Editor’s Verdict

Overview

Review

Headquarters | Cyprus |

|---|---|

Regulators | BaFin, CySEC, FCA |

Year Established | 2011 |

Execution Type(s) | No Dealing Desk |

Minimum Deposit | $30 |

Trading Platform(s) | cTrader |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Kawase was founded in 2011 as Institutional Prime Brokerage and is the tradename of TopFX Ltd. It is a European online trading broker inspired by Japanese concepts such as trust, power, determination, flexibility and simplicity. It is headquartered in Limassol, Cyprus and is regulated by CySEC. It is also registered with 25 EU regulators and is governed by MiFID.

The company has over 120 employees and is an Official Partner of the Kawase Sailing Team, The Red Cross and Unicef.

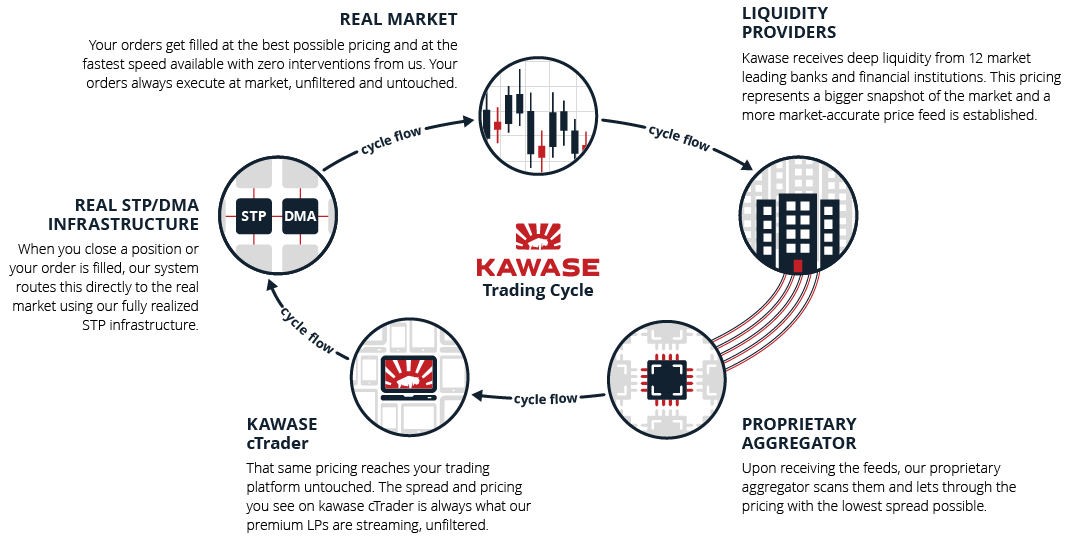

Kawase offers more than 3000 instruments to trade and boasts of executing more than 400,000 monthly trades. With CFDs, traders can deposit a small amount of money and apply leverage, enabling them to potentially magnify their profits while benefiting from market movements by going ‘long’ (buy) or ‘short’ (sell). Kawase is a pure DMA/STP broker.

Kawase Model of Execution

Accounts

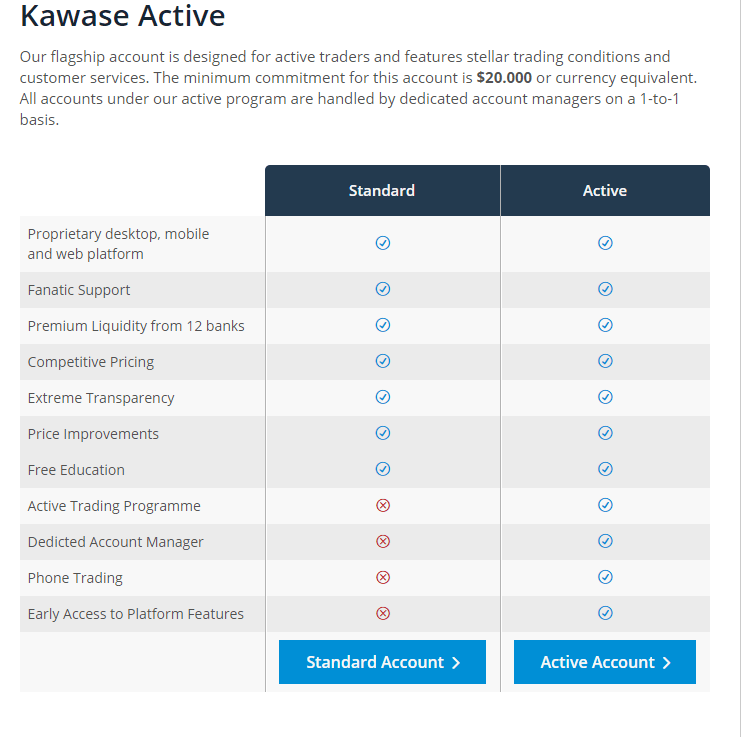

There are two main account types offered by Kawase, as well as a demo account. The account types are called the Standard and Active accounts, and they offer similar features, with the Active account offering better, more dynamic spreads, phone trading opportunities and a dedicated account manager, among other features. Traders can switch between their live accounts and demo account at the click of a button, a feature not offered by most other brokers. Accounts approval is done quickly once all the necessary documents are uploaded; the company prides itself on activation within 24 hours, if not sooner.

Account Types

To open either of these accounts, a client must simply download or launch the Kawase Trader platform and register for a Kawase ID (cTraderID). In 24 hours the account will be ready for use.

The demo account is unlimited and traders can use real market conditions that are identical to live trading accounts. Around-the-clock online help and support team is provided for each live or demo account holder.

There is no minimum deposit for a Kawase trading account, though the company recommends starting with $100. An Active Account can be opened for as little as $30. Trades are made with institutional-grade raw spreads that begin at 0.1 pip.

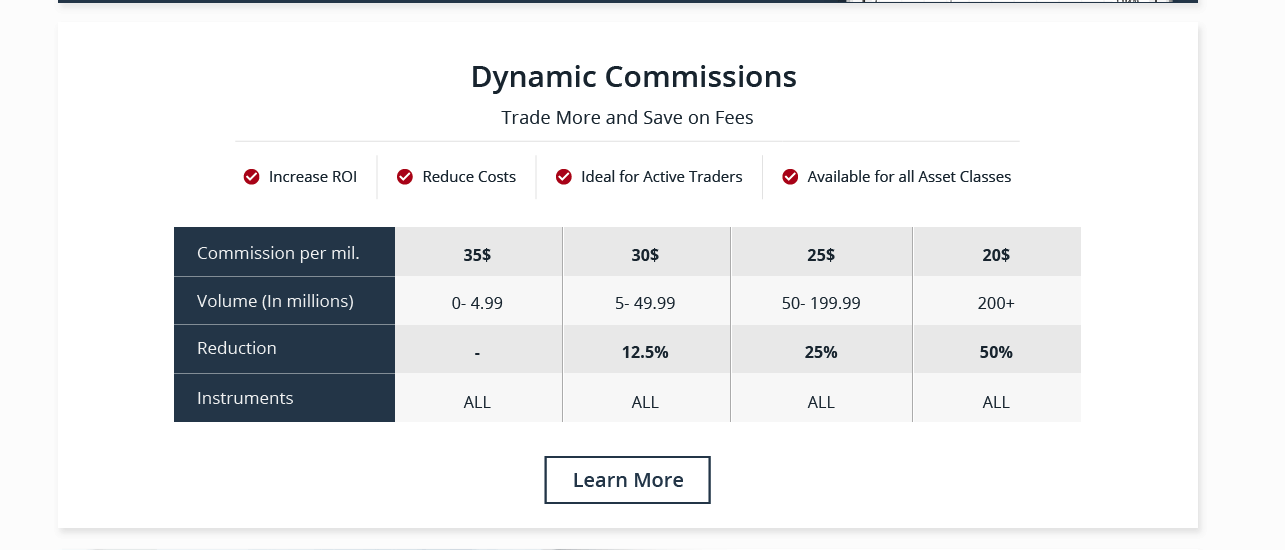

Dynamic Commisions

Commissions are $3.5 per lot or $35 per million and can go as low as $2 per lot depending on volume using dynamic commissions. Dynamic commissions are a feature in which Active traders can reduce the commission based on their trade volume, as outlined clearly on the company’s website.

Micro lots can be traded on any either of the accounts. Default leverage of live account is 1:200; maximum leverage is 1:500. Clients are required to maintain a minimum amount of funds for each open position held in their trading account, in accordance with the chosen leverage. These funds are known as Margin Requirements and are considered to be a guarantee and not a cost.

Kawase allows swap free accounts to those of Muslim faith in accordance with Shariah Law.

There are no pricing markups on any trades. Instead, a commission is charged per lot and there is a clearly defined chart with the commissions charged for each asset traded.

Features

Traders at Kawase can trade over 300 equities, energies, 60 Forex symbols, 14 indices, oil and precious metals all from the same platform. Both desktop and mobile trading is available. Trade execution speeds are below 100 milliseconds.

Among some of the interesting features at Kawase is the balance and position information bar which shows a trader’s trading history and performance and his/her open and closed transactions. The bar also allows the trader to open a position, modify orders and make changes to stop loss/take profit levels. In addition a trader can modify his stop loss and take profit levels directly from the charts.

Traders can access all available instruments, select which instruments they want to trade and add them to their favorites list by clicking on the star symbol. Favorites are also listed under the Watchlist tab. This section also shows the current price as well as the daily change per instrument.

An unusual feature at Kawase is their adaptive commissions scheme which is designed to reward traders that risk more to potentially make more. Their algorithm automatically detects investors that exceed the specified volumes and instantly places them under the correct scheme.

These schemes are based on the volume a trader moves, and not the actual money he is depositing and the Kawase website posts a Volume vs Commission chart to make things clearer.

Education

Kawase is a bit weak when it comes to educational material. A course with 11 video lessons is available and they cover a range of topics. There are also several textual articles that explain the basic concepts in Forex trading.

There were no market news reports, analysis or updates.

Bonuses/Promotions

At the time of this review, there were no bonuses or promotions offered.

Deposits/Withdrawals

All transactions with Kawase, including withdrawals, take place directly in the client platform; there are no “wallets” or “client areas”. For this reason, Kawase’s deposit and withdrawal process is designed to be faster than most other brokers. Kawase does not charge withdrawal fees, however third party processing fees might apply.

Credit/Debit Card/UnionPay take up to 5 working days to process; Wire transfers, Max 7 working days; and E-Wallets are processed within 10 minutes.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

Kawease takes customer support very seriously They call their approach “Support Fanatics,” which is a team of educated individuals who know about trading and are entirely familiar with the company’s platform. All support teams are evaluated regularly and rewarded to ensure the best results. Live chat services are available on the company’s website and within the trading platform, as well as on Skype, Viber, WeChat, Google Hangouts and Whatsapp.

Conclusion

Kawase is one of many Forex brokers domiciled in Cyprus. It prides itself on its regulation and transparency and that is commendable. However it is missing several features that other brokers offer.

Features

The Kawase website is user-friendly and quite easy to navigate. I did have some difficulty moving back and forth from some pages but once I got used to the technique, it moved along fine. The landing page has some interesting 3-d images and a lot of information is presented just by scrolling down. I was surprised that there were no promotions or bonuses despite Kawase being an official partner with a major sailing team which usually connects with some good giveaways.

Platforms

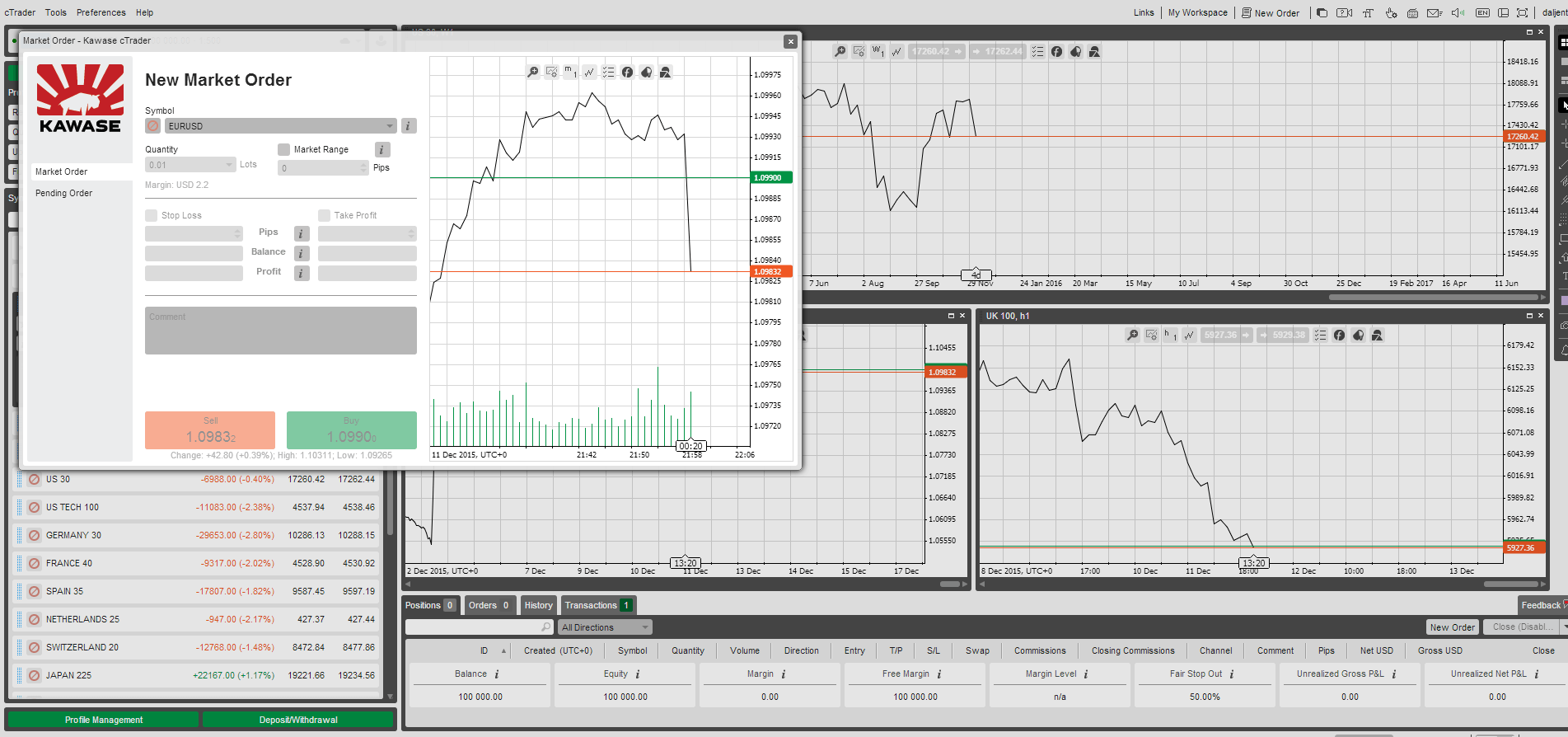

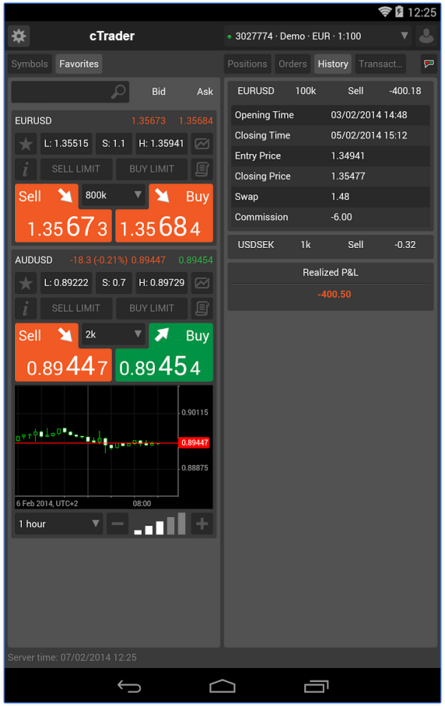

cTrader

The Kawase cTrader platform is an award-winning trading platform with a professionally designed interface. This user-friendly web platform, used by thousands of people worldwide daily, is fully customizable to suit the exact needs of the trader, ensuring that the entire trading experience is fluid and hassle-free.

What makes this platform special is that shares, indices, Forex, metals and oil can be traded from one platform.

Kawase Web cTrader Platform

There are a variety of drawing tools that enable you to customize your charts by switching from a multi-chart mode to single-chart mode, add horizontal or vertical lines to your chart and include arrows, text and shapes. You can also access technical indicators and apply them to your chart.

Setting up and logging in to your account is easy. Once you receive your confirmation email, simply log in using your designated username and password.

There are no commissions. The pricing on the platform is streamed directly from tier 1 liquidity providers without any markups. These providers are tier-1 global banks that stream prices to Kawase’s proprietary aggregator.

Mobile First

With Kawase Trader you benefit from an entire world of trading instruments in the palm of your hand. You can enjoy the very best in FX and CFD trading as a native app for both iOS and Android devices. Kawase’s mobile app delivers all of the same instruments, executions speeds, indicators and other charting tools as both the Desktop and Web applications for a uniquely smooth trading experience, from anywhere.

cTrader Mobile

Kawase cTrader mobile trading can be done from any iPhone or Android. These apps can be downloaded from Google Play Store or iOS App Store.

Kawase Mobile cTrader Platform

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |