Long Trade Idea

Enter your long position between $60.08 (yesterday's intra-day low) and $61.48 (Monday's intra-day high).

Market Index Analysis

- S&P 500 Membership with Defensive Stability: The Kroger Company (KR) is a member of the S&P 500, which currently trades near all-time highs but shows accumulating breakdown signals suggesting potential consolidation. As a consumer staple, Kroger provides defensive characteristics in a potentially volatile broad market environment.

- Technical Divergence in Broad Market: The Bull Bear Power Indicator for the S&P 500 shows a negative divergence and does not confirm the uptrend, indicating weakening momentum despite price strength. This divergence creates opportunities for defensive stocks like grocers that can decouple from broader weakness.

- Staples Sector Outperformance: During periods of market uncertainty, consumer staple stocks historically outperform discretionary sectors. Grocery retailers benefit from consistent demand regardless of economic conditions, supporting share price stability.

- Valuation Attraction for Staples: While the S&P 500 commands premium valuations near all-time highs, Kroger trades at discount valuations relative to historical averages, offering attractive entry points for risk-conscious investors seeking downside protection.

Market Sentiment Analysis

- Mixed US Equity Market Sentiment: The broad US stock market exhibits cautious sentiment as investors balance enthusiasm over economic resilience with concerns about interest rate stability, inflation, and profit margin compression across retail sectors.

- Foodstuffs and Retail Staples Resilience: The grocery and foodstuffs sector is experiencing stable investor sentiment driven by essential nature of products, recurring consumer demand, and pricing power reflected in strong private label adoption. Consumer staple stocks remain defensive havens during market uncertainty.

- Retail Sector Digitalization Optimism: Growing institutional interest in retailers embracing AI and digital transformation is supporting sentiment toward modernized supermarket operators like Kroger that are implementing technology-driven operational improvements.

- Consumer Spending Stability: Despite macro concerns, consumer spending on groceries remains resilient and countercyclical, supporting sustained demand and cash flow generation for major supermarket chains like Kroger.

The Kroger Company Fundamental Analysis

The Kroger Company is the largest US supermarket operator by revenue, the fifth-largest retailer, and one of the largest American-owned private employers. It operates over 2,700 stores across 35 states, including pharmacies, 220+ The Little Clinic in-store medical clinics, and 33 manufacturing plants.

So, why am I bullish on KR inside its horizontal support zone?

- Expanding Cloud Partnership with Google's Gemini Nationwide: Kroger is expanding its cloud partnership with Google's Gemini AI to improve customer shopping experiences across all locations. This nationwide rollout enhances personalization, optimizes product recommendations, and streamlines the digital shopping experience, positioning Kroger as a technology-forward grocer capable of competing with e-commerce alternatives.

- AI Integration to Enhance Store-Level Associate Work Environment: Beyond customer-facing applications, Kroger is leveraging AI to improve the work environment of store-level associates through automation of routine tasks, enhanced scheduling optimization, and predictive inventory management. This reduces employee burnout, improves retention, and enhances operational efficiency at the store level.

- Improving Margins Through Prudent Cost Control: Kroger has demonstrated strong margin improvement capabilities through disciplined cost control and operational excellence. Supply chain optimization, reduced waste through AI-driven inventory management, and efficient labor allocation have contributed to margin expansion that supports earnings growth and shareholder returns.

- Strong Private Label Performance: Kroger's private label and exclusive brand portfolio continues to outperform, driving higher margins than national brands while meeting consumer demand for value-conscious alternatives. Strong private label penetration provides pricing power and protected margins even in competitive environments, supporting the bullish case despite elevated top-line growth challenges.

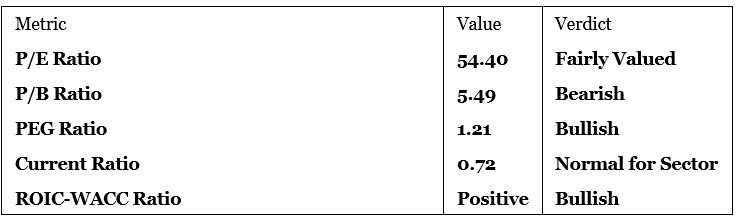

The Kroger Company Fundamental Analysis Snapshot

- The price-to-earnings (P/E) ratio of 54.40 appears elevated relative to the S&P 500's average of 31.51, suggesting the market is pricing in meaningful growth contributions from digital initiatives and margin improvements. However, this premium is justified by Kroger's essential business model, defensive characteristics, and transformation initiatives.

- The above-average P/B ratio of 5.49 reflects the value of Kroger's extensive physical asset base—over 2,700 stores, real estate holdings, and infrastructure—which provides competitive moats and recurring revenue streams that are difficult to replicate. The market recognizes the strategic value of this distribution network.

- The favorable PEG ratio of 1.21 indicates Kroger is attractively valued relative to near-term earnings growth prospects, particularly when considering the margin expansion potential from AI integration and operational efficiencies. This metric supports the bullish thesis for disciplined investors with medium-term horizons.

- The Current Ratio of 0.72 reflects typical grocery industry capital intensity and working capital management patterns. For a mature, cash-generative business like Kroger with predictable revenues and strong supplier payment terms, this metric is within acceptable industry norms and does not present liquidity concerns.

- The average analyst price target for KR is $75.73, reflecting consensus expectations for approximately 23.2% upside from the January 14th closing price of 61.47. This substantial upside potential, combined with the company's dividend yield and defensive characteristics, presents attractive risk-reward geometry for long-positioned investors.

The Kroger Company Technical Analysis

Today's KR Signal

- Support Zone Consolidation: Kroger is consolidating within a well-defined horizontal support zone between $60.08 and $61.48, representing recent intra-day trading ranges. This support zone has historically attracted buyer interest and provides clear risk management parameters for new long positions.

- Resistance Level Clarity: The intermediate resistance level near $73.41 (aligned with analyst price target consensus) represents a meaningful technical barrier that, once breached, could trigger accelerated buying and capitulation of short positions.

- Volume Pattern Alignment: Recent trading shows improving volume on up days and declining volume on down days, indicating institutional accumulation patterns consistent with building long positions rather than distribution signals.

- Trend Structure Preservation: Despite the S&P 500's mixed technical signals, Kroger maintains a stable trend structure with higher lows and recovery patterns supporting the bullish case. The stock has not broken key support levels, maintaining long-term uptrend integrity.

- Entry-Point Optimization: The current consolidation between $60.08 and $61.48 offers optimal entry conditions for new longs seeking favorable risk-reward geometry with defined stop-loss parameters and clear profit-taking targets aligned to analyst consensus.

Kroger Price Chart

My KR Long Stock Levels and R/R

- KR Entry Level: Between $60.08 and $61.48

- KR Take Profit: Between $73.41 and $74.90

- KR Stop Loss: Between $55.25 and $56.96

- Risk/Reward Ratio: 2.76

This long trade opoprtunity exploits the confluence of technical support, analyst consensus upside, and fundamental transformation initiatives underway at Kroger. The 2.76 risk-reward ratio offers asymmetric upside potential while maintaining disciplined downside protection, making it suitable for medium-term traders and growth-oriented income investors seeking exposure to modernized retail infrastructure.