Editor’s Verdict

JustForex maintains a competitive pricing environment, high leverage, quality research, and education, making it a well-rounded broker. Traders get the MT4/MT5 trading platforms, a proprietary copy trading service, and ZuluTrade. JustForex serves asset managers via the MAM module, has a rewarding partnership program, and relies on generous bonuses. I reviewed JustForex to determine if it delivers on its promise of quality, professionalism, and reliability. Is JustForex a broker you should consider?

Overview

JustForex offers copy traders a broad choice of providers and maintains a quality core trading environment focused on beginner traders.

Summary

Trade360 - A social trading broker with its proprietary CrowdTrading platform

Headquarters | Cyprus |

|---|---|

Regulators | CySEC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2013 |

Execution Type(s) | Market Maker |

Minimum Deposit | $500 |

Trading Platform(s) | MetaTrader 5, Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 1.8 pips ($18.00) |

Average Trading Cost GBP/USD | 1.8 pips ($18.00) |

Average Trading Cost WTI Crude Oil | $0.07 |

Average Trading Cost Gold | $0.20 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like that Trade360 offers MT5 alongside the ParagonEX trading platform, as it offers traders a more sophisticated trading platform. It also supports algorithmic trading, and the embedded copy trading platform remains superior to the Trade360 CrowdTrading feed, a modified sentiment indicator.

Trade360 Main Features

Retail Loss Rate | 68.01% |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 2.0 pips |

Minimum Commission for Forex | Commission-free |

Commission for CFDs/DMA | Commission-free |

Commission Rebates | No |

Minimum Deposit | $250 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | Yes |

Inactivity Fee | $100 after 45 days, every 45 days |

Deposit Fee | No |

Withdrawal Fee | Third-party |

Funding Methods | 13 |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. Trade360 presents clients with two regulated entities.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Cyprus | Cyprus Securities and Exchange Commission | License Number 202/13 |

Australia | Australian Securities & Investments Commission | AFSL No. 439907 |

Despite the pride Trade360 takes in offering a regulated trading environment, most non-EEA, non-Australian traders will be serviced by the unregulated Marshall Islands subsidiary.

Factors in favor of the unregulated Marshall Islands subsidiary:

- Higher leverage

- Flexible trading conditions

- Negative balance protection

- Segregation of client deposits from corporate funds

- Trade360 seeks to maintain its reputation and avoid malpractice, making the absence of a regulator less significant.

What could be better?

- Third-party insurance, or

- Transparency concerning its core management team

Noteworthy:

- The Cyprus subsidiary offers an investor compensation fund up to 90% or €20,000 of deposits.

- Each of the three subsidiaries lists a different corporate owner.

- Trade360 has a clean regulatory track record.

Trade360 has adequate operational experience and maintains a clean regulatory environment.

Fees

Average Trading Cost EUR/USD | 1.8 pips ($18.00) |

|---|---|

Average Trading Cost GBP/USD | 1.8 pips ($18.00) |

Average Trading Cost WTI Crude Oil | $0.07 |

Average Trading Cost Gold | $0.20 |

I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact profitability.

What does Trade360 offer traders?

- Trade360 maintains a commission-free cost structure. Its spreads cannot be described as particularly competitive.

- Only fixed spreads are available.

Here is a screenshot of live quotes at Trade360 during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

What is the spread for the EUR/USD at Trade360?

- 4.0 pips or $40.00 per round lot in the Mini account for a minimum deposit of $250.

- 3.0 pips or $30.00 per round lot in the Standard account for a minimum deposit of $1,000.

- 2.0 pips or $20.00 per round lot in the Gold account for a minimum deposit of $5,000.

- 2.0 pips or $20.00 per round lot in the Platinum account for a minimum deposit of $10,000.

- 2.0 pips or $20.00 per round lot in the Diamond account for a minimum deposit of $50,000.

- 1.8 pips or $18.00 per round lot in the VIP account for a minimum deposit of $100,000.

What could be better at Trade360?

- A volume-based rebate program for high-volume traders.

- A floating spreads pricing option.

The average trading costs for the EUR/USD in the commission-free Trade360 Standard account:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

3.0 pips | $0.00 | $30.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-freeTrade360 Standard account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

3.0 pips | $0.00 | -$3.545 | X | $33.545 |

3.0 pips | $0.00 | X | -$0.068 | $30.068 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

3.0 pips | $0.00 | -$24.815 | X | $54.815 |

3.0 pips | $0.00 | X | -$0.476 | $30.476 |

My additional comments concerning trading costs at Trade360:

- Hedging positions may incur an administration fee of 0.1% of the complete volume (deal plus hedge position) daily (Trade360 retains the right to close hedged positions after 21 days without notice).

- Currency conversion fees exist but are unclear.

- Inactivity fees are relatively high, charged at $100 every 45 days.

What Can I Trade

Forex traders are offered a selection of 49 currency pairs, and the absence of cryptocurrencies remains notable. The bulk of assets consist of equity CFDs, but only limited diversification opportunities are available at Trade360.

What could be better?

- Mid-cap and small-cap alternatives within the equity CFD listing.

- A selection of cryptocurrencies.

- Commodities and index CFDs remain below-average.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

Trade360 Leverage

Trade360 offers maximum leverage up to 1:400 through its Marshall Islands unit, and traders may adjust it on a per-trade basis from the ParagonEX trading platform. I like it for active traders and scalpers, as it presents more overall trading flexibility, which directly impacts profitability.

Other things to note about Trade360 leverage:

- Trade360 offers maximum leverage of 1:20 on equity CFDs.

- Forex and commodity traders at the Cyprus and Australian units are limited to maximum leverage of 1:30.

- Negative balance protection exists, ensuring traders never lose more than their deposit.

Trade360 Trading Hours (GMT Server Time)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Not applicable | Not applicable |

Forex | Sunday 22:00 | Friday 21:00 |

Commodities | Sunday 22:00 | Friday 21:00 |

European CFDs | Monday 8:05 | Friday 16:20 |

US CFDs | Monday 14:31 | Friday 20:59 |

Noteworthy:

- Equity markets open and close each trading and are not operational continuously like Forex and cryptocurrencies.

I recommend the following step for MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

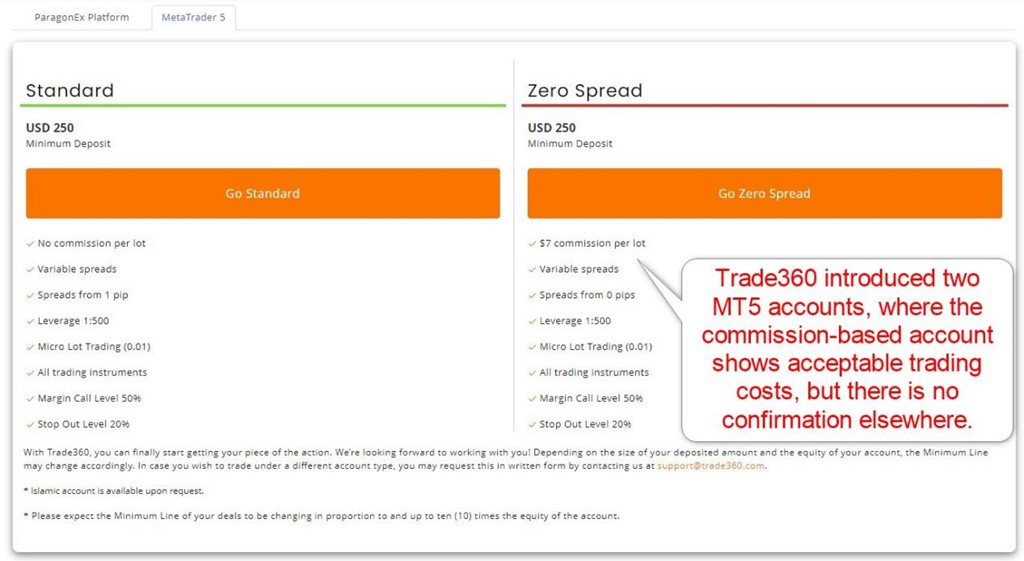

Trade360 offers six account types on the ParagonEX trading platform. It also introduced two MT5 alternatives, including one commission-based option, but fails to outline account details elsewhere on its website transparently.

Traders must choose between the following alternatives:

- ParagonEX or MT5

My observations concerning the Trade360 account types:

- The added benefits for higher account tiers are not services traders with the listed minimum deposits usually need.

- It appears as if Trade360 is currently undergoing changes, with two MT5 trading accounts offered, including one commission-based one, but full details remain unclear.

- MT5 supports algorithmic trading and comes with an embedded copy trading service.

- Supported account base currencies are USD, EUR, and GBP.

Trade360 Demo Account

Trade360 does not list a demo account, but the MT5 trading platform supports unlimited demo accounts with flexible deposits and leverage. These are ideal for testing EAs or different trading strategies, but traders should not rely on them for educational purposes due to the absence of trading psychology in demo accounts. Demo trading may additionally create unrealistic expectations.

My recommendations:

- Traders should contact customer support to ask about demo accounts and any potential time restrictions.

- MT5 offers flexible deposit amounts for the demo account, and traders should select an amount similar to the amount they plan to deposit in real money, to ensure psychological authenticity.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Traders may use the web-based ParagonEX trading platform, including Trade360 CrowdTrading. It is a modified sentiment indicator, presented as a news feed with alerts. It may assist social traders in their decision-making process. It is also available as a mobile app.

CrowdTrading features:

- Trend spotting

- Trend reversal

- Rapid activity

- Surge in position

Advanced and algorithmic traders can rely on MT5. The embedded copy trading platform presents a superior product to Trade 360 CrowdTrading, amid better diversification across trading strategies from a notably larger trader base.

What would be improvements as additions?

- MT5 plugins

- VPS hosting

- API trading

My observations:

- Traders with MT5 EAs must use the desktop client.

- MT4, the market leader in algorithmic trading, is not available.

- MT5 offers a superior overall trading environment to ParagonEX and Trade360 CrowdTrading.

Overview of Trading Platforms

MT4 | No |

|---|---|

MT5 | Yes |

cTrader | No |

Proprietary/Alternative Platform | Yes |

Automated Trading | Yes (MT5 only) |

Social Trading / Copy Trading | Yes |

MT4/MT5 Plugins | No |

Guaranteed Stop Loss | No |

Negative Balance Protection | Yes |

Unique Feature One | STP order execution |

Unique Feature Two | Services by Trading Central |

Unique Features

Trading Central, a leader in independent market research, remains the most valuable asset available at Trade360. It provides traders with market coverage, valuable research, and education. Trade360 embeds it with the ParagonEX trading platform.

Research and Education

Trade360 halted its in-house Financial Market News section, as the last update was on March 4th, 2021. It continues to publish six trading ideas from Trading Central on its website. The short-format presentation features all necessary information plus a chart, resulting in quick, well-presented trading ideas.

Beginner traders get nine educational articles. One article is dedicated to trading psychology, which I appreciate, as it remains one of the most defining aspects of successful trading. It suffices for a quality introduction to trading. The Trade360 blog offers additional quality content with educational value.

My takeaways:

- Trade360 partnered with Trading Central to deliver competitive research for manual traders.

- Beginner traders get an acceptable but entry-level educational offering.

My recommendations:

- Manual traders can get quality trading signals from Trading Central.

- The MT5 copy trading feature offers passive traders sufficient choices.

- MT5 offer thousands of EAs, and traders may explore them to determine if they suit their trading style.

- Beginner traders should source in-depth educational content elsewhere before trading at Trade360.

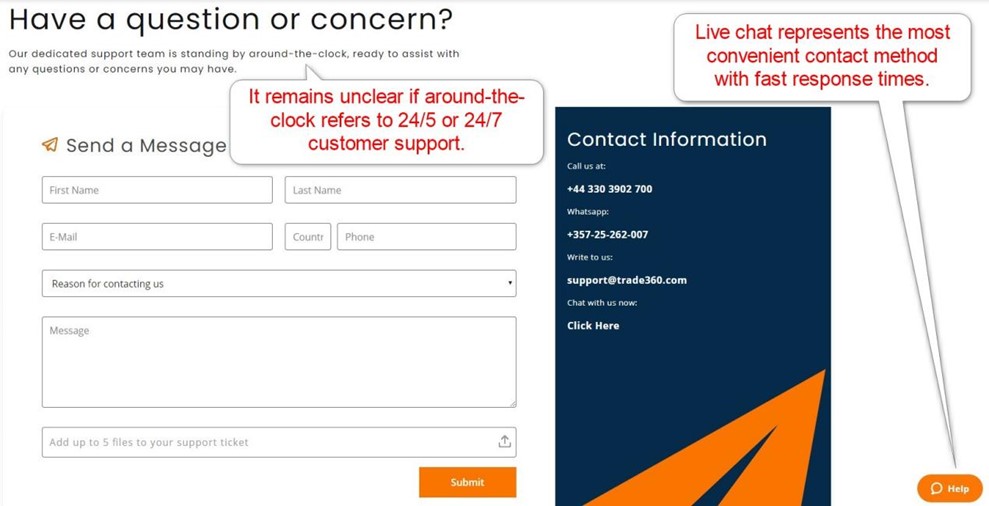

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | unspecified |

Website Languages |           |

Clients also have easy access to customer support via the live chat function. A webform is provided, together with a phone number and e-mail address. Trade360 explains the product and services well, making it unlikely clients will require customer support. It is available and accessible, but hours of operations are not listed.

My observations:

- An FAQ section is missing.

- Dedicated support for financial transactions, where most traders may face issues, is not available.

- I recommend live chat for non-urgent matters.

- Phone support is ideal for urgent questions.

Bonuses and Promotions

Trade360 offers neither bonuses nor promotions. Trade360 maintains a successful affiliate program for traders interested in earning passive income from financial markets, with 5M+ users and $80M+ in paid-out commissions.

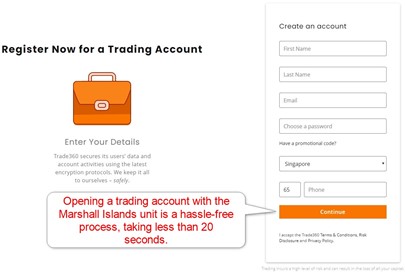

Opening an Account

Opening a trading account through the Marshall Islands unit is a hassle-free process, taking less than 20 seconds. Traders must submit their name, e-mail, country, phone number, and desired password.

Account verification is mandatory, and most traders will complete it after sending a copy of their ID and one proof of residency document.

Noteworthy:

- The Cyprus and Australian branches may ask additional questions, prolonging the account opening process.

Minimum Deposit

The Trade360 minimum deposit is $250, a bit higher than the industry average.

Payment Methods

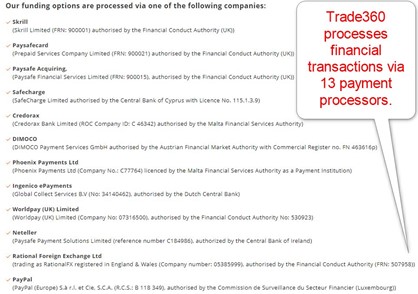

Trade360 allows payments by bank wires, credit/debit cards, Skrill, Neteller, Paysafecard, Paysafe Acquiring, Safecharge, Credorax, DIMOCO, Phoenix Payments, Ingenico ePayments, Worldpay (UK) Limited, and PayPal.

Accepted Countries

Trade360 caters to many international traders, including the UK, Australia, Singapore, and South Africa. Trade360 does not accept US persons as clients, regardless of whether they reside outside the US.

Deposits and Withdrawals

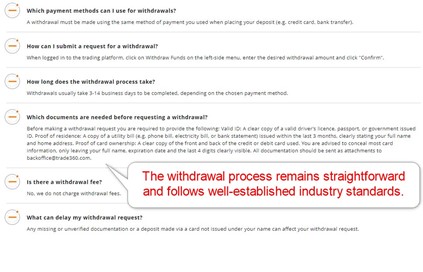

All financial transactions take place in the secure back office of Trade360. Traders have access to several payment processors, but availability remains restricted by geographic location.

My observations:

- Trade360 does not charge deposit or withdrawal fees, but third-party costs can apply.

- Internal currency conversion costs exist but are unclear.

- Internal withdrawal processing times are an excessive three days.

- Details about deposit processing times are unavailable, while Trade360 notes a withdrawal may take between three to fourteen business days after internal processing.

- Overall financial transaction transparency lags notably behind many brokers.

- Trade360 does not support cryptocurrency transactions.

My recommendations:

- Check the costs from the payment processor to the bank account unless a debit/credit card is available.

- It is ideal to use an option besides the bank or credit/debit card used for day-to-day financial operations.

The Bottom Line

I like the trading environment at Trade360 for social traders who manage passive equity portfolios and are willing to accept a higher overall cost of trading. It attempts to capitalize on cognitive research exploring the possibility that a crowd will make better choices than individual experts. The loss rate of 68.01% reported in the EU by Trade360 does not support this idea, as it ranks on par with well-established brokerages that deliver excellent in-house research by seasoned professionals.

The trading costs are somewhat high overall, but Trade360 has introduced a commission based MT5 trading account. Regrettably, it does not provide details for this on its website yet, but it is available. This broker has been in operation since 2013 and is fully compliant with two regulators. It is, therefore, a legitimate brokerage. The Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities & Investments Commission (ASIC) provide the regulatory framework for Trade360. The customer support team handles this request. While Trade360 deactivates the account, the broker will keep records for up to seven years before destroying them entirely. No, Trade360 offers only the MT5 platform alongside ParagonEX. The minimum deposit at Trade360 is $250. Yes, Trade360 is a legit site.FAQs

Is Trade360 a scam?

Is Trade360 regulated?

How do I delete my Trade360 account?

Does Trade360 offer the MT4 trading platform?

What is the minimum deposit at Trade360?

Is Trade360 a legit site?