Tickmill Editor’s Verdict

Tickmill maintains a highly competitive commission-based cost structure offering the MT4/MT5 trading platforms. It upgrades the core versions with eleven plugins under the Advanced Trading Toolkit. Tickmill also presents the Acuity trading tool, creating a distinct advantage for traders, and quality services for social and algorithmic traders. I conducted an in-depth review to evaluate if a trading edge exists at this broker. Should you consider Tickmill for one of your portfolios?

Overview

The low trading costs and high leverage make Tickmill an excellent choice for scalper and high-volume traders.

Headquarters | Seychelles |

|---|---|

Regulators | CySEC, FCA, FSA, FSCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2014 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | €100 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Web-based |

Average Trading Cost EUR/USD | 0.1 pips ($1.00) |

Average Trading Cost GBP/USD | 0.3 pips ($3.00) |

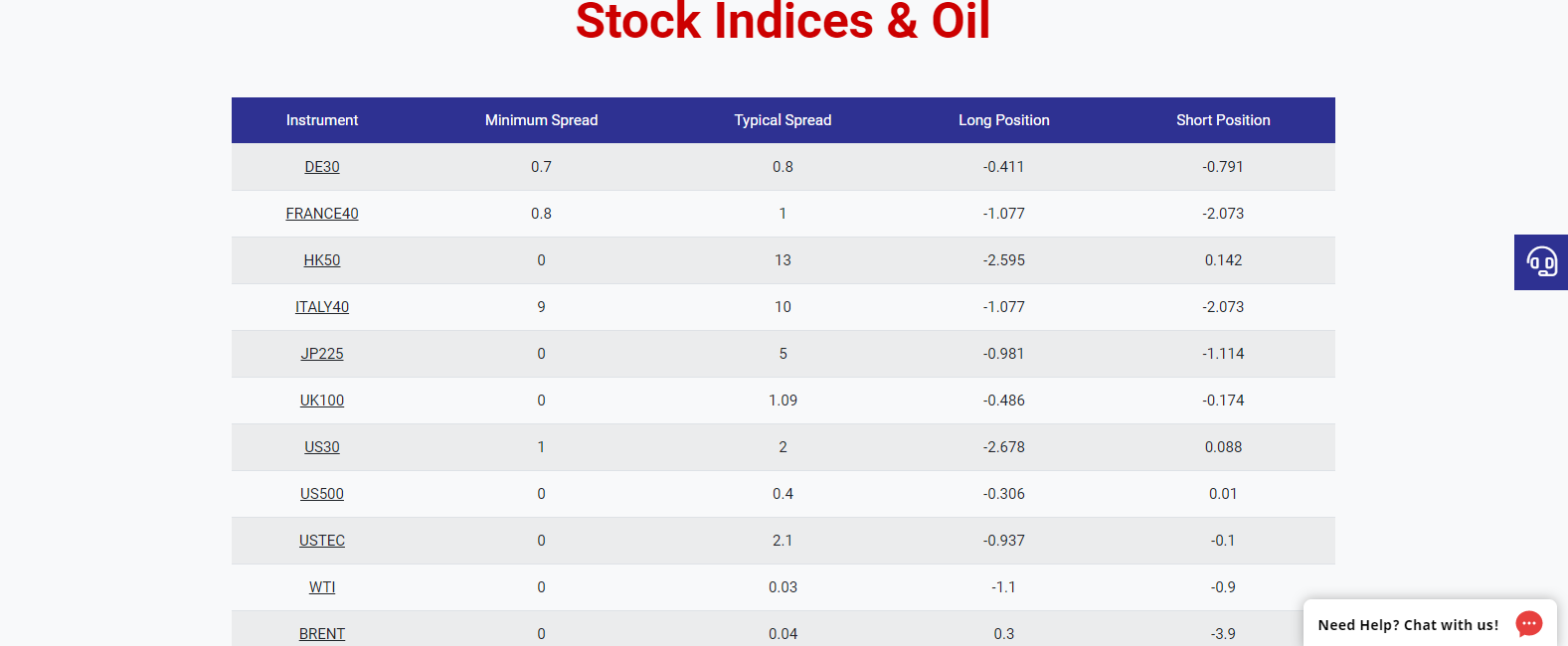

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.09 |

Average Trading Cost Bitcoin | $24.90 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

The Tickmill Group was founded in 2014 and has experienced a remarkable growth trajectory ever since. Regulated in four jurisdictions and catering to the English and Spanish markets, the award-winning broker has over 111,000 traders with more than 263,000 accounts. The company fulfilled in excess of 215 million trades, while the average monthly trading volume eclipsed $123 billion. This CFD broker places a special focus on Forex trading, offering tools such as copy trading and the MT4, MT5 and Webtrader platforms. It also employs over 150 staff members globally, executes its business model well, and strives to continually form partnerships that will improve trading conditions for its expanding client base.

Regulation and Security

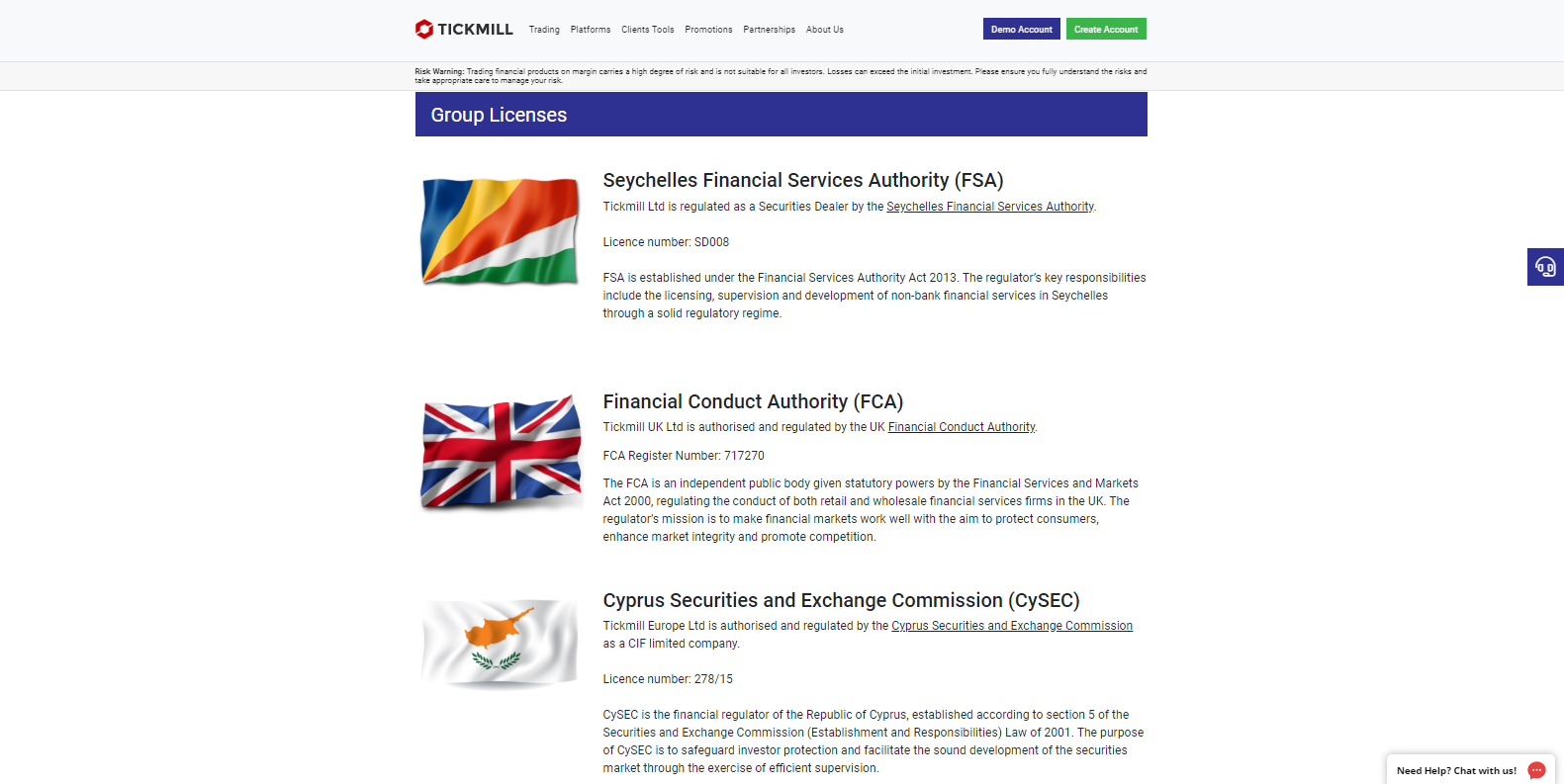

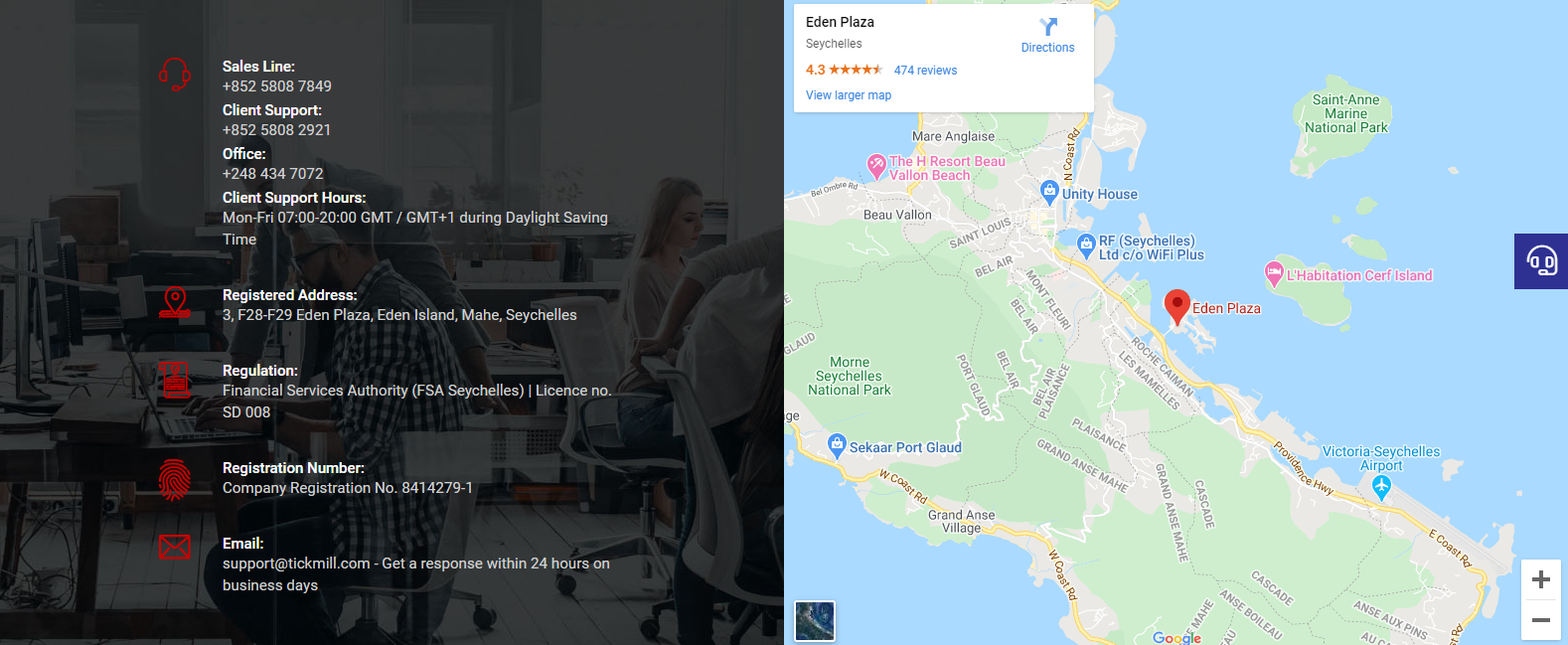

Tickmill is primarily regulated by the Seychelles Financial Services Authority (FSA), where it holds a security dealer license under number SD008. The regulatory framework is broker-friendly, allowing Tickmill to deploy a competitive trading environment. Tickmill UK LTD operates under the Financial Conduct Authority (FCA) authorization with FCA register number 717270. Traders are protected by the Financial Services Compensation Scheme (FSCS), up to a maximum deposit value of £85,000.

Tickmill Europe LTD is a Cyprus Investment Firm (CIF) operated under license number 278/15, issued by the Cyprus Securities and Exchange Commission (CySEC). It is compliant with the Financial Instruments Directive 2014/65/EU or MiFID II, as well as the EU’s 5th Anti-Money Laundering Directive. The Investor Compensation Fund (CIF), per EU Directive 2014/49/EU, protects deposits up to €20,000. All deposits remain fully segregated, and negative balance protection is in place.

Tickmill Asia Ltd is authorized and regulated by the Labuan Financial Services Authority (FSA) and Tickmill South Africa (Pty) Ltd is authorized and regulated by the Financial Sector Conduct Authority (FSCA).

The Seychelles-based subsidiary grants a superior trading environment, but the protection of traders is limited. Tickmill remains a well-respected brokerage, where the security of its traders remains paramount, suggesting that the FSA-authorized subsidiary provides a solid option for most traders.

In the past, some traders have accused this broker of stop-loss hunting and market manipulation; that charge was investigated by regulators and found to be without merit. Nonetheless, a warning regarding spikes in spreads is available, together with a notice concerning adequate capital. The complaints raised by traders also addressed this issue.

During this Tickmill review we found the broker to be fully compliant with its three regulators, providing a secure trading environment.

Does Tickmill accept US clients?

No, Tickmill is not authorized by U.S. regulators and is not configured to accept US persons as clients. See our list of US-regulated forex brokers for US citizens.

Fees

Average Trading Cost EUR/USD | 0.1 pips ($1.00) |

|---|---|

Average Trading Cost GBP/USD | 0.3 pips ($3.00) |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.09 |

Average Trading Cost Bitcoin | $24.90 |

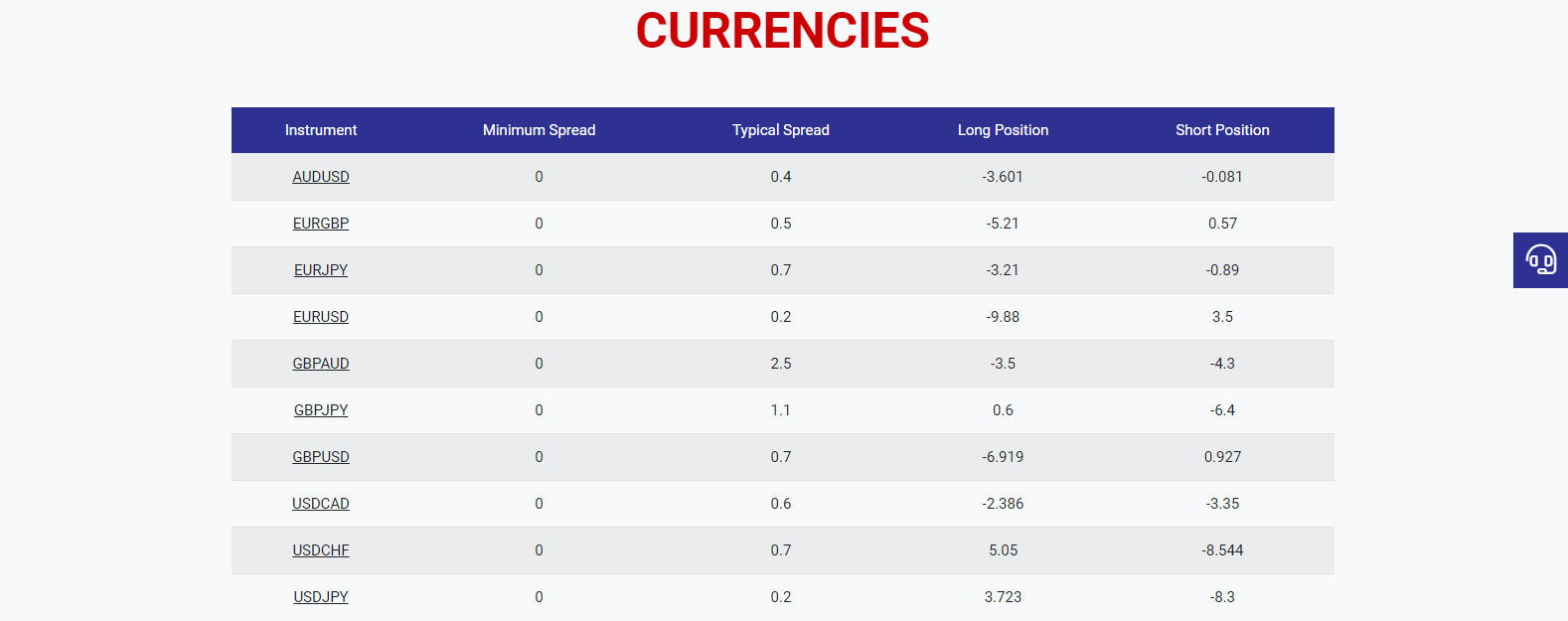

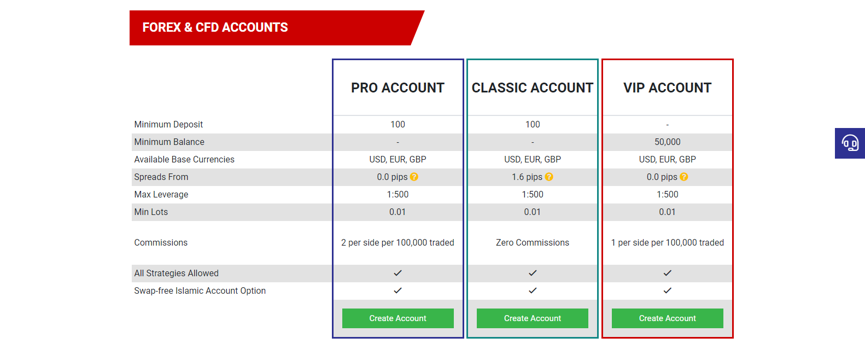

The Classic account operates under the market maker model with the minimum spread listed at 1.6 pips, which is not as low as the spreads offered by most other brokers. Tickmill generates its fees from spreads. The good news is that the Pro and VIP accounts deploy the NDD/STP model, where spreads are lowered significantly, starting from 0.0 pips. Classic accounts have no commissions at all, while Pro accounts have a commission of $2 per side per $100,000 traded and VIP accounts have a lot commission of $1 per side per $100,000 traded. Tickmill does not apply maintenance commissions or inactivity commissions. For the EUR/USD pair, 0.1 pips was the lowest average spread identified, but spreads vary all the time according to your market capitalization.

Swap rates on overnight leveraged positions apply; as such, corporate actions such as dividend distributions will impact index CFD positions. Third-party payment processor fees may apply, but a zero-fee policy exists for deposits that exceed $5,000.

What Can I Trade

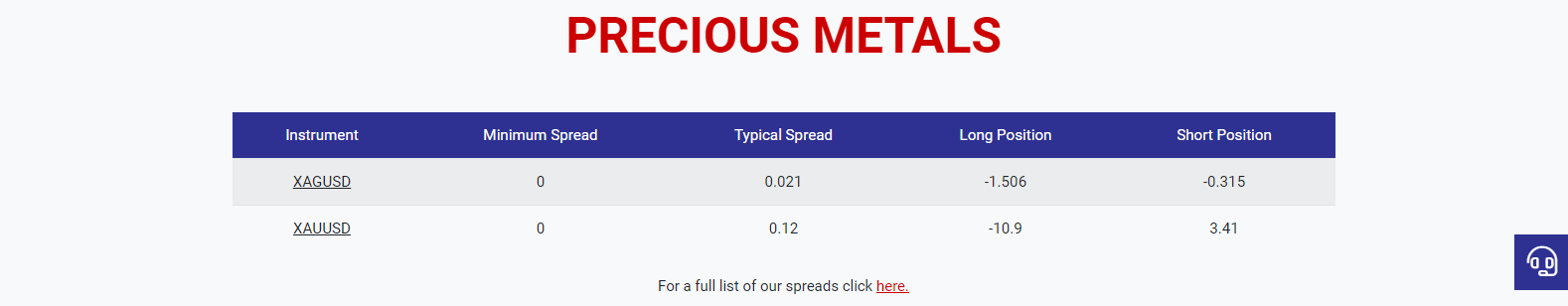

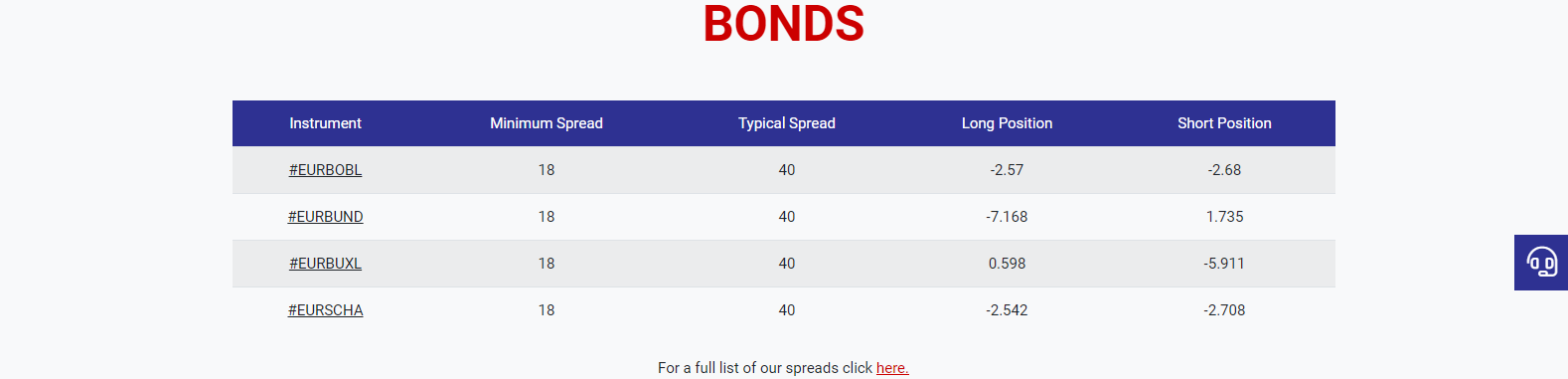

Tickmill is primarily a Forex broker, as evident in its asset selection. With 62 currency pairs available, currency traders have elevated exposure to their core market. CFDs are offered on 4 types of German bonds, energies, 16 global stock indices and metals (gold and silver). Tickmill has added some major cryptocurrencies as well, including Bitcoin, Ethereum and Litcoin.

The 62 currency pairs provide Forex traders with adequate trading opportunities.

Global stock indices are also offered at this CFD broker.

Similarly, the provision of only gold and silver fail to provide adequate commodity exposure, but should be more than adequate for new traders.

The presence of only four bond CFDs suggests another asset class that could use enhancement.

Account Types

Traders may select between three distinct account types. The minimum deposit for the Classic account of 100 base currency units (USD/EUR/GBP/PLN) matches that of the Pro account, where assets are priced competitively for a commission of $2 per lot, making the Pro account the superior choice. Once the account balance exceeds $50,000, an upgrade to the VIP account is executed; the primary benefit in the VIP account is a reduction in the commission to $1. This broker does not charge a commission for index CFDs, oil, or bonds. Tickmill grants maximum leverage of 1:500 in all accounts opened in FSA-regulated jurisdictions, and 1:30 in FCA-regulated jurisdictions. Swap rates and rollovers are not charged on Islamic accounts.

Demo Accounts

Tickmill offers a no-limit, free demo account with a virtual balance of up to $50,000.

The Tickmill Pro account grants a competitive trading environment.

Trading Platforms

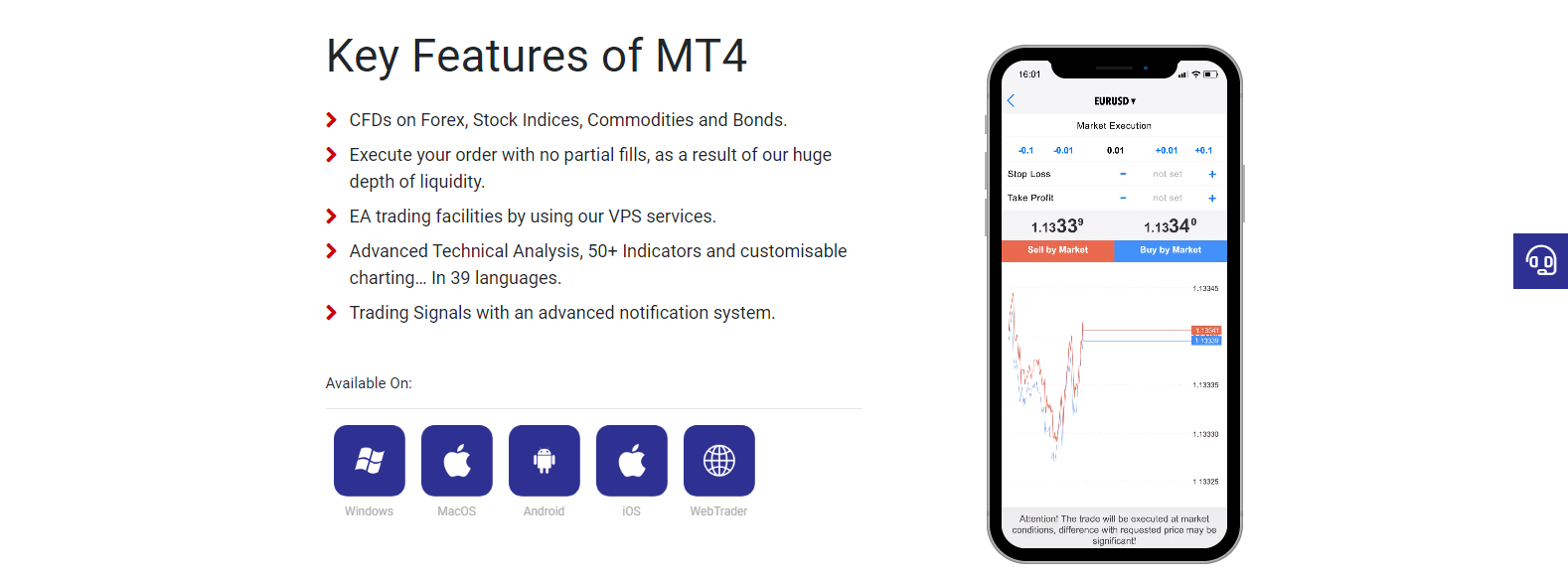

The MT4 trading platform is advertised as enabling a cutting-edge, world-class trading environment, which is common among brokers focused on the retail sector. While it has the capability, third-party plugins are required to unlock its full functionality. Tickmill offers only the most basic version of the MT4 platform, and while numerous free upgrades are available, those considered critical come at a price.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

The MT4’s successor, MT5, is also offered to traders, though it is less celebrated.

Both platforms are offered as desktop and multi-terminal versions, while only MT4 is also offered in a mobile version.

The basic version of MT4 is provided to traders. Tickmill should consider that an upgraded version would boost its appeal.

The trading platform is also available as a webtrader.

Unique Features

Tickmill created an MT4 plugin that enables one-click trading; while this feature already exists on the platform, this is admittedly an improvement. VPS hosting is provided in partnership with BeeksFX for a 20% discount on all packages. Most automated trading solutions benefit from the continuity of access to trade servers through a VPS.

Tickmill supports social trading via Myfxbook, though any benefit is mitigated by the 1.2 pips mark-up on spreads that is levied on traders on top of the pricing environment in the Pro account. Multi-account managers (MAM) have access to the MT4 multi-trader terminal, allowing entry-level portfolio management.

Tickmill Prime, operated out of the UK under FCA regulation, provides services to institutional clients and appears to be the most prominent product maintained. Regrettably, it does not improve trading conditions for retail traders.

The Autochartist tool completes the set of unique features offered by Tickmill.

The MT4 plugin created by Tickmill presents an improvement over the existing feature.

BeeksFX powers VPS hosting at a discounted price.

Myfxbook enables social trading, but traders should be aware of the mark-ups on spreads.

The MT4 multi-account terminal supports entry-level account management.

Tickmill Prime is a promising feature but is geared only towards institutional clients.

Research and Education

The Tickmill blog is comprised of eleven experts who provide research and market commentary to traders. It is divided into Market Insight, Fund Analysis (referring to fundamental analysis), Tech Analysis (referencing technical analysis), and Articles. We found this offering especially refreshing during our Tickmill review, especially since many brokers neglect education entirely. The presentation is comprehensive; the blog represents the most valuable asset Tickmill possesses within its retail brokerage division. Multiple updates throughout the trading day, together with a solid mix of written content, charts, and videos, provide an exceptional service.

Autochartist complements the analytics provided by Tickmill’s experts. It scans markets autonomously for predefined patterns, alerting traders of potential upcoming opportunities. Three calculators allow manual traders to compute margin requirements and pip values. Manual traders are provided with a wide range of analytics to manage their portfolios or to confirm their existing strategies.

Eleven experts provide excellent coverage of financial markets, representing the most beneficial asset of Tickmill’s retail operations.

Autochartist enhances the research capabilities of manual traders.

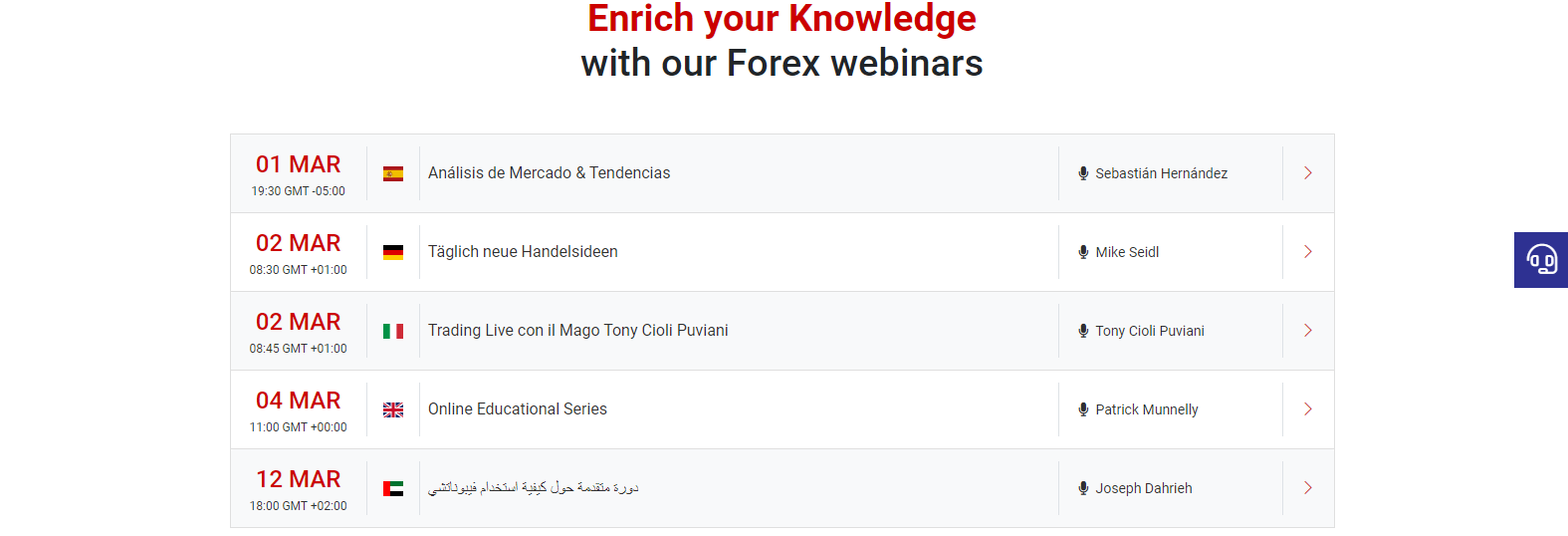

A combination of multi-lingual webinars, seminars, eBooks, video tutorials, and infographics present educational content to new traders. Multiple webinars are provided weekly, covering a wide range of topics. Tickmill additionally hosts seminars globally, introducing Forex trading to new and potential clients. Two eBooks are available for download; in a marketing-inspired push, one eBook covers potential affiliation with Tickmill and, as such, is of little value to most traders.

An extensive video library of tutorials is available, with content in English, Spanish, German, Arabic and Russian. Tickmill might want to consider segregating the videos by language for easy access to the myriad of topics. The brokerage also offers a glossary which acts as a principal source of education, and where basic terms are described in short sentences. While education is honored at Tickmill, new traders will receive more value from the research provided by its eleven experts than from the dedicated education section.

Webinars cover various topics for new traders to discover.

Tickmill hosts several seminars per year around the world.

One of the two eBooks offered is largely promotional and lacks educational value.

The number of video tutorials is extensive, but Tickmill should focus on quality over quantity.

Infographics are self-promotional rather than informative.

The glossary plays a key role in Tickmill's educational section.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |              |

Customer service is available 24/5. Traders may e-mail Tickmill, use the webform, call, or use the live chat function. An FAQ section answers the most basic questions. Assistance from the customer service team is rarely required at a well-operated brokerage, though if an emergency arises, it is comforting to know that one stands ready to assist.

Bonuses and Promotions

Tickmill hosts four bonus and promotion campaigns. The Trader of the Month promotion requires no sign-up as every live account participates. $1,000 is awarded to the winner, but it remains unclear if this is a cash price or a non-withdrawable deposit into the trading account. A prize of either $200 or $500 (dependent upon the accuracy of the guess) is deposited into the trading account of the NFP Machine winner, a contest held during NFP week each month. New trading accounts may be provided with a $30 deposit, which cannot be withdrawn, but any profits generated are for traders to keep. A four-months long contest focused on referrals, known at Tickmill as the IB contest (Introducing Broker) is also held annually. The prize for the winner is either a complete travel package to London, New York, and Singapore, or else one of over $10,000 (equivalent) in prizes.

Each trading account is automatically entered in the Trader of the Month contest.

The NFP machine is hosted each month during NFP week, with a deposit prize of either $200 or $500.

New trading accounts may come with a $30 no deposit bonus.

Tickmill additionally hosts an IB contest.

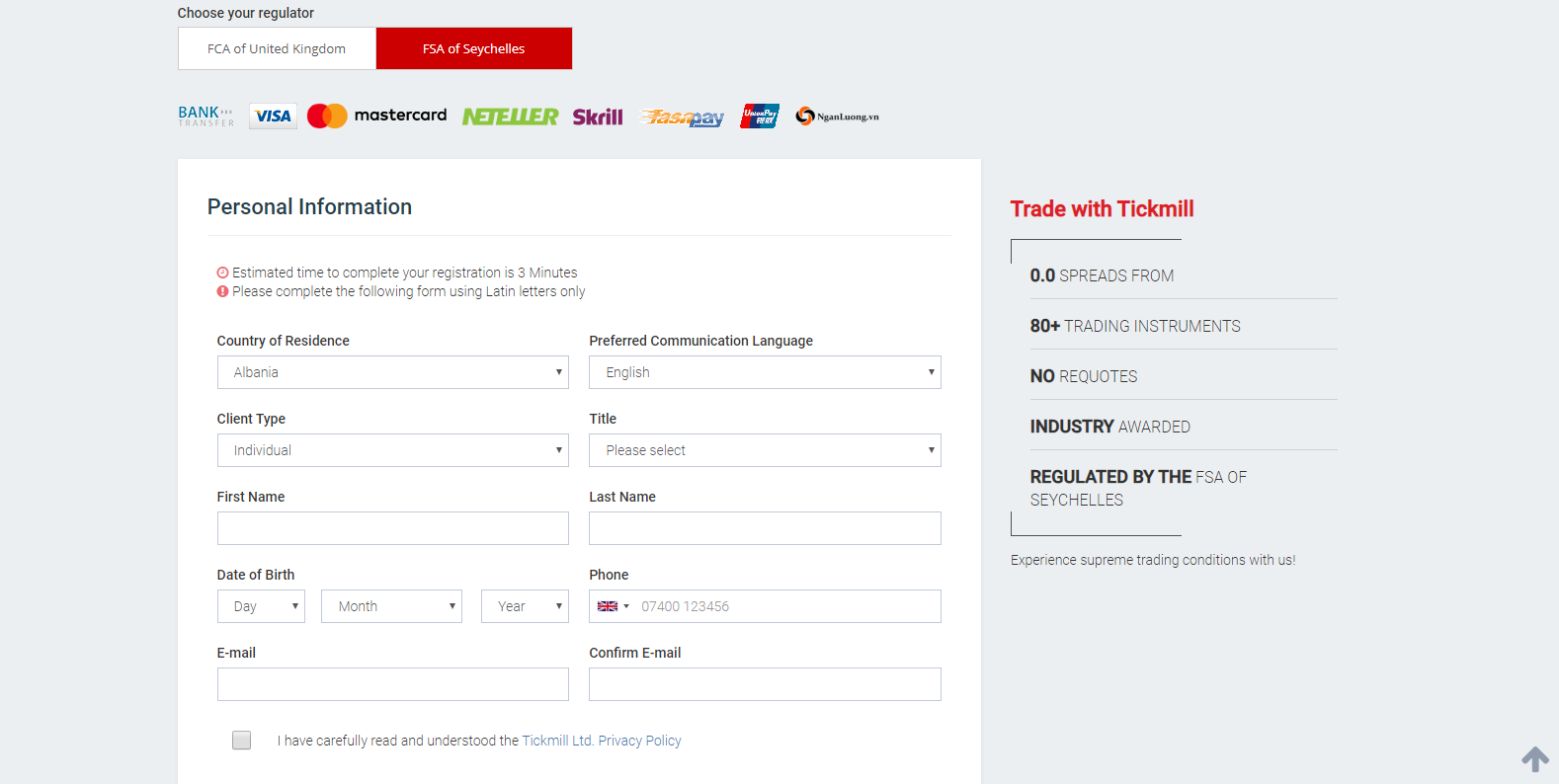

Opening an Account

A simple online application is all that is needed to open a new account. The layout is extremely user-friendly and easy to complete. New traders need to confirm their identity by sending a copy of their ID as well as one proof of residency document. The standard operating procedure across the brokerage industry ensures compliance with AML/KYC regulatory requirements.

The account opening procedure is simple and streamlined.

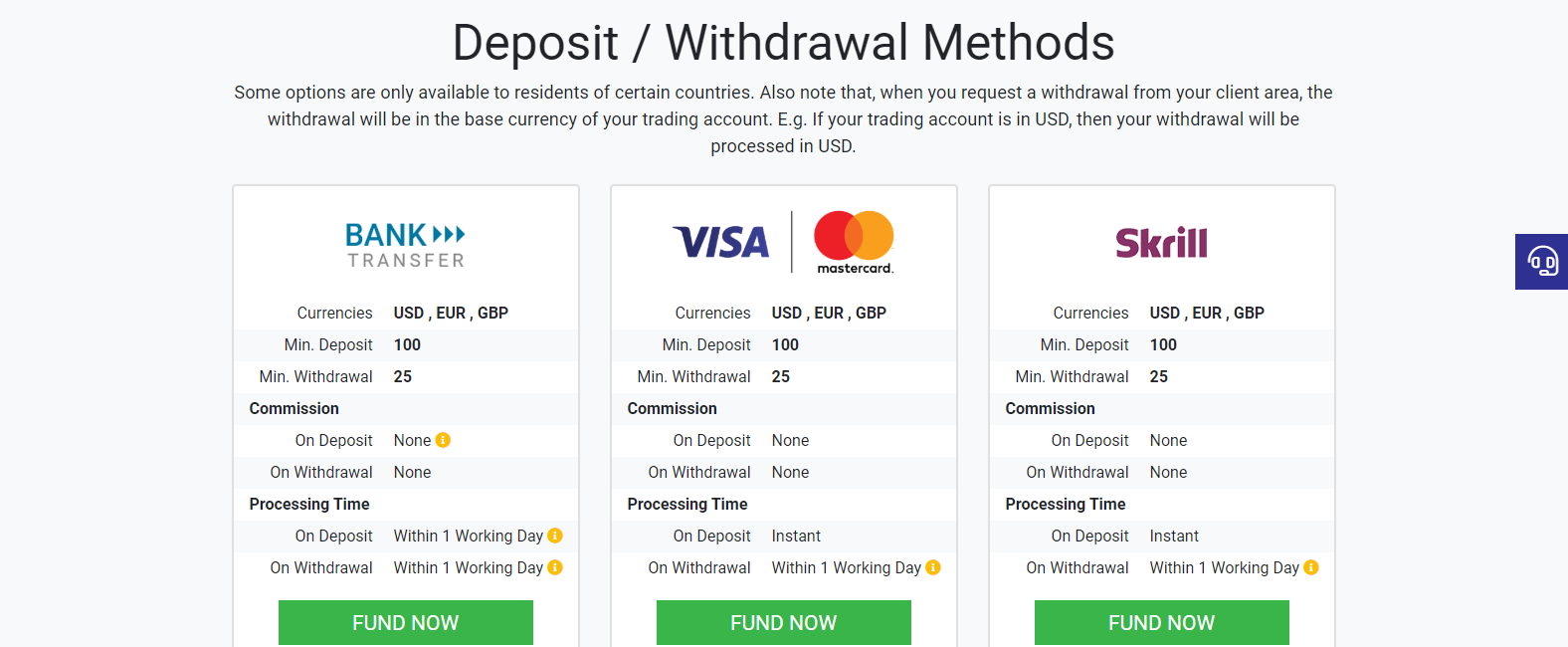

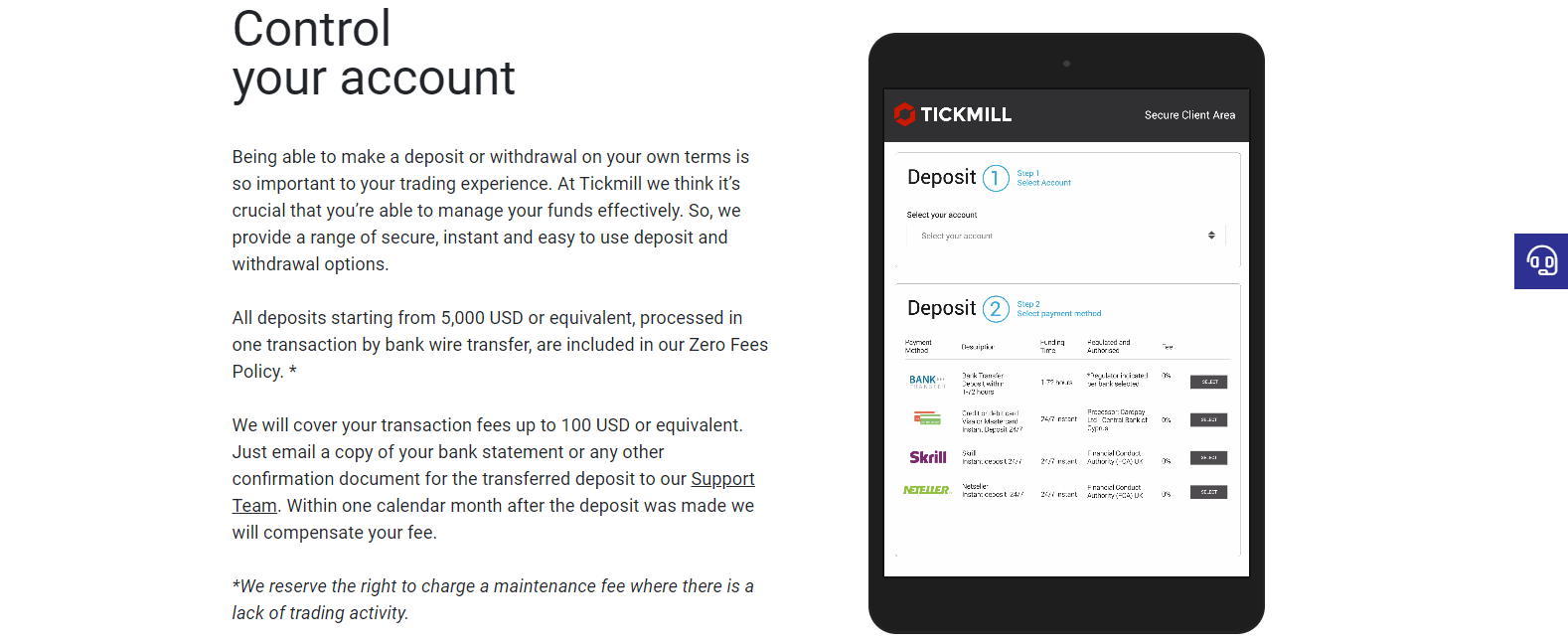

Deposits and Withdrawals

Tickmill supports bank wires, credit/debit cards, Skrill, Neteller, Sticpay, Fasapay, Unionpay, NganLuong, QIWI, and WebMoney. The minimum deposit and withdrawal amounts are $100 and $25, respectively. Processing times range between instant and seven business days. While this broker waives most fees, third-party charges generally apply. Tickmill covers fees for wire deposits above $5,000, up to $100. Not all options are available to all traders, and withdrawals will be returned to the same processor used for the deposit.

Tickmill supports a broad selection of payment processors.

Wire fees on deposits that exceed $5,000 are reimbursed, up to $100.

Summary

Tickmill is a well-regulated brokerage, respected across the industry, but a review of the services offered suggests institutional clients fare better through Tickmill Prime than Tickmill's retail traders. The asset selection, aside from the Forex market, is notably limited. The most basic version of the MT4 trading platform is offered, as is MT5. Spreads in the Classic account are not competitive, though the Pro account, for the same deposit amount, provides a competitive pricing environment and thus is a superior option.

Tickmill's most valuable asset is its eleven-member research team, which provide traders with exceptional coverage of the financial markets. While this broker clearly cares about the education of its traders, it should focus less on quantity and more on quality. Social trading via Myfxbook carries an unacceptable mark-up on spreads.

While there is clearly a vast amount of untapped potential at Tickmill, management should find a way to access that potential in an effort to attract new traders and retain existing ones. In the current environment, while traders may be better served at other brokerages, they would be wise to keep Tickmill on their radar as this broker certainly could be a contender for any trader looking for new opportunities. Tickmill is regulated by the Seychelles Financial Services Authority (FSA), where it holds a security dealer license under number SD008. Tickmill UK LTD operates under the Financial Conduct Authority (FCA) authorization with FCA register number 717270. Tickmill Europe LTD is a Cyprus Investment Firm (CIF) operated under license number 278/15. Tickmill Asia Ltd is authorized and regulated by the Labuan Financial Services Authority (FSA) and Tickmill South Africa (Pty) Ltd is authorized and regulated by the Financial Sector Conduct Authority (FSCA). This broker allows all trading strategies, including scalping. Only profits earned with the bonus are available for withdrawal. Tickmill is a market maker, evident in its Classic account. The Pro account is marketed as an ECN/NDD account. This broker fails to provide which MT4 bridge is deployed, suggesting a market maker model across all account types. The minimum deposit for the Classic and Pro accounts is €100.FAQs

Is Tickmill regulated?

Does Tickmill allow scalping?

How do I withdraw my Tickmill bonus?

Is Tickmill a market maker?

What is the minimum deposit for Tickmill?