For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Octa Editor’s Verdict

Founded in 2011, Octa (formerly OctaFX) is home to more than 42 million trading accounts. It continues to increase its market share with its swap-free offering, competitive pricing model, plus generous bonuses and incentives. An impressive aspect of the offering is Space, a powerful analytics tool built into OctaTrader that is a smart feed with actionable trading ideas and deep analysis. Another tool setting the broker apart is OctaVision, OctaTrader's AI-powered tool that allows traders to analyse trades individually or in bulk, providing valuable trading feedback. The broker’s AI pattern recognition feature, which shows the most relevant technical analysis patterns for a chosen instrument and time frame is another exciting addition to the Octa toolkit.

Overview

Octa (formerly OctaFX), developed a proprietary copy trading service, expanding into a sector that is gaining popularity, especially among younger traders. Its mobile trading and copy trading service apps remain highly popular, with over 10 million downloads.

Headquarters | Comoros |

|---|---|

Regulators | CySEC, FSCA, MWALI International Services Authority |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2011 |

Execution Type(s) | Market Maker |

Minimum Deposit | $25 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform |

Average Trading Cost EUR/USD | 0.9 pips |

Average Trading Cost GBP/USD | 1.3 pips |

Average Trading Cost WTI Crude Oil | $0.07 |

Average Trading Cost Gold | $0.30 |

Average Trading Cost Bitcoin | $11 |

Retail Loss Rate | 67.65% |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.6 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 9 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Octa Highlights for 2025

- MT4/MT5 trading platforms for algorithmic traders.

- Proprietary OctaTrader as a web-based alternative for manual traders.

- Octa trading app for mobile traders.

- Commission-free trading fees from 0.6 pips or $6.00 per 1.0 standard round lot.

- Status program with trading perks for active traders, including lower fees.

- Swap-free trading on many assets for all traders.

- A balanced asset selection consists of highly liquid trading instruments, including 30 cryptocurrency CFDs and equity CFDs listed on 16 exchanges.

- A 50% withdrawable deposit bonus.

- 1:1000 maximum leverage with negative balance protection.

- $25 minimum deposit requirement.

- Several payment processors, including cryptocurrencies.

- 19 minutes average withdrawal processing time for most withdrawals.

- Leading copy trading provider with in-house service and 40M+ trading accounts.

- Quality beginner education and market research.

- A high-paying partnership program with up to 80% revenue share.

- Recognized as the Best Professional Trading Platform 2024 by World Business Stars Magazine

- Financial Achievements in Markets Excellency (FAME) award for the Best Trading Conditions in Africa 2024.

- Global Brands Magazine award for the Best Mobile Trading Platform 2024.

- Space, a built-in smart feed of trading ideas and market analysis

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. Octa presents clients with one regulated entity in Cyprus, regulated by CySEC, license number 327/18. EU-resident traders will be onboarded through this entity. Octa is also regulated in the Union of the Comoros by the MWALI International Services Authority (license number HY00623410), and in South Africa by the Financial Sector Conduct Authority (license number 51913).

Octa segregates client deposits from corporate funds and offers negative balance protection. Octa also has been catering to clients from over 100 countries for over a decade.

Country of the Regulator | Cyprus, Comoros, South Africa |

|---|---|

Name of the Regulator | CySEC, FSCA, MWALI International Services Authority |

Regulatory License Number | 372/18, 51913, HY00623410 |

Octa Fees

Average Trading Cost EUR/USD | 0.9 pips |

|---|---|

Average Trading Cost GBP/USD | 1.3 pips |

Average Trading Cost WTI Crude Oil | $0.07 |

Average Trading Cost Gold | $0.30 |

Average Trading Cost Bitcoin | $11 |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.6 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | No |

Octa presents traders with a competitively priced, commission-free pricing environment. The EUR/USD starts as low as 0.6 pips or $6 per 1 standard lot, with an average cost of 0.7 pips. It is the same as commission-based brokers offering raw spreads of 0 pips for a commission of $6. I rank Octa among the best-priced ones, and Octa delivers on its statement to help Forex traders earn more.

Here is a screenshot of Octa live quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The minimum trading costs for the EUR/USD in the commission-free Octa account:

Minimum Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.6 pips | $0.00 | $6.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Octa takes it further and offers swap-free trading in its MT4/MT5 accounts. This makes a tremendous difference to leveraged traders who keep positions open overnight. Traders pay no financing fees, irrelevant of how long a trade remains open.

It makes Octa the first broker with such an offer. It is also a rare broker fully compliant with Shariah law for Islamic traders. I cannot stress enough the difference this makes, especially over time.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-free Octa MT5 account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.6 pips | $0.00 | -$0.00 | X | $6.00 |

0.6 pips | $0.00 | X | -$0.00 | $6.00 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.6 pips | $0.00 | -$0.00 | X | $6.00 |

0.6 pips | $0.00 | X | -$0.00 | $6.00 |

I like the cost savings at Octa for traders who keep leveraged positions open for multiple trading days. The cost savings for a 1 standard lot EUR/USD position can amount to $60+. Octa has recently improved its pricing environment, and I rank the overall trading costs among the best industry-wide, and there is no inactivity fee or currency conversion cost.

What Can I Trade on Octa?

Octa maintains a selection of 52 currency pairs, 34 cryptocurrencies, 5 commodities, 10 index CFDs, and 150 equity CFDs. Since Octa has a limited selection of trading instruments, except for its above-average choice of cryptocurrency CFDs, I find it ideal for focused trading strategies that rely on fewer but high-liquid assets.

Asset List and Leverage Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Octa Leverage

The maximum leverage at Octa is 1:1000 for Forex traders and 1:200 for cryptocurrency traders. Commodity and indices traders max out at 1:400, while equity traders get the industry standard of 1:40. It is excellent for scalpers and traders who require highly leveraged trading accounts. I also want to note the absence of swap rates and the presence of negative balance protection again, combining for an unrivaled offer.

Octa Trading Hours (GMT +1 Server Time)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:00 | Friday 23:59 |

Cryptocurrencies | Monday 00:00 | Friday 23:59 |

Commodities | Monday 00:00 | Friday 23:59 |

Crude Oil | Monday 00:00 | Friday 23:59 |

Gold | Monday 00:00 | Friday 23:59 |

Metals | Monday 00:00 | Friday 23:59 |

Equity Indices | Monday 09:00 | Friday 22:00 |

Stocks | Monday 09:00 | Friday 22:00 |

Please note that equity markets open and close each trading and are not operational continuously like Forex and cryptocurrencies.

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Octa Account Types

Octa offers traders one MT4 and one MT5 trading account. The minimum deposit for both is $25, and the maximum leverage is 1:1000. The account base currencies are the euro and the US dollar. The primary difference between the two is that MT5 offers equity CFDs unavailable at MT4.

Additional info on Octa Account Types

I highly recommend the MT5 trading account for equity traders and MT4 for Forex traders due to its superior tools for algorithmic traders. Octa classifies the MT4 trading account for the Traditional Trader and MT5 for the Innovative Trader.

Octa Demo Account

Traders may open MT4/MT5 demo accounts at Octa, and there is no time limit on active accounts. The MT4 demo account will expire after eight days with no trading activity and the MT5 demo account after 30 days. The flexibility of MT4/MT5 allows traders to select their deposits and leverage, creating more realistic demo results. They are ideal for algorithmic traders to test EAs and fix bugs.

Octa Trading Platforms

Octa offers traders the out-of-the-box MT4/MT5 trading platforms and upgrades the trading experience with the Autochartist Pro plugin. MT4 remains the market leader for algorithmic trading and is the most versatile trading platform with 25,000 custom indicators, plugins, and EAs. Both come with an integrated copy trading service.

MT4/MT5 trading platforms exist as a desktop client, supporting all features, a lightweight web-based trading portal for manual traders, and a mobile app.

A proprietary trading platform, OctaTrader, is also available for desktop, laptop, or mobile devices as an app, allowing traders to manage their Octa portfolios. OctaTrader uses TradingView’s charting technology, which allows for comfort and customisation. It has more than 10 million downloads from Android-based devices. The success of the proprietary Octa copy trading service resulted in the launch of a dedicated mobile app.

OctaTrader offers a selection of 80 trading instruments, including currencies, metals, energies, indices, and cryptocurrencies. No overnight charges and no commissions are charged when using this trading platform.

OctaTrader includes a feature called Space, which is a built-in smart feed of customised trading ideas and market analysis.

Octa Copy Trading Review

I like that Octa invested in developing a proprietary copy trading service, which it also launched as a mobile app. Traders may follow signal providers, which Octa refers to a Master Traders. One of the best features is the flexibility regarding commissions.

Octa allows revenue share, where copiers only pay a fee on profitable trades or fixed revenue per lot, where a trading charge applies irrelevant to the outcome. Copiers may use the filter to evaluate the Master Traders most suitable based on the commission structure.

A ranking system is also in place, evaluating the trading history of the Master Trader with Octa. In-depth details on the trading strategy and performance of each Master Trader are equally available. Copiers have the option to evaluate each trade individually, and I like the range of trading metrics Octa provides, allowing copiers to make better choices when selecting which Master Traders to follow.

Copiers must fund their copy trading account before following Master Traders. They may opt for a direct deposit or transfer from their trading account. Octa displays a recommended amount to allocate to each Master Trader. Copiers may copy trades in full or proportionally to their trading balance versus the Master Trader. I recommend the former, as it will result in superior trading results, as it adjusts positions based on portfolio size and leverage.

A risk management tool is also available, called the drawdown percentage (DDP). Copiers may adjust it to their liking. Should the Master Trader face losses, the DDP will close the copiers position. Copiers can also manually close open positions and retain complete control over their portfolios.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Octa Trading App

The in-house developed Octa Trading App is an excellent choice for mobile and copy traders. It is available on the Google Play Store, where it has 10M+ downloads with a 4.6 out of 5.0 rating based on 241K+ reviews, in the Apple App Store, where it ranks #22 in Finance, and has a 4.5 out of 5.0 rating based on 6K+ reviews. Alternatively, Octa offers the Octa Trading App as an APK download for traders who cannot access Google or Apple. It shows that Octa understands its trader base and ensures it can take advantage of its competitive trading environment.

The Octa Trading App uses 128-SSL encryption, and even if traders lose their device or have it stolen, Octa restricts withdrawals to the deposit method. The Octa Trading App includes daily trading signals, non-stop in-app customer support, and beginner education.

Integrated into the terminal is Space, the smart feed with powerful market analytics capabilities, which helps traders make informed decisions, at any given moment.

The 50% deposit bonus boosts traders, and Octa allows bonus withdrawals once traders satisfy reasonable volume conditions, where Octa ranks among the industry leaders.

Traders can make deposits and request withdrawals from the Octa Trading App in six cryptocurrencies, e-wallets, local payment processors, credit/debit cards, and bank wires. Most payment processors have instant to near-instant processing times for deposits and one to three hours for withdrawals. Mobile traders can rely on the security of the Octa Trading App to handle all their trading requirements, especially if they want to monitor portfolios, stay up to date with economic developments that may impact their portfolios, or engage in passive copy trading.

Unique Features

I find the Space smart feed, which offers a timely asset analysis, to be the best unique feature at Octa It helps you decide what assets to trade, how to manage risk and how to make the most informed decisions. The feature enables traders to save time on analysis, compare trade ideas, with explanatory breakdowns and open positions directly in the chart.In addition, Octa’s AI pattern recognition feature indicates the most relevant technical analysis patterns at any given time for a chosen asset, based on a large database of historical data, The machine learning algorithms are embedded into the Octa app and are designed to highlight actionable trends. Another important AI feature that is unique to the broker is OctaVision. The tool enables traders to analyze historical trades, providing insightful trading feedback and highlighting decision-making strengths and weaknesses.

Research and Education

The Market Information section at Octa provides traders with twelve categories of well-presented content. It includes technical trading signals, Forex news, and market insights. The Octa blog complements the research category, and traders have a wealth of quality, market-oriented information. Together with services provided by Autochartist, Octa maintains a highly competitive research section.

Beginner traders get the most educational value from webinars, which Octa also publishes on its YouTube channel. I also recommend the 21 well-thought-through articles and its 11-video beginner’s course, which introduces new traders to financial markets. The Octa combination of written content, charts, and videos creates a valuable product. Platform tutorials are equally available, guiding beginners through the initial steps. Additionally, I recommend that new traders seek in-depth education from third parties covering trading psychology and avoid paid-for education.

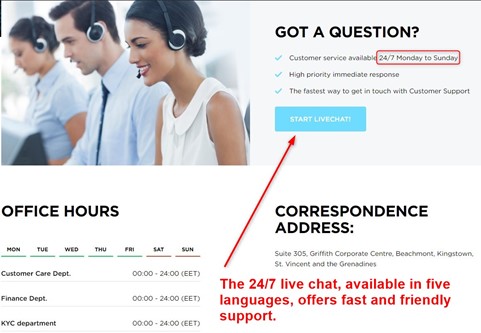

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |           |

Octa offers 24/7 customer support, primarily via live chat, with fast response times. Email support is also available, and the FAQ section answers many of the most common questions. I only found a phone number missing from the overall support offer.

Bonuses and Promotions

Octa offers a 50% bonus on each deposit, and a four-tier status program rewarding active traders. It also maintains a Trade & Win promotion, where each lot counts as a prize lot, redeemable for prizes. Octa also has a refer-a-friend program. Demo contests for real money exist as well. Terms and conditions apply, and I recommend traders read and understand them before participating.

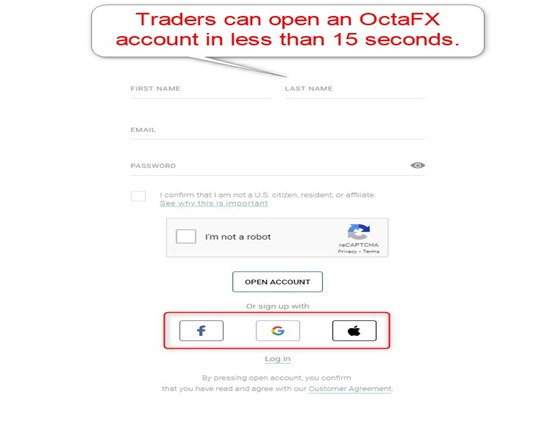

Octa Opening an Account

Traders can typically open an Octa account in less than 15 seconds. Traders must submit their email and select their password. They may also use their Google, Facebook, or Apple accounts to sign-up. Account verification is mandatory, and most traders will complete it after sending a copy of their ID and one proof of residency document.

Octa Minimum Deposit

The minimum deposit at Octa is $25, higher than many brokers but within a reasonable range.

Payment Methods

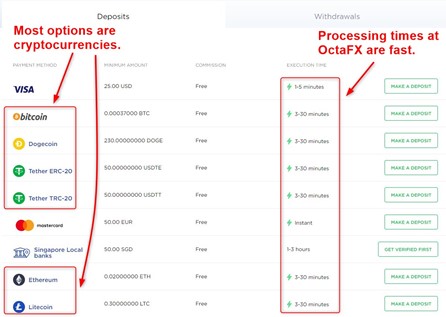

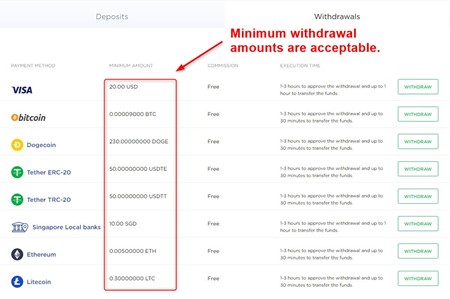

Octa offers bank wires, credit/debit cards, Skrill, Neteller, and six cryptocurrencies.

Withdrawal options |     |

|---|---|

Deposit options |     |

Accepted Countries

Octa caters to most international traders, including resident India, Pakistan, Malaysia, Nigeria, Singapore, and Indonesia. It does not accept US person or resident traders.

Octa Deposits and Withdrawals

Traders conduct all financial transactions from the secure back office, and Octa does not charge deposit or withdrawal fees. Third-party costs may apply, and I recommend traders check with their preferred provider. I like that Octa offers several cryptocurrencies, but I am missing more third-party payment processors and localized options, especially for its core markets. Octa processes withdrawal requests between one and three hours.

Bottom Line

I like the trading environment at Octa as it remains swap-free. The cost savings from the overall pricing environment alone make Octa a broker to consider. Additionally, I like the proprietary copy trading service.

Space, Octa’s exclusive analytics tool, offering actionable trading ideas and in-depth analysis, which is integrated into OctaTrader is also impressive. So too, are broker’s AI pattern recognition feature, and OctaVision, the AI-powered tool that allows traders to analyse historic trades.

Beginner traders will benefit from well-thought-out research and educational services. The generous bonuses and promotions complement the excellent core trading services, explaining why Octa has attracted deposits from more than 42 million traders.

With more than a decade of experience and 6.6 million trading accounts from over 100 countries, traders should be able to have trust in Octa. Octa is a duly registered international business company (IBC) in Saint Vincent and the Grenadines and operates legally. Octa does not have a license in India, but it is not a requirement, making accepting Indian traders legal for Octa. Octa offers bank wires, credit/debit cards, and several cryptocurrencies as withdrawal methods. It processes requests between one hour and three hours, making it one of the best in this category. The Octa MT5 account is the best for equity traders, and the Octa MT4 account is for Forex traders due to asset availability and trading tools. Traders can deposit US Dollars via bank wires, credit/debit cards, Skrill, and Neteller. Octa does not charge account opening or administrative fees, but traders must pay spreads on assets, which is the standard business model at commission-free brokers. Octa grants one significant advantage as it provides swap-free trading for all traders. Since the minimum spread is 0.6 pips, the per-dollar cost is $0.00006 for the EUR/USD. The Octa minimum deposit is $25. It is higher versus many brokers but well within a reasonable range and justified by its products and services. Octa does not levy internal withdrawal fees, but traders should consider potential third-party payment processor charges. The minimum Octa deposit is $25, but the minimum trade size is 0.01 lots. Octa only charges internal mark-ups over market spreads, which start from 0.6 pips or $6.00 per 1.0 standard round lot. It has no other notable fees and ranks among the best-priced brokers. Yes, Octa pays real money to traders who earn from their trading activities. It also includes $31M in bonus funds Octa paid over the past eleven years. Octa is available in India and caters to Indian Forex traders via its website in Hindu. Octa is available in Indonesia and translates its website into Bahasa Indonesia. Octa is available in Malaysia, where Malaysian Forex traders can access its services in Bahasa Melayu. Octa is available in Pakistan, where it ranks highly among Pakistani Forex and copy traders.FAQs

Is Octa trusted?

Is Octa legal?

Is Octa legal in India?

Can I withdraw money from Octa?

Which Octa account is best?

How do I deposit USD into Octa?

Is Octa free?

How much does Octa charge per dollar?

How much must you deposit at Octa?

How much is withdrawal from Octa?

What is the minimum amount to start with Octa?

How much is the Octa fee?

Does Octa pay real money?

Is Octa Available in India?

Is Octa Available in Indonesia?

Is Octa Available in Malaysia?

Is Octa Available in Pakistan?