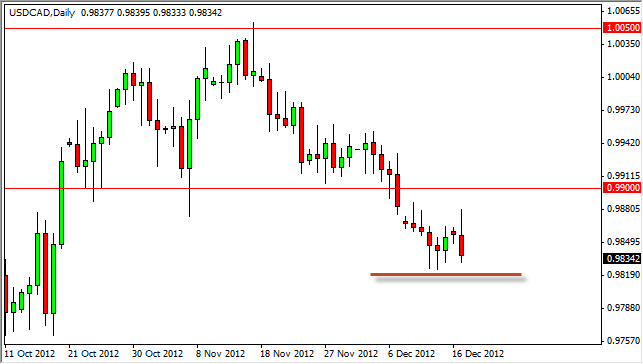

The USD/CAD pair initially tried to rally for the Monday session, but was left wanting as the 0.99 resistance level continues to be a bit too much for the buyers. Looking forward, this pair will be an interesting one follow because it is probably the one that is most likely affected by the so-called "fiscal cliff” talks in the United States.

As I pointed out for, the Canadian send 85% of their exports to the United States, so the economic health of United States have a drastic effect on what goes on in Canada. Because of this, the Canadian dollar actually gains when the United States does better all things being equal. With this in mind, the fiscal talks in United States will have a major affect on which direction this pair chooses. In the meantime, it looks like we’re going sideways until either Congress decides what they're going to do, or the market makes them to decide.

100 pip range

The fact that the Monday session saw an attempt to push the pair higher fail suggests to me that we will more than likely fall in the end. We've been in a downtrend for quite some time, so this of course makes sense and is the easiest trade to take. This also assumes that eventually Congress and the President will get together and come up with some kind of deal, and even if they don't there are already automatic moves in place.

The markets hate uncertainty. Once we get certainty, either through a deal or the actual triggering of the “fiscal cliff”, we should see some type of progress in this pair. I believe that the Canadian dollar will gain in the end, because it will simply be too painful for the Americans to go through some self-imposed massive recession simply because the few politicians can’t get it together.

However, you should be aware the fact that is very possible we won't get a deal until after New Year's. Even if that happens, any and all punitive measures can and will be reversed after the fact. Because of this, I believe that this pair will eventually continue lower, and then everything will be back to normal relatively soon. And as you can see by the longer-term charts, "normal" is this pair falling.