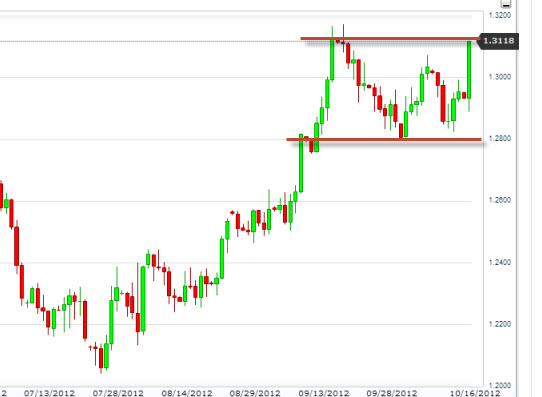

The EUR/USD pair rallied during the session on Tuesday, as the "risk on rally continued. There were murmurs of a possible breakthrough in the idea of the Spanish finally asking for a bailout, and if that's the case this should do quite a bit of good for the European Union in general. However, ultimately the Euro will suffer as the printing of the currency will devalue the Euro.

The 1.30 level is the beginning of a lot of noise in this figure currency pair, and as such is going to be a bit of a fight getting to the 1.35 level. Because of this, even though I see the Euro as getting a bit of a reprieve, I would be reluctant to trade it in this pair. The 1.28 level below is certainly a supportive, and that is a much clearer signal for the market as it would have this pair falling quite a bit.

The trend has certainly been higher lately, and as such I think that we are biased to the upside. If that is certainly the case, and we continue to climb, I believe that we will see the Euro higher and a much easier manner against several different currencies. Remember, the selling of the Euro has basically been relentless across the board, and as such there will be quite a bit of short covering.

There are better alternatives

One of the biggest problems with this particular currency pair is that far too many Forex traders focus solely on it. The truth of the matter is that you are paid in whatever the base currency of your Forex account is. In other words, if it is based in US dollars, you will realize your profits in those very same US dollars. In reality, it really doesn't matter what you are trading.

The Euro will more than likely be easier to trade against other currencies such as the Japanese Yen, Swiss franc, and various other currencies. The truth is that the US dollar will continue to get a bit of a bid even as the Federal Reserve is working against it mainly because of the headline risks out there. With this being said, I actually prefer trading the Euro against the Yen at the moment.