Trading212 Editor’s Verdict

UK-Bulgarian broker Trading212 prides itself on 15 million+ downloads of its mobile app. Two of its most promising services consist of fractional share dealing and AutoInvest. Tading212 lists commission-free trading but lacks pricing transparency. I decided to review Trading212 to determine if the commission-free pricing environment is as good as advertised. Is Trading212 hiding something with hidden fees?

Overview

Trading 212 has over 1,800 assets available which means every trader has a great deal of diversification possibilities when trading with this broker.

Additionally, tight spreads and no commissions make Trading 212 a solid option for most traders. Great trading conditions explain why Trading 212 has enjoyed tremendous growth since it hit the scene, the major drawback is that short-selling on equities is not possible with this brokerage which is why many serious equity traders are likely to shy away from it. Short-selling enables traders to make money when an asset decreases in price and the inability to do so with Trading 212 may be its only flaw, but a major deal-breaking one for serious retail traders as well professional clients who seek to transact in equities. This does not apply to CFD trading.

Headquarters | Cyprus |

|---|---|

Regulators | FCA, FSC Mauritius |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2006 |

Execution Type(s) | Market Maker |

Minimum Deposit | $1 |

Trading Platform(s) | MetaTrader 4, Proprietary platform |

Average Trading Cost EUR/USD | 1.9 pips ($19.00) |

Average Trading Cost GBP/USD | 2.9 pips ($29.00) |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.68 |

Average Trading Cost Bitcoin | $46.59 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

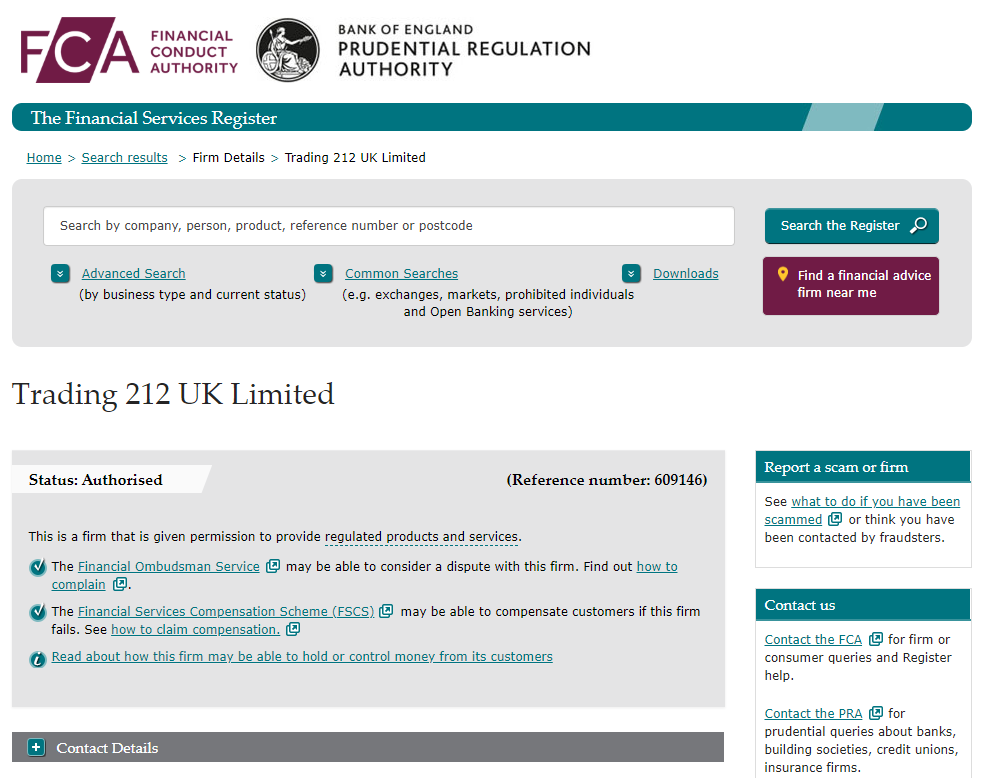

Regulation and Security

Trading 212 is the brand name of Trading 212 UK LTD as well as Trading 212 LTD. Trading 212 UK LTD is registered in England and Wales with company number 08590005 and authorized ad regulated by the Financial Conduct Authority (FCA) under registration number 609146. Trading 212 LTD is registered in Bulgaria with register number 201659500 and authorized and regulated by the Financial Supervision Commission under registration number RG-03-0237. Client funds remain segregated from company funds and the UK regulator is known to be a top regulator.

Client funds are also protected by the Financial Services Compensation Scheme (FSCS) for Trading 212 UK LTD clients, which covers deposits up to £85,000, and by the Investors Compensation Fund or ICF Bulgaria for Trading 212 LTD, which covers up to 90% of deposits with a limit of €20,000. Given the current financial state of this broker, a default is very unlikely, and clients should feel secure when dealing with Trading 212; in the event of unexpected future issues all clients are well protected. As far are regulation, security and protection are concerned, Trading 212 has checked all boxes.

Trading 212 Fees

Average Trading Cost EUR/USD | 1.9 pips ($19.00) |

|---|---|

Average Trading Cost GBP/USD | 2.9 pips ($29.00) |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.68 |

Average Trading Cost Bitcoin | $46.59 |

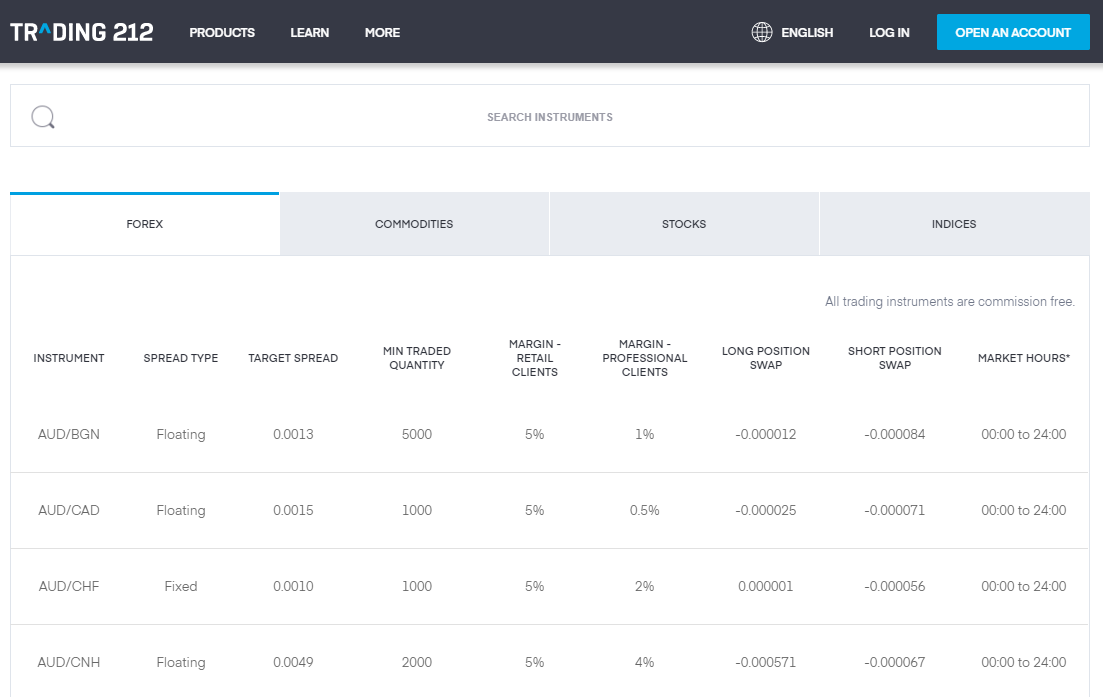

Trading 212 fees consist primarily of the mark-up between the bid and ask price, known as the spread, as this is one of a few brokers that offer zero commission trading and investing. Over 2,500 assets are available in the Trading 212 CFD account, free of charge, while the Trading 212 Invest lists more than 6,500. The EUR/USD, the most liquid currency pair, commences from a 0.09 spread, sometimes displayed as 0.00009. It is an acceptable mark-up considering no additional Trading 212 fees apply to it. Equity CFDs equally face a higher mark-up, but the overall pricing environment, especially for high-frequency traders, remains superior to most competitors, where a minimum commission of £10 or a currency equivalent, or a cost between 0.08% and 0.10%, whichever is greater, exists. The cost savings due to the absence of a Trading 212 commission will compound over time, delivering a notable boost to the profitability of portfolios.

Spreads vary depending on the asset and can either be a variable one dictated by market forces via supple and demand or a fixed one, which ignores market conditions. The former is better suited for short-term traders and scalpers, as it is generally lower than the latter, where brokers increase the mark-up to compensate for the potential lack of revenues from widening spreads during certain market conditions. With the Trading 212 fees limited, the highest cost for traders will come from swap rates on leveraged overnight positions. Trading 212 is very transparent about all fees, which it lists on its website in a well-organized list. Most are negative swap rates, but some assets carry a positive one, where traders will get paid to hold the position. They apply daily, and while often insignificant, they do add up over time and depend on the amount borrowed from Trading 212 to maintain the position.

Other Trading 212 fees to consider at this broker is the inactivity fee if no trading activity occurred for 180 consecutive days, which is a downside of this broker. While most brokers charge one, traders can easily avoid this by placing one trade during the specified period. Usually, traders with a balance in their portfolios do not remain idle for a prolonged time and never face his unnecessary fee. A withdrawal fee for bank wires will apply, and third-party levies from payment processors should also be kept in mind.

Corporate actions like dividends, splits, and mergers will impact equity and index positions, and traders, as well as investors, need to be aware of them. Trading 212 will pass them on to portfolios, and on the ex-dividend date, assets tend to experience a price drop roughly equal to the dividend at the start of the first ex-dividend trading session. Those with long positions will receive the amount added to their balance during the dividend adjustment, while those who remain short will have it deducted from their cash balance. Since Trading 212 does not charge commissions on most assets, the most significant cost factor is daily swap rates. Unlike some brokers who have high spreads to compensate for the lack of a commission structure, Trading 212 maintains mid-range mark-ups, making it a highly competitive broker from a pricing perspective. The combination of both results in Trading 212 charges below the average of most other brokers.

Trading 212 Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 23:00 | Friday 23:00 |

Commodities | Monday 00:00 | Friday 21:59 |

Crude Oil | Monday 00:00 | Friday 21:59 |

Gold | Monday 00:00 | Friday 21:59 |

Metals | Monday 00:00 | Friday 21:59 |

Equity Indices | Monday 00:00 | Friday 21:59 |

Stocks | Monday 01:00 | Friday 22:00 |

Stocks (non-CFDs) | Monday 09:00 | Friday 22:00 |

Bonds | Monday 00:00 | Friday 21:59 |

ETFs | Monday 15:30 | Friday 22:00 |

Futures | Monday 00:00 | Friday 21:59 |

What Can I Trade

Asset selection is great since Trading 212 offers over 1,800 assets to trade. This allows for great diversification and only professional clients who trade smaller equities in less capitalized markets will reach their limits. Generally speaking, most traders who will use this broker will find that they have access to a great deal of choices which allows them to operate a well-diversified, cross-asset portfolio. Note that cryptocurrencies are listed under the Forex umbrella. The full list of assets can be easily browsed on the Trading 212 website, but clients will find it easier to search the trading platform which includes all the information required. The openness and transparency of the asset selection on their website is a great example of how a broker should operate and another big positive for Trading 212.

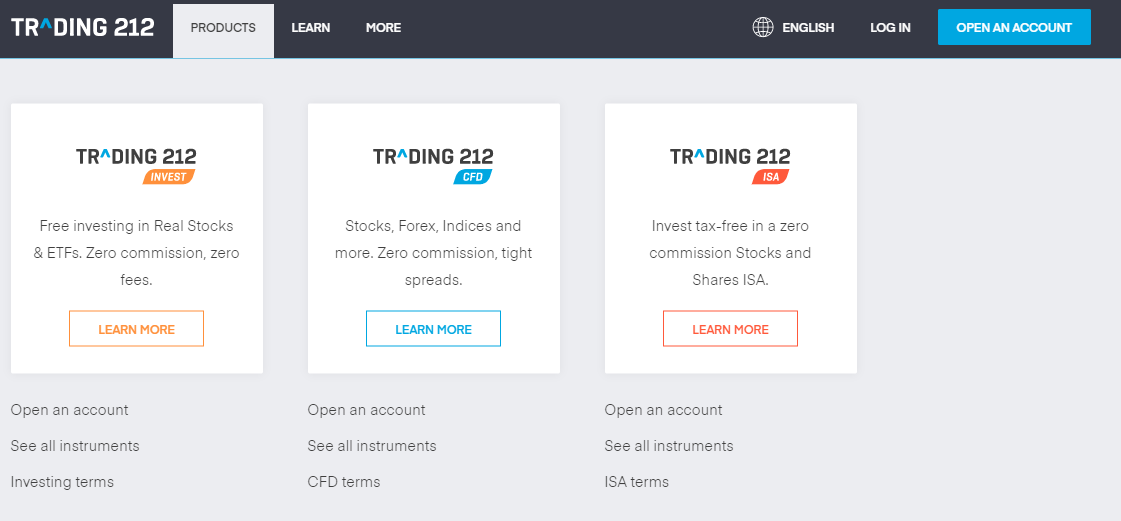

Account Types

Instead of traditional account types, Trading 212 offers three different accounts based on what clients want to trade. It’s important to note that account availability varies by geographic location. The type of account is the same for each trader which is in-line with its mission to democratize financial markets and treat everyone equal. It is worth pointing out that individual traders may qualify for certain bonuses, but traders need to contact support in order to get the details of any bonus which may be applicable to them.

The three different account types are: Trading 212 Invest, Trading 212 CFD and Trading 212 ISA. Trading 212 Invest offers traders to invest and trade in real equities where short-selling is not available. Trading 212 CFD is where most traders are expected implement their trades. Trading 212 ISA offers to take full advantage of tax-free trading up to a certain amount, but this type of account is only available to UK traders. All international clients will trade in the Trading 212 CFD account. The trading terms are essentially the same across all three account types. This Trading 212 review has focused on the Trading 212 CFD account as most traders will be managing their portfolios from this account type.

Trading 212 Leverage

While the Trading 212 Invest account does not offer leverage, the Trading 212 CFD one does. It is paramount to understand the difference between investing and trading to determine which one suits the individual. Until the end of the Brexit transition period, which ends on December 31st, 2020, the maximum Trading 212 leverage granted to retail traders is 1:30. It is due to the 2018 decision by the European Securities and Markets Authority (ESMA) to reign in margin trading and bonuses offered by CFD brokers. UK-based brokers lobbied unsuccessfully against the rule changes, and being a member of the European Union (EU), they had to comply with uncompetitive and counter-productive measures by the ESMA.

It remains unclear by when Trading 212 can revert to the pre-2018 changes, where the maximum leverage was 1:500. The margin requirement varies across assets. Presently, traders get 1:30 on major currency pairs, 1:20 on minor ones, 1:20 on gold, and 1:10 on other commodities. Equity CFDs are available at 1:5, 1:20 on major index CFDs, and 1:10 on minor ones. Those who classify for a professional account may receive maximum Trading 212 leverage of 1:500, the same level for retail traders before the ESMA action lowered it to 1:30. Adjustments will likely see improved margins for all traders starting in 2021, which will deliver a boost to the competitiveness of the trading environment.

Leverage is one of the most beneficial trading tools if deployed in conjunction with risk management. Regrettably, many traders and regulators, led by the ESMA, misunderstand the concept of it and ignore that the absence of risk management causes outsized losses for traders, not the amount of deployed leverage. It does impact the number of points a position can remain at a loss before risk management demands closure at a loss. The higher the margin requirement, the more traders can be wrong before facing an equal loss. For example, if the maximum accepted loss is 3%, the amount of leverage does not alter it. Until the UK announces changes, the Trading 212 leverage for retail traders does not exceed 1:30.

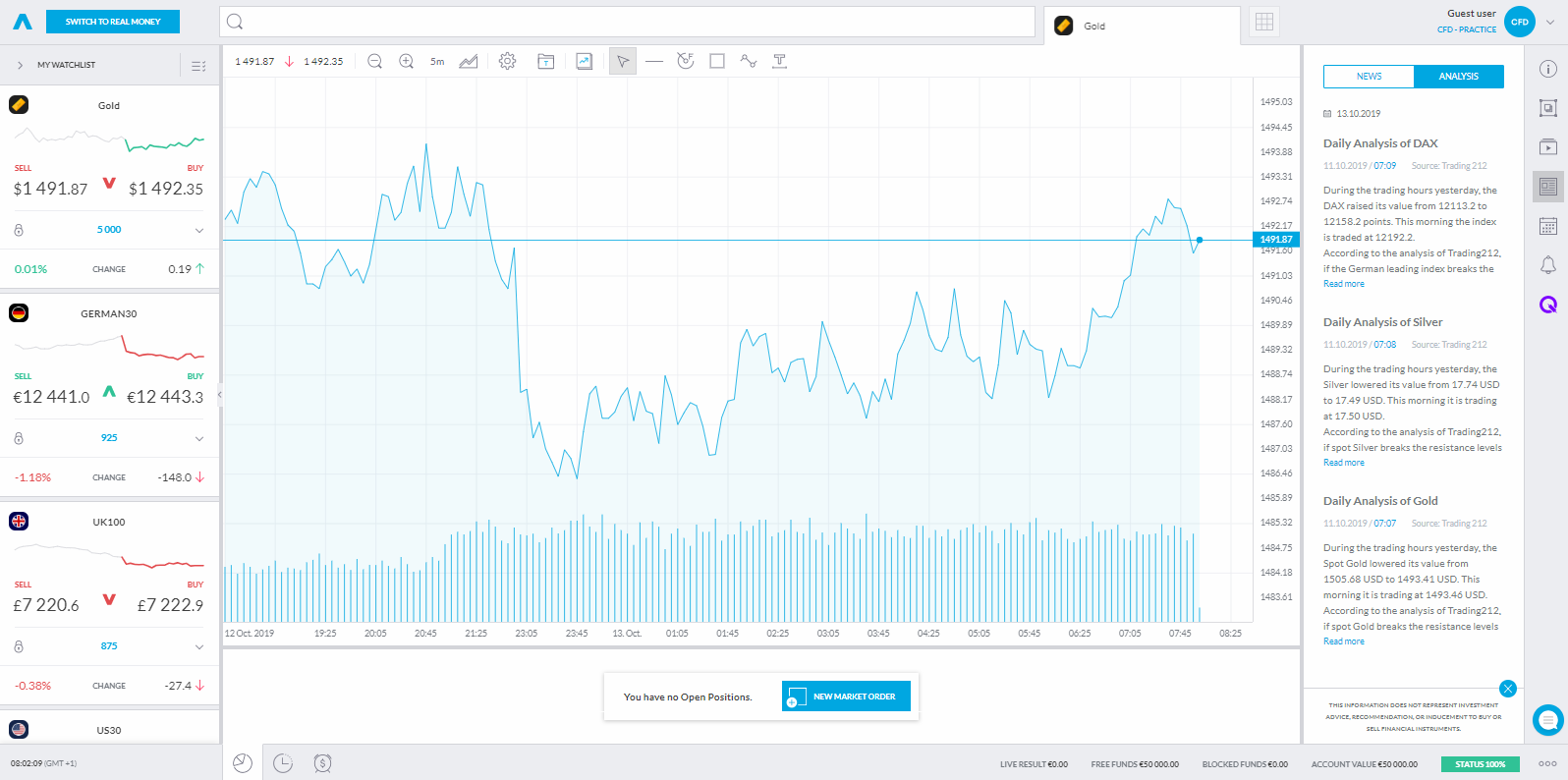

Trading 212 Practice Account

Like most brokers, Trading 212 offers a demo or practice account, but unlike the majority of competitors, it is available without the need to sign-up or submit personal information. New traders can click on the Practice for Free button located towards the bottom of the Trading 212 CFD homepage. It loads the demo version of the webtrader with a virtual balance of $50,000. Since the trading account differs from MT4, it offers a complete insight look at how to operate it. There is no time limit, so new traders can practice for as long as they wish, and the Trading 212 practice account keeps the history unless you clean your browser cookies, history, and cache.

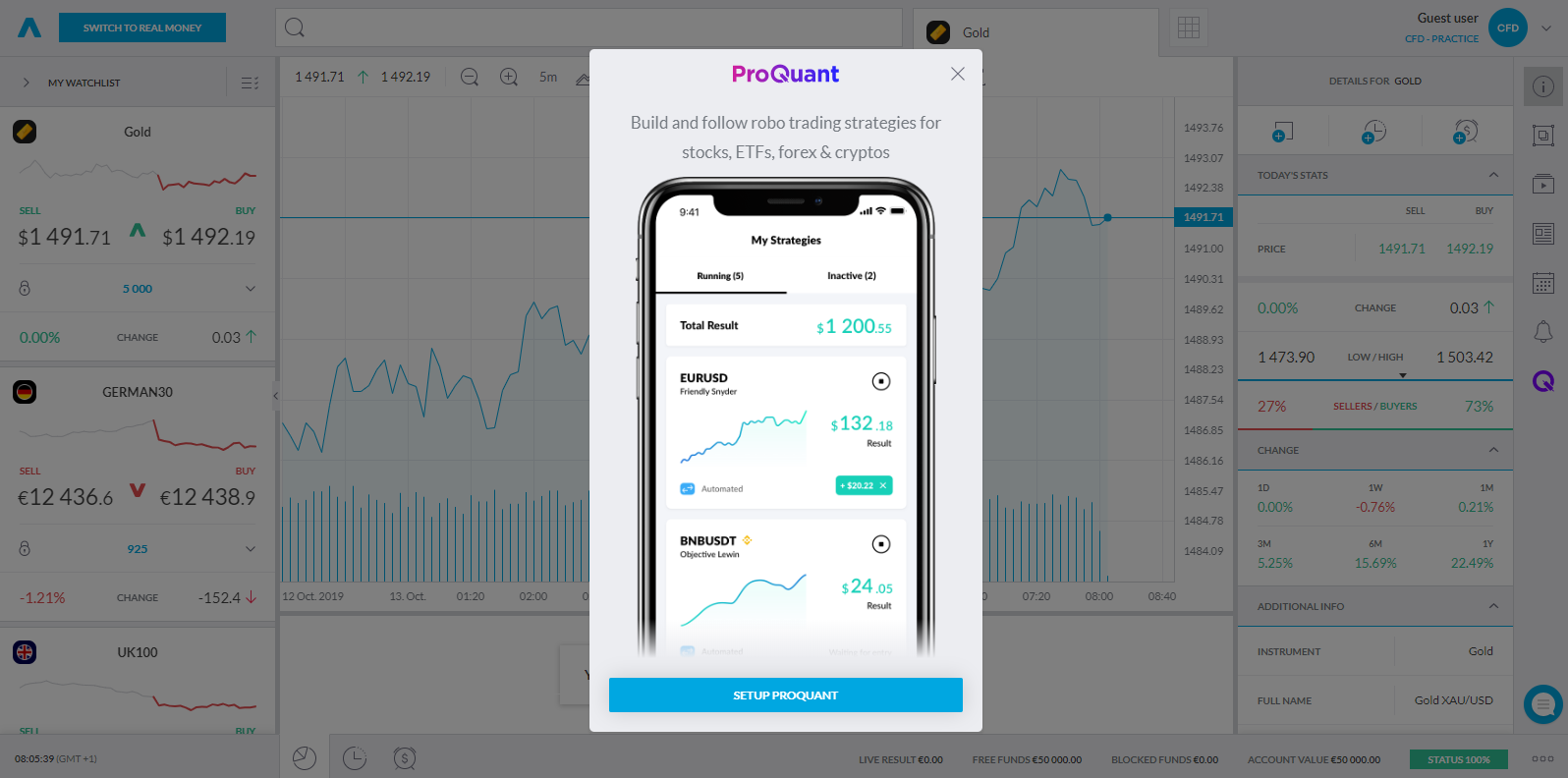

To use automated trading strategies, traders must set-up ProQuant, for which a mobile phone is necessary. While the option remains visible in the demo web trader of the Trading 212 practice account, the ProQuant may not be available as a demo version. Many new traders want to use a practice account to learn how to trade, which is not ideal and partially the reason why so many fail. Learning how to trade is best accomplished in a live account with a small deposit, while demo accounts serve developers testing strategies and fixing bugs. New traders can use it to get a feel for the trading platform, which should take no more than thirty minutes.

The trading platform features a clean interface and does not require a long time to get accustomed to, especially if you have experience with other alternatives like MT4, cTrader, or any of the proprietary versions. Since the Trading 212 practice account requires no information, it offers interested potential clients a commitment-free look at what to expect from it. Other brokers collect contact data like name, e-mail, and sometimes a phone number in an attempt to convert demo users into deposits. Marketing campaigns exist for that purpose with special offers, and some new traders may feel pressured by time-limited promotions to convert to a live account. At Trading 212, this is not the case, and everyone is free to proceed at their desired pace.

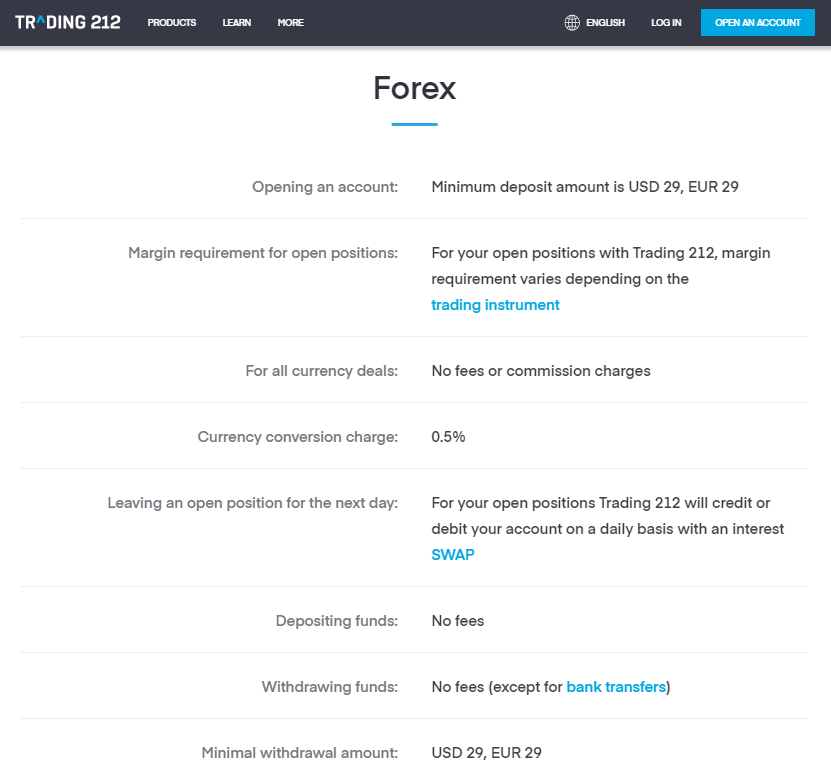

Below are the trading terms for the Trading 212 CFD account which are excellent. This broker is very transparent about all costs involved.

Trading 212 Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Since Trading 212 is a fintech company, it is only natural that this broker provides its own proprietary trading platform. Unfortunately, there is no specific information about the trading platform provided, but it is obvious that mobile trading is front and center while an image displaying a desktop version is available on their website. It would be nice if more information about the trading platform would be available, especially since it is an unfamiliar platform. A demo account can be accessed without registration to test drive the platform, but lack of information about the platform on the website is a misstep on the broker’s side.

Since we are left with scarce information, what we do know is that all normal trading operations are supported. It remains unclear, and unlikely, that third-party applications can communicate with the trading platform which rules out automatic trading with existing applications; no mention of APIs were made anywhere on the website. Given the information available makes the offered trading platform acceptable to new traders, but an unacceptable choice for established traders who have either created their own or purchased third-party software which they use as part of their trading routine.

For many traders this means that no-commission trading comes at the cost of abandoning their existing software, which may be a price to steep to pay. Trading 212 is pushing its own platform as a complete solution and it has gathered plenty of attention as judged by the 14,000,000 plus downloads. Despite this, many traders use auto-trading software and they are left out unless they plan to invest more capital and create costly workarounds in order to take advantage of the great trading conditions offered at this broker.

Trading 212 does offer ProQuant which allows traders to create automated trading solutions, which could also be a limitation for new traders who want some help. This is the only known form to operate automated trading solutions with the Trading 212 platform which makes it an unacceptable choice for established traders. The desktop version is browser-based, with no downloads required. A browser extension is available.

ProQuant is the only way to operate automated trading solutions.

This is the Trading 212 browser version of its trading platform:

Unique Features

The unique feature at Trading 212 remains commission-free trading in over 1,800 assets across multiple sectors. There are very few other standout features offered by this broker. This broker focuses on clients who seek to trade free of commissions on their trading platform and sticks to the bread-and-butter business of brokerage operations. Trading volume is key for the profitability of this broker and all facts point towards a solid execution of their business model.

While Trading 212 manages a blog, updates are few and far between. The latest post was published more than six weeks before this Trading 212 review. This is another sign that operating their trading platform remains the focus with other services treated more as a hobby than as professional brokerage.

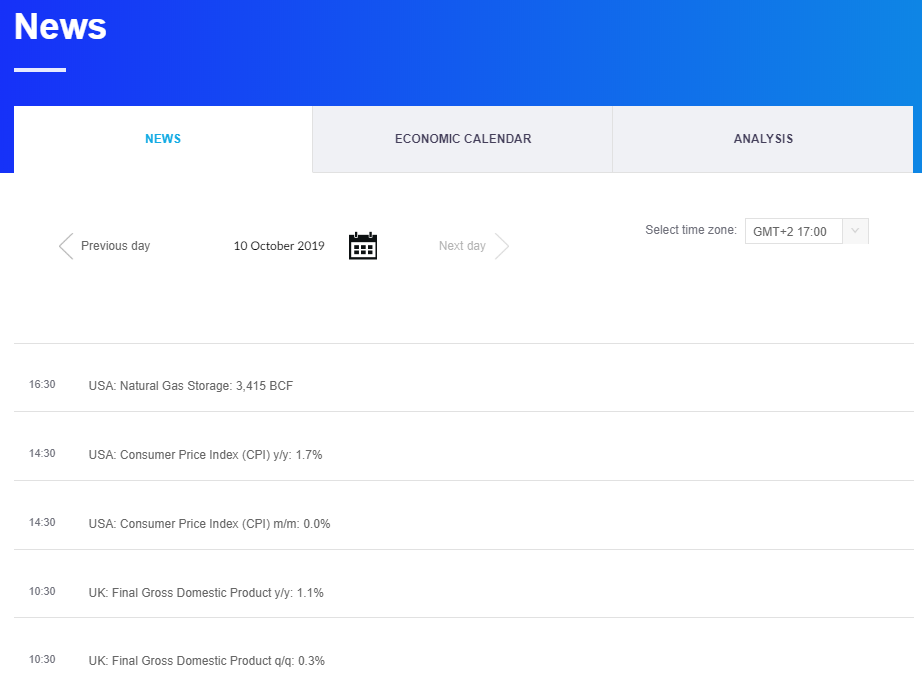

Research and Education

When it comes to research, Trading 212 does offer an analysis section which together with a news section and an economic calendar comprises the research capabilities offered by this broker. Once again, this is not an area Trading 212 pays too much attention and each analysis is limited to one paragraph which touches the basics. Where Trading 212 shines with its trading conditions, it fails with its research department.

In order to fully compete with top tier brokers, this is a section which clearly needs to be improved. Offering no commissions is a great start, but by no means should this be the end of what is offered. Currently, this is where Trading 212 stopped its own development which drags down the overall great core of this broker. It is worth to keep this broker on your watch list as services may expand in the future and add value to the overall end product offered to its clients.

There is an education section filled with videos on their official Youtube channel which promises weekly updated and has over 350,000 subscribers. This can be relevant for the millennial crowd which appears to be the target crowd for this broker.

News

The news section is updated through the day, but usually limited to one-to-two sentences and is more of a headline compilation service. The source is listed as Trading 212 and traders can get the link of the report, but at the time of this Trading 212 review the links didn’t work.

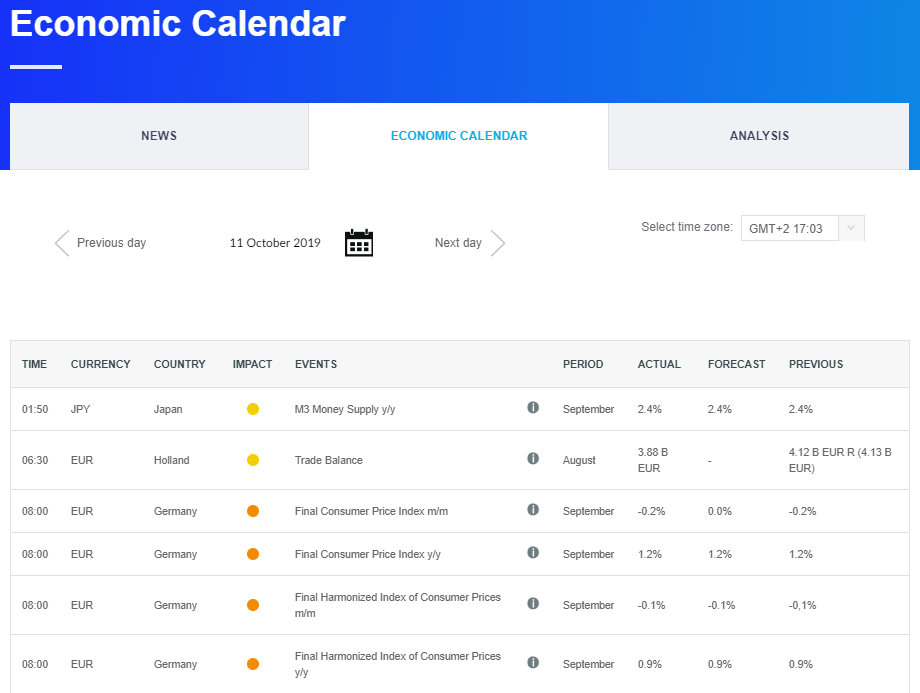

Economic Calendar

The economic calendar offered by Trading 212 is the one you will find at many outlets online and offers a nice overview of economic reports with the expected impact. Navigation is easy and the overall presentation is clean.

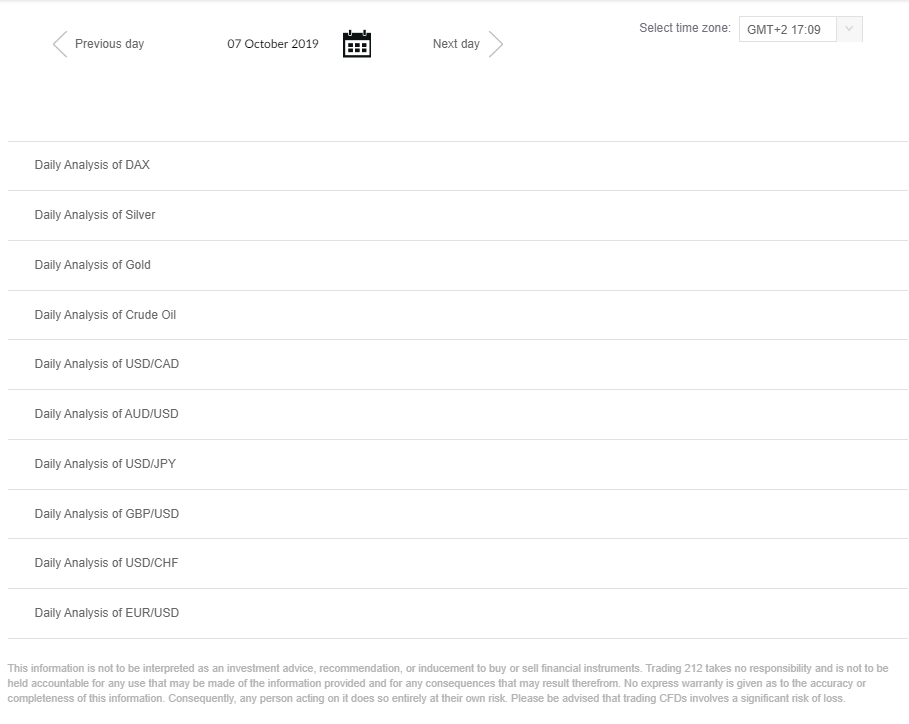

Analysis

A one-paragraph analysis is hardly a professional approach to delivering an analysis to clients. It appears that only ten assets are covered, given the 1,800 assets available this is a major fail and it would have been better not to offer anything at all. This shows that Trading 212 is indeed a fintech company which is dabbling in a service industry it may not fully understand.

Education and Training

When it comes to education, more effort has been placed into this service. As younger traders love videos, Trading 212 has taken advantage of this and made its educational content available on its official Youtube channel which appears to be fairly popular. Content is added weekly which shows commitment.

Trading 212 Tutorial

The most valuable educational tool at Trading 212 is presented as videos, capturing the generation of young traders who prefer to learn via videos rather than reading written content. While commission-free trading benefits all traders, new retail traders under the age of 40 respond to its the most. Creating high-quality educational tools appealing to the largest group of new downloads and account openings is where the Trading 212 tutorial section in video format shines. It represents a well-thought- approach with a genuine intent to introduce trading related topics for educational purposes without marketing-inspired aspects. Many brokers use education to market their services, which is not the case with Trading 212, creating a significantly superior service.

Trading 212 maintains its Youtube channel, but all videos can be watched directly from the website via a pop-pit rather than redirect to Youtube. The quality remains exceptional, with most video over ten minutes long. It allows enough time to explain the covered topic adequately without taking too much time from traders. The attention span from the majority of younger traders remains ideal up to the ten-minute window before fading. Numerous topics require more time, which Trading 212 splits into sufficient sections over multiple days. Therefore, traders have the flexibility to learn at their own pace and when they have the time. It is similar to an online classroom setting, with the difference being that the lesson begins on demand.

While the Trading 212 tutorial consists dominantly of video, excellent written tutorials are equally available. They consist of quality educational content and explanatory charts, offering traders an additional tool to learn the basics of trading before they can learn how to earn from it. The quality of this service adds value to Trading 212, and new traders should take advantage of the well-presented and easy to understand educational section.

Trading 212 for Beginners

New traders may get overwhelmed by the amount of information they need to process and master. There are countless paid-for educational services, which sound appealing to many, but new traders should avoid them. All of the information in those is available free of charge. Trading 212 for beginners offers video tutorials and written content, as mentioned above. Unlike some brokers, the content is accessible for all beginners without the need to open and fund a trading account. It is a comprehensive and marketing-free tool to allow new traders a high-quality education without paying money for it. Traders can use the saved money to fund their portfolios when they feel comfortable at doing so.

Offering quality education shows that a broker cares about their traders and does not only seek an initial deposit, which is usually lost. While beginners receive an exceptional add-on service to the competitive core trading environment, Trading 212 builds a relationship based on trust and confidence with their clients. The long-term success of any top tier broker depends on the quality of its traders and investors. Brokers that deploy a 100% market maker execution model tend to favor traders who face losses, as those translate into direct profits for the broker. There are always exceptions, which can be identified by the overall trading environment. At Trading 212, education fulfills an essential role.

Despite offering an exceptional Trading 212 for beginners service, 76.0% of retail traders at Trading 212 CFD operate portfolios at a loss. It ranks in the mid-section as compared to all brokers, irrelevant if an in-house educational section exists. It shows that the majority skips the most defining step in their trading career and does not commit to trading with the same mindset as they would another career choice. Trading 212 offers all the tools required for beginners to get started but taking advantage of them is up to the individual.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/7 |

Website Languages |

This will most likely be the section of Trading 212 which most traders will never have to use, but there are some items which the broker asks clients to reach out for such as special promotions or bonuses which are granted on an individual basis. Traders can either call, send an e-mail or fill out the web form available on the website; live chat is also available. Support hours were not mentioned, but regular business hours can be assumed.

Bonuses and Promotions

No bonuses or promotions are offered, but they may apply on an individual basis and Trading 212, in their FAQ section under “Miscellaneous” state that traders should ask support through chat which is available on the website or directly from inside the trading platform.

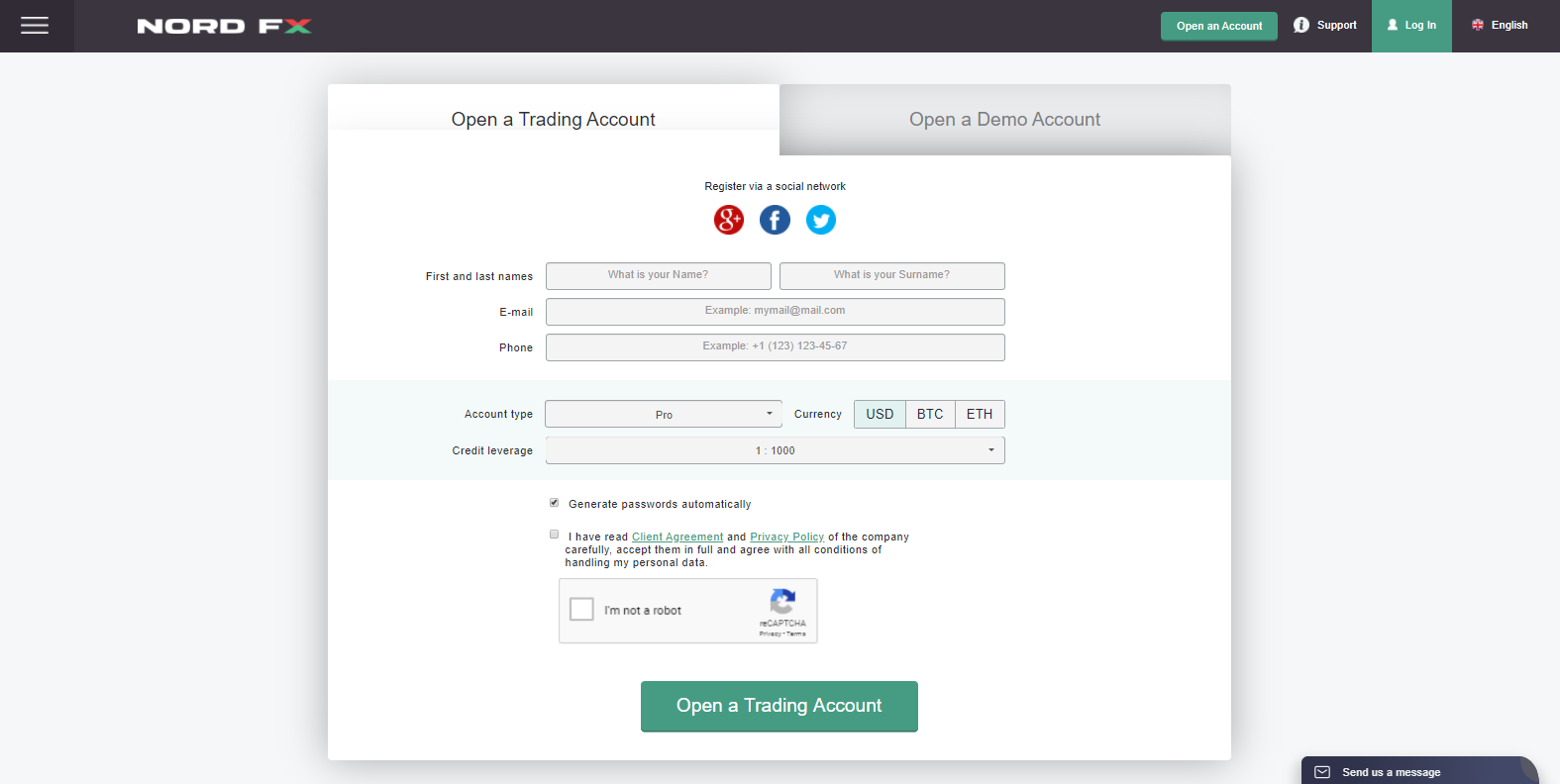

Opening an Account

Traders will have to complete the online application which consists of a multi-step process. After new clients click on “Open an Account”, a pop-up appears and the process is started. A green progress bar gives new clients a rough idea of how many more windows they have to browse through and provide data. It would have been nicer if this process would take place in one window, but the required information is the same as with other regulated brokers in order to satisfy the AML/KYC requirements.

Deposits and Withdrawals

Trading 212 offers bank transfers, credit and debit card payments, Skrill, Dotpay, Giropay, and Direct eBanking as deposit and withdrawal options. Certain fees will apply for deposits and withdrawals as per their FAQ section. While bank wire fees are the norm, some brokers reimburse their clients for the costs in order to have zero costs with deposits, other deposit fees should only be on the side of the payment processor used. Bank wires are charged with a small and unnecessary €5 fee on top what the bank will charge.

Processing times are listed as 10 minutes for debit/credit card deposits and 2-3 business days for bank wires; for withdrawals to debit/credit cards and for bank wires the times are again listed at 2-3 business days. There is no mention on the other payment options. It would be nice for Trading 212 to offer a complete table with all costs involved.

Trading 212 Minimum Deposit

The Trading 212 minimum deposit depends on the account type, but both are extremely low, allowing all retail traders access to the excellent trading conditions available at this broker. Investors can deposit just €1/$1 in the Trading 212 Invest account, which is for long-term investing from unleveraged portfolios, with all payment processors, except for bank wires, where it is €10/$10. Trading 212 does not levy internal deposit fees, and there is no currency conversion cost if you deposit from a different currency. Since the account is unleveraged, there are no overnight swap rates, meaning you do not face fees for keeping your investment for the long-term.

Traders will manage their portfolios from the Trading 212 CFD account, where the minimum deposit increases to €10/$10, which remains one of the lowest available in today’s financial market. While there is no deposit fee, a 0.50% currency conversion cost applies. Commission-free trading exists in both accounts, but daily swap rates apply, which is why more capital is necessary to trade CFDs than to invest from unleveraged portfolios. The Trading 212 minimum deposit remains low, but new traders should not confuse this with an appropriate amount to start trading or investing.

Due to the low Trading 212 minimum deposit, this broker offers all traders flexibility to grow their trading and investing accounts. While the appropriate portfolio size depends on the individual traders and goals, anything below €10,000/$10,000 remains an insignificant amount to justify the hard work with the possible rewards. There are always exceptions, and those seeking to trade for a living will require a higher amount than that, often ten times more. New traders should not be discouraged by this, as it will take time to build a portfolio with trading, investing, and depositing. Trading 212 offers all the tools and flexibility for genuine traders and investors to grow their accounts with low minimum deposits and commission-free transactions.

Trading 212 Withdraw

While the Trading 212 minimum deposit amounts offer a high degree of flexibility to build portfolios, withdrawing profits is equally convenient. The minimum Trading 212 withdraw amount is €1/$1 in the Trading 212 Invest account and €10/$10 in the Trading 212 CFD alternative. There are not internal fees by this broker, but clients must consider third-party processor charges, which vary across the elven support options. For security reasons, withdrawals are sent back to the same payment processors as the deposit method. Some traders and investors will make multiple deposits from different processors, in which case Trading 212 will honor withdrawals to credit/debit cards, but not to alternative payment processors like Skrill or PayPal.

In case the credit/debit card expired and was the only registered payment method, clients must make another deposit with their new card or provide Trading 212 with bank wire details for a withdrawal. Since the Trading 212 minimum deposit is between €1/$1, and €10/$10, depositing to confirm the new card poses no challenge. Should the debit/card be lost and blocked, Trading 212 requires an official bank letter with confirmation of it. At all times, this broker adheres to strict revelatory mandated anti-money laundering (AML) protocols to ensure a safe and secure trading environment for all traders.

Clients must also consider any costs from the payment processor to receive the funds into their bank account. Especially a third-party online method is a preferred choice, and the processor does not provide a debit card. While the Trading 212 withdraw amount allows traders the freedom to take as little as €1 or $1 from the investment account and €10 or $10 from the trading account, traders and investors should avoid micro-transactions. It is best to limit withdrawals to once per month, quarter, or year. It avoids fees and allows portfolios to grow, which returns the generated income.

Trading 212 Minimum Withdrawal

Let us take a closer look at the Trading 212 minimum withdrawal and why the ability to withdraw as little as €1 or $1 may appeal to many traders but remains counterproductive. Being flexible in account management is a topic most educational outlets fail to cover or reduce to a side note. It is as essential of an aspect to successful trading as the more obvious ones like trading strategies and psychology, especially once you master them. Up to 85% of retail traders will never be in a position to withdraw from their account or to do so in limited amounts, which is where the Trading 212 minimum withdrawal is beneficial. Traders who remain committed to the long-term success of trading should not engage in small transactions. While no withdrawal fees exist from Trading 212, third-party charges do apply. Therefore, requesting just €1/$1 makes no economic sense.

Traders have a shorter time horizon than investors, and those who trade for a living require capital to fund their expenses the same way they would if they were a salaried employee. The withdrawal frequency is, therefore, higher than with investors who should request one only once per year, if at all, or focus more on the five to ten-year horizon. Some decide to withdraw part of their dividends, but most reinvest them for an increase in cash flow. Since traders operate under a different set of rules, they must satisfy more frequent capital needs. The Trading 212 minimum withdrawal offers no restrictions on their financial planning.

Despite the absence of withdrawal fees from Trading 212 and the low withdrawal amount, traders must create a plan for withdrawals and adhere to it. Most people get paid once per month, and the same framework should apply to trading. It also impacts your trading activity by lowering the free margin in your account. Without a withdrawal plan, it may influence open positions and result in future losses. Withdrawing more than the profits earned will reduce the profit potential moving forward, another fact to consider. Knowing how much each monthly withdrawal will consist of, and implementing it into a trading strategy, allows for a balanced and long-term profitable approach to trading. Traders should focus more on portfolio building than withdrawals. Once mastering the former, the latter follows suit.

Summary

Trading 212 is a broker operated by a fintech company. This has broker has disrupted the brokerage scene by offering commission-free trading. The trading conditions are great and with over 1,800 assets available for trading across multiple classes, it is a great broker for new traders. Its target market is clearly new millennial traders who seek to trade on the go from their mobile devices.

Established traders who have their own trading software will be disappointed as Trading 212 offers only its own proprietary trading platform with no support for existing automated trading programs. It offers ProQuant which allows the creation of automated trading robots without the need to program which is yet another sign that it targets new millennial traders while it remains an unacceptable choice to advanced and professional traders.

Regulation, safety and security of funds are top of the line with the FCA out of the UK serving as its main regulator. It subsidiary is additionally authorized and regulated by the Financial Supervision Commission in Bulgaria. Client’s funds are segregated and are insured in the unlikely event of financial default. Traders can rest assured that their capital is well protected.

Trading 212’s primary short-fall remains its research department or lack of a quality one educational offering.

This is definitely a broker to watch out for and if Trading 212 decides to improve its services it will be a credible competitor for big, established brokers. For now, there is a solid foundation on which this broker can expand if it decides to do so; otherwise its explosive growth story may be short-lived. Trading 212 is headquartered in London, UK. Trading 212 earns the majority of its income from spreads on its 1,800 assets. Small, unnecessary fees are charged which remain more of a nuisance than a cost. Trading 212 offers bank transfers, credit and debit card payments, Skrill, Dotpay, Giropay, Carte Bleue and Direct eBanking. The minimum trading size depends on the asset traded and a complete list can be obtained on the broker’s website. Trading 212 issues a margin call at 45% with an automatic stop out at 25%. Trading 212 is the brand name of Trading 212 UK LTD as well as Trading 212 LTD. Trading 212 UK LTD is registered in England and Wales with company number 08590005 and authorized ad regulated by the Financial Conduct Authority (FCA) under registration number 609146. Trading 212 LTD is registered in Bulgaria with register number 201659500 and authorized and regulated by the Financial Supervision Commission under registration number RG-03-0237. Trading 212 offers maximum leverage of 1:300, but this is available to professional clients only. Trading 212 has an online application form which is standard operating procedure. No, Trading 212 offers its own proprietary trading platform. Traders have to open a trading or investing account, fund it, and then have access to over 6,500 assets commission-free, with a primary focus on equities. It derives most of its revenues from the mark-up between the bid and ask price, known as the spread. Trading 212 is not only legit but fully compliant with all its regulators. It maintains a secure and trustworthy trading environment. Over 180,000 clients rank it between 4.5 and 4.7 out of 5.0. Open the account type best suited for you, deposit, and you can start investing or trading with Trading 212. Yes, Trading 212 offers a Bitcoin but only as a CFD. Trading 212 issues the occasional promo code campaign offering financial rewards, for example, a free €100 share. Terms and conditions apply and interested traders must learn and understand them before using and accepting any promo code offer.FAQs

Where is Trading 212 based?

How does Trading 212 make money?

How can I deposit into an Trading 212 account?

What is the minimum lot size at Trading 212?

When does a margin call take place at Trading 212?

Is Trading 212 regulated?

What is the maximum leverage offered by Trading 212?

How do I open an account with Trading 212?

Does Trading 212 offer the MetaTrader Trading Platform?

How does trading 212 work?

Is Trading 212 legit?

How to use Trading 212?

Can you buy Bitcoin Trading 212?

What do I get by using a Trading 212 promo code?