Editor’s Verdict

Overview

Review

Headquarters | Vanuatu |

|---|---|

Regulators | VFSC |

Year Established | 2013 |

Minimum Deposit | $500 |

Trading Platform(s) | Proprietary platform, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

TradeTime makes a number of bold statements, including the assertion that they are both an industry leader and innovator. The broker further makes that claim that it has been in operation for seven years, is regulated, and segregates accounts. Unfortunately, TradeTime is unable to back up its assertions; in nearly every case it fails to provide details and/or proof. At the same time, it focuses exclusively on marketing its proprietary trading platform and account customization, both of which come at an elevated cost, that is unless a trader is willing to make a substantial deposit.

Regulation and Security

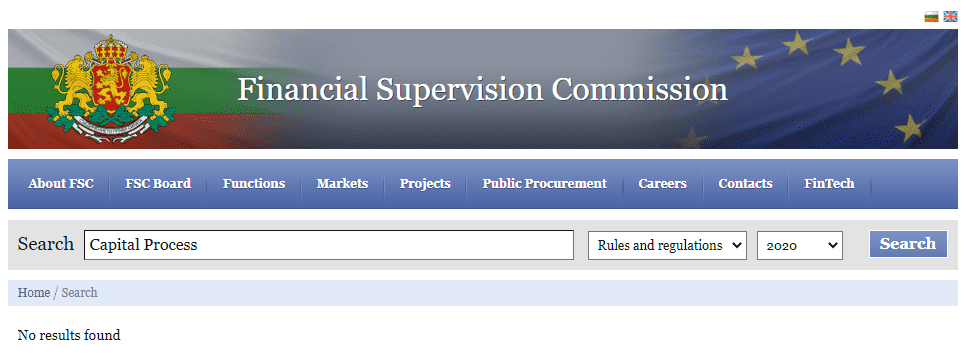

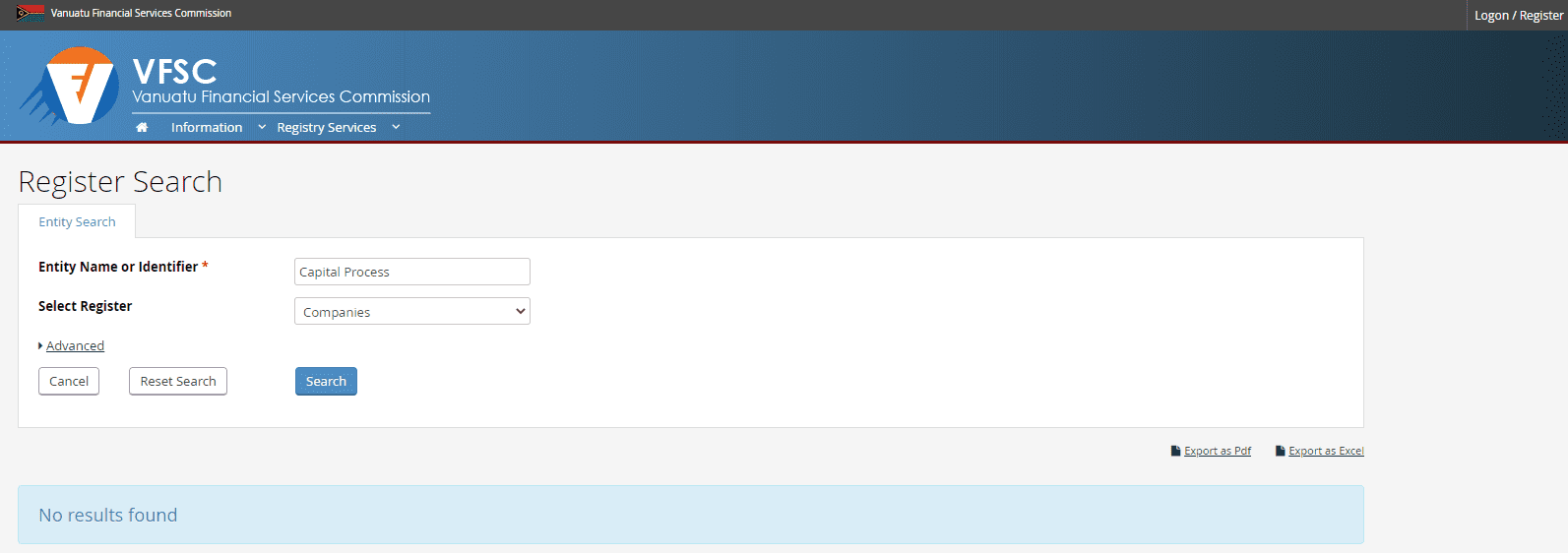

While TradeTime lacks transparency, the Term & Conditions available at the bottom of each website page links to a PDF where the Bulgarian company, “Capital Process ltd. LTD,” is revealed as the corporate owner. Independent confirmation of that assertion is unavailable; the Bulgarian Chamber of Commerce, the e-Justice portal of the European Union, and Company Informer Bulgaria has no record of a registered entity by this name.

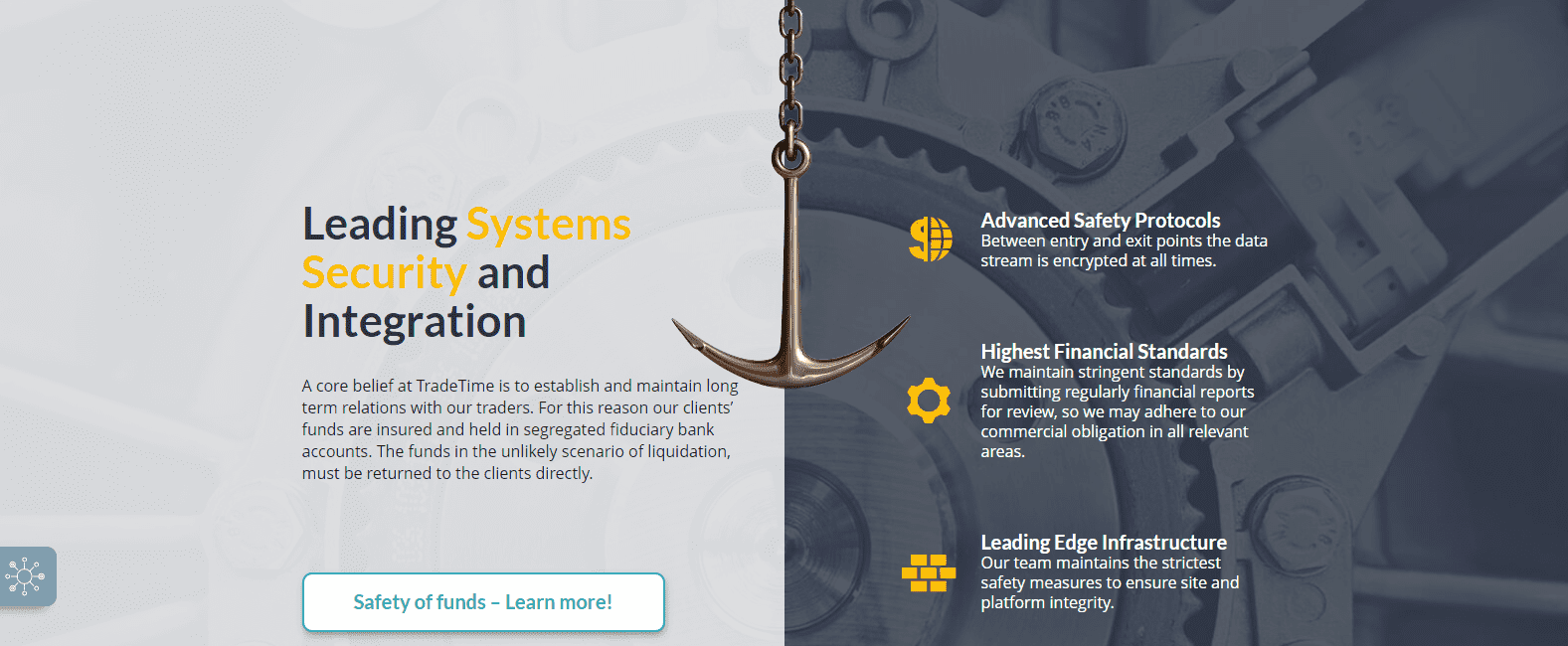

Adding to the numerous red flags is the claim that TradeTime is a regulated broker; potential traders should know that the Bulgarian Financial Supervision Commission (FSC) does not provide regulatory oversight. The marketing team at TradeTime instead created a convincing presentation to reassure potential clients of regulatory oversight, but this broker grants no proof of that claim. Interested traders should be extraordinarily cautious when considering TradeTime as an option, with essential documents missing even as the broker makes false claims regarding regulatory oversight.

TradeTime is not transparent regarding its ownership or regulation, with only sparse details available in the Terms & Conditions.

Numerous claims about regulation, segregation of client capital, and fund security are a product of the broker's marketing team.

No regulatory record exists for this broker.

Fees

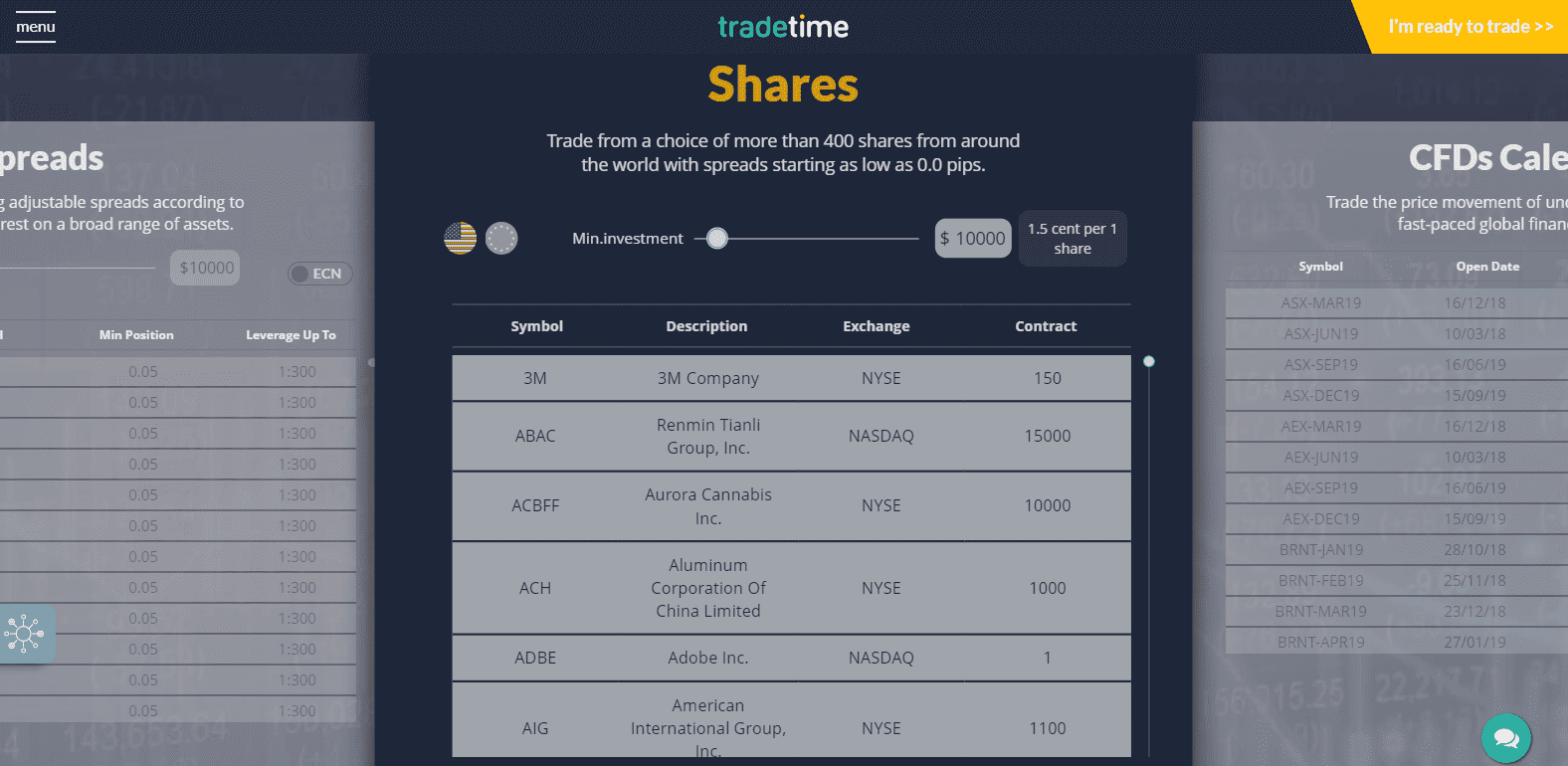

TradeTime features an outrageous cost structure for Forex traders. A $10,000 deposit results in a 2.2 pips spread for the EUR/USD, which is unacceptable by any standard. Lesser deposits see the mark-up increase to 3.3 pips. The ECN account carries a 0.6 pips EUR/USD spread for a commission of $1.80 per CFD. Equity CFDs face a $0.015 cost per share, a slight improvement but elevated, nevertheless. Where account customization dominates marketing to unknown traders, a significant pricing environment persists, regardless of the customization. No mention of swap rates and corporate action exists, extending this broker's ambiguity on essential critical aspects such as regulation and cost structure.

The cost structure favors broker profitability, especially in the Forex market.

Equity CFDs provide lower costs, but the general fees at TradeTime are unacceptable.

What Can I Trade

TradeTime offers over 490 assets across Forex, commodities, equity, and index CFDs, but once again, details are scarce. Traders may explore assets with an incomplete list and search box, where one can hazard a guess as to which ones are actually available. Over 60 currency pairs are available, and 400+ equity CFDs form the bulk of tradable instruments. Seven commodities and seven index CFDs complete the selection.

The overall choice of assets is suitable for most retail traders.

Account Types

Customized accounts are at the core of marketing efforts. It sounds appealing, but the result is, as expected, far less than advertised. TradeTime merely filters the available assets or highlights the ones it believes you may want to trade. Lack of details is dominant, while everything points toward the submission of personal and financial information with the intent of encouraging a potential trader to open a trading account. The maximum leverage of 1:300 further suggests the broker's lack of regulation, particularly in the EU, where the ESMA limits leverage to 1:30 for retail traders.

Customized accounts represent an adjusted asset filter from the scarce public information, but it is marketed well to unknown traders.

Trading Platforms

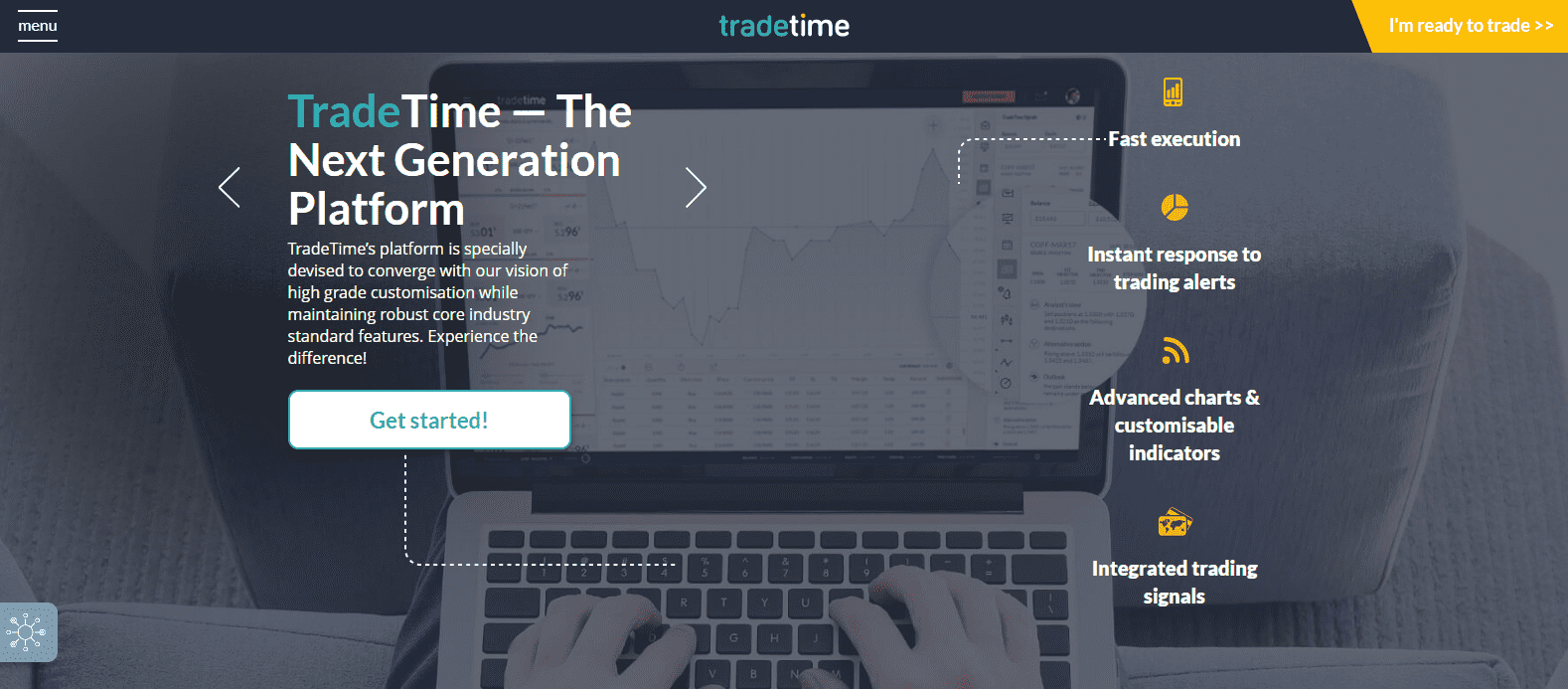

TradeTime grants its traders a proprietary trading platform, which is marketed as a superior choice but in actuality lacks essential features. An average charting package meets elegant design. A news feed and in-house generated trading signals are supported. On the whole, it closely resembles typical trading platforms from the now-defunct binary options industry. Finally, the lack of automated trading solutions compounds the short-falls.

The proprietary trading platform resembles that of the failed binary options sub-sector.

Unique Features

There are no unique features at TradeTime, but the lack of transparency and misleading information is noteworthy.

Research and Education

In-house research focuses on quantity rather than quality. A one-paragraph introduction leads to chats with a one-sentence explanation. It appears as if the analysis was conducted in the MT4 trading platform, a platform not currently offered by TradeTime, granting further evidence of missing elements of the proprietary trading platform. The absence of education content is unacceptable, especially given this questionable broker's target market. A blog is available but appears discontinued as of January 2020.

Traders receive numerous trading signals per day.

TradeTime focuses on quantity over quality.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Unspecified |

Website Languages |  |

Clients may engage customer support via e-mail, phone, and a live chatbot which attempts to collect personal information before responding to inquiries. The chatbot pops up frequently, ruining the user experience. Operating hours are unavailable, while the support center features an FAQ section with limited answers, omitting essential ones.

Customer Support is haphazard and intrusive, at best, and duplicitous, at worst.

Bonuses and Promotions

A $27 no deposit bonus exists, though no additional details are forthcoming.

Opening an Account

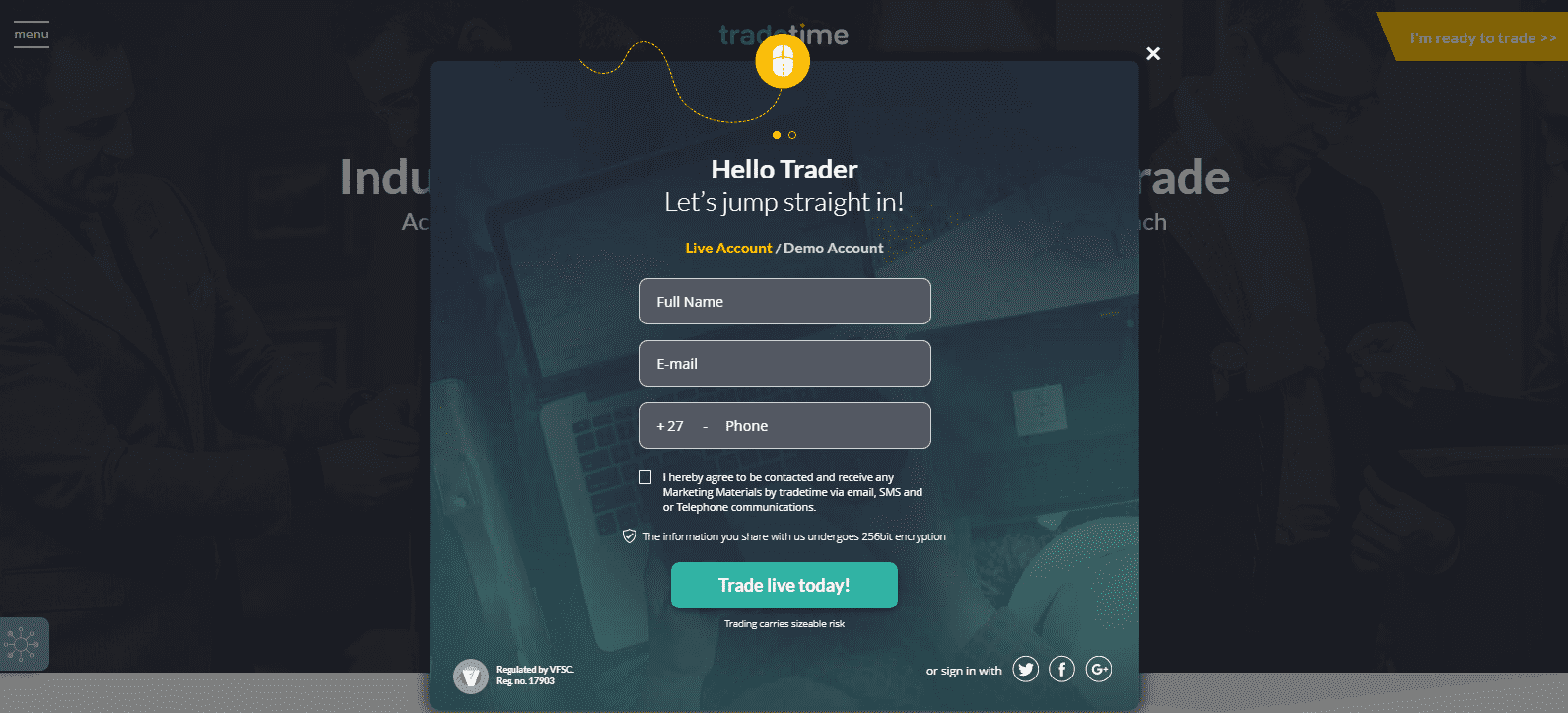

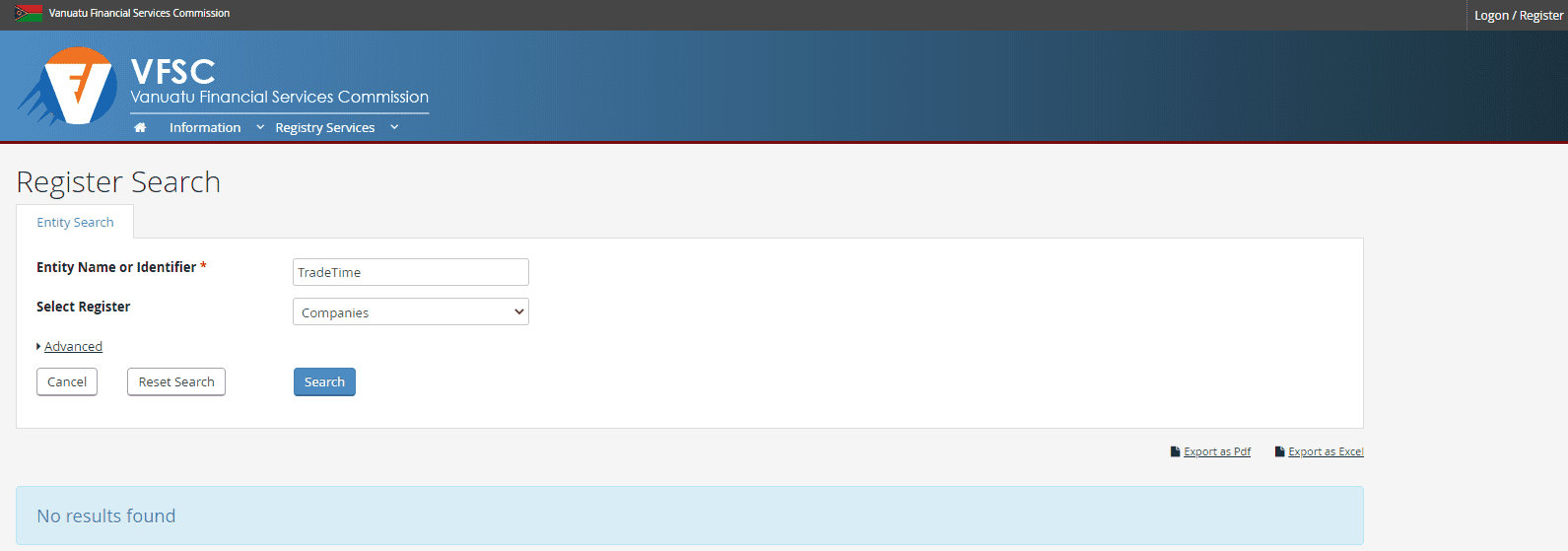

A simple online application asks for a full name, e-mail, and phone number. Clients may also complete this step via Twitter, Facebook, and Google+. It is the first instance where TradeTime references its regulator, the Vanuatu Financial Services Commission (VFSC). No records of Capital Process or TradeTime exist with the VFSC, adding to concerns over the authenticity of this broker.

On the account opening page, TradeTime claims to be regulated by the VFSC.

No record of Capital Process exists at the VFSC.

A search for TradeTime likewise yields no results.

Deposits and Withdrawals

TradeTime merely notes support for bank wires, credit/debit cards, and a range of online payment methods, together with a minimum deposit of $500. A consistent lack of transparency exists throughout the website.

Deposit and Withdrawal information is vague.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

TradeTime appears to operate as a scam. From the start, false claims with a complete lack of transparency are an overriding occurrence. The Terms & Conditions reveal a Bulgarian company as the corporate owner, though numerous searches suggest that no official records exist. The online application form notes regulatory oversight by the Vanuatu Financial Services Commission (VFSC), which is another unverified claim. Together, the details render TradeTime as an unregulated entity using deception to entice new clients. The overpriced cost structure from a sub-standard trading platform adds to an overall unsuitable trading environment. Education is missing, and only low-quality research is provided, while marketing for new clients remains the primary focus at TradeTime. Numerous sources label this broker as a scam and the details and facts uncovered by this review suggest that those claims, that TradeTime is a scam, are not without merit. TradeTime claims to be owned by Bulgarian company, Capital Progress, and notes an address in Varna. No official records of this company seem to exist. Misleading claims about its regulatory oversight, coupled with the apparent lack of transparency, raise grave concerns. Multiple sources label TradeTime a scam. A scam operation is highly probable, given the overall presentation by this broker. No, it only grants its proprietary trading platform, which is a sub-standard alternative. The seven contact numbers are +64-48303348, +61-284881087, +34-917936712, +46-840308827, +41-315087562, +44-2031501127, and +33-170726507. TradeTime offers CFD trading in an apparent scam, where a demo account simulates all activities.FAQs

Is TradeTime a legitimate company?

Is TradeTime a scam?

Does TradeTime offer MT4?

What is the TradeTime contact number?

What are the TradeTime financial services?