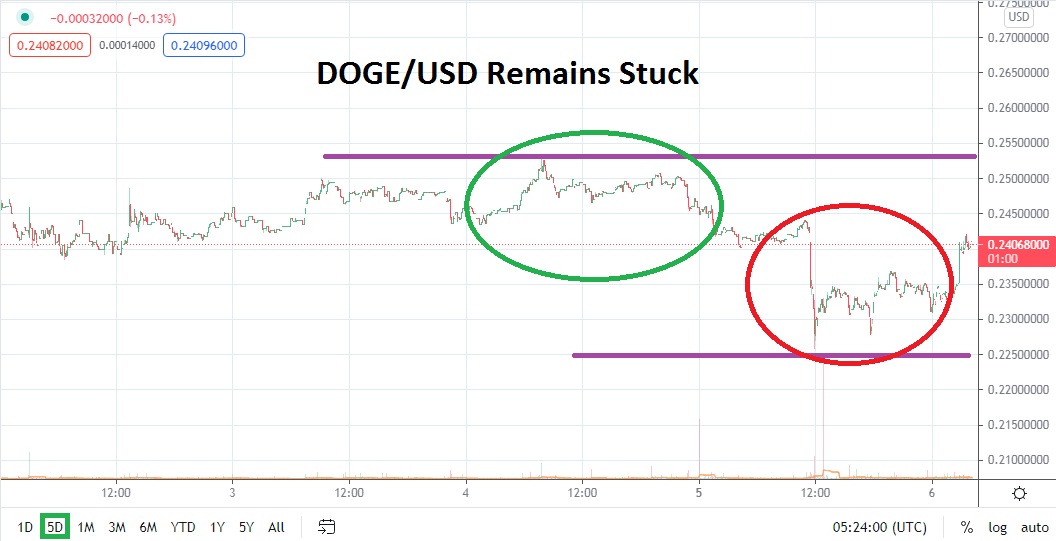

DOGE/USD came off weekend highs yesterday and slumped to nearly 22-and-a-half cents. Yes, since the lows were touched, DOGE/USD has climbed a bit and, as of this writing, is traversing slightly over 24 cents. However, after seeing some slow and incremental gains for a few days like the broad cryptocurrency market, the inability of not achieving a real test of week-long resistance levels is likely a negative indicator.

DOGE/USD has been struggling between a rather tight range in many respects and it did achieve a high of nearly 27-and-a-half cents on the 29th of June. Since then, DOGE/USD has suffered from its regular bouts of volatility, but it has not come close to retracing the one-week highs. It looks as if every buying wave is met with a rather consistent amount of selling which remains nervous. When the 24 cents mark was penetrated lower yesterday after serving as support essentially since the end of June, the move was harsh.

Dogecoin remains a favorite talking point of many important social media trading groups and it needs to be questioned how long many of the speculators will be willing to hold onto their positions, particularly if the trend remains progressively negative. It was reported late last week in the NY Post that Robinhood, the popular U.S based retail broker, has a lot of exposure to Dogecoin. A large percentage of the trading in the Robinhood platform has been generated because of the cryptocurrency.

Technically, DOGE/USD continues to tread near important support and can’t quite seem to lift itself up from its lower price band. After yesterday’s move lower, the slight rise in value from DOGE/USD can be perceived as positive. However, until the cryptocurrency breaks, resistance near 24-and-a-half cents puts in a sincere challenge to 25 cents, and traders may believe that negative sentiment will rule the day.

Selling DOGE/USD within its current price vicinity looks enticing if it can be accomplished over 24 cents. Traders need to use solid risk management, but shorting DOGE/USD with a target around the 23-and-a-half cents level could prove to be a rather intriguing speculative wager. Conservative traders may want to place their take-profit orders near current support levels around the 0.23850000 ratio.

Dogecoin Short-Term Outlook:

Current Resistance: 0.24560000

Current Support: 0.23850000

High Target: 0.25450000

Low Target: 0.22300000