Editor’s Verdict

Overview

Review

Headquarters | New Zealand |

|---|---|

Regulators | FMA |

Year Established | 1999 |

Execution Type(s) | No Dealing Desk |

Minimum Deposit | $1000 |

Trading Platform(s) | MetaTrader 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Pacific Financial Derivatives Limited (PFD-NZ), founded in 1991, may be based in Auckland, New Zealand, but its Forex services have a decidedly global reach. The company is authorized by the Financial Markets Authority in New Zealand. is also a member of the Financial Dispute Resolution scheme in New Zealand, a third party service that helps settle resolutions between companies and their clients.

Being a licensed broker, PFD follows stringent laws including segregation of investors' funds, maintenance of adequate net tangle assets, and dealing only with licensed hedging counterparties from stringent jurisdictions. Traders' dealings with PFD are subject to oversight and monitoring by the regulated body whose aim is to protect the interest of investors.

PFD offers brokerage services and trading platforms for trading in Spot Foreign Exchange, Spot Metals, Spot Oil, Commodities, CFDs, and Indices for small, medium and large investors and market participants across the globe.

Accounts

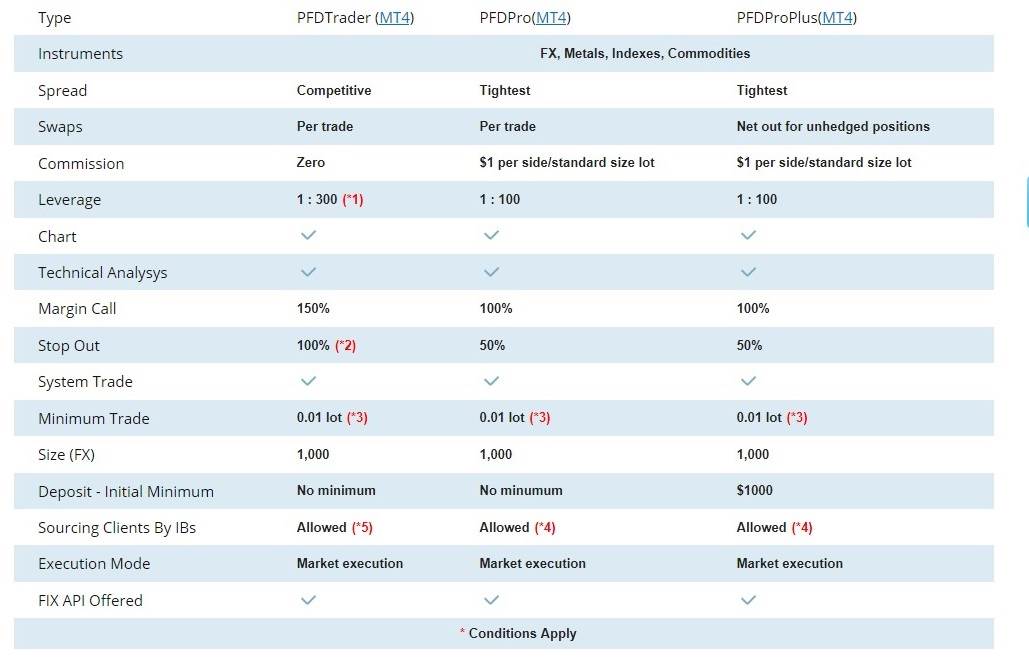

PFD's most popular account types are PFDTrader, PFDPro and PFDProPlus. PFDTrader offers commission free FX trading. PFDPro and PFDProPlus offer tightest spreads bundled with positive slippage, competitive trading terms, no restriction trading strategy and charges only $1/side/lot commission.

PFDProPlus is unique that it allows swap net out on the top of all other features of PFDPro - Net out swaps mean accurate swap values calculated for summarised unhedged position. PFD also offers FIX API accounts without any special stipulation as regards minimum funding or minimum monthly trade volume.

There is no minimum deposit for the PFDTrader or PFDPro account; the maximum leverage is 1:300 and 1:100 respectively.

Account Types

When it comes to spreads, PFD prides itself on offering the most competitive in the industry.

PFD offers traders a 15 day demo account through which they have $10,000 of virtual credit to test the company’s platform and execution.

Features

PFD is connected with about a dozen liquidity providers and enjoys deep liquidity during all trading sessions. PFD's hosting is at the key data centre in Equinix NY4, USA to offer low-latency and best liquidity to its clients.

PFD uses the most popular trading platform (MT4), most competitive spreads, no-restriction trading strategy and hassle-free execution. PFD prides itself as offering one of the most competitive spreads in the industry.

PFD offers the MT4 Multi-Terminal which is designed for managing multiple Forex trading accounts simultaneously and is appropriate for account managers and traders who handle multiple concurrent accounts. It works with securities of Forex, CFD, and spot metals, and offers a Single-Click, Single-Platform, Multiple Accounts solution as well as multiple order types such as Market, Stop and Limit. All unique order types accepted including Trailing Stop, Close by and Close all. Traders can receive quotes and news in the online mode.

Multi Account Manager (MAM) is designed for Money Managers. It is an integrated software tool to quickly execute block orders under a master account and conveniently automate trade allocations to multiple customer accounts. MAM broadens the functionality of the MT4 platform by enabling the Money Manager to effectively trade and manage multiple accounts. MAM supports Expert Advisors (EAs).

During the course of our Pacific Financial review I was satisfied to see that most information about the brokerage was listed on their website. In fact, the website is clear, intuitive and suited to new users who want to learn about the company without being distracted by irrelevant or unnecessary features.

Deposits/Withdrawals

Funding to accounts at PFD can be using Credit/Debit Cards, bank wires and a host of online payment programs such as Skrill.

Withdrawals are made by filling out an online withdrawal form which can be used for bank wires and other funding methods. The same form can be sent in its physical form also.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

PFD provides continual 24 hour support from 10:00 am Monday New Zealand time (11:00 PM Sunday London time, 6:00 PM Sunday New York time) through 10:00 am Saturday New Zealand time (11:00 PM Friday London time, 6:00 PM Friday New York time)

Customer service can also be reached via email, online Chat or Skype.

Conclusion

PFD is the logical choice when looking for a broker of high end performance with a personal approach. Investors' funds are segregated and protected. PFD tops the list when it comes to transparency and fairness in dealings.

Features

PFD has several interesting features but what stands out are its platforms and trading tools. In addition to the two different MetaTrader trading platform, the PFDTrader (MT4) and the PFDPro (MT4), PFD offers the MT4 Multi-terminal platform which is designed for managing multiple Forex trading accounts simultaneously as well as the Multi Account Manager (MAM) integrated software designed for Money Managers to quickly execute block orders under a master account.

Platforms

PFD offers traders two types of trading platforms.

PFDTrader (MT4)

PFDTrader (MT4) is a user friendly dealing and order management system which allows PFD clients to access global markets in real time. The platform is internet based and allows real time so clients can manage their portfolio from anywhere in the world. The PFD Trader (MT4) terminal provides clients with a real time profit and loss position as well access to daily and monthly statements. PFD clients can also view their trading history and open positions on-line 24 hours per day.

PFDTrader Platform

PFDPro (MT4)

PFDPro (MT4) has all unique features of the MetaTrader 4 platform. What makes PFDPro (MT4) most attractive is the tight spreads bundled with positive slippage. PFDPro is most suited to professional, speed and news traders by offering deep liquidity and attractive features. Since it is a NDD (No Dealing Desk) broker it allows the use of scalping and robots without any restrictions as a way to generate results.

MT4 MultiTerminal

MT4 MultiTerminal is a real-time trading platform, which enables introducers and money managers to simultaneously observe the system at the same time as their investors.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |