For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

RoboForex Ltd and its partners do not operate in the USA, Canada, Japan, Australia, Iran, Russia, and other restricted countries. RoboForex Ltd and its partners do not target clients from the EU/EEA/UK. You may receive investment services from a third-party company solely on your own initiative, assuming all associated risks.

RoboForex Editor’s Verdict

RoboForex is one of the fastest-growing multi-asset brokers globally. Founded in 2009 with its headquarters in Belize, it offers traders one of the best asset selections and trading costs in the industry. It is also home to one of the most competitive trading environments, and traders enjoy industry-leading protection. I reviewed RoboForex to determine if their fast order execution, tight spreads, and value-added services create a competitive edge for clients. Should you join the 5 million traders with RoboForex?

Overview

A fast-growing broker with industry-leading protection and trading conditions

Headquarters | Belize |

|---|---|

Regulators | FSC Belize |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2009 |

Minimum Deposit | $10 |

Trading Platform(s) | Other, MetaTrader 4, MetaTrader 5, Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 0.1 pips ($1.00) |

Average Trading Cost GBP/USD | 0.1 pips ($1.00) |

Average Trading Cost WTI Crude Oil | $0.02 |

Average Trading Cost Gold | $0.08 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I rank RoboForex as one of the best brokers operational today, where the trade execution remains superb. RoboForex is also home to one of the most intuitive proprietary web-based trading platforms, with full support for algorithmic trading. It includes a strategy builder, allowing traders to program automated trading solutions without needing to code.

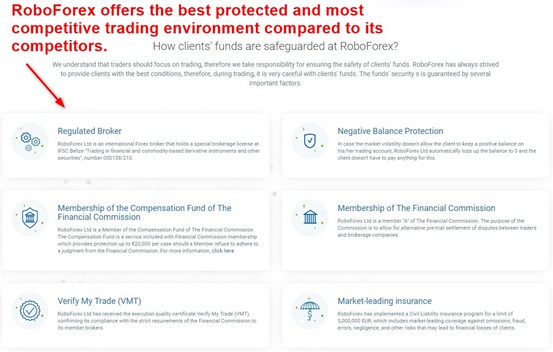

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. RoboForex presents clients with one well-regulated entity.

Country of the Regulator | Belize |

|---|---|

Name of the Regulator | FSC Belize |

Regulatory License Number | 000138/32 |

Regulatory Tier | 4 |

RoboForex Client Protection

RoboForex is also a member of the Hong Kong-based Financial Commission. It is the most trusted independent self-regulatory organization and external dispute resolution (EDR) body globally.

RoboForex received the Verify My Trade (VMT) certificate, confirming its compliance with the strict requirements of the Financial Commission. The compensation fund provides coverage up to €20,000 per claim. Additionally, RoboForex implemented a Civil Liability insurance program with a limit of €2,500,000.

It makes RoboForex the only broker offering all three pillars of a well-regulated trading environment where most offer only one or two. I rank RoboForex among the most trustworthy brokers.

The company’s full address is 2118 Guava Street, Belama Phase 1, Belize City, Belize. Its telephone number is +593 964 256 286.

Does RoboForex accept US clients?

No, RoboForex is not regulated in the U.S. and does not serve American citizens. Check the top forex brokers accepting U.S. clients legally.

Fees

Average Trading Cost EUR/USD | 0.1 pips ($1.00) |

|---|---|

Average Trading Cost GBP/USD | 0.1 pips ($1.00) |

Average Trading Cost WTI Crude Oil | $0.02 |

Average Trading Cost Gold | $0.08 |

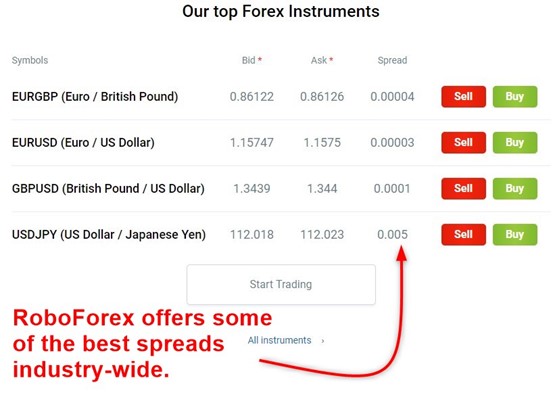

The commission-free Pro account features a minimum spread of 1.3 pips or $13.00 per standard lot. RoboForex shines brighter in its commission-based options, where RoboForex ranks among the cheapest brokers. The ECN account shows an average spread of 0.1 pips for a commission of $2.00 per lot, bested in the Prime account, where the commission drops by 50% to $1.00. There are no commissions for equity traders. Instead, RoboForex charges a markup included in the spread, which doesn't exceed 0.3% of the asset value. Index traders pay a minimum of $1.00, making RoboForex one of the most cost-effective brokers for equity trading.

Here is a screenshot of live quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

RoboForex Live Forex Quotes

The average trading costs for the EUR/USD in the commission-free RoboForex Pro account:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.3 pips | $0.00 | $13.00 |

The average trading costs for the EUR/USD in the commission based RoboForex ECN account:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.1 pips | $2.00 | $3.00 |

The average trading costs for the EUR/USD in the commission based RoboForex Prime account:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.1 pips | $1.00 | $2.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs. RoboForex offers a positive swap on EUR/USD short positions, meaning traders get paid money.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission based RoboForex Prime account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.1 pips | $2.00 | -$0.92 | X | $3.92 |

0.1 pips | $2.00 | X | $0.09 | $2.91 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.1 pips | $2.00 | -$6.44 | X | $9.44 |

0.1 pips | $2.00 | X | $0.63 | $2.37 |

I rank the commission-based pricing environment at RoboForex among the best industry-wide. The volume-based cash rebate program lowers the competitive costs further, and there is no inactivity fee at RoboForex.

The swap rates for leveraged traders are the cheapest I have seen anywhere, and the overall pricing environment for Forex traders is ideal for scalpers and high-frequency traders.

What Can I Trade

RoboForex offers traders 28 currency pairs, 5 commodities, 10+ index CFDs, 12,000+ equity CFDs, and 1,000+ ETFs. While RoboForex features a low selection of currency pairs and commodity CFDs, it maintains an excellent choice of all other trading instruments.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

RoboForex Leverage

Retail traders get maximum leverage of 1:2000, lowered to 1:300 in the Prime account, which I find an excellent offer. Negative balance protection exists, and I always recommend leveraged traders to ensure their broker offers it.

RoboForex Trading Hours (GMT +1 Server Time)

Asset Class | From | To |

|---|---|---|

Commodities | Monday 01:00 | Friday 23:55 |

Crude Oil | Monday 03:00 | Friday 23:15 |

Gold | Monday 01:00 | Friday 23:55 |

Metals | Monday 01:00 | Friday 23:55 |

Equity Indices | Monday 03:00 | Friday 23:15 |

Stocks | Monday 10:01 | Friday 22:59 |

Stocks (non-CFDs) | Monday 16:31 | Friday 22:59 |

ETFs | Monday 13:30 | Friday 22:00 |

Please note that equity markets open and close each trading and are not operational continuously like Forex.

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

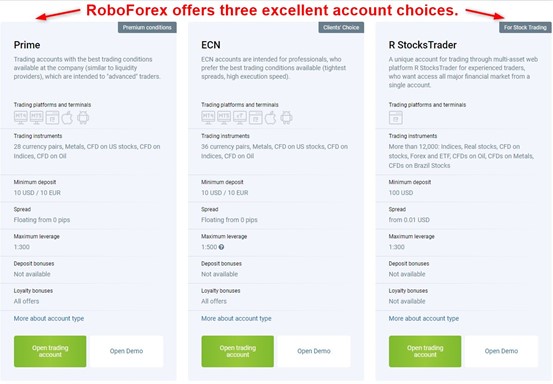

Account Types

RoboForex offers two commission-free accounts, ProCent and Pro, ideal for testing new strategies and EAs. The minimum deposit is $10, and the maximum leverage 1:2000. These account types have certain strengths, but their trading costs are higher than the other account types offered.

RoboForex’s ProCent account is a cent-based micro account where balances are denominated in cents (US Cent, EU Cent, etc.), so a small deposit like $10 becomes 1,000 cents and lets you trade in real market conditions with very low monetary risk. It mirrors the broker’s standard trading conditions, offering a minimum deposit of 10 USD/EUR, extended 5-digit quotes, market execution, floating spreads from 1.3 pips, and trading on 28 currency pairs plus metals via MT4, MT5, WebTrader and mobile apps. The account also supports swap-free trading, one-click execution and a 30% stop-out level, making it ideal for beginners and for testing new strategies or EAs on micro lots before scaling up.

The R Stocks Trader account eliminated separate commissions for the R Stocks account on September 2, 2024. Since then, there are no commissions for this account type. Instead, RoboForex charges a markup included in the spread, which never exceeds 0.3% of the asset value.

The three most competitive account types which traders should consider are Prime, ECN, and R StocksTrader. The minimum deposit remains the same for all, except for R StocksTrader, which requires $100. RoboForex lowers the maximum leverage to between 1:300 and 1:500, but all three are excellent choices.

RoboForex Account Types

The ECN account shows an average spread of 0.1 pips for a commission of $2.00 per lot, bested in the Prime account, where the commission drops by 50% to $1.00. Floating spreads start from 0 pips.

The commission-free Pro account features a minimum spread of 1.3 pips or $13.00 per standard lot. No commission is charged for order execution information.

RoboForex Demo Account

RoboForex offers unlimited demo accounts for MT4, MT5, and its proprietary trading platform. They are ideal for testing expert advisors. The RoboForex demo accounts allow traders to recreate trading conditions close to but not the same as those experienced in a live account.

Trading Platforms

RoboForex offers MT4 and MT5, the MobileTrader App, and its proprietary R Trader platforms R Stocks Trader and R Web Trader. It is refreshing that a broker makes a tremendous effort to provide the proper trading environment for different trader mentalities and strategies. I highly recommend the proprietary R StocksTrader, which also supports algorithmic trading in a code-free environment.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

RoboForex Copy Trading System

The RoboForex copy trading system allows traders to copy trades from other traders as social trading has gained popularity and continues its expansion. The minimum investment required is $100, and there are thousands of participating traders.

One of the most interesting aspects is the flexible commission system, which allows trade providers to choose between a performance fee, a subscription model, or by sharing strategies for free to build a following.

0% Withdrawal Commissions

RoboForex repays withdrawal commissions three times per month as part of its “Withdrawal without Commission” promotion. The offer is available on the second, third, and fourth Tuesday of any calendar month.

RoboForex Infinity Partner Program

Partners earn from:

- Spreads on closed positions: up to 85%, equal to $10 partner payout per lot on certain instruments.

- Swaps on open positions: 30% of the swap value—a unique feature rarely offered in partner programs, enabling earning from clients who maintain longer-term trades.

RoboForex Market Analytics

RoboForex offers traders real-time market analytics by Acuity – an advanced AI-driven solution that combines technology and expert insights to enhance decision-making and reinforce risk management.

The service delivers more than 50 trade ideas daily, along with automated alerts, market trend analysis, and performance tracking.

Free VPS Hosting

Another significant feature offered by RoboForex is free VPS hosting. It is available to all verified accounts that maintain a monthly trading volume of just 3 lots. Otherwise, a relatively low $5 monthly fee applies.

Research and Education

RoboForex provides traders with in-house analytics, but it established itself with automated solutions at the core. It publishes numerous articles consisting of market commentary and actionable trading ideas daily. I highly recommend it to traders looking for a quick market snapshot or a fresh take on a potential trade.

The educational offering at RoboForex is light, as beginners are not its core market. The limited content helps new clients to open an account and select the best trading platform for their requirements. I recommend beginners seek in-depth education from third-party providers, start with trading psychology, and avoid paid-for courses before funding a trading account with RoboForex.

Bonuses and Promotions

- Up to 10% in extra funds - RoboForex clients can receive up to 10% extra accruals on their account balance, subject to terms and conditions.

- Cashback - RoboForex clients can receive additional payouts through the Cashback program. The cashback amount depends on the calculation method for each account type and is credited automatically each month if all conditions are met.

- Welcome bonus - RoboForex grants a $30 Welcome Bonus to new verified clients.

Profits earned from both the bonus and personal funds are fully withdrawable.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |     |

Since RoboForex is an efficiently managed brokerage and stacked with plenty of outstanding services, customer support is unlikely to be utilized frequently by traders if it is necessary at all. The FAQ section answers most questions, and RoboForex describes its products and services well.

Traders who require assistance can access the support team via the green chat button. Support is available 24/7, and clients may also write an e-mail, use the web form, call directly, or request a callback. RoboForex offers support in multiple languages, another confirmation of the global reach this broker is building.

Bonuses and Promotions

RoboForex offers four bonuses, a $30 no deposit bonus, a VIP program. The $30 Welcome offers apply only to the ProCent and Pro accounts.

A 15% cashback is available to all verified trading accounts with a minimum trading volume of 10 lots per month. This can lower trading costs significantly. RoboForex pays between 2.5% to 10% on the account balance if traders reach minimum volume requirements.

.webp)

The three-tier VIP program, based on lifetime deposits, increases the value of bonuses and promotions. It makes RoboForex one of the best brokers for high-frequency traders.

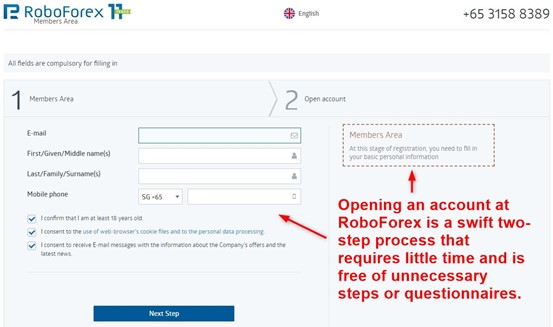

Opening an Account

I like the hassle-free account opening process at RoboForex. A quick online form asking for a name, e-mail, and valid mobile phone number grants access to the back office. Account verification is mandatory, per regulatory requirements, and RoboForex remains in full compliance. A copy of an ID and a proof of residency document generally satisfies this step.

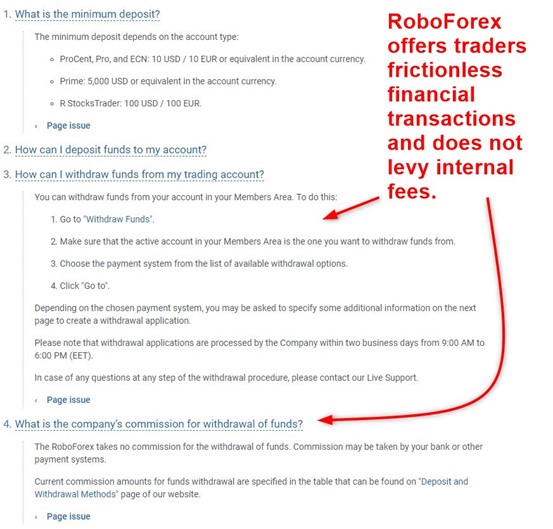

Minimum Deposit

The minimum deposit for all accounts is $10, except for the R StocksTrader, which requires $100.

Payment Methods

RoboForex offers bank wires, credit/debit cards, AstroPay, Skrill, Neteller, Perfect Money, AdvCash, Google Pay, Apple Pay, and several local cash and voucher payment options and e-wallets.

Accepted Countries

RoboForex caters to most international traders, including clients from Latin American countries, middle Asia, and the Arab world. RoboForex does not accept traders who are US persons.

RoboForex Account Opening

Deposits and Withdrawals

The time until traders receive their funds depends on the payment processor, which can take ten business days. Most options remain instant once RoboForex processes a request, which can take 24 hours. The overall process is among the best I have come across.

RoboForex Withdrawal Processing Times

RoboForex does not levy internal costs for deposits or withdrawals, and the secure Members Area handles all financial transactions.

RoboForex Withdrawals

Summary

I like the trading environment at RoboForex for all types of traders, but especially for active high-frequency traders, scalpers, and equity traders. Algorithmic trading remains at the core of RoboForex, where it offers a proprietary trading platform allowing traders to create automated trading strategies without the need to code.

RoboForex also deploys its proprietary copy trading platform, is home to the best pricing environment, and grants industry-leading traders protection. Beginner traders get quality research but little education, while RoboForex maintains a generous bonus and reward program. RoboForex offers traders industry-leading protection no other broker matches. Together with its history and excellent regulatory track record, RoboForex ranks among the safest brokers. Yes, RoboForex is regulated by the Belize Financial Services Commission. RoboForex generally processes most withdrawal requests in less than 24 hours, but it can take as long as 48 hours. No, RoboForex does not have an FCA license. Yes, RoboForex is a true ECN broker with eight liquidity providers. The maximum RoboForex leverage is 1:2000, which applies to Forex traders. No, RoboForex does not offer trading in cryptocurrency. Yes, RoboForex allows scalping and maintains one of the most competitive trading environments for scalpers. Yes, RoboForex offers the MT4 trading platform alongside MT5 and its proprietary alternatives. No, RoboForex does not accept PayPal. The RoboForex minimum deposit is $10. No, since RoboForex does not cater to traders from the USA, it does not have a regulatory license in the USA. No, RoboForex does not accept traders resident in the USA or who hold US nationality or a green card. RoboForex offers ultra-low trading fees, a superb trading infrastructure, an excellent choice of trading platforms, which includes a proprietary option supportive of algorithmic trading in a code-free environment, industry-leading client protection, an outstanding asset selection for most traders, and a choice of low-cost and high-speed payment processors. The RoboForex headquarters is in Belize.FAQs

Is RoboForex safe?

Is RoboForex regulated?

How long does it take to withdraw from RoboForex?

Is RoboForex FCA regulated?

Is RoboForex a true ECN broker?

What is the maximum leverage at RoboForex?

Does RoboForex offer cryptocurrency?

Does RoboForex allow scalping?

Does RoboForex use MT4?

Does RoboForex accept PayPal?

What is the minimum deposit at RoboForex?

Is RoboForex regulated in the USA?

Is RoboForex allowed in the US?

What are the benefits of RoboForex?

Where is RoboForex based?