Short Trade Idea

Enter your short position between $105.84 (the lower band of its horizontal resistance zone) and $112.90 (the upper band of its horizontal resistance zone).

Market Index Analysis

- Merck & Co (MRK) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

- All three indices are currently trading near all-time highs with rising bearish trading volumes.

- The Bull Bear Power Indicator of the S&P 500 is bullish with a descending trendline, approaching a bearish crossover.

Market Sentiment Analysis

Equity futures are lower this morning after US President Trump imposed additional tariffs on eight NATO allies amid his push to gain control of Greenland, in a rapidly escalating situation. The EU prepared a response worth tariffs on $108 billion of US imports, with the potential to impose tariffs on up to $8 trillion. Gold and silver jumped, and oil prices steadied. The civil unrest in Iran has intensified, where President Trump announced 25% tariffs on countries dealing with Iran, reigniting US-China trade tensions. Earnings reports from Netflix, Intel, 3M, and Johnson & Johnson could also impact price action today.

Merck & Co Fundamental Analysis

Merck & Co is a multinational pharmaceutical company. It is a leader in cancer treatments, with vaccines and animal health products rounding out its top three revenue drivers.

So, why am I bearish on MRK despite its 37%+ rally?

I believe the good news is fully priced into the current share price. Its top-selling drug, Keutruda, faces a patent cliff in two years, and I don’t see a replacement for the $30 billion revenue drug right now. Regulatory and commercial setbacks are a red flag, led by Gardasil’s struggles in China. Earnings estimates have also plunged for 2026, driven by its aggressive M&A activity, including the Cidara Therapeutics deal and talks to acquire Revolution Medicines.

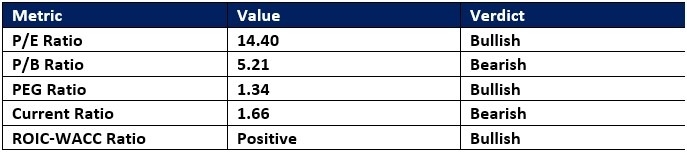

Merck & Co Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 14.40 makes MRK an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 31.34.

The average analyst price target for MRK is $113.48, suggesting negligible upside potential with expanding downside risks.

Merck & Co Technical Analysis

Today’s MRK Signal

Merck & Co Price Chart

- The MRK D1 chart shows price inside a horizontal resistance zone.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with a descending trendline.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- MRK flatlined as the S&P 500 advanced, a bearish confirmation.

My Merck Short Stock Trade

- MRK Entry Level: Between $105.84 and $112.90

- MRK Take Profit: Between $82.01 and $87.26

- MRK Stop Loss: Between $115.16 and $117.46

- Risk/Reward Ratio: 2.56

Ready to trade our analysis of Merck & Co.? Here is our list of the best stock brokers worth checking out.