Long Trade Idea

Enter your long position between $320.89 (yesterday’s intra-day low) and $328.09 (yesterday’s intra-day high).

Market Index Analysis

- Alphabet (GOOG) is a member of the NASDAQ 100, the S&P 100, and the S&P 500.

- All three indices sold off amid fresh tariffs and risks of reigniting trade and capital wars.

- The Bull Bear Power Indicator of the NASDAQ 100 is bearish with a descending trendline.

Market Sentiment Analysis

Equity markets sold off heavily yesterday amid escalating geopolitical tensions, especially over Greenland, after President Trump doubled down on his quest to acquire the island. He continues to lash out at NATO allies, with the UK its latest target. Risks of reigniting a US-Euro trade war, with the added risks of a capital war, have triggered the sell-off. Still, most investors are likely to brush aside geopolitics and focus on earnings after 3M disappointed, Netflix slid, but futures point towards a rebound this morning. Johnson & Johnson, Charles Schwab, and mid-sized financial institutions will report earnings today.

Alphabet Fundamental Analysis

Alphabet is a technology conglomerate holding company, the largest technology company by profit and the third largest by revenue globally. It is a hyperscaler in the AI sector and a significant player in driverless technology with its Waymo brand.

So, why am I bullish on GOOG at current levels?

I am bullish on Alphabet’s cloud infrastructure and custom AI chips (TPUs). Meta Platforms is reportedly set to buy billions of dollars’ worth of semiconductor chips from Alphabet, boosting its AI hardware capabilities. I am equally bullish on Gemini’s 5-month doubling of usage, from 35 billion API requests to 85 billion. Valuations are reasonable for an AI company, and I am cautiously bullish ahead of next month’s earnings release and believe its Waymo business is underappreciated.

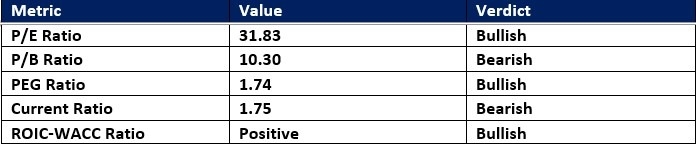

Alphabet Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 31.83 makes GOOG an inexpensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 37.76.

The average analyst price target for GOOG is $332.32. It suggests negligible upside potential, but I see shares rallying towards the high end of estimates at $386.00, while the risks for an AI stock remain reasonable.

Alphabet Technical Analysis

Today’s GOOG Signal

Alphabet Price Chart

- The GOOG D1 chart shows price action inside a bullish price channel.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator turned bearish but remains close to its ascending trendline.

- The average bullish trading volumes are higher than the bearish trading volumes.

- GOOG outperformed the NASDAQ 100 Index, a bullish confirmation.

My GOOG Long Stock Trade

- GOOG Entry Level: Between $320.89 and $328.09

- GOOG Take Profit: Between $378.28 and $386.00

- GOOG Stop Loss: Between $297.45 and $304.25

- Risk/Reward Ratio: 2.45

Ready to trade our analysis of Alphabet? Here is our list of the best stock brokers worth reviewing.