Long Trade Idea

Enter your long position between £645.00 (an intermediate horizontal support zone) and £654.82 (an intermediate horizontal resistance zone).

Market Index Analysis

- NatWest Group (LSE:NWG) is a member of the FTSE 100 Index.

- This index trades near all-time highs with rising bearish pressures.

- The Bull Bear Power Indicator for the FTSE 100 shows a negative divergence and does not confirm the uptrend.

Market Sentiment Analysis

Equity futures are lower this morning after US President Trump imposed additional tariffs on eight NATO allies amid his push to gain control of Greenland, in a rapidly escalating situation. The EU prepared a response worth tariffs on $108 billion of US imports, with the potential to impose tariffs on up to $8 trillion. Gold and silver jumped, and oil prices steadied. The civil unrest in Iran has intensified, where President Trump announced 25% tariffs on countries dealing with Iran, reigniting US-China trade tensions. Earnings reports from Netflix, Intel, 3M, and Johnson & Johnson could also impact price action today.

NatWest Group Fundamental Analysis

NatWest Group is a banking and insurance holding company offering personal and business banking, private banking, investment banking, insurance, and corporate finance.

So, why am I bullish on NWG.L despite its 15%+ rally?

Its aggressive share buyback program, with over 1.7 million shares bought in January-to-date, has provided a floor under selling pressure from geopolitical events. I remain bullish on its notable improvements in capital build, its excellent return on equity, and attractive valuations despite the recent rally. The hiring of a non-executive board member with extensive AI and tech experience should further boost its innovation, cost efficiencies, and customer experience.

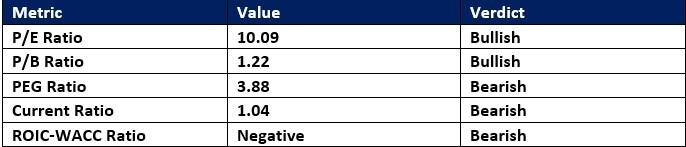

NatWest Group Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 10.09 makes NWG an inexpensive stock. By comparison, the P/E ratio for the FTSE 100 Index is 20.03.

The average analyst price target for NWG is £675.41. It suggests decent upside potential with acceptable downside risks.

NatWest Group Technical Analysis

Today’s NWG Signal

NatWest Price Chart

- The NWG D1 chart shows price action inside a bullish price channel.

- It also shows price action between its ascending 50.0% and 61.8% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with an ascending trendline.

- The average bullish trading volumes are higher than the average bearish trading volumes.

- NWG advanced with the FTSE 100 Index, a bullish trading confirmation.

My LSE:NWG Long Stock Trade

- NWG Entry Level: Between £645.00 and £654.82

- NWG Take Profit: Between £725.00 and £739.50

- NWG Stop Loss: Between £607.60 and £611.60

- Risk/Reward Ratio: 2.14

Ready to trade our analysis of NatWest? Here is our list of the best stock brokers worth checking out.