Long Trade Idea

Enter your long position between $81.68 (yesterday's intra-day low) and $82.94 (this week's intra-day high).

Market Index Analysis

- Wesfarmers (ASX:WES) is a member of the S&P/ASX 200.

- The ASX 200 continues to drift higher with decreasing bullish trading volumes, reflecting cautious sentiment despite broader strength.

- The Bull Bear Power Indicator of the S&P/ASX 200 is bullish with a negative divergence, suggesting consolidation before the next leg higher.

- The index has rebounded 497 points (5.9%) into recent highs following seasonal strength from mid-December into mid-January 2026.

- Important support levels exist at 8700–8675, with upside targets targeting 8950–9000, providing clarity on index direction.

Market Sentiment Analysis

Australian market sentiment remains constructively bullish as of January 2026, with the ASX 200 on track for a fourth consecutive session of gains. The Materials sector has led performance throughout 2025, rising nearly 32%, with industrial conglomerates like Wesfarmers benefiting from improved commodity outlooks and energy transition tailwinds. Institutional investors have shown increasing appetite for diversified industrial plays with exposure to critical minerals, particularly lithium beneficiaries positioned to capitalize on global electric vehicle adoption. Retail investors are closely monitoring Wesfarmers' Covalent Lithium joint venture ramp-up, viewing production increases as a potential catalyst for earnings growth and margin expansion. The broader Australian economy remains resilient, supporting confidence in dividend-paying blue-chip industrials. Seasonal strength typically persists through mid-January, providing a constructive backdrop for cyclical and growth-oriented equity selection.

Wesfarmers Fundamental Analysis

Wesfarmers is a diversified Australian conglomerate operating across retail, chemicals, fertilisers, industrial and safety products, with a dominant presence in Australia and New Zealand. It ranks among Australia's largest companies by revenue and is one of the country's largest private employers. The company operates Bunnings, Kmart, Officeworks, and increasingly, through its 50% stake in Covalent Lithium, holds a strategic position in the battery minerals supply chain. With over AU$45.7 billion in total revenue (trailing twelve months) and AU$2.93 billion in earnings, Wesfarmers demonstrates substantial scale and diversification that insulates it from single-sector cyclicality.

So, why am I bullish on WES following its breakout?

- Wesfarmers' strategic positioning in the lithium supply chain through Covalent Lithium represents a compelling long-term thesis. The 50-megawatt (50,000 tonnes per annum capacity) Kwinana refinery, operated as a 50:50 joint venture with Chilean lithium producer SQM, achieved first production in August 2025 and is expected to ramp to nameplate capacity over the next 18 months. This production ramp-up directly supports lithium hydroxide supply for approximately one million electric vehicles annually, positioning Wesfarmers at the centre of Australia's battery and critical minerals strategy.

- Revenue growth averaging 8.3% over the past five years, with peaks reaching 18.2% in fiscal 2023, demonstrates Wesfarmers' operational execution and market adaptability. The Bunnings division continues to deliver resilient earnings despite consumer headwinds, while chemical, energy, and fertiliser operations (WestCEF) maintain diversification and cash generation. The return on invested capital has turned positive, contrasting favourably with the weak ROIC-WACC metrics seen in comparable conglomerates, suggesting that management's capital allocation has improved shareholder value creation.

- Additionally, Wesfarmers' foray into lithium processing improves long-term margins as battery-grade lithium hydroxide commands premium pricing, particularly as automotive OEMs lock in supply contracts. The company's exposure to international expansion through Mount Holland and Kwinana, combined with improving operational leverage, supports cautious optimism over 2026 earnings and capital returns to shareholders.

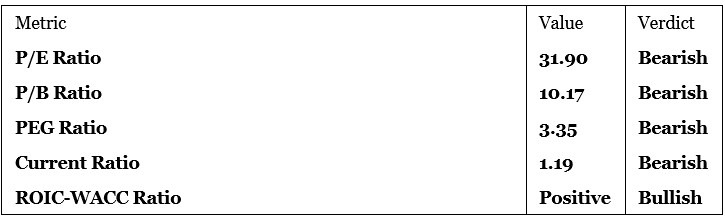

Wesfarmers Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 31.90 makes ASX:WES an expensive stock on an absolute basis. By comparison, the P/E ratio for the ASX 200 is 20.97, indicating Wesfarmers trades at a 52% premium to index valuations. This elevated multiple reflects market pricing of the lithium joint venture's growth trajectory and the perceived quality of Wesfarmers' diversified earnings streams.

The average analyst price target for WES is $80.80, suggesting limited upside from current levels. However, based on lithium production ramp-up catalysts and potential margin expansion as Covalent Lithium reaches capacity, fair value estimates extend to $100.00 on a 12-month horizon, with downside risks diminishing as execution risk decreases.

Key Valuation Insights

The bearish valuations across P/E, P/B, and PEG ratios reflect the market's pricing of growth expectations already embedded in the share price. However, the positive ROIC-WACC ratio is notably bullish, indicating that Wesfarmers generates returns above its cost of capital—a rarity among diversified conglomerates and a signal of improving capital efficiency. The current ratio of 1.19, while technically bearish, is not problematic for a large, cash-generative business with strong banking relationships. The valuation premium is justified if Covalent Lithium achieves production ramp-up targets and margins expand to industry-standard levels, which would support earnings growth of 8–12% annually over the next three years.

Wesfarmers Technical Analysis

Today's WES Signal

The technical setup for Wesfarmers presents a constructive bullish configuration as of January 15, 2026. The stock has successfully broken above key resistance at the $82.00 psychological level, establishing a new intermediate-term support zone at $81.68–$82.00. Volume analysis indicates healthy institutional accumulation, with above-average trading activity supporting upward price momentum. The 50-day moving average has crossed above the 200-day moving average, forming a classic bullish moving average crossover that typically signals sustained upside momentum. Price action remains constructive within an established uptrend channel, with support confirmed at $81.68 and intermediate resistance at $85.00–$86.00 levels. Momentum indicators show positive divergence with the Relative Strength Index (RSI) positioned in the 50–65 range, indicating neither overbought nor oversold conditions, leaving room for further appreciation. The MACD (Moving Average Convergence Divergence) has generated a bullish signal with the fast line above the slow line, providing technical confirmation for the bull thesis.

Wesfarmers Price Chart

Technical Indicators Summary

- Trend Direction: Bullish with higher highs and higher lows establishing since late December 2025

- Key Support Level: $81.68 (yesterday's intra-day low)

- Key Resistance Level: $85.00–$86.00 (intermediate technical resistance)

- Volume Profile: Above-average accumulation with institutional participation

- Momentum: Positive with RSI in neutral-to-bullish zone

- Moving Average Configuration: Bullish (50-day > 200-day)

My ASX:WES Long Stock Level and R/R

- NYSE:WES Entry Level: Between 81.68 and 82.94

- NYSE:WES Take Profit: Between 97.54 and 100.00

- NYSE:WES Stop Loss: Between 75.68 and 77.22

- Risk/Reward Ratio: 2.64

- Upside Potential: Approximately 18.6% to 21.8% (entry to targets)

- Downside Risk: Approximately 7.3% to 8.4% (entry to stop loss)

Ready to trade our analysis of Wesfarmers? Here is our list of the best stock brokers worth checking out.