For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Pepperstone Editor’s Verdict

Pepperstone shines as a world-class broker for traders prioritizing speed and deep liquidity. Perfect for scalpers and algorithmic traders, the trading infrastructure is top-notch, presenting traders with an excellent choice of institutional-grade trading platforms, API support, competitive trading costs, with raw spreads from 0.0 pips, high-speed trade executions, and a well-balanced asset selection. Although Pepperstone is less than ideal for passive investors, its extensive toolkit, high execution quality, and customization options make it the go-to broker for technical traders requiring precision and flexibility.

Pepperstone Video Review

Overview

A Dedicated Broker for Algorithmic Traders and Scalpers

Australia ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB 2010 No Dealing Desk, NDD $0 Other, MetaTrader 4, MetaTrader 5, cTrader, Proprietary platform, Trading View 1.1 pips 1.4 pips $2.50 $0.15 25 74-89% 0.0 pips 1.0 pips 6.00 per round lot (cTrader) / $7.00 per round lot (MT4/MT5) (Visa, Mastercard, Bank transfer, Bpay, Paypal, Neteller, Skrill, Union Pay, M-Pesa, FlutterWave, USDT, PayID)

Pepperstone, founded in 2010 and regulated in seven different jurisdictions, maintains a trading environment geared to scalping and algorithmic trading strategies, which account for the bulk of its trading activity. Delivering one of the most versatile, high-performance trading experiences in the industry, Pepperstone uses a no-dealing-desk (NDD) trading model, where traders get access to raw spreads for a commission between $6.00 and $7.00 per round lot. Algorithmic traders can leverage VPS hosting and FIX API, while discretionary traders can utilize TradingView or MetaTrader with Pepperstone’s Smart Tools suite. Pepperstone caters well to beginner traders with a quality educational offering, in-house research, and 24/5 multilingual support, while the Active Trader Program and the VIP client service reward high-frequency traders.

Who Should Trade with Pepperstone?

Trader Type | Rating | Summary |

Newer Traders | 4/5 | Quality educational content and user-friendly tools, but overall, the broker is better suited for intermediate and advanced traders |

Copy Traders | 4.5/5 | Support for MetaTrader Signals, DupliTrade, and Copy Trading by Pepperstone ensure simple strategy replication |

Swing Traders | 4.5/5 | A diverse array of assets and competitive swaps on platforms designed to support strategy development |

News Traders | 4/5 | Rapid trade execution and deep liquidity allow for timely trades, but macro tools are limited |

Automated Traders | 5/5 | Exceptional execution with MT4/MT5/cTrader, VPS, TradingView, and API support |

Investors | 2.5/5 | Pepperstone is not geared to long-term investing, lacking actual stock ownership or fund access |

Day Traders | 5/5 | A first-class day-trading experience created by low latency, raw spreads, and smart tools |

Scalpers | 5/5 | Ideal for scalpers due to ultra-tight spreads, rapid execution, and customizable platforms |

Pepperstone Highlights 2025

- MT4/MT5 and cTrader platforms for algorithmic traders

- 28-plugin Smart Trader Tools package and Autochartist for enhanced MT4 functionality

- Signal Start and DupliTrade for copy trading, plus the proprietary Copy Trading by Pepperstone

- TradingView for social traders plus a user-friendly mobile app

- Raw spreads from 0.0 pips and low commissions ($6–$7 per round lot)

- Same-day withdrawals for verified traders and 24/5 multilingual support

- Well-balanced asset selection of 1,200+ instruments, including currency indices and ETFs

- Excellent order execution due to deep liquidity pools

- VPS hosting for low-latency 24/5 Forex trading and API access for advanced algo trading

- 24-hour CFD trading on select US-listed equities

- Five-part AI-focused trading strategies using ChatGPT.

Pepperstone Regulation and Security

Compared to close competitors, Pepperstone is licensed by a wide range of top-tier regulatory authorities.

How Does Pepperstone Regulation Measure Up to the Competition?

At DailyForex we appreciate just how critical it is for you that you are placing your hard-earned cash in the hands of a well-regulated broker.

Brokers with at least one tier-1 entity will have a reputation to protect and will be more likely to provide the highest levels of oversight, transparency, and investor protection, across their entire operation.

Regulators like the FCA (UK), ASIC (Australia), or CFTC/NFA (US) impose strict rules relating to capital requirements, client fund segregation, and fair-trading practices. These are designed to minimize the risk of fraud and malpractice, while creating a trusted framework for traders. Tier-1 regulation gives you confidence that your funds are safe with a forex broker that is reliable, well-capitalized, and committed to operating under the most stringent global regulatory standards.

Number of Tier 1 Regulators:

Pepperstone | FX Pro | IC Markets |

|---|---|---|

5 | 2 | 2 |

Pepperstone presents clients with seven well-regulated subsidiaries.

Country of the Regulator | United Arab Emirates, Australia, The Bahamas, Cyprus, Germany, Kenya, United Kingdom |

|---|---|

Name of the Regulator | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB |

Regulatory License Number | 414530, 91279, 128, 388/20, F004356, 684312, F217 |

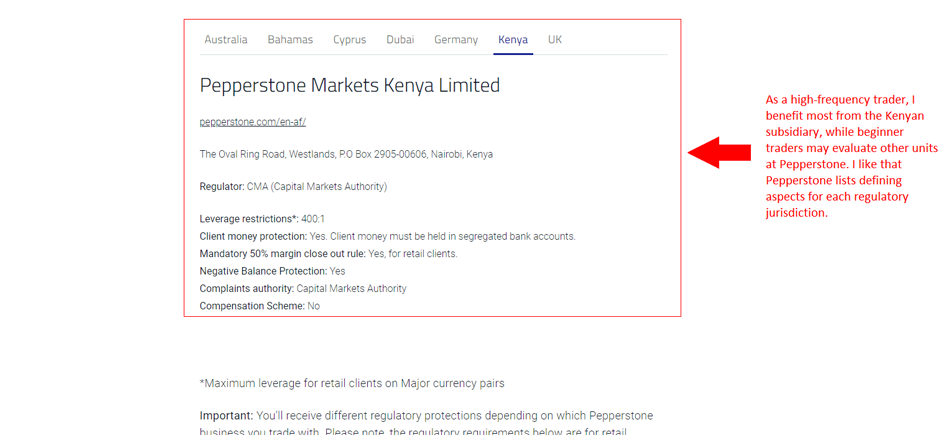

All client deposits remain segregated from corporate funds held at Tier 1 banks. As an active high-frequency trader, I prefer the Kenyan subsidiary over the Bahamas, as it offers negative balance protection plus maximum leverage of 1:400. Traders at the Bahamas unit get 1:500 in a Pro account or 1:200 in a Retail account, both without negative protection. Pepperstone is a global brand with a spotless record and a reputation to maintain. Therefore, I am confident trading from the CMA-licensed subsidiary. Each trader must weigh what matters most to their trading style.

Pepperstone Australia

Pepperstone Australia offers maximum leverage of 1:30, negative balance protection, but no compensation scheme for depositors.

Pepperstone UK

Pepperstone UK offers maximum leverage of 1:30, negative balance protection, and the best regulatory mandated compensation scheme up to £85,000 per client.

Does Pepperstone accept US clients?

No, Pepperstone is regulated in the UK and Australia but is not licensed to operate in the United States. Check the best forex brokers in the USA accepting U.S.-based traders.

Pepperstone Fees

HOW WE TEST BROKER FEES

At DailyForex, we review broker fees by opening live accounts and trading multiple asset classes to assess spreads, commissions, and overall trading costs. We compare each broker’s fees against industry averages for major currency pairs. We also assess deposit, withdrawal, inactivity, and swap fees, rewarding price competitiveness and transparency. Learn more here.

How Do Pepperstone Fees Stack Up to Competitors?

Competitive trading costs are hugely important when choosing a forex broker, directly impacting your bottom line, especially if you are someone who trades frequently.

The EUR/USD pair is the most liquid and heavily traded currency pair, making it the best benchmark for spreads and commissions. Any forex broker that offers consistently low costs on EUR/USD will typically provide competitive pricing across other major, minor and exotic pairs as well. Lower costs mean that more of your profits stay in your pocket, and over time this can lead to significant savings, as less of your earnings are lost to fees.

Average Trading Cost EUR/USD:

Pepperstone | FX Pro | IC Markets |

|---|---|---|

1 | 1.4 | 0.8 |

Pepperstone’s trading costs are highly competitive, particularly for active traders using the Raw account. Spreads start from 0.0 pips, with commissions between $6 (cTrader) and $7 (MT4/MT5) per round lot. There are no deposit or inactivity fees, and withdrawal charges only apply for certain payment methods such as international wire transfers.

Average Trading Cost EUR/USD | 1.1 pips |

|---|---|

Average Trading Cost GBP/USD | 1.4 pips |

Average Trading Cost WTI Crude Oil | $2.50 |

Average Trading Cost Gold | $0.15 |

Average Trading Cost Bitcoin | 25 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | 6.00 per round lot (cTrader) / $7.00 per round lot (MT4/MT5) |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | $0 |

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.0 pips | $0.00 | $10.00 |

0.0 pips | $7.00 (MT4/MT5) | $7.00 |

0.0 pips | $6.00 (cTrader) | $6.00 |

Here is a screenshot of the Pepperstone MT4 trading account during the most liquid overlap session, London-New York, where traders usually get the lowest spreads.

.jpg)

Pepperstone Spreads

The average spread observed for the benchmark EUR/USD during the London-New York session is 0 pips plus a commission of $7, lowered to $5.95 via the Active Trader Program, which I like, as it increases profits per trade. Meanwhile, the cTrader commission is an attractive $6, equivalent to a spread between 0.6 and 0.7 pips. Commissions on equity CFDs can be as low as 0.07%, averaging 0.10%, which is also competitive. Another fact I appreciate is the absence of an inactivity fee. Pepperstone levies a fixed administration fee on trades held for more than ten trading days.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-based Pepperstone Razor account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the tightest spread, and holding it for one night, costs the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $7.00 | -$4.23 | X | $11.23 |

0.0 pips | $7.00 | X | -$0.48 | $7.48 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for seven nights costs the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $7.00 | -$29.61 | X | $36.61 |

0.0 pips | $7.00 | X | -$3.36 | $10.36 |

Noteworthy:

- cTrader traders pay a commission of $6.00 per 1.0 standard round lot instead of $7.00.

What Can I Trade on Pepperstone

Pepperstone offers over 90 currency pairs, 3 currency indices, over 30 cryptocurrencies, and 3 cryptocurrency indices. The selection is average for the retail Forex brokerage industry and competitive for Forex brokers offering cryptocurrency CFDs. Traders also have access to over 20 commodities, 23 index CFDs, 100+ ETFs, and an impressive 1200+ equity CFDs.

Asset List and Leverage Overview

Currency Pairs | |

|---|---|

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

Pepperstone Leverage

Pepperstone’s leverage depends on the regulatory jurisdiction, ranging from 1:30 available at the ASIC, FCA, DFSA, BaFin, and CySEC units to a high 1:400 at the CMA and 1:200 at the SCB subsidiaries.

Trading Hours

Cryptocurrency trading is available 24/7 with daily breaks between 23:59 and 00:05 Sunday through Friday. On Saturdays, there is a break between 00:00 and 01:01 and from 17:00 to 23:59. Forex trading is available from Monday 00:00 to Friday 24:00. Most commodities can be traded from Monday through Friday from 01:00 to 23:59.

European index CFDs are tradeable Monday through Friday between 00:01 to 23:59, while those from the US can be traded between 01:00 to 23:15 and from 23:30 to 23:59. US equity trading is available Monday through Friday between 16:31 and 22:55, European equities can be traded between 10:00 and 18:29, and Australian equities between 03:01 and 09:00. All times shown in this section are UTC +3.

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:00 | Saturday 00:00 |

Commodities | Monday 01:00 | Friday 23:59 |

Crude Oil | Monday 01:00 | Friday 23:59 |

Gold | Monday 01:00 | Friday 23:59 |

Metals | Monday 01:00 | Friday 23:59 |

Equity Indices | Monday 00:01 | Friday 23:59 |

Stocks | Monday 10:00 | Friday 22:55 |

ETFs | Monday 16:31 | Friday 22:55 |

Pepperstone Account Types

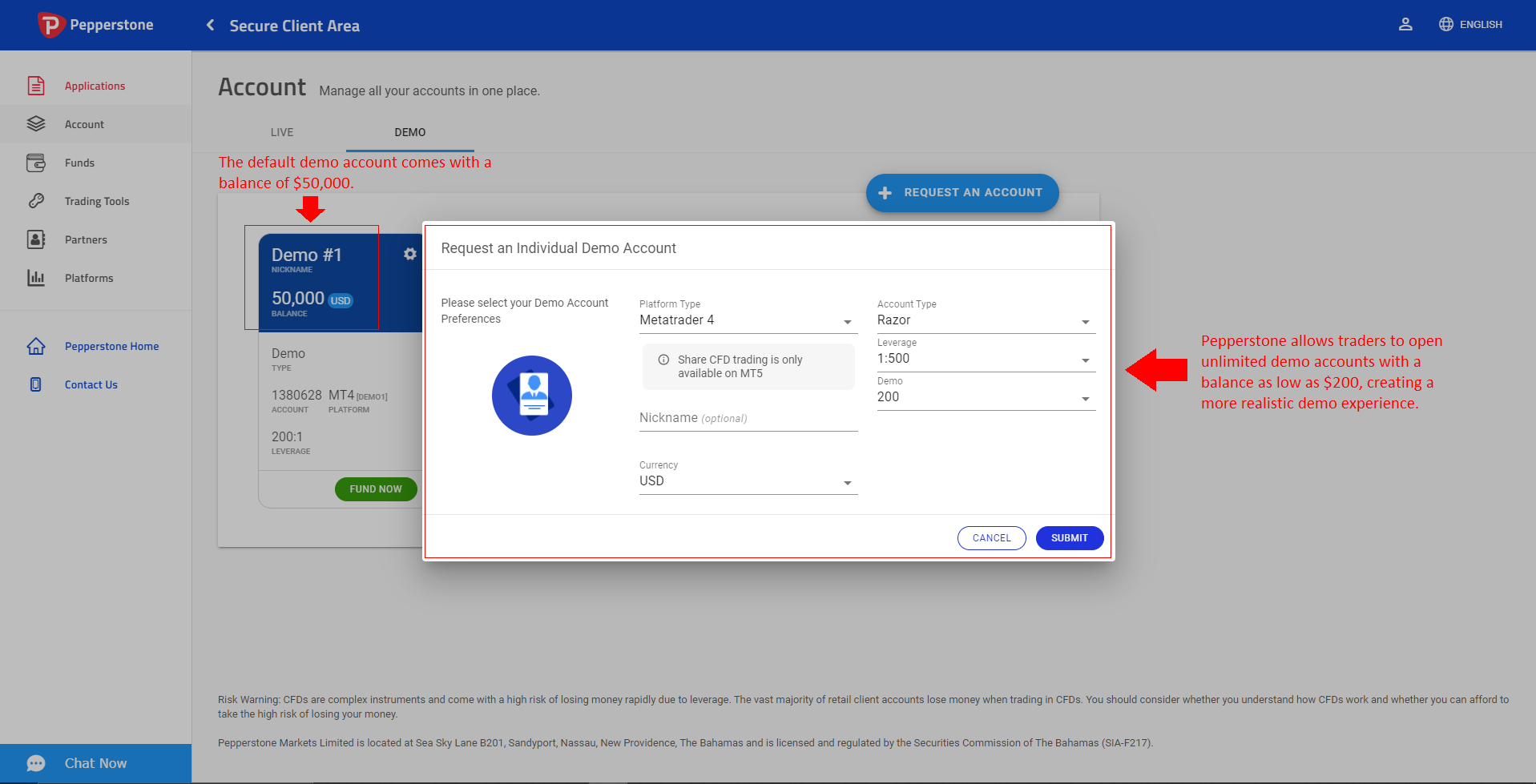

Pepperstone offers two main live account types: the Standard Account and the Razor Account. Islamic accounts are available on request, and demo accounts are available on all platforms, with different expiration rules depending on platform choice.

I like the commission-based Razor account, with its spreads from 0.0 pips and low commissions, because it qualifies me for the Active Trader Program, which rewards high activity with lower trading costs. Traders who only trade major currency pairs can also lower costs in the competitively priced commission-free Standard account. Pepperstone has no minimum deposit, although a $200 starting balance is recommended.

Pepperstone Demo Account

With the Pepperstone demo account, traders may adjust the leverage and portfolio size to as low as $200. A 60-day time limit applies in the MT4 and MT5 demos unless traders make a live deposit and contact customer support to request a non-expiry demo account option, which I find reasonable. cTrader demo accounts will not expire if they are logged into at least once every 30 days, and TradingView demo accounts have no time limit.

Pepperstone Trading Platforms

Every trader has their own style of trading and so access to a variety of trading platforms is useful because it allows you to choose the one that best fits your preferred strategies, tools, and experience level. Popular platforms like MT4, MT5, TradingView, and cTrader each offer unique features, such as advanced charting, automated trading, or social trading integrations.

In reality, each of these platforms provides all the main tools and features that most retail traders use. However, by offering a range of choices, including proprietary platforms designed in-house, a broker ensures that all different kinds of traders can benefit from a flexible and convenient trading experience. This variety and versatility allows you to switch between platforms as your strategies, capabilities, and requirements evolve.

Available Trading Platforms:

Platform | Pepperstone | FX Pro | IC Markets |

|---|---|---|---|

MT4 | √ | √ | √ |

MT5 | √ | √ | √ |

C Trader | √ | √ | √ |

TradingView | √ | X | √ |

Pepperstone delivers one of the most flexible and comprehensive platform selections in the industry, with multiple platforms supporting algorithmic trading and embedded copy trading functions.

Traders may choose between the MT4/MT5 platforms, upgraded via plug-ins like the Smart Trader suite, and Autochartist, further increasing their edge. Additionally, Pepperstone offers the cTrader platform, the proprietary Pepperstone Trading Platform, TradingView connectivity, and the cutting-edge Capitalise AI service, which complements the broker’s algorithmic-focused trading environment. VPS hosting and API access are also available for more advanced setups.

Moreover, Pepperstone provides social trading via third-party providers Myfxbook, Signal Start, MetaTrader Signals, cTrader Copy, DupliTrade and Copy Trading by Pepperstone.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Pepperstone MT4

The Pepperstone MT4 trading environment remains among the best given the Smart Trader Suite, Autochartist, and VPS hosting.

Pepperstone cTrader

Pepperstone cTrader is an outstanding alternative to Pepperstone MT4, and both occupy the top two spots among algorithmic trading solutions with full support for third-party upgrades.

Pepperstone Webtrader

The Pepperstone Webtrader offers a lightweight trading platform for manual traders who trade from numerous devices during the day.

Pepperstone VPS

Pepperstone VPS is available from ForexVPS and New York City Servers in support of algorithmic traders. Pro traders at Pepperstone are offered the VPS for free.

Unique Features

I appreciate the option to use API trading at Pepperstone. To be eligible, traders must accumulate $250 million in monthly trading volume or approximately 2,500 lots. While this is comparatively high, I find it acceptable. Traders with advanced trading solutions that require API trading should have no problems meeting this minimum, and Pepperstone maintains an excellent trading environment for traders with advanced technical requirements.

Research and Education

Pepperstone does not forget about manual and beginner traders. The analysis section features well-explained written market commentary and trade ideas, as well as clear, concise videos presenting actionable information. I rank Pepperstone research among the best offered by brokers.

Less experienced traders have access to an in-depth collection of articles, supplemented by webinars and two trading courses, granting them a high-quality introduction to financial markets.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |        |

Pepperstone explains its products and services well, and I recommend checking the FAQ section before reaching out. Pepperstone presents 24/5 customer support, where the live chat function from the back office offers the most convenient contact method. Pepperstone also lists an e-mail and a phone number. I recommend the latter for emergencies, which I am confident will remain minimal.

Bonuses and Promotions

I find the Active Trader Program an excellent reward for high-volume traders, but there is no Pepperstone deposit bonus. Depending on the regulatory jurisdiction, traders have access to the refer-a-friend promotion. I do not find the offer attractive, as the payout remains minimal, and referrals must fulfill requirements in 90 days. Yet this is a minor issue that is unlikely to deter traders looking at the Pepperstone package as a whole.

Terms can vary based on jurisdiction.

Pepperstone Opening an Account

Opening an account at Pepperstone took me only a few moments via the online application form. New traders may use their Google or Facebook accounts to complete the initial step. I like that Pepperstone also requires KYC. A copy of the trader’s ID and one proof of residency document generally satisfy mandatory account verification.

Pepperstone deploys a secure online application for onboarding new traders.

Pepperstone Minimum Deposit

Pepperstone has no minimum deposit which makes it more accessible than many brokers. Pepperstone recommends $200.

Payment Methods

Traders may deposit into their Pepperstone trading account via bank wires, credit/debit cards, POLi, BPay, PayPal, Neteller, Skrill, Union Pay, M-Pesa, FlutterWave, USDT, or PayID (depending on jurisdiction).

Withdrawal options |     |

|---|---|

Deposit options |     |

Pepperstone Deposits and Withdrawals

The available choice of payment methods at Pepperstone is a well-balanced mix. However, the broker is missing a cryptocurrency option. There are no internal deposit or withdrawal fees, except for a $20 bank wire charge, which applies everywhere. I want to point out that traders will pay third-party payment processor costs, which Pepperstone does not control. Traders will make all financial transactions from the secure back office, and I find the available payment methods offer all types of traders a decent option.

Applicable to the methods available under SCB regulation.

Pepperstone Withdrawals

Pepperstone withdrawals are hassle-free from the back office and fast. I appreciate brokers who ensure that withdrawing funds is as straightforward and without delays as depositing. There are no fees, except for bank wires, USDT and China UnionPay. Traders should check payment processor costs to determine the most efficient method, which varies by geographic location. I recommend traders use third-party payment methods to keep their trading activity separate from their day-to-day banking operations.

Bottom Line

Pepperstone has earned its reputation as a market leader for high-frequency, algorithmic, and intraday trading. While not ideal for long-term investors or those implementing passive strategies, for active market participants, Pepperstone is a standout choice. Its unmatched execution speeds, broad platform support, and smart trading tools make it a top broker for performance-driven traders.

How We Make Money

DailyForex generates revenue by publishing promotional materials from paying brokers and service providers, which has no impact on the objectivity of our reviews. Our mission is to offer clear, accurate, and transparent evaluations of Forex and CFD brokers, using a rigorous, data-driven approach. Our partners may be placed highly within certain areas of the site, but our broker ratings are always based on objective analysis. Find out more here.

FAQs

Is Pepperstone a good broker?

Pepperstone ranks among the best brokers globally due to its competitive trading environment and trustworthiness.

Is Pepperstone a trusted broker?

Yes, Pepperstone complies with seven regulators and maintains a spotless track record. Therefore, Pepperstone has established itself among the most trusted brokers.

What are Pepperstone’s fees?

All Pepperstone fees depend on the account type and asset. They consist of spreads, with minimums between 0.0 and 1.0 pips, commissions of $6.00 to $7.00 for Forex and 0.07% to 0.10% or $0.02 per share, where applicable, and swap rates on leveraged overnight positions.

Is Pepperstone regulated in Europe?

Yes, Pepperstone has three regulated European offices: in the UK, Germany, and Cyprus.

Is Pepperstone commission free?

Yes, Pepperstone offers a commission-free account type but has notably lower trading fees in its commission-based alternative.

How much is Pepperstone’s withdrawal fee?

Pepperstone does not levy internal fees except on bank wires, where the minimum charge for a withdrawal is $20.

Can you trade $10 with Pepperstone?

Traders can trade for $10 at Pepperstone but must consider the severe limitations and disadvantages, which explains the Pepperstone recommendation of a minimum of $200.

How fast is the Pepperstone withdrawal?

Internal processing times for the Pepperstone withdrawal are the same day if traders confirm the transaction before 07:00 (AEST). Otherwise, Pepperstone will process it during the following business day. Depending on the geographic location of traders, bank wire and credit/debit card withdrawals can take several days to arrive.

How do I cash out on Pepperstone?

The secure and user-friendly Pepperstone back office handles all financial transactions for verified traders.

How much can I trade with Pepperstone?

Pepperstone does not impose limits and caters to institutional clients. Therefore, the amount traders can trade at Pepperstone depends on their deposit and leverage, which depends on the operating subsidiary.

Does Pepperstone require KYC?

Pepperstone requires KYC as it complies with seven regulators and is a well-trusted broker with a clean operational track record spanning 12+ years.

How does Pepperstone make money?

Pepperstone earns the bulk of revenues from spreads, commissions, and swap rates on leveraged overnight positions.

Is Pepperstone a true ECN broker?

ECN is how banks and liquidity providers connect, making Pepperstone, and most other brokers, technically not an ECN broker. The technology infrastructure allows Pepperstone to offer traders ECN like pricing and trade execution.

What is the minimum deposit for Pepperstone?

Pepperstone has no minimum deposit, but recommends that traders get started with at least $200.

Is Pepperstone a good broker?

Pepperstone ranks among the best brokers globally due to its competitive trading environment and trustworthiness.