By Jonatan Randin, Market Analyst at PrimeXBT

Following a strong rally earlier this year, silver is beginning to stabilise as the market digests renewed dollar strength and shifting risk sentiment. While price action against the US dollar has entered a consolidation phase, silver is starting to show resilience when compared to Bitcoin, hinting at a potential rotation back toward defensive assets.

This market outlook takes a closer look at silver’s performance against both the US dollar and Bitcoin, highlighting the XAG/BTC pair, one of the newly introduced cross pairs available on PrimeXBT’s MT5 platform as part of its latest expansion of commodity and crypto-based instruments.

Macro backdrop: structural drivers for silver

Silver is increasingly showing dual momentum as both an industrial metal and a monetary asset. On the industrial side it benefits from the green energy transition, solar panel demand, electronics and other tech applications.

On the monetary side it remains sensitive to currency debasement, inflation and real interest rate dynamics, much like gold, but with the added twist that over half of its demand is industrial so economic cycles matter.

Supply is under pressure, mine output has been relatively flat or declining, much of silver is produced as a by-product of other metals, meaning that even higher prices may not induce much extra primary supply. All told this creates a compelling setup, industrial demand rising, supply constrained, monetary demand present, a combination which supports a bullish case for silver, provided the macro and industrial backdrops remain favourable.

Technical analysis: XAG/USD

Following the breakout this summer, silver has been on an impressive run, extending its bullish structure to new multi year highs. The local top forming now appears to be a shallow retracement within the broader uptrend rather than a structural reversal.

The key area to watch lies around $42, where several technical factors converge. This zone aligns with the reload area between the 0.618 and 0.786 Fibonacci retracement levels, with the weekly 20 EMA sitting almost exactly at the 0.618 mark. In addition, the ascending trend line that was broken to the upside earlier this summer now intersects near the same region.

A move back into this confluence would mark the first retest of that breakout structure since the rally began, providing a potentially strong support zone for continuation if tested. As long as silver holds above this region, the broader bullish bias remains intact, and a renewed push toward recent highs would likely follow.

Technical analysis: XAG/BTC

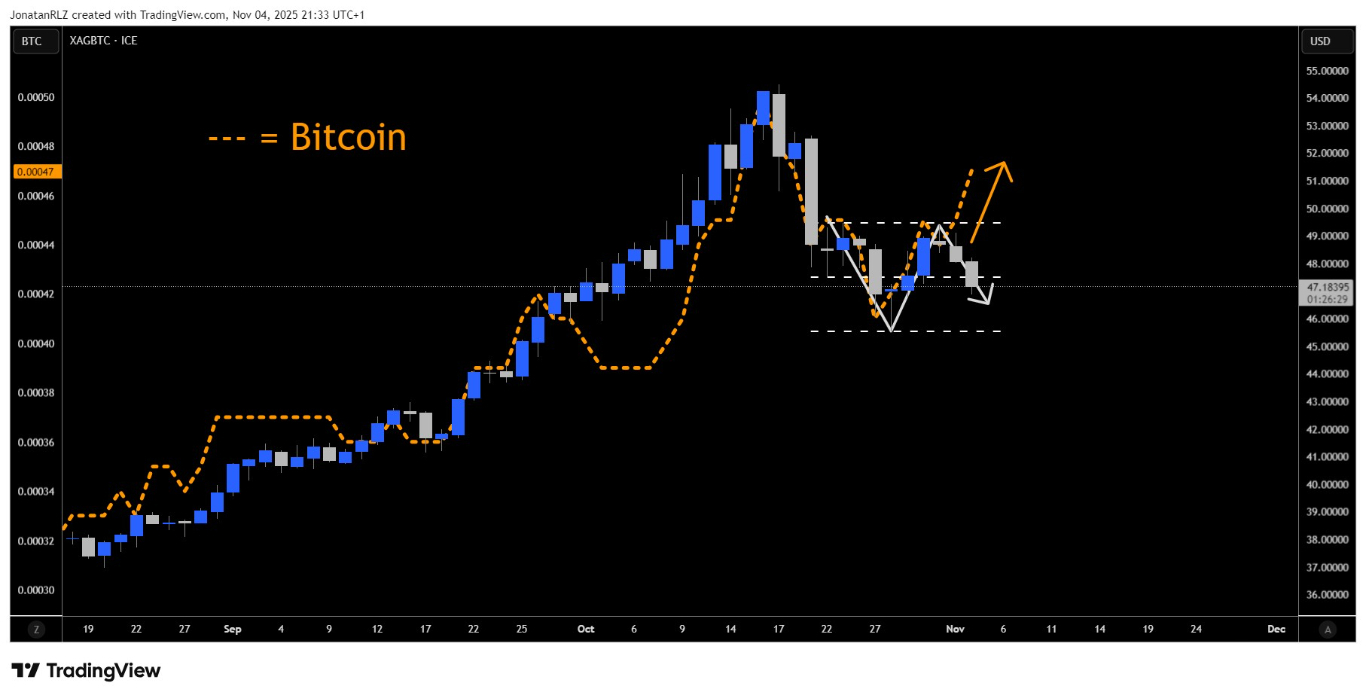

While XAG/USD continues to consolidate after its summer breakout, the XAG/BTC chart is beginning to tell a different story. When plotted together, with XAG/USD as the background and XAG/BTC displayed as a line overlay, a clear divergence emerges. Silver remains in a range against the dollar, yet it is beginning to bounce when measured against Bitcoin.

This divergence reflects a subtle shift in market sentiment. As the US dollar strengthens and risk assets like Bitcoin face renewed downside pressure, silver is starting to show relative strength. This type of price behaviour often occurs during risk-off phases, when investors favour tangible, defensive assets over speculative ones.

The XAG/BTC chart therefore offers valuable insight into how capital rotates within the broader hard asset space. A stable XAG/USD combined with a rising XAG/BTC ratio suggests that silver may be quietly gaining ground as liquidity tightens and markets adopt a more cautious tone.

Trading Silver and Synthetic Cross Pairs with PrimeXBT

Silver’s dual role as both an industrial and monetary asset makes it a key market to watch, particularly as investors seek protection against inflation and shifting global liquidity. With PrimeXBT’s recent MT5 product expansion, traders can now access new silver-based pairs, including XAG/BTC, alongside multiple new crosses against major currencies such as EUR, GBP, and JPY, as well as additional commodity and crypto instruments. Available across MT5 Standard, ZeroStop, and MT5 Pro accounts, this update provides flexibility for every trading style, offering competitive conditions for retail traders and raw spreads with advanced execution for professionals.

With leverage up to 1:1000 on commodities and up to 1:500 on crypto pairs, PrimeXBT continues to deliver high-performance, multi-asset trading for both traditional and digital market participants.

As silver consolidates following its summer breakout, the addition of XAG/BTC and other metal-based cross pairs highlights PrimeXBT’s commitment to connecting the worlds of commodities and crypto, creating new ways for traders to capitalise on macro-driven opportunities across markets.

Disclaimer:

The content provided here is for informational purposes only and is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results. The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money. The Company does not accept clients from the Restricted Jurisdictions as indicated on its website / T&Cs. Some products and services, including MT5, may not be available in your jurisdiction. The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.