Short Trade Idea

Enter your short position between $200.20 (its current 2026 intra-day low) and $211.05 (the intra-day high of its last bearish candlestick).

Market Index Analysis

- DoorDash (DASH) is a member of the NASDAQ 100 and the S&P 500 indices.

- Both indices are retreating from their all-time highs with rising bearish catalysts.

- The Bull Bear Power Indicator of the NASDAQ 100 is bearish with a descending trendline.

Market Sentiment Analysis

Equity markets rebounded after a bearish start to the session, as investors welcomed President Trump’s announcement that he will not use force to acquire Greenland. Futures are rising this morning, but are off their highs, and the focus will shift to earnings season, where expectations are sky-high. A recent Bloomberg report noted that beating estimates has the lowest impact on stocks on record. Today’s calendar features releases by Intel, Procter & Gamble, and GE Aerospace.

DoorDash Fundamental Analysis

DoorDash is the largest food delivery company in the US, with a 56% market share and a 60% share in convenience store deliveries. It caters to over 450,000 merchants, over 20,000,000 users, and employs over 1,000,000 couriers.

So, why am I bearish on DASH after its breakdown?

Despite the pullback, valuations remain excessive, and competition in the food delivery sector is rising rapidly. Last quarter’s earnings miss and announcement of increased capital expenditures amid a build-out of robotic deliveries cast a shadow, while labor risks and regulatory changes present notable challenges. I also see integration risks following its Deliveroo acquisition, and downside margin pressure could magnify amid rising costs.

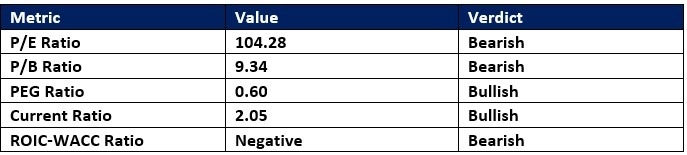

DoorDash Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of $104.28 makes DASH an expensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 34.80.

The average analyst price target for DASH is $276.88. This suggests there is good upside potential, but downside risks are gaining at an outsized pace.

DoorDash Technical Analysis

Today’s DASH Signal

DoorDash Price Chart

- The DASH D1 chart shows price action breaking down below its horizontal resistance zone.

- It also shows price action above its descending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator is bearish with a descending trendline.

- The average trading volumes have been higher during bearish days than during bullish days.

- DASH corrected with the S&P 500 Index but faces greater bearish catalysts.

My DASH Short Stock Trade

- DASH Entry Level: Between $200.20 and $211.05

- DASH Take Profit: Between $155.40 and $162.56

- DASH Stop Loss: Between $222.45 and $234.43

- Risk/Reward Ratio: 2.01

Ready to trade our analysis of DoorDash? Here is our list of the best stock brokers worth checking out.