Long Trade Idea

Enter your long position between $259.27 (yesterday's intra-day low) and $266.27 (Tuesday's intra-day high).

Market Index Analysis

- NASDAQ 100 and S&P 500 Membership: Autodesk (ADSK) is a member of the NASDAQ 100 and the S&P 500. While both indices recently retreated from record highs, the temporary weakness creates a tactical buying opportunity for high-quality software companies like Autodesk that benefit from essential enterprise design and infrastructure workflows.

- Technical Divergence Presents Opportunity: The Bull Bear Power Indicator for the NASDAQ 100 has turned bearish with a descending trendline, indicating weakening momentum despite overall market strength. This divergence creates tactical opportunities for quality design and AI infrastructure software providers like Autodesk to decouple from broader weakness through superior fundamentals.

- Design Software Sector Resilience: During periods of market consolidation, enterprise design software providers historically demonstrate relative strength. CAD/BIM software spending by architects, engineers, and construction professionals remains essential and countercyclical, supporting revenue stability and margin expansion regardless of broader economic cycles.

- AI Infrastructure and AI-Assisted Design Positioning: Autodesk's dominant position in AI-assisted design workflows and infrastructure software positions the company to outperform as institutional investors increasingly recognize the strategic value of AI-powered design tools and the company's leadership in generative design capabilities.

Market Sentiment Analysis

- Cautious But Recognizing Quality: The broad US stock market exhibits temporary caution following recent highs, yet institutional investors are increasingly recognizing Autodesk's leadership in AI-assisted design as a key driver of 2026 outperformance. Autodesk benefits from the shift toward AI integration in enterprise workflows.

- Design and Infrastructure Software Momentum: The design and CAD software sector is experiencing positive long-term sentiment driven by irreversible digital transformation trends, infrastructure investment cycles, and recognized value creation from AI-powered design workflows. Autodesk is viewed as the category leader in design software with AI integration.

- AI-Assisted Design Leadership: Market sentiment toward Autodesk has shifted positively following successful integration of AI capabilities across its platform portfolio. Investors recognize Autodesk as the leading AI-assisted design provider, positioning the company for sustainable competitive advantage.

- Margin Expansion Recognition: Institutional investors are recognizing Autodesk's impressive margin expansion trajectory (operating margin at 25.4% in Q3 FY26, up 340 bps YoY) as evidence of operational discipline, cloud migration success, and the operating leverage embedded in the software business model.

Top Regulated Brokers

Autodesk Fundamental Analysis

Autodesk is a multinational software company best known for AutoCAD, a computer-aided design software used by architects, engineers, and designers to design and construct models of buildings and structures. The company has evolved into a comprehensive cloud-based design and engineering platform with AI-powered capabilities across architecture, engineering, construction, manufacturing, and media & entertainment verticals.

So, why am I bullish on ADSK following its correction?

- Strong Revenue Growth Driven by Cloud Migration and AI Adoption: Autodesk is delivering robust revenue growth with 15.55% trailing-twelve-month growth (TTM) and recent quarterly growth of 18.03%. This acceleration reflects successful cloud migration of its subscription base, increased adoption of AI-assisted design features across its platform portfolio, and expanding demand from infrastructure modernization cycles.

- Exceptional Operating Margin Expansion Demonstrating Operating Leverage: Autodesk has achieved operating margins of 25.4% in Q3 FY26, up 340 basis points year-over-year and 2,400+ basis points since FY2019. Management projects further margin expansion of 200-300 bps in FY26. This dramatic improvement demonstrates the operating leverage in Autodesk's cloud-based SaaS business model and management's commitment to disciplined cost control.

- Robust and Growing Free Cash Flow Generation: Autodesk generated $1.6 billion in free cash flow in FY25, up 22% year-over-year with a free cash flow margin of 30.7%. Management projects FY26 free cash flow of $2.075-2.175 billion. This robust cash generation demonstrates the profitability of Autodesk's subscription business and substantial capital deployment flexibility.

- Industry-Leading Gross Margins with Expanding Operating Leverage: Autodesk maintains exceptional gross margins of 90.74%-91.96%, among the highest in enterprise software. The combination of premium gross margins and expanding operating margins demonstrates the company's pricing power, product differentiation, and ability to scale profitably in a high-margin SaaS business model.

- Cyclical Growth Tailwinds from Infrastructure Investment and Construction Rebounds: Autodesk's exposure to architecture, engineering, construction, and manufacturing positions the company to benefit from infrastructure investment cycles, construction rebounds post-correction, and capital expenditure acceleration. These cyclical tailwinds provide growth acceleration potential beyond organic software adoption.

- AI-Powered Generative Design Platform Creating Competitive Moat: Autodesk's generative design and AI-assisted workflow capabilities are creating defensible competitive advantages and pricing power. Customers are increasingly willing to pay premium subscription rates for AI-enhanced productivity tools, supporting margin expansion and customer lifetime value growth.

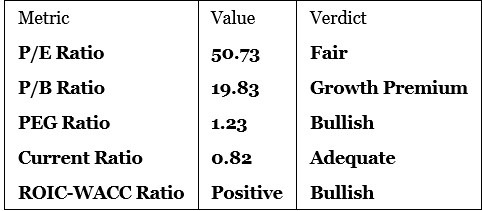

Autodesk Fundamental Analysis Snapshot

- The price-to-earnings (P/E) ratio of 50.73 appears elevated relative to the NASDAQ 100's 38.07, but this premium is justified by Autodesk's 15.55% TTM revenue growth, 25.4% operating margins, exceptional cash flow generation, and leadership in AI-assisted design software. For a high-quality SaaS provider with accelerating growth and expanding margins, a 50x multiple on forward earnings offers fair valuation.

- The P/B ratio of 19.83 reflects the substantial intangible asset value of Autodesk's software platforms, AI intellectual property, customer relationships, and $63 billion+ in future contracted revenues. For a software company with exceptional margins, growing cash flows, and market leadership position, this multiple is justified by competitive moat strength and returns on invested capital.

- The favorable PEG ratio of 1.23 indicates Autodesk is reasonably valued relative to its strong earnings growth prospects. This metric suggests the market has not fully appreciated the company's return to double-digit growth combined with exceptional margin expansion, creating potential for multiple re-rating.

- The current ratio of 0.82 reflects typical software company capital structure with strong operating cash flow generation. Software companies routinely operate with current ratios below 1.0 due to negative working capital (customers pay in advance, suppliers paid on terms). This metric should not be viewed as a liquidity concern given Autodesk's $1.6B annual free cash flow generation.

- The positive ROIC-WACC ratio indicates Autodesk is creating substantial shareholder value through capital deployment, with returns on invested capital significantly exceeding the cost of capital. This metric supports the fundamental bullish case for value creation and share price appreciation.

- The average analyst price target for ADSK is $366.90, suggesting approximately 40.4% upside from the current price of 261.28. This substantial consensus upside reflects Wall Street recognition of Autodesk's AI leadership in design software, margin expansion trajectory, and return to accelerating growth. Analyst targets range from $319 to $430, indicating meaningful disagreement but with consensus skewed bullishly (19 "Strong Buy," 4 "Buy," 9 "Hold," 0 "Sell" ratings).

Autodesk Technical Analysis

Today's ADSK Signal

Oversold Pullback Creating Entry Opportunity: Autodesk has pulled back 3.45% from recent highs, creating an oversold technical condition that represents a tactical buying opportunity. The pullback appears to be profit-taking rather than a breakdown pattern, particularly given the stock's resilient advance of 0.22% in after-market trading.

Support Zone Definition: The intra-day low of $259.27 combined with broader support architecture around the $250-$260 level provides well-defined risk management parameters for new long positions. This support has demonstrated buyer interest throughout the recent correction period.

Volume Accumulation Signals: Despite the recent price decline, the ability to hold gains in after-market trading and maintain close proximity to intra-day highs suggests continued institutional interest and buying support. This behavior is consistent with accumulation patterns rather than capitulation.

Resistance Levels Clear: The intermediate resistance near $280-$290 represents the recent consolidation highs and technical barrier that, if breached decisively, could trigger acceleration toward $330-$366.90 analyst consensus targets. Breaking above this zone would confirm sustained bullish momentum.

Entry-Point Optimization: The current pullback between $259.27 and $266.27 provides favorable entry conditions for disciplined longs with defined risk parameters and clear profit targets aligned to analyst consensus near $366.90. The risk-reward geometry is attractive for tactical buyers seeking AI-exposed software exposure.

My ADSK Long Stock Levels and R/R

- ADSK Entry Level: Between $259.27 and $266.27

- ADSK Take Profit: Between $343.50 and $366.90

- ADSK Stop Loss: Between $240.00 and $248.00

- Risk/Reward Ratio: 3.42

Ready to trade our analysis of Autodesk? Here is our list of the best stock brokers worth checking out.