Long Trade Idea

Enter your long position between 82.11 (its 52-week low) and 88.51 (Friday’s intra-day high).

Market Index Analysis

- Netflix (NFLX) is a member of the NASDAQ 100, the S&P 100, and the S&P 500.

- All three indices are currently trading near all-time highs with rising bearish trading volumes.

- The Bull Bear Power Indicator of the NASDAQ 100 is bullish with a descending trendline, approaching a bearish crossover.

Market Sentiment Analysis

Equity futures are lower this morning after US President Trump imposed additional tariffs on eight NATO allies amid his push to gain control of Greenland. This move indicates the US-EU trade war is resuming, following a similar action last week that reignited tensions with China after the announcement of a 25% tariff on all countries doing business with Iran. Gold and silver jumped, and oil prices steadied. Earnings reports from Netflix and Intel could also impact price action, along with updates on President Trump’s candidate for the next Fed Chair.

Netflix Fundamental Analysis

Netflix is the best-known over-the-top (OTT) subscription video-on-demand service. It has its own production studios, acquires original programming, and showcases third-party content via its subscription-based streaming services. It also expanded into gaming and live sporting events.

So, why am I bullish on NFLX ahead of its earnings release?

I am cautiously optimistic about its earnings release today and anticipate better-than-expected fourth-quarter earnings, partially driven by its underappreciated advertising business. The WBD acquisition battle continues, but the WBD board remains in favor of the Netflix offer, and a completion would significantly expand its content. Even without the WBD deal, Netflix maintains an exciting content library, and I monitor its potential for big-screen content creation, as favored by its co-CEO.

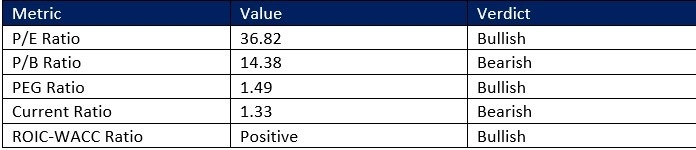

Netflix Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 36.82 indicates NFLX is fairly valued. By comparison, the P/E ratio for the NASDAQ 100 is 37.76.

The average analyst price target for NFLX is 122.96. It suggests excellent upside potential, with limited downside risks.

Netflix Technical Analysis

Today’s NFLX Signal

- The NFLX D1 chart shows price action inside a horizontal support zone

- The chart also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels

- The Bull Bear Power Indicator is bearish with an ascending trendline

- The average bearish trading volumes have risen, suggesting more volatility ahead

- NFLX decreased more than the S&P 500, a bearish signal, but bullish catalysts have accumulated over the past week

My NFLX Long Stock Trading Recommendation

- NFLX Entry Level: Between 82.11 and 88.51

- NFLX Take Profit: Between 122.96 and 126.70

- NFLX Stop Loss: Between 70.44 and 73.60

- Risk/Reward Ratio: 3.50

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.