Editor’s Verdict

Trade.com offers traders its proprietary web-based trading platform alongside MT4/MT5, a well-balanced asset selection, and services by Trading Central and TradingView. Trade.com also features asset management services and IPO trading. I conducted an in-depth review of this broker to evaluate if it delivers industry-beating prices as advertised. Is Trade.com the right broker for you?

Overview

Asset Management and Copy Trading from a Trusted Broker

Review

Headquarters | Cyprus |

|---|---|

Regulators | CySEC, FSCA |

Year Established | 2013 |

Execution Type(s) | Market Maker |

Minimum Deposit | $100 |

Trading Platform(s) | MetaTrader 4, Proprietary platform, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.00% of retail investor accounts lose money when trading spread bets and CFDs with this provider. Please consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

I like the well-balanced asset selection covering seven sectors, asset management, and copy trading features at Trade.com. It has a growing client base, presently exceeding 100,000, which improves the quality of its copy trading service amid an expanding strategy base. DMA trading is available via Interactive Brokers, granting access to 100,000+ assets on 120 markets.

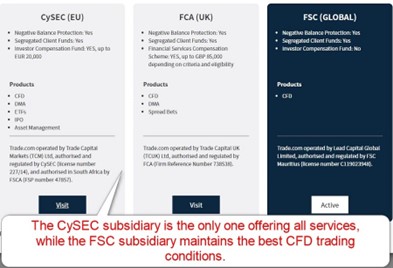

Only the CySEC-regulated subsidiary provides access to all features, making it the best choice for investors. CFD traders get the most competitive conditions at the FSC-regulated Mauritius unit.

Retail Loss Rate | 79.00% |

Regulation | Yes |

Minimum Raw Spreads | 0.15 pips |

Minimum Standard Spreads | 1.40 pips |

Minimum Commission for Forex | $8.00 per round lot |

Commission for CFDs / DMA | 0.16% or $0.02 / share (US) |

Cashback Rebates | No |

Minimum Deposit | $100 |

Inactivity Fee | $25 monthly after 90 days, $100 quarterly after twelve months |

Deposit Fee | Third-Party |

Withdrawal Fee | Third-Party |

Funding Methods | 16 |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. Trade.com presents clients with four regulated entities and maintains an overall secure trading environment.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

Cyprus | Cyprus Securities and Exchange Commission | 227/14 |

UK | Financial Conduct Authority | 738538 |

South Africa | Financial Sector Conduct Authority | 47587 |

Mauritius | Financial Services Commission | C119023948 |

Is Trade.com Legit and Safe?

Trade.com is a legit and safe broker, segregating client deposits from corporate funds and offering negative balance protection. Trade Capital Markets (TCM) LTD is the CySEC-regulated subsidiary compliant with the EU Financial Instruments Directive 2014/65/EU or MiFID II and the EU 5th Anti-Money Laundering Directive. An investor compensation fund, per EU Directive 2014/49/EU, protects 90% of client deposits up to a limit of €20,000.

Trade Capital Markets (TCM) LTD also has oversight from the South African Financial Sector Conduct Authority, without additional investor protection. Trade Capital UK (TCUK) Ltd, the UK subsidiary, offers an £85,000 investor protection fund under the Financial Services Compensation Scheme (FSCS). Lead Capital Global LTD operates the Mauritius subsidiary regulated by the FSC.

Fees

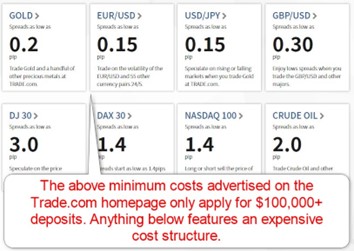

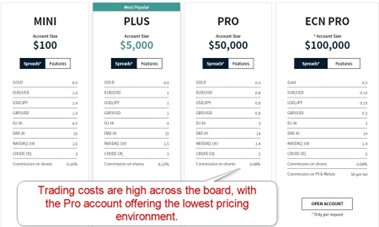

I rank trading costs among the most defining aspects when evaluating an exchange, as they directly impact profitability. Trade.com offers Forex costs from 0.15 pips for a commission of $8.00 for a total fee of $9.50, but it requires a $100,000+ deposit. Most retail traders must accept minimum spreads of 1.4 pips or 1.0 pips for portfolios above $5,000. Therefore, I rank this broker as relatively expensive.

The best-priced trading account at Trade.com is the Pro account, where minimum spreads commence from an expensive 0.8 pips or $8.00 per round lot. The ECN Pro account features a minimum markup of 0.15 pips but a commission of $8.00 for total trading costs of $9.50, which I find puzzling. Both are out of reach for retail traders, who will trade from the Mini and the Plus alternatives, where costs increase to 1.4 pips and 1.0 pips, requiring a minimum deposit of $100 and $5,000, respectively.

The $25 monthly inactivity fee after 90 days is also higher and faster than many competitors, while swap rates on leveraged overnight positions are relatively expensive. Trade.com also levies a 2.00% currency conversion fee.

The minimum trading costs for the EUR/USD in the various account types at Trade.com:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

1.40 pips (Mini) | $0.00 | $14.00 |

1.00 pips (Plus) | $0.00 | $10.00 |

0.80 pips (Pro) | $0.00 | $8.00 |

0.15 pips (ECN) | $8.00 | $9.50 |

Here is a screenshot of the Trade.com quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- Trade.com does not offer a positive swap on qualifying short positions, where traders can get paid money to hold trades overnight

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the Mini account for deposits below $5,000.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

1.4 pips | $0.00 | -$12.6561 | X | $26.6561 |

1.4 pips | $0.00 | X | -$11.7981 | $25.7981 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

1.4 pips | $0.00 | -$88.5927 | X | $102.5927 |

1.4 pips | $0.00 | X | -$82.5867 | $96.5867 |

Range of Assets

Trade.com offers CFD traders 2,100+ assets covering seven sectors, ensuring clients can achieve proper cross-asset diversification. Cryptocurrencies are not available to all, dependent on their geographic location. Trade.com, in partnership with Interactive Brokers, also grants 100,000 DMA instruments listed on 120 global markets, adding appeal to their asset management service. Trade.com provides investors and traders with an industry-leading choice of trading instruments.

Asset List Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

ETFs |

Trade.com Leverage

The maximum Trade.com leverage depends on the regulatory jurisdiction and asset. CFD traders get a maximum of 1:290 at the Mauritius-regulated subsidiary, and negative balance protection exists. Due to regulatory restrictions, the Trade.com CySEC-regulated unit limits retail leverage to a restrictive 1:30.

Trade.com Trading Hours (GMT +1)

Asset Class | From | To |

Cryptocurrencies | Sunday 22:00 | Friday 22:00 |

Forex | Sunday 22:00 | Friday 22:00 |

Commodities | Sunday 23:01 | Friday 22:00 |

European Equities | Monday 8:02 | Friday 16:25 |

US Equities | Monday 14:31 | Friday 21:00 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex, cryptocurrencies, and commodities, which trade non-stop

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

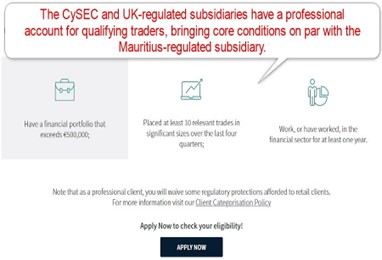

Most traders will manage their portfolios in one of the four CFD account types. Unfortunately, entitlement depends upon deposit size, so in practice most retail traders must accept high trading costs. At the time this review was written, the advertised spread of 0.8 pips in the EUR/USD, already high, was solely available for an account size of $50,000 or more, which is unacceptable. The Mini and the Plus accounts list the minimum spread as 1.4 pips and 1.0 pips for a deposit of $100 and $5,000, respectively. Interactive Brokers powers DMA accounts, UK-based traders get tax-free spread betting accounts, and an elective professional client program is available.

Trade.com Demo Account

Trade.com does not mention the availability of demo accounts in its website, but I came across one for its DMA services powered by Interactive Brokers. The account registration process grants a $10,000 demo account for the WebTrader. MT4/MT5, both available at Trade.com, support unlimited demo accounts.

I recommend a demo account balance similar to their planned live deposit. I also want to caution beginner traders against using a demo account as a real money trading simulator. It creates unrealistic trading expectations, and the absence of trading psychology negates that value.

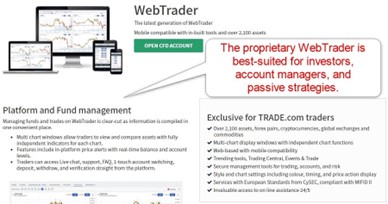

Trading Platforms

Trade.com features its proprietary trading platform, MT4, and MT5. The focus is on WebTrader, equipped with fund management and intelligent analytics tools. It is best suited for investors and passive strategies. Automated trading is unavailable there, where MT4/MT5 excel. MT4 receives the Trading Central plugin, and both come with integrated copy-trading services, while paid upgrades can result in a cutting-edge trading solution. The WebTrader grants access to a more suitable trading environment for manual traders who don’t require the MT4 infrastructure for advanced trading solutions.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

I like the IPO marketplace at Trade.com, offering retail traders access to volatile, risky, but potentially rewarding listings, leveling the accessibility playing field between institutional and professional traders. Complementing its asset management and copy trading services, Trade.com added the TradingView community to its offering, granting traders charting tools, stock screeners, and a highly active trading community.

Research and Education

Trade.com doesn’t publish its research, but the CFD account features lists a Daily Analysis and Morning Review. Trading Central provides reliable, daily, actionable trading signals, but traders with the CySEC-regulated subsidiary must deposit $10,000 for access versus $100 for traders at the Mauritius-regulated subsidiary. A premium daily analysis service exists, for a deposit of $10,000 and $5,000, respectively.

Trade.com does not offer educational resources for beginner traders, which is not unusual for a brokerage with an asset management service. It relies on Trading Central, TradingView, its in-house copy trading service, and the embedded MT4/MT5 alternatives for education. I recommend traders source third-party educational material before considering an account with Trade.com.

The overall services structure shows that Trade.com does not cater to those who either well want to test their service with a low deposit or don’t have a higher net worth.

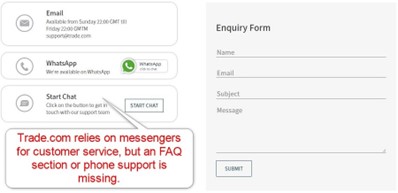

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |       |

Customer support is available from Sunday 22:00 GMT until Friday 22:00 GMT. Clients may engage via e-mail, use the webform, launch live chat, or reach out through WhatsApp. An FAQ section does not exist, but Trade.com explains its products and services in detail, and most traders will not require any additional assistance.

A direct line to the finance department where most issues may arise is missing, but I recommend WhatsApp should traders require it. Live chat is ideal for non-urgent matters. It is essential to have quick access to a representative for emergencies.

Bonuses and Promotions

Trade.com lists a deposit bonus, with a 50% maximum, through its Mauritius subsidiary. Due to regulatory restrictions, its CySEC subsidiary neither offers bonuses nor hosts promotions.

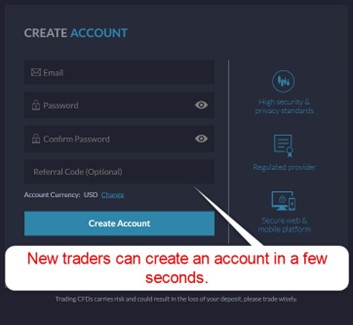

Opening an Account

Per standard operating procedure, an online application handles new account openings. An e-mail address, password, and account currency selection available in USD, EUR, GBP, or ZAR grant access to the back office.

Trade.com adheres to AML/KYC stipulations, and account verification is mandatory. A copy of the trader’s ID and one proof of residency document generally satisfies the final step. CySEC traders may have to fill out an unnecessary questionnaire collecting personal information, as mandated by the regulator.

Minimum Deposit

The minimum deposit at Trade.com is $100 or the currency equivalent.

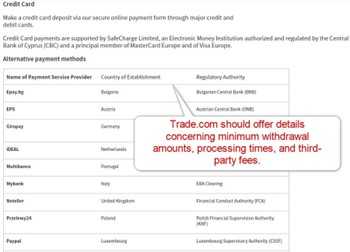

Payment Methods

Trade.com accepts bank wires, credit/debit cards, Epay, EPS, Giropay, iDEAL, Multibanco, Mybank, Neteller, Przelewy24, Paypal, Safecharge, Safetypay, Skrill, Sofort, and Trustly.

Accepted Countries

Trade.com caters to many international traders, except Japanese and Canadian residents, and US persons, like most international brokers.

Deposits and Withdrawals

The secure Trade.com back office handles all financial transactions.

Trade.com’s minimum deposit is $100, and while Trade.com supports a broad range of payment options, it fails to offer details in its website. An FAQ section is missing, and it remains unclear how fast Trade.com processes withdrawal requests internally or what the minimum withdrawal amount is. As I reviewed Trade.com, no internal fees existed, but it notes that it reserves the right to add them in the future. Third-party payment processor costs may apply, and the processing time depends on the preferred option.

Only verified accounts may request withdrawals. Not all options are available to all traders, but I like the abundance of choices available at Trade.com.

Is Trade.com a good broker?

I like the trading environment at Trade.com for its regulation and trustworthiness. The asset selection in partnership with Interactive Brokers is outstanding. Other features I like are the asset management and copy trading service. Unfortunately, trading costs and fees at this broker remain relatively high.

CySEC traders must deposit $10,000 for access to research by Trading Central, where clients of the Mauritius subsidiary get it from $100, per the account features listed under each regulatory environment. This broker remains ill-positioned to handle new traders, while advanced traders will find better conditions elsewhere. Potential remains, but a complete overhaul of the business model is required.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

79.00% of retail investor accounts lose money when trading CFDs with this provider. Yes, Trade.com features an account type with a minimum deposit of $100. The maximum leverage depends on the asset and operating subsidiary. Retail traders at the Mauritius-regulated subsidiary get maximum Forex leverage of 1:290 versus 1:30 at the CySEC-regulated one. Clients can log into their Trade.com account via the login button in the top right corner or their MT4/MT5 desktop trading platforms and mobile apps. Traders may use bank wires, credit/debit cards, Epay, EPS, Giropay, iDEAL, Multibanco, Mybank, Neteller, Przelewy24, Paypal, Safecharge, Safetypay, Skrill, Sofort, and Trustly. This broker complies with four regulators, including powerhouse FCA in the UK. Therefore, it is a legit brokerage.FAQs

Can I trade Forex with $100 at Trade.com?

What is the maximum leverage granted by Trade.com?

How do I log into my Trade.com account?

How do I withdraw money from Trade.com?

Is Trade.com legit?