Long Trade Idea

Enter your long position between $176.24 (and intermediate horizontal support level) and $188.55 (and intermediate horizontal resistance level).

Market Index Analysis

- Molina Healthcare (MOH) is a member of the S&P 500 Index.

- This index closed at a fresh all-time high, but decreasing bullish trading volumes do not confirm the uptrend.

- The Bull Bear Power Indicator of the S&P 500 Index is bullish with a negative divergence.

Market Sentiment Analysis

Equity futures rose this morning after the S&P 500 Index closed at a fresh record high, brushing aside tariffs and geopolitical tensions, while focusing solely on earnings season. The tech sector, led by AI and AI-related companies, continues to drive equity markets higher, and ASML shone in its latest earnings report. The US Federal Reserve is expected to keep interest rates on hold, but markets await guidance for 2026. On the earnings front, Microsoft, Meta Platforms, and Tesla (TSLA) will report after the market close.

Molina Healthcare Fundamental Analysis

Molina Healthcare is a managed care company. It focuses on health insurance coverage for lower-income households through government programs, Medicaid, and Medicare.

So, why am I bullish on MOH following its one-day drop?

The US government’s surprise proposed 0.09% increase in Medicare Advantage payments for 2027 cratered healthcare stocks with a strong underwriting position in Medicare contracts. Still, I remain bullish about its stable net profit margins despite cost pressures, cash positions, and low valuations. I am cautiously optimistic about its upcoming earnings release after management expects earnings normalization amid rising market share, despite rising cost pressures.

Metric | Value | Verdict |

P/E Ratio | 11.34 | Bullish |

P/B Ratio | 2.26 | Bullish |

PEG Ratio | 2.77 | Bearish |

Current Ratio | 1.68 | Bearish |

ROIC-WACC Ratio | Positive | Bullish |

The price-to-earnings (P/E) ratio of 11.34 makes MOH an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 31.52.

The average analyst price target for MOH is $186.69. This suggests negligible upside potential, but I see more growth ahead. The downside risks remain manageable.

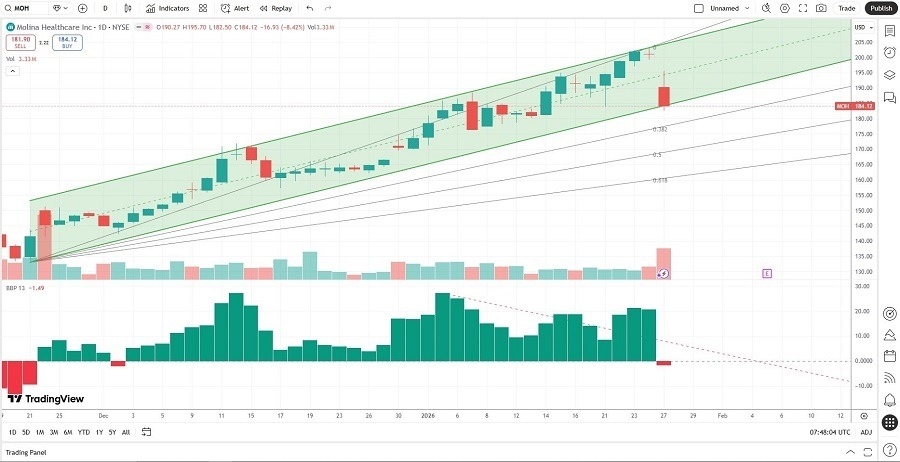

Molina Healthcare Technical Analysis

Today’s MOH Signal

- The MOH D1 chart shows price action inside a bullish price channel.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator turned bearish with a descending trendline, suggesting short-term volatility could rise.

- The average bullish trading volumes are higher than the average bearish trading volumes, except for yesterday’s one-day news-related selloff.

- MOH is moving higher with the S&P 500, a bullish confirmation.

My MOH Long Stock Trade

- MOH Entry Level: Between $176.24 and $188.55

- MOH Take Profit: Between $262.32 and $268.15

- MOH Stop Loss: Between $143.72 and $157.20

- Risk/Reward Ratio: 2.65

Ready to trade our analysis of Molina Healthcare? Here is our list of the best stock brokers worth reviewing.