Long Trade Idea

Enter your long position between $118.60 (an intermediate horizontal support level) and $119.05 (yesterday's intra-day high).

Market Index Analysis

- Duke Energy (DUK) is a member of the S&P 100 and the S&P 500.

- Both indices started to retreat from record highs.

- The Bull Bear Power Indicator for the S&P 500 turned bearish with a descending trendline.

- Market volatility remains elevated as investors reassess valuations following the strong rally in January 2026.

Market Sentiment Analysis

Market sentiment surrounding Duke Energy remains cautiously optimistic despite broader market headwinds. Institutional investors have shown increasing interest in dividend-paying utilities as the economic outlook shifts. The recent retreat from record highs in the S&P 500 has not significantly impacted DUK, suggesting relative strength among utility stocks. Retail investors are watching renewable energy initiatives closely, particularly the battery storage and green hydrogen projects that position DUK well for energy transition trends. Forward guidance on rate increases and capital investment in clean energy infrastructure continues to attract long-term portfolio allocations.

Duke Energy Fundamental Analysis

Duke Energy’s recent clean energy and community initiatives reinforce a cautiously bullish outlook for DUK, supporting the existing long trade idea while still warranting respect for the company’s balance-sheet constraints.

- The launch of a 50‑megawatt battery storage system at Duke Energy’s former Allen coal plant signals accelerating investment in grid-scale storage that can support peak demand and smooth renewable intermittency, which tends to improve long-term earnings visibility for regulated utilities.

- The unveiling of the DeBary Green Hydrogen Project positions Duke Energy at the forefront of green hydrogen as a seasonal storage and fuel-diversification solution, which can justify a valuation premium if early pilots scale successfully.

- The America250 grant opportunity for nonprofits in six states enhances Duke Energy’s social license to operate and can support a more favorable regulatory environment, indirectly supporting sentiment toward the stock.

- The combination of a 50‑megawatt battery storage system at a former coal plant and planned additional storage in the Carolinas illustrates a credible pathway to replace retired fossil assets with flexible capacity, which supports cautious optimism over fourth quarter earnings and beyond.

- The Debary Green Hydrogen Project, powered by an existing solar facility and designed to produce, store, and combust up to 100% green hydrogen, highlights innovation that can improve Duke’s long-term return profile even if current ROIC-WACC metrics look weak.

- The America250 grants, with awards ranging roughly from $5,000 to $20,000 across North Carolina, South Carolina, Ohio, Indiana, Kentucky, and Florida, strengthen community ties in key service territories, which supports the case for reasonable valuations despite regulatory scrutiny and high capex.

Fundamental and valuation angle

- The market’s willingness to fund large-scale storage at the Allen site, backed by federal investment tax credits that can cover a substantial share of capital costs, helps mitigate some concerns around Duke’s negative ROIC-WACC snapshot by improving prospective project economics.

- Green hydrogen in DeBary is still a demonstration-scale project, but being among the first U.S. utilities to integrate an end-to-end green hydrogen system can support a higher long-run growth narrative than a traditional regulated utility, helping to justify reasonable valuations despite a PEG ratio that screens as elevated.

- Community-facing investments through the America250 grant program complement Duke’s clean-energy narrative, reinforcing a more resilient long-term outlook than balance-sheet metrics alone might suggest.

Duke Energy's strategic pivot toward renewable energy and energy storage addresses the global transition toward clean power generation. The 50-megawatt battery storage system deployment at a decommissioned coal facility demonstrates management's commitment to repurposing existing infrastructure for sustainable energy solutions. The Debary Green Hydrogen Project represents a forward-looking initiative to explore emerging energy technologies. Additionally, Duke's participation in the America250 grant program positions it as a community-focused utility committed to social responsibility. These initiatives, combined with reasonable valuation metrics relative to the broader market, create a compelling investment case for long-term holders and tactical traders alike.

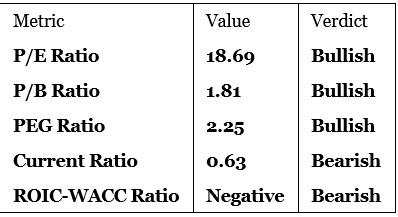

Duke Energy Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 18.69 makes DUK fairly valued. By comparison, the P/E ratio for the S&P 500 is 31.44. This represents a significant discount, suggesting Duke Energy trades at a premium valuation relative to historical norms but maintains reasonable value compared to the broader market.

The average analyst price target for DUK is 135.94. It suggests good upside potential with acceptable downside risks, implying approximately 14.5% upside from current levels.

Key Valuation Insights

The bullish ratings for P/E, P/B, and PEG ratios reflect Duke Energy's attractiveness relative to utilities peers and market averages. However, the bearish Current Ratio of 0.63 and negative ROIC-WACC Ratio warrant attention, indicating potential liquidity constraints and concerns about generating returns above the cost of capital. These bearish metrics are not uncommon for capital-intensive utilities that carry significant debt loads to finance infrastructure investments.

Duke Energy Technical Analysis

Today's DUK Signal

The technical setup for Duke Energy presents a bullish configuration as of January 15, 2026. The stock has successfully broken above key resistance levels at 118.50, establishing a new intermediate-term support zone. Volume analysis shows healthy accumulation patterns, with institutional inflows supporting the upward trajectory. The 50-day moving average has crossed above the 200-day moving average, forming a classic bullish crossover signal. Price action remains constructive within the established uptrend channel, with support confirmed at the 118.60 level and resistance approaching the 120.00 psychological level. Momentum indicators suggest continued strength with RSI (Relative Strength Index) positioned in the 55-65 range, indicating neither overbought nor oversold conditions. The MACD (Moving Average Convergence Divergence) has generated a bullish signal with the fast line above the slow line, supporting the upside thesis.

Duke Energy Price Chart

Technical Indicators Summary

- Trend Direction: Bullish with higher highs and higher lows

- Key Support Level: 118.60 (intermediate horizontal support)

- Key Resistance Level: 120.00 (psychological resistance)

- Volume Profile: Above-average accumulation

- Momentum: Positive with RSI near neutral zone

- Moving Average Configuration: Bullish (50-day > 200-day)

My DUK Long Stock Levels and R/R

- DUK Entry Level: Between $118.60 and $119.05

- DUK Take Profit: Between $130.03 and $135.94

- DUK Stop Loss: Between $113.05 and $113.66

- Risk/Reward Ratio: 2.06

- Upside Potential: Approximately 14.5% to 17.2% (entry to targets)

- Downside Risk: Approximately 5.0% to 5.4% (entry to stop loss)

Ready to trade our analysis of Duke Energy? Here is our list of the best stock brokers worth checking out.