Editor’s Verdict

Overview

Review

Headquarters | United Kingdom |

|---|---|

Regulators | GFSC |

Year Established | 2009 |

Execution Type(s) | No Dealing Desk |

Trading Platform(s) | MetaTrader 4, Proprietary platform, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Intertrader is a Gibraltar regulated, UK-based brokerage, owned and operated by GVC Holdings PLC. GVC is listed on the London Stock Exchange under the ticker symbol “GVC” and is a constituent of the FTSE 250 Index with a market capitalization exceeding £5 billion. This firm owns several brands with a combined heritage of over 250 years. Intertrader was established in 2009 as a CFD and spread betting broker with a successful management team in place.

Intertrader traders are treated to an excellent trading environment that features competitive spreads with a superb asset selection across five asset classes, direct market access (DMA) on equity trading, ECN/STP on forex trading and no dealing desk (NDD) execution on spread betting and CFD trading. The main regulator is the Gibraltar Financial Services Commission (GFSC) with limited regulation by the UK Financial Conduct Authority (FCA). GVC Holdings PLC is licensed in more than 20 jurisdictions and has offices in 18 territories across five continents.

Besides its proprietary trading platform, the full suite of the MT4 trading platform is offered. Intertrader offers services for all types of traders, from retail clients through professional traders and institutional clients. Over the past decade this broker has established itself as a prime location for traders to manage their capital and the 2018 acquisition of Sigma Trading, a specialist in the derivatives market, shows that Intertrader continues to expand across the financial sector. Prime brokerage services are provided through Argon Financial, a Category 1 Investment Dealer.

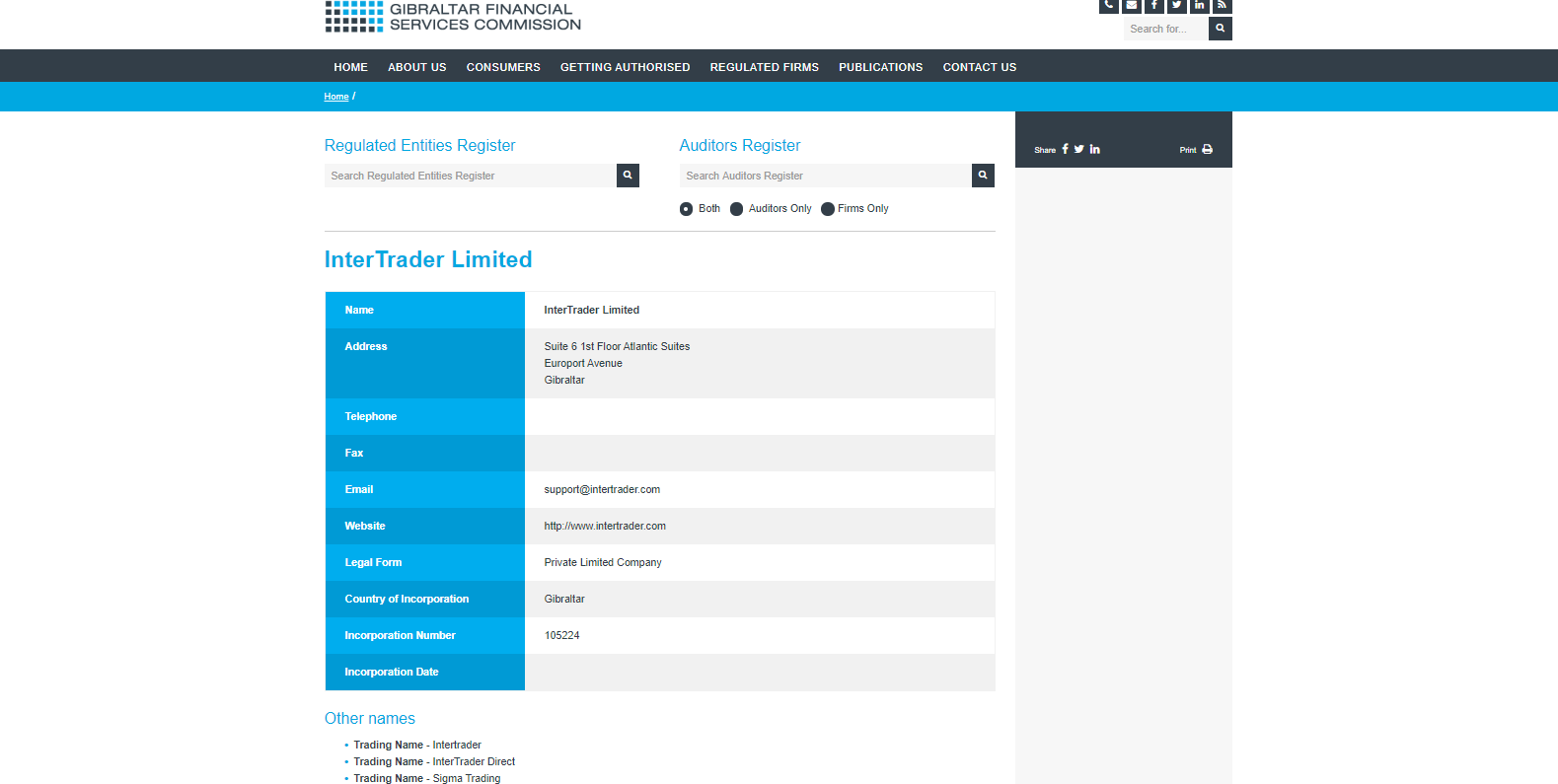

Regulation and Security

The main regulator for Intertrader is the Gibraltar Financial Services Commission (GFSC) and this broker is regulated under license number 105224. Gibraltar is a British Overseas Territory and the UK Financial Conduct Authority (FCA) has limited oversight, the GFSC is modeled after the FCA and enjoys the flexibility of a smaller jurisdiction. Since Gibraltar is a member of the European Union, it is subject to the Markets in Financial Instruments Directive 2014/65/EU or MiFID II as well as the EU’s 4th Anti-Money Laundering Directive.

Client funds are held in segregated bank accounts and protected by the Gibraltar Investor Compensation Scheme (GICS); the GICS covers accounts in the unlikely event of a default up to €20,000 maximum per client. Adding another layer of protection is the parental guarantee from bwin.party Holdings LTD on all segregated funds which cover losses in the eve of default above the €20,000 the GICS covers, therefore retail traders are 100% covered in an insolvency event by Intertrader. bwin.party holdings Ltd is an operating subsidiary of GVC Holdings PLC and the innovative parental guarantee ensures that clients receive the best protection available in the brokerage industry.

Fees

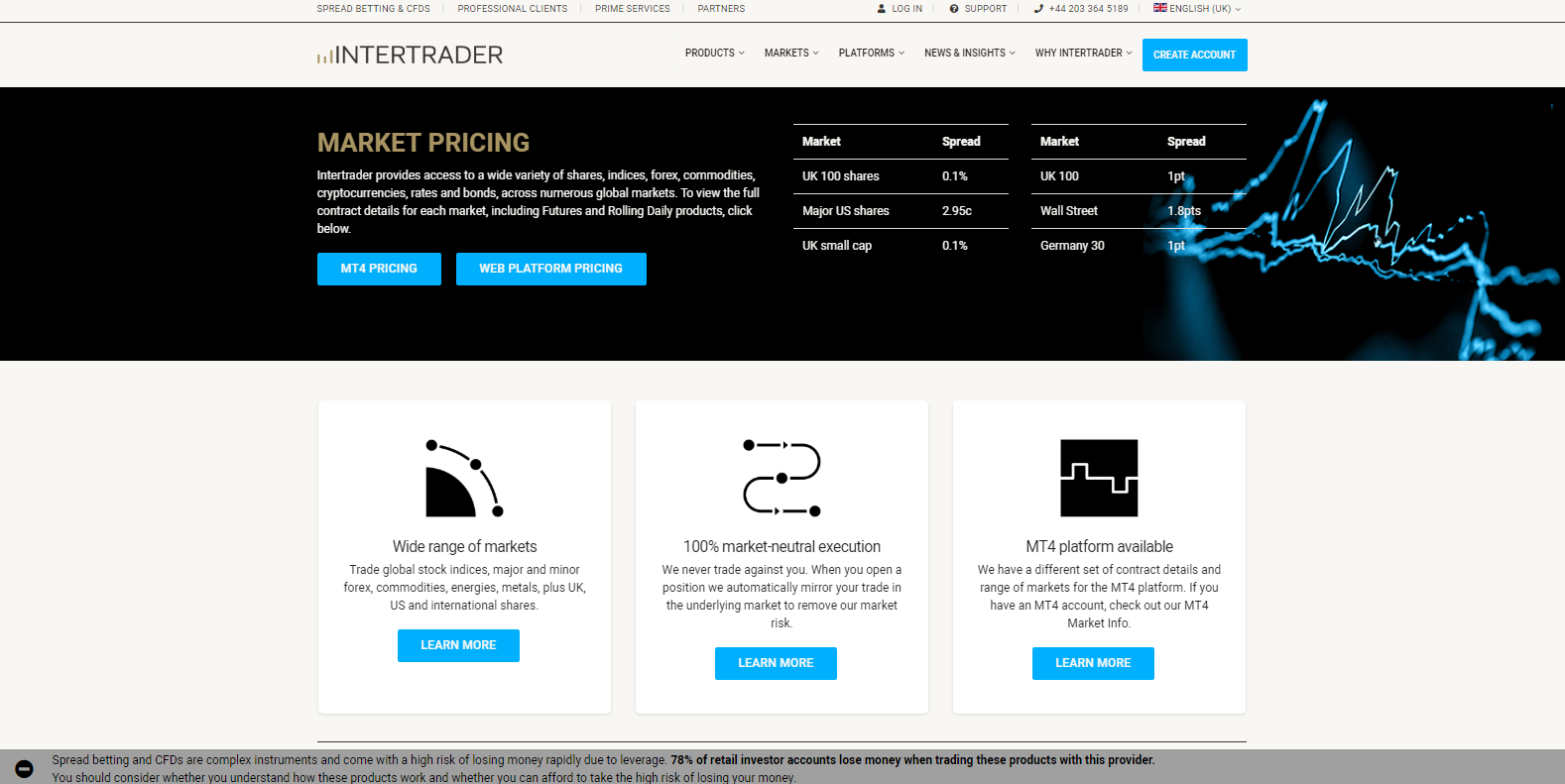

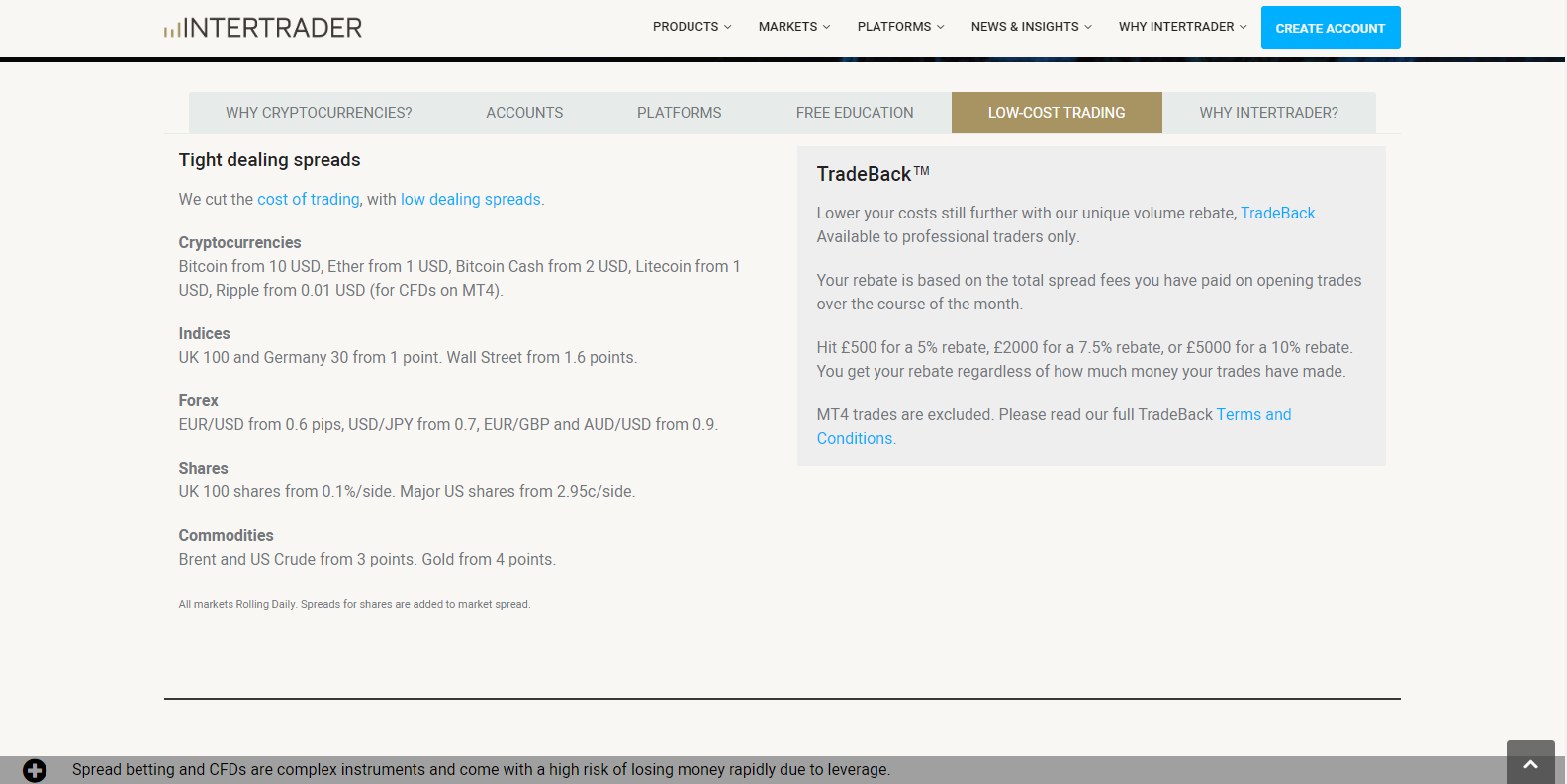

Intertrader earns all its revenues from brokerage services only and has no conflict of interest with its clients. It has a market-neutral operating model; most fees are earned through spreads and commissions. The spread on the EUR/USD starts from 0.6 pips which is a great spread with limited mark-up; commissions start as low as 0.10% while UK clients can enjoy commission-free, tax-free trading through spread betting accounts. Swap rates on overnight positions also apply and traders who manage their portfolios from the Intertrader Advanced Trading Platform will get the exact swap rates from the deal ticket.

Intertrader remains 100% market-neutral; when a trader places a trade in their spread betting or CFD account, this broker mirrors the same trade in the underlying market. This means that if a trader earns on a position, Intertrader earns the same amount; if a trader faces a loss, Intertrader faces a loss. This market neutrality results in the best trading conditions for clients as each position take at this broker is offset by a mirror trade taken by Intertrader and no money is earned by clients’ losses.

What Can I Trade

Traders have access to a deep asset pool and following Intertrader’s acquisition of Sigma Trading, DMA equity and options trading are available on most available assets. CFD and spread betting account holders can choose from stock indices, currencies, individual shares, commodities, interest rates, bonds as well as specials offered by Intertrader which includes grey market pricing on IPO’s. Regardless of what type of trader decides to take advantage of the excellent trading environment offered by this broker, the desired asset is available for trading. This allows for full cross-asset diversification of portfolios and broker-assisted trading over the phone rounds up a top-notch service.

There are hardly any limitations to what can be traded at Intertrader which allows all types of clients to diversify assets, risk and trading strategies. Intertrader gives a nice overview of all assets on their website, but traders will get a much more detailed presentation from inside the trading platform.

Spreads across the Forex market are competitive with the EUR/USD starting at 0.6 pips, commission-free.

Professional traders enjoy even better trading conditions through improved margins while trading costs are reduced via the TradeBack program in CFD and spread betting accounts.

Account Types

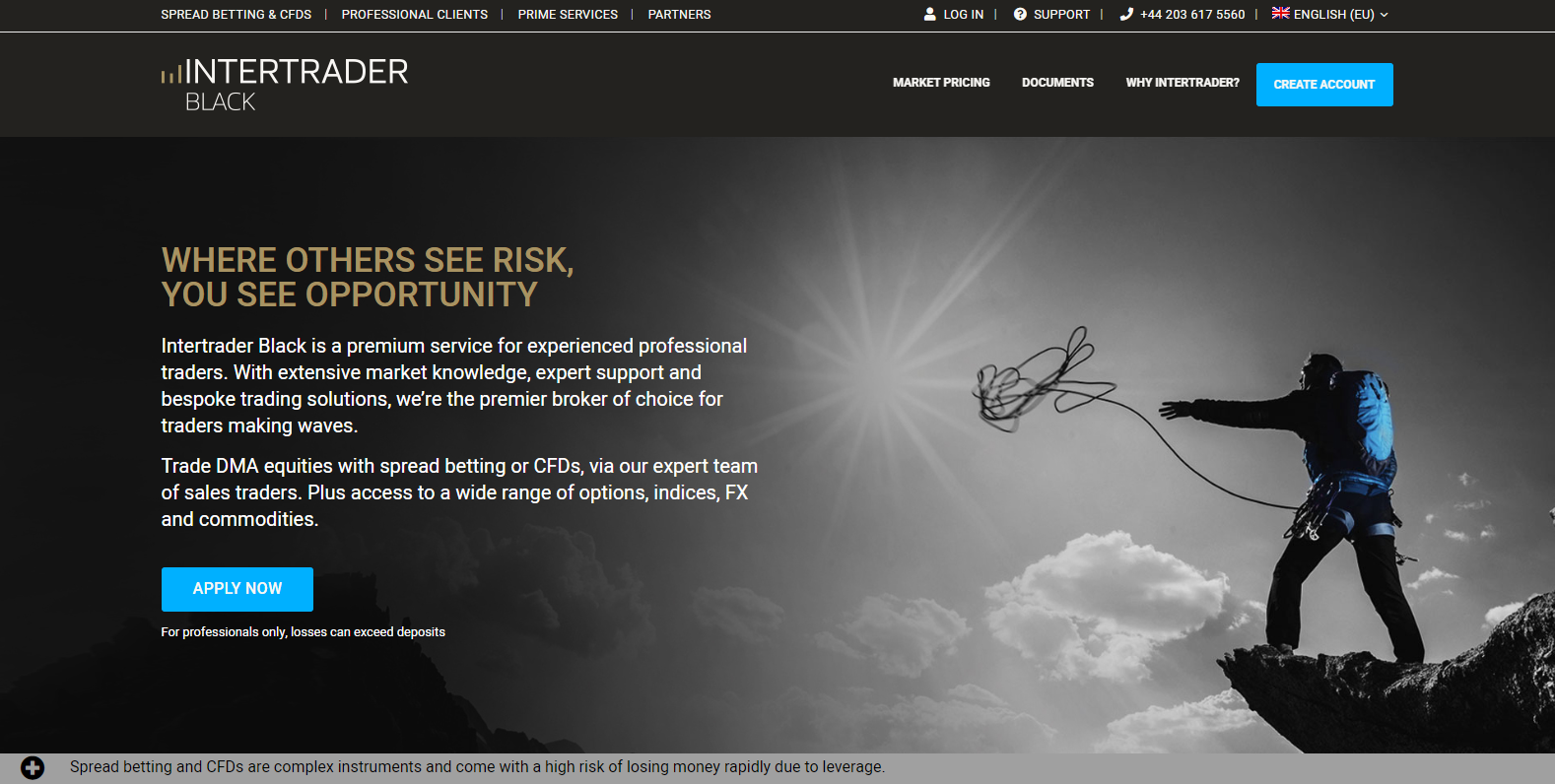

Intertrader offers CFD and spread betting accounts to all clients, while professional traders also have access to Intertrader Back for DMA equity trading. Institutional clients are served through Argon Financial. Spread betting accounts are for UK based traders as they offer tax-free trading, all international traders are best served in the CFD account where trading conditions are the same. Traders who have existing trading software built on the MT4 infrastructure will be able to migrate them to Intertrader as the MT4 platform is offered.

Within each account, all traders are treated equally. A growing trend has been to democratize the trading environment and not up-sell better conditions for higher deposits; at Intertrader, all retail traders have access to the same trading environment, while only professional traders get preferential treatment when it comes leverage. A cash-back program is also in place. This is primarily a result of changes by regulators relating to leverage; before the changes, all traders had access to maximum leverage. All brokers petitioned regulators not to implement the changes but failed at doing so.

To qualify for a professional account, traders need to have assets worth €500,000, one-year working experience in the financial market as a professional and placed 10 trades of significant size per quarter over the last four quarters.

The spread betting account is the ideal choice for UK based clients as it offers tax-free trading which leads to higher overall profitability. All non-UK clients are equally well served in CFD accounts at Intertrader where most clients will manage portfolios.

Professional traders will operate their accounts via Intertrader Black, with DMA access to equity trading, higher leverage, and the TradeBack reward program.

Institutional clients are served by Argon Financial which complements to overall services offered by Intertrader, an all-around prime brokerage.

Trading Platforms

Clients have the choice between Intertrader’s own proprietary trading platform, simply named Intertrader Advanced Trading Platform, or the popular MT4 trading platform. The Intertrader Advanced Trading Platform should be the default selection for all clients who don’t trade with automated trading solutions, which are built on the MT4 infrastructure, as it offers an overall better trading environment. Traders who have custom-built solutions that require MT4 will have access to the same great spreads and fast execution as those who trade on the Intertrader Advanced Trading Platform.

The Intertrader Advanced Trading Platform comes as a downloadable desktop version, a web platform or a mobile version for smartphones and tablets. This platform is built on the Java infrastructure and comes packed with many great features that will make trading more efficient. Intertrader, in partnership with Trading Central, offers research and analysis from inside the platform. The Autochartist feature scan assets for chart patterns which will enable retail traders to scan a broader aspect of the market with ease; another nice feature is the Bloomberg TV function which comes with the platform. The platform can be fully customized and user properties, as well as alerts, are stored securely in the cloud.

Other features embedded with the web trader are cross-platform trading charts provided by NetDania, advanced trading charts from IT-Finance, the economic calendar provided by Econoday and real-time market news by RANsquawk. Regardless if traders seek signals, scan for new ideas or wish to confirm their own signals, Intertrader offers a full suite of tools which shows that this broker cares about the success of its clients. All tools are also available on the MT4 trading platform via the Direct MT4 customized terminal offered by Intertrader.

The Intertrader web trader is how most clients will access financial markets, which is packed with an extensive range of trading tools.

The MT4 trading platform is available with full support for automated trading solutions.

Unique Features

Intertrader offers all its clients an extensive suite of free trading tools which truly enhances their trading experience. Retail traders have access to high-quality analysis and trading signals which can also improve their overall knowledge of the market. In today’s fast-paced, automated trading environment it is important to have access to automated solutions to speed up and broaden the analysis of assets and Intertrader delivers just that. Clients who prefer to follow trades of other clients can do so through ZuluTrade which is also available, this broker has spared no costs and the effort to provide a superior trading environment clearly shows.

NetDania offers plenty of tools for traders which are essential to market analysis which goes beyond charts; it was a very nice finding to see during our Intertrader review, and one which should serve traders well.

IT-Finance provides advanced trading charts with over 70 technical indicators, fully customizable and with back-testing functionality. Traders can also easily create their technical indicators and programs based on the ProBuilder language. Yutorials are available.

Trading signals are provided through a partnership with Trading Central, while Autochartist allows traders to scan multiple assets for real-time trading opportunities. Detailed technical analysis is also provided by Trading Central.

The economic calendar provided by Econoday includes all important economic releases.

ZuluTrade allows traders to follow other strategies on auto-pilot in a set-and-forget mode.

Research and Education

Most of the research and education is provided through partnerships mentioned above, but Intertrader runs its own blog where research and educational content is published weekly. While the Intertrader blog is managed nicely and is filled with good content, it would have been nice for this broker to have a dedicated educational section with at least an introduction to financial markets.

The Intertrader blog is filled with occasional educational articles as well as technical analysis which is presented well and makes for a good read, especially during breaks from active trading.

Intertrader decided to outsource education and research, for the most part, to third parties and there is nothing wrong with this approach. Clients have access to plenty of educational content through Trading Central, and countless research avenues to access. The end-product is outstanding and allows traders to manage their portfolios with a prime broker which creates a competitive edge.

Customer Support

Support Hours | 24/5 |

|---|---|

Website Languages |  |

Customer support is available Monday through Friday, 24 hours per day. This is a function most traders will never use, but in case it is required a dedicated team stands by. As confirmed during our Intertrader review, clients can either call, request a call-back or send an e-mail. An FAQ section was not found and while this broker does an excellent job explaining its products and services, it would have been nice to provide one location where most basic questions will be answered.

Bonuses and Promotions

No bonuses or promotions are offered by Intertrader, but professional clients qualify for their TradeBack program. This is a three-tiered cash-back loyalty program with rebates of up to 10%.

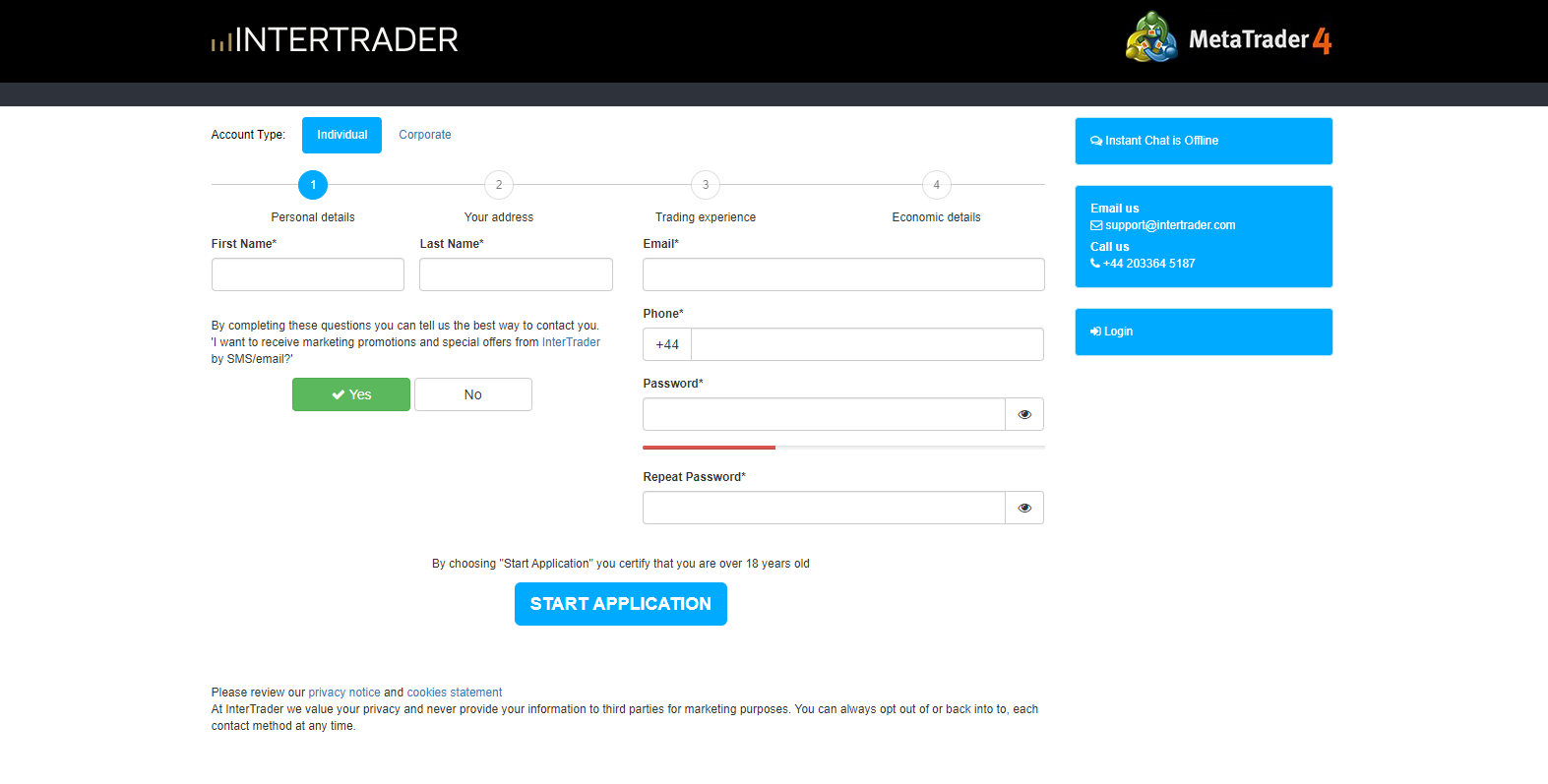

Opening an Account

Accounts are opened conveniently online as is the standard approach across all brokers. The four-step process asks for all basic information and after successful completion, clients will be asked to verify their account by sending a copy of their ID as well as proof of residency documents. This is also the standard operating procedure to satisfy AML/KYC requirements as stipulated by their regulator. Individual, as well as corporate accounts, are available for both trading platforms offered.

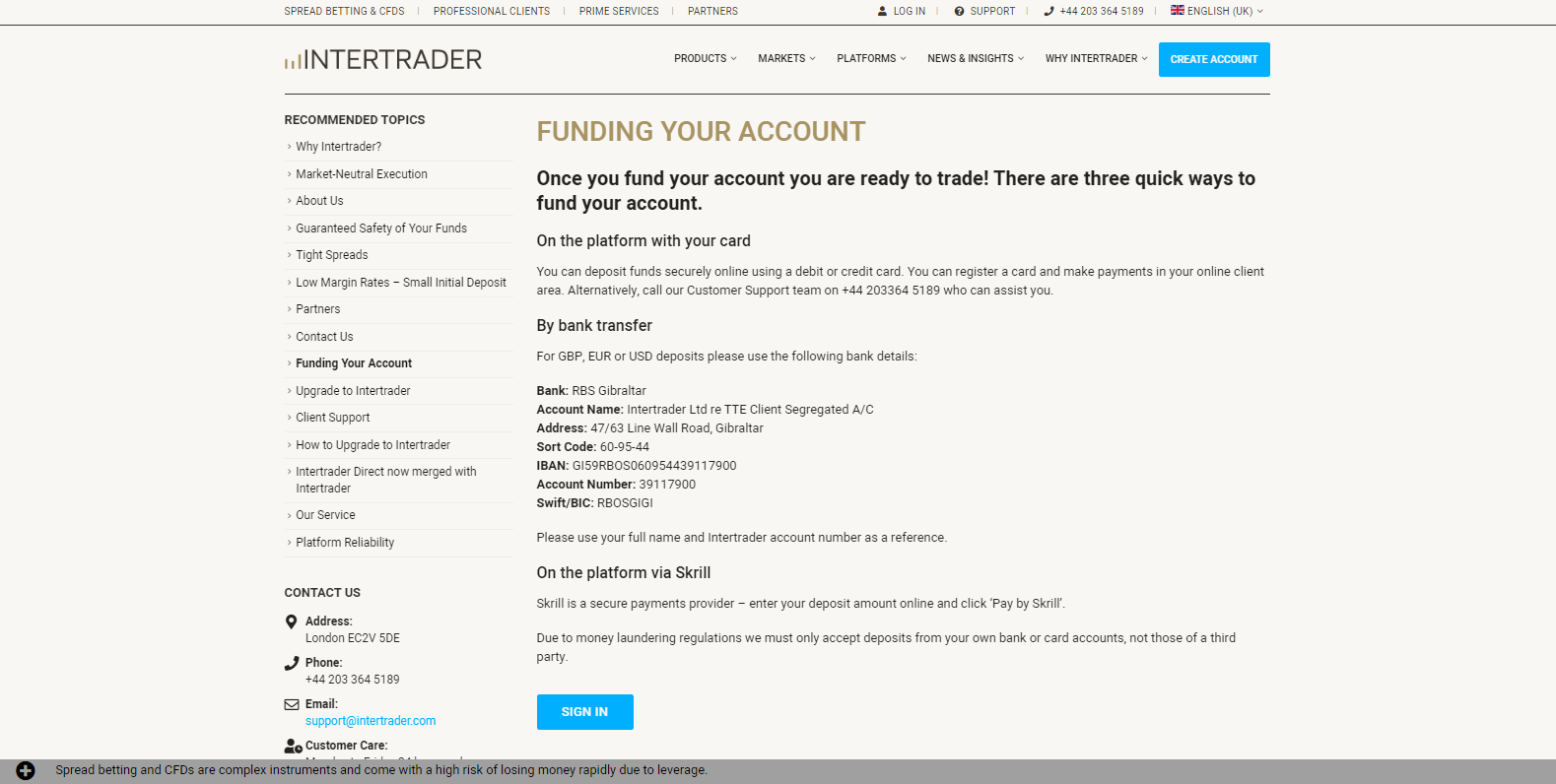

Deposits and Withdrawals

As with many other prime brokers, the deposit and withdrawal options are limited to bank wires and credit/debit cards. Intertrader offers those but has added Skrill due to the popularity of this regulated third-party processor. It would be nice to see other options added, but since most traders prefer to use credit/debit cards it should not create a problem. More details about fees and processing times were not provided which was the only oversight this review uncovered. Fees are most likely only applicable from the bank or Skrill, while Intertrader waives any deposit fees which is also standard practice. Processing times are also assumed to be standard as this broker operates at a high-efficiency level.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

Intertrader is a prime broker that fires on all cylinders, established in 2009 and owned by GVC Holdings PLC, this broker has constantly grown its business as well as market share. Regulated by the Gibraltar Financial Services Commission (GFSC) with limited oversight by the UK Financial Conduct Authority (FCA), clients can feel safe and secure that their portfolios are well taken care of. Intertrader offers the best protection for retail trading accounts available through the Gibraltar Investor Compensation Scheme (GICS) and the parental guarantee from bwin.party Holdings LTD; this ensures 100% coverage in case of a very unlikely default by this broker.

A flexible regulatory environment and outstanding trader protection is just the start for this broker, the corporate ownership of a £5 billion LSE listed company only adds to the thick layer of support. An excellent management team is driving this broker forward, as evident by strategic acquisitions while its market-neutral operating model ensures that there is no conflict of interest. Asset selection is great and spreads very competitive which allows traders to diversify their portfolios across assets with limited trading costs.

The proprietary trading platform offered by Intertrader is filled with trading tools which will make research & analysis of markets easier; trading signals, research & education as well as real-time news are provided through partnerships with third parties which further creates an edge for clients. MT4 is also available for all traders who have existing solutions build on this infrastructure and through the Intertrader Direct MT4 customized terminal, all tools which are available in the proprietary trading platform are available to MT4 portfolios.

Transparency, security and trading environment are top of the class and Intertrader offers the right solution for all types of traders and portfolios. Overall, we can conclude this Intertrader review with confidence that traders choosing this brokerage will be satisfied with the service they receive. Intertrader is headquartered in London, UK. Intertrader earns all of its revenues from spreads and commissions and maintains a market-neutral operating model. Traders can deposit into their Intertrader trading accounts through bank wires, credit/debit cards, and Skrill. The minimum trading size depends on the asset traded, but currency pairs start at 0.01 lots in the MT4 platform while CFD and spread betting sizes start a £1 per point or currency equivalent. Intertrader initiates a margin call when the equity margin level reaches 50%. Intertrader is authorized and regulated by the Gibraltar Financial Services Commission (GFSC) and this broker is regulated under license number 105224. Gibraltar is a British Overseas Territory and the UK Financial Conduct Authority (FCA) has limited oversight The maximum leverage for retail traders is 1:20 while professional traders receive up to 1:400. Intertrader has an online application form which is the standard operating procedure. Yes, Intertrader offers the MT4 trading platform on top of its own Intertrader Advanced Trading Platform.FAQs

Where is Intertrader based?

How does Intertrader make money?

How can I deposit into an Intertrader account?

What is the minimum lot size at Intertrader?

When does a margin call take place at Intertrader?

Is Intertrader regulated?

What is the maximum leverage offered by Intertrader?

How do I open an account with Intertrader?

Does Intertrader offer the MetaTrader Trading Platform?