there because it is worthwhile.

Research is available as news and analysis on key markets and relevant geopolitical developments, including technical analysis on selected price charts. Forex, commodities, and stocks are covered. XM offers actionable trade ideas, and the XM TV channel provides ongoing market coverage of core events. I like the well-structured approach to research and rate the XM research section among the industry leaders.

In the XM Learning Center, subsections are divided into Live Education, Educational Videos, Forex Webinars, Platform Tutorials, and Forex Seminars.

The educational rooms are live trading rooms where clients may enter and participate to see live markets traded in real time. Most of them are open for eight hours continuously on weekdays, which is extremely impressive. Eight educational videos on a range of common Forex trading topics are also available in their relevant subsection. XM Live features daily commentary presented by five hosts and seven researchers. Two English trading rooms exist, where 15 instructors and seven researchers offer live educational content.

Account holders can benefit from weekly webinars in nine different languages, including Arabic, Bengali, Indonesian, Polish, and others, given by 25 expert instructors whose pictures are on the site.

The list of video tutorials seems endless and cover topics as basic as how to open a Forex account to how to use a MT4 Droid pad on the Mobile Trader app.

Upcoming XM workshops and seminars are listed as are ones that have already taken place.

In addition, their economic calendar posts any upcoming events taking place in markets throughout the world.

There are market reviews, a Forex news report and technical analysis that appear daily.

A selection of trading tools are also offered, in addition to free forex signals and forex calculators.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7* |

Website Languages |         |

*Please note that the products, services and features advertised here vary between the XM entities. For further information, please visit the XM website

Most traders will never use their broker’s customer support service beyond the occasional query for clarification of the trading terms offered. Still, its good to know that if you do need the help desk, you will be dealt with promptly and helpfully.

XM’s customer support has a good reputation, partly because it is offered in a wide variety of languages with dedicated native speakers offering support to clients in their own language.

The XM customer support desk is available 24 hours a day, from Monday to Friday (for EU clients), the same period markets are open. Representatives speak English, Greek, Simplified Chinese, Traditional Chinese, Bahasa Malay, Bahasa Indonesia, Korean, Russian, French, Spanish, Italian, German, Polish, Hindi, Arabic, Portuguese, Czech, Slovakian, Bulgarian, Romanian, Urdu, Thai, Nepali, Tagalog, Vietnamese, Cebuano, and Serbian.

Traders can contact a rep at different departments in several international locations via email of telephone. Live chat is also available.

Bonuses and Promotions

- Free Virtual Private Server (VPS) for clients who maintain a balance of at least USD 500 or its currency equivalent in their trading account are eligible for a free VPS provided by XM. However, this offer comes with the condition that these clients must trade a minimum of 2 standard round turn lots or 200 micro round turn lots per month. For clients registered under the European entity, they can request the XM VPS through the Members Area with a monthly fee of 28 USD.

- The XM Loyalty Program offers the clients XM Points (XMP) per lot traded. These XMP can be redeemed at any time for credit bonus which can be used for trading purposes only.

*Loyalty Program is not eligible for clients registered under Trading Point of Financial instruments Ltd (CySEC), Trading Point of Financial instruments Pty Limited (ASIC) and Trading Point MENA Ltd (DFSA).

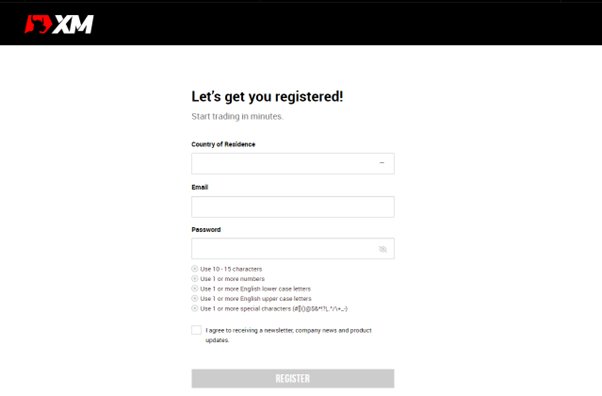

XM Opening an Account

The account opening process with XM is relatively quick and painless. You can expect to get your account open and ready on the same day that you begin the account opening process. Clients only need to navigate through a couple of web screens where they submit a few details and choose the type of account they want to sign up for.

XM Supported Countries

XM accepts clients from all over the world except United States of America, Canada, Israel and the Islamic Republic of Iran.

In addition to providing personal and account details, new clients are required to verify their ID and proof of residency by way of utility bills or bank statements. Proof of ID may be verified by providing an official national identity card, passport, or driver license. Images can be uploaded for verification and response times are very quick.

XM Deposits and Withdrawals

At XM there is no minimum deposit required. However, system restrictions limit the minimum deposit amount to $5 for electronic funding such as Moneybookers, Skrill and Neteller as well as credit cards and bank wire transfers.

Withdrawals can be made using the same methods. In fact, the deposit and withdrawal options are listed side by side on the website and a trader needs only click on “make a deposit” or “request a withdrawal” in order to make a transaction.

Withdrawals via bank-wire of amounts under $200 are subject to a $15 administration fee. While this is not completely uncommon, it is a little unusual and smaller depositors should consider whether they will be able to plan to sit tight and hope to grow their account to a level where this fee would not apply to any likely amount the client will wish to withdraw.

Summary

XM deserves a positive review. Fees are competitive for depositors of a few hundred dollars, and the XM Zero account option is competitive for Forex traders at any deposit size, starting at the $5 minimum! A diverse range of assets exists for trading, including over 1,350 individual stocks and shares. XM’s reputation is towards the higher end of the industry average, with a long track record and good regulatory standing in Australia, the UK, Belize, and Cyprus.

FAQs

Where is XM based?

Cyprus

How does XM make money?

XM makes its money from spreads and commissions charged on trades, an overnight financing mark-up, and from its clients’ trading losses on its market-maker account types.

How can I deposit into an XM account?

XM allows several methods for depositing and withdrawing funds. Transactions can be made using Moneybookers, Skrill and Neteller as well as credit cards and bank wire transfers. Moneygrams and Western Union payments are also accepted.

Is XM available in Canada?

Unfortunately, XM doesn't accept Canadian residents as their traders. For the best Forex brokers in Canada, See our list of brokers: best Forex brokers in Canada.

IS XM regulated? Are its clients protected by regulatory deposit insurance?

XM is regulated by DFSA, CySec, FSC, FSCA and ASIC. CySec offers an investor protection fund up to €20,000 but eligibility is not automatic even if a depositor’s funds become inaccessible due to no fault of their own.

What is the maximum leverage offered by XM?

The maximum leverage offered is 1000:1. Leverage is fixed 30:1 for clients registered under EU, AU and MENA regulated entity.

How do I open an account with XM?

Simply click on the “open account” button on the home page of XM’s website. You will be directed through a very easy to complete digital form.

Does XM offer the MetaTrader trading platform?

Yes, XM offers both the MT4 and MT5 trading platforms.

Does XM have a minimum deposit in ZAR?

The minimum deposit at XM is $5, and traders can deposit from any currency, which XM converts into the trading account base currency at inter-bank exchange rates. XM does not provide South African Rand denominated trading accounts.

Is XM regulated in South Africa?

Yes, XM is regulated in South Africa by the Financial Sector Conduct Authority (FSCA). The FSCA is the regulatory body responsible for overseeing and regulating financial institutions and financial markets in South Africa.