Long Trade Idea

Enter your long position between £1,135.50 (an intermediate horizontal support zone) and £1,160.00 (an intermediate horizontal resistance zone).

Market Index Analysis

• FTSE 100 Membership Risk: National Grid (LSE:NG) is a member of the FTSE 100, which currently trades near all-time highs, but shows accumulating breakdown signals that suggest potential weakness ahead.

• Technical Divergence Concern: The Bull Bear Power Indicator for the FTSE 100 shows a negative divergence and does not confirm the uptrend, indicating weakening momentum despite price strength.

• Defensive Positioning: Despite broader market caution, UK utility stocks like National Grid offer defensive characteristics in a potentially volatile environment, making them attractive for risk-conscious investors.

• Sector Resilience: The energy infrastructure sector remains relatively insulated from macro uncertainty due to essential service demand and regulated revenue streams.

Market Sentiment Analysis

• Mixed UK Market Sentiment: The UK equity market exhibits cautious optimism with investors balancing concerns about economic growth against the appeal of fairly valued dividend stocks in the FTSE 100.

• Energy Sector Optimism: The UK energy sector is experiencing positive sentiment driven by the government's net zero transition agenda, substantial infrastructure investment requirements, and growing recognition of energy security importance post-geopolitical tensions.

• Investor Appetite for Utilities: Institutional demand for utility stocks remains strong due to inflation-hedging characteristics and reliable dividend yields, supporting share price appreciation for well-positioned operators like National Grid.

• AI and Technology Adoption Boost: Market sentiment toward traditional utilities is improving following announcements of AI-powered operational efficiency initiatives, positioning National Grid as a modern, technologically advanced enterprise.

National Grid Fundamental Analysis

National Grid is a multinational electricity and gas utility and one of the largest investor-owned utilities globally. It is also at the core of making the UK energy grid net zero.

So, why am I bullish on LSE:NG despite its two-day slide?

- Above-Average Returns on Equity and Assets: National Grid demonstrates above-average return on equity (ROE) and return on assets (ROA) compared to utility sector peers, indicating efficient capital deployment and operational excellence in converting shareholder investments into profits.

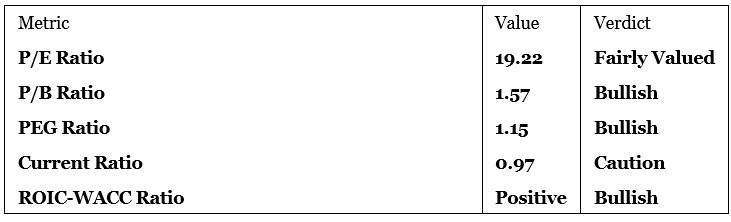

- Undervalued Share Valuation: Despite its critical infrastructure role and growth prospects, NG.L trades at a P/E ratio of 19.22—virtually aligned with the FTSE 100 average of 19.94—suggesting the market has not yet fully priced in the transformational impact of the UK energy grid overhaul and AI initiatives.

- Defensive Portfolio Capabilities: As an essential utility operator with regulated revenue streams and long-term contracts, National Grid provides portfolio stability and consistent dividend income, making it an ideal defensive holding during periods of market uncertainty.

- Favorable 5-Year PEG Ratio: The PEG ratio of 1.15 indicates the stock is fairly valued relative to its growth prospects, suggesting reasonable upside potential without excessive valuation risk over the medium term.

- AI-Powered Wildfire Risk Initiative with Rhizome: National Grid's partnership with Rhizome on AI-powered wildfire risk detection and prevention represents a strategic technological advancement that reduces operational risks, protects infrastructure, and enhances shareholder value while positioning the company as an innovation leader.

- Ongoing UK Energy Grid Overhaul: The extensive overhaul of the UK energy grid to support net zero transition and increase renewable energy integration presents a multi-year revenue growth opportunity for National Grid, with the company positioned as the essential infrastructure operator benefiting from substantial capital investment requirements.

National Grid Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 19.22 indicates LSE:NG as fairly valued. By comparison, the P/E ratio for the FTSE 100 is 19.94. The stock does not command a growth premium, suggesting market recognition of utility sector maturity while overlooking the transformation potential from grid modernization.

The above-average P/B ratio of 1.57 reflects market confidence in National Grid's tangible asset base and the strategic value of its infrastructure monopoly. The favorable PEG ratio of 1.15 indicates the stock is attractively priced relative to expected earnings growth.

The average analyst price target for LSE:NG is £1,208.50. It suggests decent upside potential of approximately 4.7% with manageable downside risks, particularly given the defensive nature of the business and support from net zero transition tailwinds.

National Grid Technical Analysis

Today's NG Signal

• Support Zone Strength: The intermediate horizontal support at £1,135.50 represents a significant technical floor where buyer interest historically emerges, providing risk management clarity for new longs.

• Resistance Level Definition: The intermediate horizontal resistance at 1,160.00 marks a recent price ceiling where profit-taking has previously occurred, establishing a clear risk-reward framework for entry.

• Momentum Consolidation: The recent two-day slide to £1,153.50 (down 2.12%) is consistent with healthy consolidation following strength, rather than a breakdown pattern, as the stock remains comfortably above key support levels.

• Trend Continuity: Despite the minor pullback, the overall price structure remains consistent with a long-term uptrend, with higher lows and recovery patterns supporting the bullish case.

• Entry Validation: The tight trading range between support (£1,135.50) and resistance (£1,160.00) offers optimal entry conditions with favorable risk-reward geometry and clear stop-loss parameters.

National Grid Price Chart

My LSE:NG Long Stock Levels and R/R

• NG.L Entry Level: Between £1,135.50 and £1,160.00

• NG.L Take Profit: Between £1,208.50 and £2,371.05

• NG.L Stop Loss: Between £1,102.50 and £1,122.00

• Risk/Reward Ratio: 2.21

This analysis offers asymmetric risk-reward with upside targets extending over 100% while limiting downside to approximately 1% below the entry support zone, making it suitable for disciplined traders with medium-term holding horizons.

Ready to trade our analysis of the National Grid? Here is our list of the best stock brokers worth reviewing.