Short Trade Idea

Enter your short position between $167.00 (Friday’s low) and $174.69 (the upper band of its horizontal resistance zone).

Market Index Analysis

- 3M Company (MMM) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

- All three indices are currently trading near all-time highs with rising bearish trading volumes.

- The Bull Bear Power Indicator of the S&P 500 is bullish with a descending trendline, approaching a bearish crossover.

Market Sentiment Analysis

Equity futures are lower this morning after US President Trump imposed additional tariffs on eight NATO allies amid his push to gain control of Greenland, in a rapidly escalating situation. The EU prepared a response worth tariffs on $108 billion of US imports, with the potential to impose tariffs on up to $8 trillion. Gold and silver jumped, and oil prices steadied. The civil unrest in Iran has intensified, where President Trump announced 25% tariffs on countries dealing with Iran, reigniting US-China trade tensions. Earnings reports from Netflix, Intel, 3M, and Johnson & Johnson could also impact price action today.

3M Company Fundamental Analysis

3M Company is an industrial conglomerate that supplies over 60,000 products to industrial clients, the transportation sector, the electronics industry, the worker safety market, and the consumer goods market. It has over 100,000 patents.

So, why am I bearish on MMM ahead of its earnings release?

While analysts expect a 4.6% revenue growth and 8.3% earnings-per-share growth compared to one year ago, the EPS figure has decreased 0.50% over the past 60 days. I am more focused on its outlook and the impact of its ongoing costs and PFAS-related litigation. While I appreciate its shift to an advanced materials and technology company, the results will take time to materialize, and the lackluster organic revenue growth, worsening debt-to-asset ratio, and high valuations are imminent red flags.

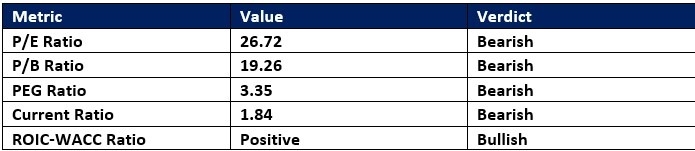

3M Company Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 26.72 makes MMM an expensive stock. By comparison, the P/E ratio for the S&P 500 is 31.34.

The average analyst price target for MMM is $175.91. It suggests negligible upside potential, with rising downside risks.

3M Company Technical Analysis

Today’s MMM Signal

3M Price Chart

- The MMM D1 chart shows price action breaking down below its horizontal resistance zone.

- It also shows price action between its ascending 50.0% and 61.8% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with a descending trendline.

- The average bearish trading volumes have risen during the breakdown.

- MMM advanced with the S&P 500, a bullish trading signal, but bearish catalysts have emerged.

My MMM Short Stock Trade

- MMM Entry Level: Between $167.00 and $174.69

- MMM Take Profit: Between $144.25 and $148.46

- MMM Stop Loss: Between $178.18 and $183.53

- Risk/Reward Ratio: 2.04

Ready to trade our analysis of 3M? Here is our list of the best stock brokers worth checking out.