Long Trade Idea

Enter your long position between $148.68 (yesterday’s intra-day low) and $152.74 (yesterday’s intra-day high).

Market Index Analysis

- Dollar General (DG) is a member of the S&P 500 Index.

- This index trades in a bearish chart pattern with decreasing bullish volumes.

- The Bull Bear Power Indicator of the S&P 500 Index is bullish but shows a descending trendline.

Market Sentiment Analysis

Equity futures are mixed this morning as investors gear up for the earnings releases of 90 of the S&P 500 companies this week. The two-day FOMC meeting will start today, but markets expect no change in the benchmark interest rate. A partial government shutdown is looming as Democrats will not back the current funding bill if it includes funding for the DHS amid the latest violence in Minnesota. Markets are also digesting more news on the tariff front after President Trump noted an increase in South Korean tariffs from 15% to 25%.

Dollar General Fundamental Analysis

Dollar General is a discount retailer with over 19,000 stores and more than 170,000 employees. DG has a line of inexpensive private-label brands. It is also under heavy criticism for creating food deserts and low-wage jobs.

So, why am I bullish on DG despite its recent 60%+ rally?

The Dollar General Value Valley deals, and myDG Delivery expansion to 17,000+ stores, are not reflected in the current price. Despite margin pressures, DG has managed its inventory and supply chains well. It also benefits from tailwinds, including positive market sentiment, higher disposable income boosted by tax reliefs for lower-income shoppers, and value-seeking consumers who flock to Dollar General, as evidenced by foot traffic.

Metric | Value | Verdict |

P/E Ratio | 25.96 | Bullish |

P/B Ratio | 3.95 | Bearish |

PEG Ratio | 1.72 | Bullish |

Current Ratio | 1.17 | Bearish |

ROIC-WACC Ratio | Positive | Bullish |

The price-to-earning (P/E) ratio of 25.96 makes DG an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 31.39.

The average analyst price target for DG is $138.43. This shows that prices have overshot the average estimate, but I expect more upside ahead towards the high-end estimate of $170.00, while downside risks remain manageable.

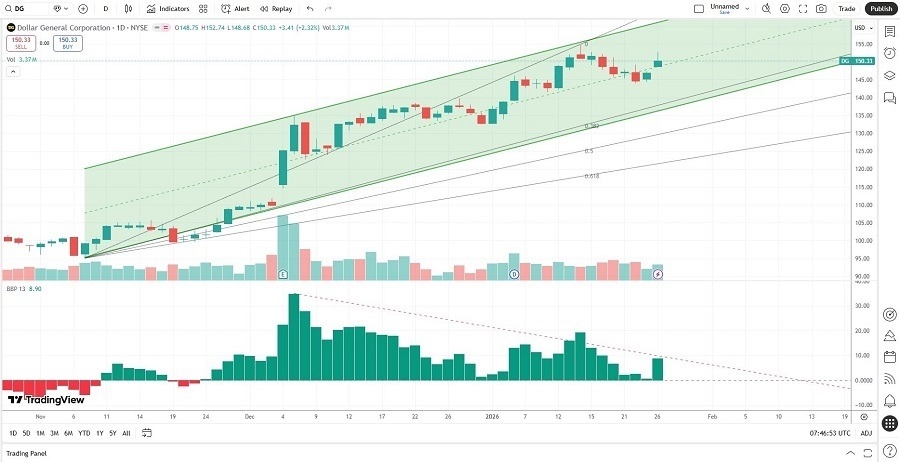

Dollar General Technical Analysis

Today’s DG Signal

- The DG D1 chart shows price action inside a bullish price channel.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with a negative divergence, hinting at potential volatility ahead.

- The average bullish trading volumes are higher than the average bearish trading volumes.

- DG accelerated as the S&P 500 Index struggled, a significant bullish trading signal.

My DG Long Stock Trade

- DG Entry Level: Between $148.68 and $152.74

- DG Take Profit: Between $175.10 and $180.35

- DG Stop Loss: Between $135.71 and $139.83

- Risk/Reward Ratio: 2.04

Ready to trade our analysis of Dollar General? Here is our list of the best stock brokers worth checking out.