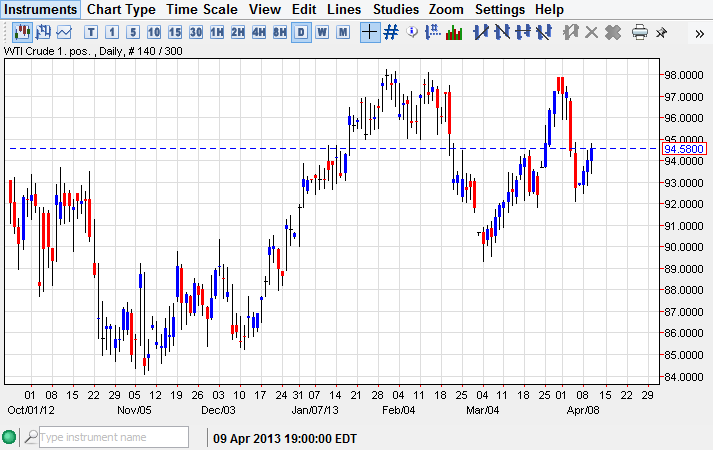

The WTI Crude Oil market place initially sold off during the Wednesday session, dipping as low as the $93.50 level before bouncing back to the upside. We close that $94.58, which of course shows that we are just over the minor resistance area at $94.50 that I had mentioned previously.

The demand for crude oil remains a bit suspect, and I still believe that we are trying to form some type of range for the warmer months. After all, most demand comes out of North America, and as a result the "driving season" has a fairly strong effect on this particular grade of crude oil. This being the case, one has to pay attention to how things are going in America, which is essentially just okay. In other words, I expect a relatively quiet market over the course of spring and summer, and perhaps this is the attempt to carve out a range between $90.00 and $92.00 in the meantime.

One of the most technical markets out there

The great thing about the oil markets is that they tend to be extremely technical. It's quite common to see the market simply bounce around in a $10.00 region, going back and forth for weeks at a time. Because of this, a lot of day traders love this market as it provides ample opportunity over the course of several weeks to get involved. With that being said, sometimes we find ourselves in these larger ranges that offer a lot of back-and-forth swing trading, which is exactly my thesis at the moment.

However, I would be remiss if I didn't mention the fact that yesterday I brought up the idea of a potential symmetrical triangle on the weekly chart. If that's the case, and he gets broken out of, we could see a significant move in one direction or the other. Trust me; you will certainly know it when you see it as it will be significant to say the least. However, there is the possibility that we simply drift sideways, and that is what I think is about to happen. However, as you know by now, trading isn't what you think, but what you observe.