Short Trade Idea

Enter your short position between $183.40 (yesterday's intra-day low) and $188.11 (yesterday's intra-day high).

Market Index Analysis

- NASDAQ 100 Multiple Index Risk: NVIDIA (NASDAQ:NVDA) is a member of the NASDAQ 100, Dow Jones Industrial Average, S&P 100, and S&P 500. All four indices trade near all-time highs but show accumulating breakdown signals that suggest vulnerability to profit-taking and mean reversion.

- Technical Divergence Signal: The Bull Bear Power Indicator for the NASDAQ 100 shows a negative divergence and does not confirm the uptrend, indicating weakening momentum despite price strength and suggesting caution for extended long positions.

- Valuation Stretch in Tech: The technology sector is priced for perfection, with mega-cap names trading at elevated valuations that leave limited room for disappointment. Individual stock weakness in this environment can cascade through broader indices.

- AI Boom Narrative Fatigue: Market enthusiasm around AI appears to be moderating, with investors increasingly scrutinizing which companies will actually capture profitable returns from the AI infrastructure buildout, creating headwinds for expensive players.

Market Sentiment Analysis

- Cautious US Equity Market Sentiment: The broad US stock market exhibits mixed sentiment as investors balance enthusiasm over AI applications with concerns about geopolitical tensions, inflation persistence, and the sustainability of 2025's strong equity rally.

- Technology Sector Rotation Signals: The tech sector faces emerging headwinds as investors shift capital toward value and dividend-paying sectors. Large-cap semiconductor and AI infrastructure plays face increased scrutiny over valuation justification.

- AI Hardware Saturation Concerns: Growing skepticism about the near-term demand sustainability for AI chips is building among sophisticated institutional investors, with questions emerging about whether deployment rates justify current multiples.

- Institutional Profit-Taking: Despite positive earnings reports, institutional investors are reportedly reducing exposure to mega-cap technology names that have already delivered significant gains, suggesting consolidation and potential weakness ahead.

NVIDIA Fundamental Analysis

NVIDIA is a semiconductor company that emerged as the leading AI company. Originally catering to gamers with high-end GPUs, it broadened into AI, and its tremendous success made it the first company to reach a $5 trillion market cap.

So, why am I bearish on NVDA despite its superb earnings report?

- Heavy Reliance on AI Boom and TSMC for Manufacturing: NVIDIA's extraordinary growth depends almost entirely on the continuation of the AI boom, while the company outsources all manufacturing to TSMC, creating concentration risk in both demand and supply chains. Any slowdown in AI capex or TSMC supply disruptions creates existential risk to revenue growth.

- Decelerating Growth Rates for Revenues and Earnings: While NVIDIA's absolute growth remains impressive, the rate of acceleration is decelerating as comparables become increasingly difficult. Forward guidance suggests growth rates normalizing to more modest levels than the explosive 2024-2025 performance.

- High Valuations Disconnect from Peers: At a P/E ratio of 46.11, NVIDIA trades at a significant premium to the NASDAQ 100's 38.14, and even its favorable PEG ratio of 0.56 becomes misleading if growth rates slow materially. Current valuation leaves minimal room for execution missteps.

- Circular Financing Concerns: NVIDIA benefits from circular capital flows where data center operators generate excess returns from AI capex, which they reinvest into more chips, creating a feedback loop that may break if ROI calculations on AI infrastructure investments deteriorate.

- Limited Penetration in China and H200 Ban: China represents a massive potential market where NVIDIA has minimal presence due to export restrictions and the H200 ban. This geopolitical limitation caps addressable market and creates regulatory uncertainty for future growth.

- Rapidly Rising Expenses and Operational Leverage: Operating expenses are escalating dramatically as NVIDIA builds research capacity, data centers, and expands headcount. Operating leverage appears to be reversing, with expense growth outpacing revenue growth on a percentage basis.

- Non-Core Investments and Capital Allocation Concerns: NVIDIA's management has made significant non-core investments in companies like ARM, creating complexity and potential write-down risks. Capital allocation appears less disciplined than during earlier growth phases.

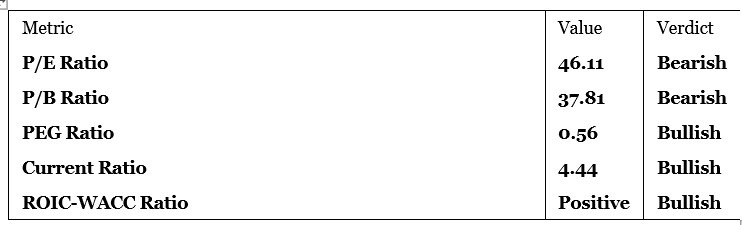

NVIDIA Fundamental Analysis Snapshot

- The price-to-earnings (P/E) ratio of 46.11 makes NVDA an expensive stock relative to current fundamentals. By comparison, the P/E ratio for the NASDAQ 100 is 38.14, indicating NVIDIA trades at a 20.8% premium to the index, reflecting significant growth expectations that may not materialize.

- While the PEG ratio of 0.56 appears attractive, it assumes sustained high growth rates that face headwinds from AI capex normalization, capacity constraints, and competitive pressure. The metric's bullish appearance masks deteriorating growth dynamics.

- The strong current ratio of 4.44 and positive ROIC-WACC reflect NVIDIA's fortress balance sheet and operational efficiency at current scale. However, balance sheet strength does not protect against valuation mean reversion or demand destruction.

- The average analyst price target for NVDA is $252.81, suggesting upside potential of 36.1% with significantly greater downside risks given the elevated valuation and vulnerable demand dynamics. The wide dispersion of analyst targets (ranging from $155 to $350) indicates deep disagreement about appropriate valuation and demonstrates forecast uncertainty, and I believe the average is far too optimistic.

NVIDIA Technical Analysis

Today's NVDA Signal

- Resistance Zone Formation: NVIDIA faces intermediate resistance at $188.11, which represents recent intra-day highs. Failure to break above this level suggests weakening momentum and potential reversal to established support zones below.

- Support Structure Weakness: The primary support at $183.40 (yesterday's intra-day low) is relatively shallow, with a further critical support zone at $147.96-$151.49. The limited cushion between current price and near-term support increases downside acceleration risk.

- Bearish Divergence Signals: Despite recent earnings strength and stable fundamentals, price action exhibits bearish divergence characteristics, with declining volume support on rally attempts and increased institutional distribution patterns.

- Trend Deterioration Indicators: The recent consolidation between $183.40 and $188.11 is consistent with distribution patterns preceding larger downside moves, rather than accumulation preceding breakouts. Price structure suggests vulnerability.

- Risk-Reward Asymmetry Favors Short: The geometric configuration from current levels offers attractive risk-reward for short positions, with defined stop-loss risk at $199.94-$203.15 and profit targets at $147.96-$151.49, creating a favorable 2.14:1 risk-reward ratio for disciplined shorts.

NVIDIA Price Chart

My NVDA Short Stock Trading Recommendation

- NVDA Entry Level: Between $183.40 and $188.11

- NVDA Take Profit: Between $147.96 and $151.49

- NVDA Stop Loss: Between $199.94 and $203.15

- Risk/Reward Ratio: 2.14

This short recommendation exploits the divergence between elevated near-term valuations and weakening operational metrics, positioning for tactical downside moves while maintaining disciplined risk parameters. The strategy is suitable for directional traders with 2-4 week holding horizons seeking to capitalize on semiconductor sector volatility and valuation normalization.

Ready to trade our analysis of Nvidia? Here is our list of the best stock brokers worth reviewing.