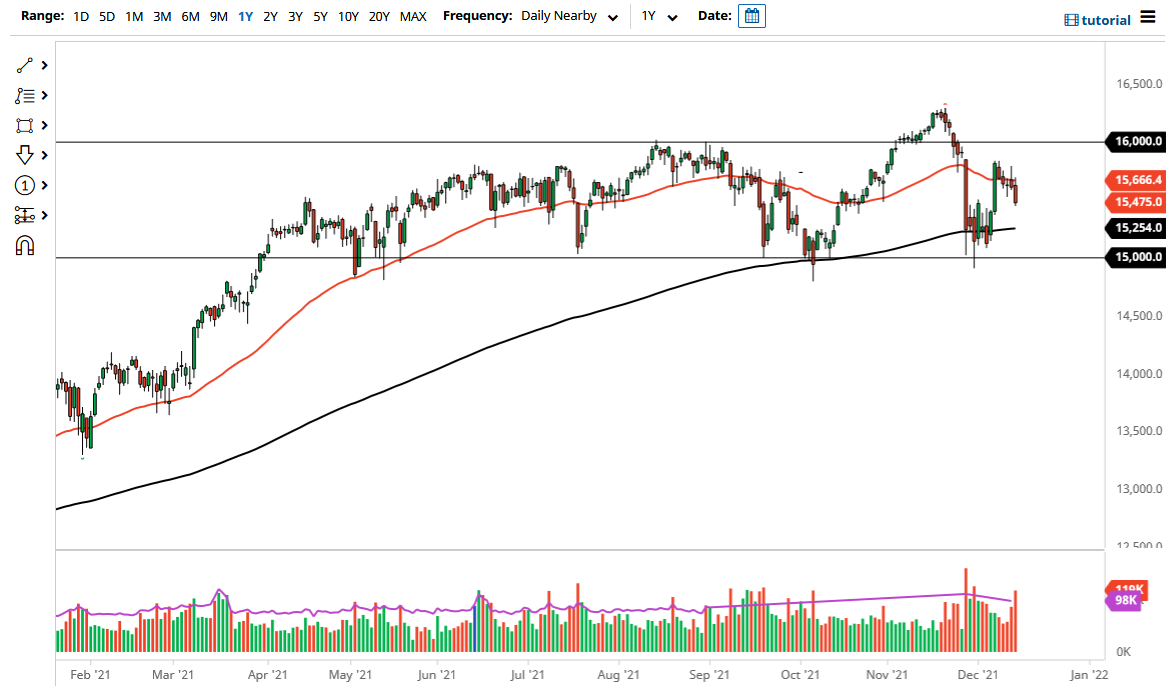

The DAX initially tried to rally on Tuesday but found enough resistance near the 50 day EMA to turn things around and start falling. Perhaps some of this is due to the fact that there are continued discussions about lockdowns in the European Union, and the DAX is the first place people put money to work. In other words, it is the “blue-chip index” for the continent. Furthermore, you should also keep in mind that Germany is a major exporter, especially to other countries in the European Union. With that in mind, it is difficult to imagine a scenario where lockdowns around the rest of the continent will not have some type of major effect on the German economy itself.

Nonetheless, there is still a significant amount of support just below, especially near the €15,250 level. There is a big consolidation area in that overall vicinity, and as a result I think we will probably continue to see this market offer a bit of noise in that general vicinity. Longer-term, I think that the 200 day EMA also captures a lot of attention, so we need to be cognizant of that. The market has been very volatile as of late, but you can say that about almost any market around the world. With that being said, I think we will probably see the DAX act the same as many others, as there is just simply a lot of noise heading into the end of the year.

The size of the candlestick is somewhat impressive, and it is worth noting that we still have not taken out the massive shot higher from last week, so one would have to think there is still the potential for a relatively bullish outcome. Nonetheless, pay close attention to risk appetite around the world, because that obviously will have its say in this market as well. If we can break out above the €15,800 level, then I think we will go looking towards the €16,000. At this point in time, I believe that the absolute “bottom in the market” is probably closer to the €15,000 level, so that should be paid close attention to because a break of that area would be extraordinarily negative and send German stocks plunging. Keep in mind liquidity is going to be a major issue this time of year as well, so you also have to be cautious about getting too big in your positioning.