Editor’s Verdict

Lirunex serves traders with a trading environment focused on algorithmic trading and retail account management. With a minimum deposit of $25, Lirunex ensures all traders have access, but a $200 deposit lowers trading costs notably, while $10,000 provides competitive fees. I reviewed this broker to determine if it delivers raw spreads and fast order execution from its MT4 trading platform. Is Lirunex the right broker for you?

Overview

Lirunex - A competitive trading environment for algorithmic and copy traders

Labuan CySEC, MED 2016 ECN/STP, Market Maker $25 MetaTrader 4 96.15%

Lirunex - first look:

- The limited asset selection makes Lirunex a choice for traders with a focused strategy that requires few but liquid assets.

- Scalpers and other high-frequency traders will benefit from fast order execution and high leverage.

- The retail loss rate ranks among the worst industry-wide

- MAM/PAMM accounts and in-house copy trading services

- Low minimum deposit and withdrawable bonuses with reasonable conditions.

Lirunex Main Features

Retail Loss Rate | 96.15% |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | 0 pips |

Minimum Standard Spreads | 1.5 pips |

Minimum Commission for Forex | $8.00 per round lot |

Commission for CFDs/DMA | $4.00 |

Commission Rebates | No |

Minimum Deposit | $25 |

Demo Account | Yes |

Managed Account | Yes |

Islamic Account | Yes |

Inactivity FeeNone | None |

Deposit Fee | low as 0% |

Withdrawal Fee | low as 0% |

Funding Methods | 10 |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. Lirunex presents clients with two registered entities.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Malaysia (The Federal Territory of Labuan) | Labuan Financial Services Authority | License Number MB/20/0050 |

Cyprus | Cyprus Securities and Exchange Commission | 338/17 |

Republic Of Maldives | Ministry Of Economic Development | FC00022020 |

Please Note:

- Lirunex also operates a subsidiary from Hong Kong which provides FinTech and financial services to the group, with China an increasing core market for Lirunex.

- Lirunex can provide services within all EU member states.

The Marshall Islands subsidiary offers:

- Higher leverage

- Negative balance protection

- Segregation of client deposits from corporate funds

- Flexible trading conditions

What is missing?

- Investor compensation fund or

- Third-party insurance or

- Financial Commission membership

- Transparency concerning its core management team

Noteworthy:

- The Cyprus subsidiary offers an investor compensation fund up to 90% or €20,000 of deposits but more restrictive trading conditions.

- Lirunex can provide services within all EU member states, with regulators in Germany, France, and Spain.

Fees

I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact profitability.

Lirunex offers traders two cost structures:

- Commission-free trading costs start at 1.5 pips or $15.00 per 1 standard lot and 1 pip, or $10.00.

- Commission-based accounts commence with a minimum spread of 0 pips and a commission of $8.00 per round lot for a final cost of $8.00.

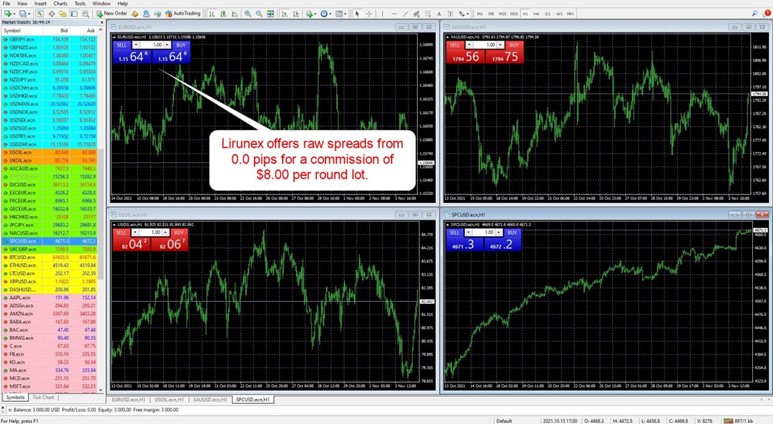

Here is a screenshot of Lirunex live quotes during the London-New York overlap session in their MT4, the most liquid one, where traders usually get the lowest spreads.

Which pricing environment should Forex traders select?

I recommend the following:

- The commission-based cost structure is best as trading costs are between 20% and 45%+ cheaper.

- The minimum deposit for the commission-based account is a reasonable $200 versus $25 for the commission-free alternative.

- Traders with $10,000+ qualify for another 50% trading cost reduction and get raw spreads from 0.0 pips for a commission of $4.00 per standard lot.

What is missing at Lirunex?

- A volume-based rebate program for the commission-based trading account.

The average trading costs for the EUR/USD in the commission based Lirunex LX Prime account:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.0 pips | $8.00 | $8.00 |

Noteworthy:

- The commission is higher versus many competitors but drops to $4.00 in the LX Pro account available for deposits above $10,000.

- Swap rates on leveraged overnight positions rank among the lowest, resulting in excellent trading costs for traders holding positions overnight.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- Lirunex offers a positive swap at the time of writing on EUR/USD short positions and other select assets, meaning traders can get paid money to hold such a position overnight.

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission based Lirunex LX Prime account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD at the minimum spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $8.00 | -$4.59914 | X | $12.59914 |

0.0 pips | $8.00 | X | $0.65604 | $7.34396 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD at the minimum spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $8.00 | -$32.19398 | X | $40.19398 |

0.0 pips | $8.00 | X | $4.59228 | $3.40772 |

My additional comments concerning trading costs at Lirunex:

- $5.00 monthly inactivity fee after 90 days of dormancy.

- Third-party payment processor costs may apply.

- Lirunex lists no internal currency conversion costs.

What Can I Trade?

The limited asset selection at Lirunex caters well to traders with focused strategies who require few but highly liquid assets. Scalpers have enough choices, while deep liquidity results in tight spreads.

Traders who seek a diversified approach or cross-asset exposure will not achieve it, and I cannot recommend Lirunex for those strategies.

What is missing?

- Lirunex only offers four commodities.

- The equity selection focuses on 14 large-cap names focused on trending names.

- Cryptocurrency CFD traders only have a choice of six cryptocurrency assets.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

ETFs |

Lirunex Leverage

The maximum leverage at Lirunex is 1:2000 at the Marshall Islands subsidiary, which decreases to 1:100 in a multi-tier system. I recommend the LX Prime/LX Pro accounts for active traders and scalpers. It presents more overall trading flexibility, which directly impacts profitability.Other things to note about Lirunex leverage:

- Lirunex offers dynamic maximum leverage, lowering the total based on the account balance (most brokers reduce it based on trading volume), assisting proper risk management.

- Negative balance protection exists, ensuring traders never lose more than their deposit.

- The Cyprus units limits it to 1:30 amid regulatory restrictions.

Lirunex Trading Hours (GMT +2 Server Time)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Sunday 00:00 | Saturday 24:00 |

Forex | Monday 00:05 | Friday 23:55 |

Commodities | Monday 01:05 | Friday 23:55 |

European Index CFDs | Monday 10:00 | Friday 18:30 |

US CFDs | Monday 16:30 | Friday 23:00 |

Noteworthy:

- Equity markets open and close in line with real market hours each trading session and are not operational continuously like Forex and cryptocurrencies.

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

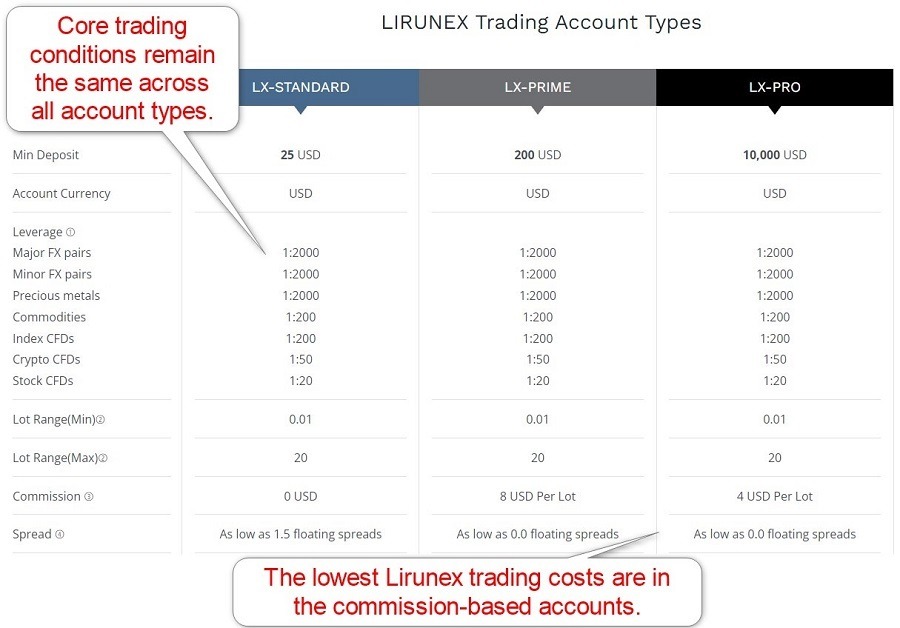

Traders at Lirunex may choose between three account types, where most core trading aspects remain the same.Traders must decide between the following:

- Commission-free versus commission-based account.

My observations concerning the Lirunex account types:

- Beginner traders may start with as little as $25 in the LX Standard account, with trading costs for the EUR/USD at 1.5 pips or $15.00 per 1 standard round lot.

- The commission-free trading account serves little purpose, as traders can open a better-priced alternative for $200.

- The best value is available in the LX Prime account, where Lirunex lowers fees to an attractive range for a minimum deposit of $200.

- The LX Pro account features highly competitive trading costs but requires a minimum deposit of $10,000.

- Lirunex only offers US Dollar accounts.

- All trading accounts are for MT4, the market leader for algorithmic trading, which also features an embedded copy trading service.

- VPS hosting is available with third-party providers at a cost.

- Lirunex offers third-party copy trading from ZuluTrade and Chills Trading.

- Lirunex offers an in-house copy trading service.

- Islamic and corporate accounts are available.

My recommendation:

- Traders should opt for the LX Prime account unless they can afford the LX Pro alternative, where trading costs rank among the best industry-wide in the Pro account and reasonable in Prime

Lirunex Demo Account

Traders can open unlimited demo accounts in MT4. They are ideal for testing and bug fixing EAs or for testing new trading strategies. I caution that no demo account can replicate live trading conditions, as it omits trading psychology. Therefore, they are great for testing and fixing but not as an educational tool.

My recommendation:

- MT4 offers flexible deposits, and traders should select an amount equal to what they plan for their live trading account.

Trading Platforms

Lirunex only provides the out-of-the-box MT4 trading platform. It is available as a desktop client, a web-based alternative, and a mobile app. MT4 maintains its leadership position as the most trusted Forex trading platform but requires upgrades.

With more than 25,000 available plugins and EAs, traders can transform MT4 into a cutting-edge trading solution, but traders must purchase them, as the free ones hardly function as advertised.

What is missing?

- Lirunex does not provide any MT4 plugins, leaving traders with the core MT4 version.

- An option for free VPS hosting based on monthly trading volume.

My observations:

- Traders with MT4 EAs must use the desktop client.

- VPS hosting supports algorithmic traders who require 24/7 access, but it comes at a cost.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

MT4 | Yes |

|---|---|

MT5 | No |

cTrader | No |

Proprietary/Alternative Platform | No |

Automated Trading | Yes |

Social Trading / Copy Trading | Yes |

MT4/MT5 Add-Ons | No |

Guaranteed Stop Loss | No |

Negative Balance Protection | Yes |

Unique Feature One | VPS hosting |

Unique Feature Two | In-house copy trading service |

Unique Features

Lirunex offers VPS hosting in partnership with ForexVPS or Beeks, but it comes at an extra cost of no less than $18 monthly. I would like to see an offer for high-volume traders to obtain free VPS hosting.

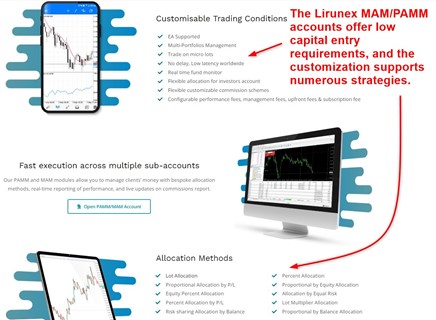

Besides the integrated copy trading feature in MT4, Lirunex offers an in-house copy trading service, ensuring traders have diverse trading strategies to follow.

Lirunex offers a prop trader program with maximum funded accounts of $250,000, leverage up to 1:50, and a 70% profit share with a 10% maximum drawdown. The conditions are competitive, but traders must pass a three-phase verification process. Unlike most competitors, Lirunex allows traders to begin their evaluation with a $100 MT4 account, and the evaluation fee is only $10 for a 5K funded account. I rate the Lirunex prop trader program among the best in the industry.

Research and Education

Lirunex neither publishes in-house research nor sources it from third parties. With the wealth of quality free and paid-for research accessible online, I do not count the absence as a negative in my Lirunex review. It does create a service gap to competitors who provide traders with quality research.

Lirunex offers beginners dozens of educational articles, which I can recommend as an introduction. Since the low minimum deposit requirements will attract many first-time traders, it would benefit if Lirunex rethinks its approach to offer a step-by-step introduction to Forex trading.

My takeaway:

- Traders should rely on Lirunex as an execution-only broker, where it maintains a competitive trading environment, especially for deposits above $10,000.

My recommendations:

- Beginner traders may explore the MAM/PAMM accounts, and the copy trading services available at Lirunex.

- MT4 has thousands of EAs, and traders may research them to determine if they suit their trading style.

- Traders should acquire high-quality educational content elsewhere before trading at Lirunex.

- Traders who seek market research or trading signals may source it from countless free research available online.

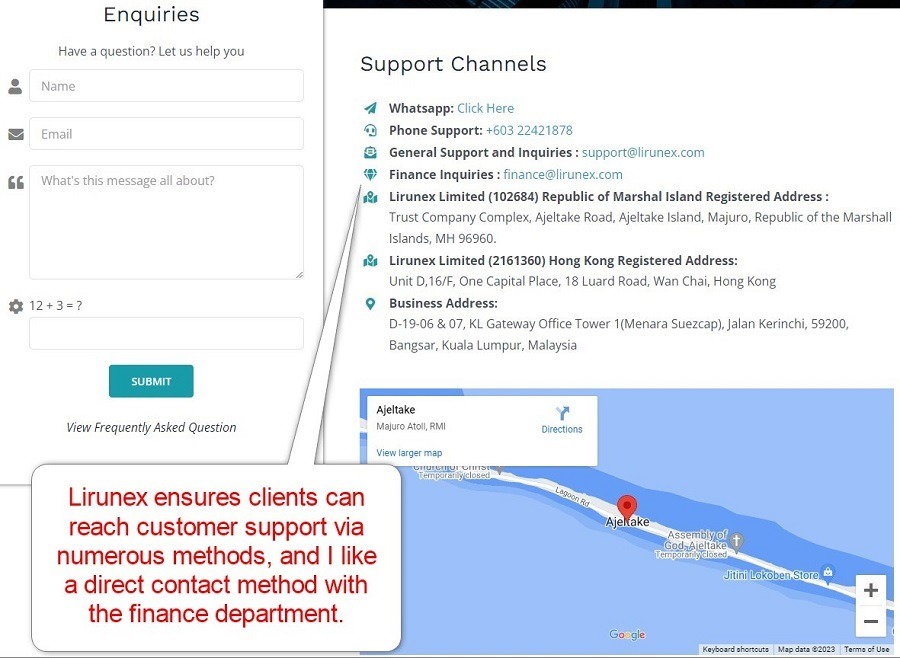

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | M - F, 10:00 - 17:30 (GMT+8) |

Website Languages |       |

Customer support is available from Monday through Friday between 10:00 and 17:30 (GMT+8).

Since Lirunex explains its products and services well and ensures flawless operations, I doubt traders will be likely to ever require customer support.

My recommendations:

- The FAQ section answers several questions, and traders should read them before contacting a support representative.

- The most convenient contact method is either live chat or WhatsApp messenger.

Bonuses and Promotions

Lirunex offers a 20% bonus up to $500 and a 100% bonus up to $20,000. The minimum deposit requirement is $100, and both bonuses are withdrawable, but traders should read and understand the terms and conditions before requesting one.

Lirunex also features other promotions, which are time-limited but well-introduced on its website. An IB partnership program with high payouts also exists.

Opening an Account

I appreciate the hassle-free account opening process at Lirunex. Traders must select their account type and username, fill out their name and email, select a password, and provide their country of residence with a valid mobile phone number. Account verification is mandatory, and most traders will complete it after sending a copy of their ID and one proof of residency document.

Minimum Deposit

The minimum deposit at Lirunex ranges between $25 and $10,000, depending on the preferred account type.

Payment Methods

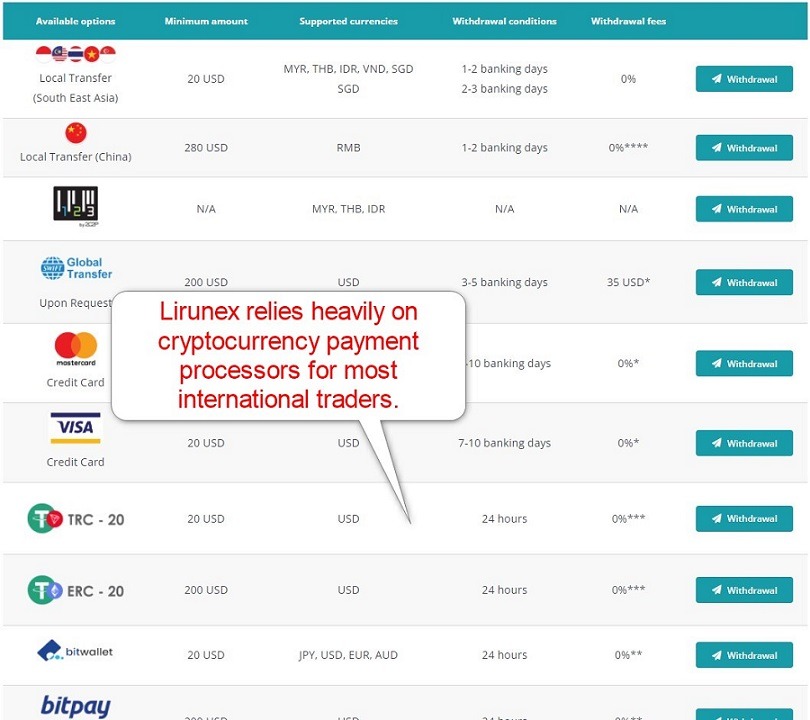

Lirunex offers bank wires, credit/debit cards, three domestic solutions in Asia, and five cryptocurrency payment providers.

Accepted Countries

Lirunex caters to most international traders but does not accept US person traders. Its website lists North Korea, Congo, Libya, Afghanistan, Cuba, Mali, Syria, Sudan, South Sudan, Yemen, Somalia, Belarus, and Venezuela as ineligible countries of residence.

Deposits and Withdrawals

All financial transactions take place in the secure back office of Lirunex. Besides bank wires and credit/debit cards, only cryptocurrencies are available. I miss the flexibility of some of the better-established online payment processors.

My observations:

- Deposits remain free of charge, but third-party costs may apply.

- Bank wire withdrawals cost $35, but credit/debit cards are free of internal costs.

- Lirunex processes withdrawals within 24 hours, and all will follow the deposit path.

- Processing times depend on the payment processor, but only local Asian ones are instant.

- Withdrawals may take up to ten business days to arrive.

- Traders outside of South-East Asia and China must heavily rely on credit/debit cards unless they prefer cryptocurrencies.

- l Cryptocurrency deposits and withdrawal minimum range between $20 and $200.

My recommendations:

- Traders should explore cryptocurrencies if they want to trade at Lirunex.

- It is ideal to use an option besides the bank or credit/debit card used for day-to-day financial operations.

- I also recommend checking the costs from the payment processor to the bank account unless a debit card is available.

Bottom Line

I like the trading environment at Lirunex for scalpers and high-frequency traders with a focused trading strategy requiring few but liquid assets. Lirunex offers high leverage and is a high-quality execution broker. MAM/PAMM accounts cater to traditional retail account management, VPS hosting supports algorithmic traders, and Lirunex offers an in-house copy trading service plus the integrated one in MT4. Traders can also qualify for a funded prop trading account with generous conditions, where Lirunex adds tremendous value. Lirunex is a duly registered broker in two jurisdictions with regulatory oversight. Lirunex processes withdrawal requests within 24 hours, but it can take up to ten business days to receive funds, dependent on the payment processor. Lirunex operates as a legit and regulated Forex broker present in seven countries. The Lirunex maximum leverage is 1:2000. The Lirunex headquarters is in the Marshall Islands. Yes, Lirunex has regulatory licenses from the Maldives and Cyprus. Lirunex established itself as a trustworthy Forex broker with a clean track record. It continues to expand its product and services portfolio with a highly competitive funded prop trading program, the latest addition next to its educational section for beginners.FAQs

Is Lirunex a scam?

How long does it take to withdraw from Lirunex?

Is Lirunex legit?

What is the maximum leverage with Lirunex?

Where is Lirunex based?

Is Lirunex regulated?

What is the trust score for Lirunex?