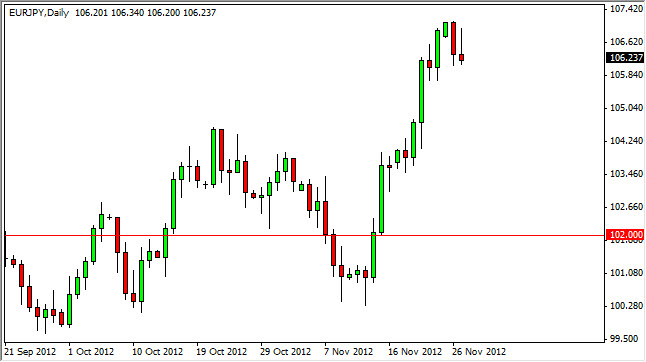

The EUR/JPY pair fell during the session on Tuesday, after initially gaining quite a bit. The resulting candle formed a shooting star, and this of course is a very bearish sign. This suggests that the Japanese yen will continue to strengthen, and as such I think we will enter a "risk off" type of environment.

In that type of scenario, the Japanese yen will normally rise in value, dragging these Yen related pairs down. However, I feel that there has been a significant change in the attitude of this pair, and as such I would not take advantage of this selling "opportunity." After all, any time a pair rises almost 700 pips in just two weeks, a pullback can be expected. This is exactly what we're looking at in this pair right now, and as such I think waiting for a drop down to roughly the 105 level would be a decent strategy.

Bank of Japan

We have an election in Japan in the next few weeks, and it should bring in the opposition party to power. We have already made it clear that they are looking for more stimulus and a higher inflation rate, and it appears that the Bank of Japan is willing to give that to them. In other words, they will print more Yen going forward, and as such it should weaken the value of the Japanese currency against most other currencies around the world. Even the US dollar is starting to gain against the Japanese yen, which is something that we have not seen quite some time.

However, a pullback would be expected and quite welcome by a lot of bullish traders. Simply put, it allows us to buy the Euro had a cheaper price against a currency that should continue to crumble. With this in mind, I am sitting on the sidelines, but willing to look at buying this pair at the first signs of support as I believe we will hit 110 before it's all said and done. I also believe that if we get above 110, we will most certainly have a long-term buy-and-hold type of trade on our hands.