IG Markets Editor’s Verdict

IG Markets US is the US subsidiary of UJK brokerage powerhouse IG Markets, but unlike its international offering, IG Markets US is a pure-play Forex broker which has grown into one of the leading US Forex brokers. I decided to review IG Markets US to determine if its commission-free trading environment offers the promised cost advantage. Does IG Markets US deserve the praise it gets?

Overview

As far as US-based Forex brokers go, I believe IG Markets US presents one of the best choices, if not THE BEST choices on the market.

Traders get a great selection of currency pairs, offering excellent trading opportunities, a competitive commission-free trading environment. and superb trading platforms. I can also recommend the IG Academy to beginner traders, where IG Markets US delivers an industry-leading service.

Headquarters | United Kingdom |

|---|---|

Regulators | FCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1974 |

Execution Type(s) | Market Maker |

Minimum Deposit | $250 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, Proprietary platform |

Average Trading Cost EUR/USD | 0.9 pips |

Average Trading Cost GBP/USD | 1.4 pip |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.30 |

Average Trading Cost Bitcoin | $90 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.8 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 3(credit/debit card, HK FPS or via bank transfer.) |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

IG Markets US Main Features

Retail Loss Rate | Undisclosed |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.8 pips |

Minimum Commission for Forex | Commission-free |

Commission for CFDs/DMA | Not applicable |

Volume Rebates | Yes |

Minimum Deposit | $250 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | No |

Inactivity Fee | $12 monthly after 24 months of inactivity |

Deposit Fee | Yes |

Withdrawal Fee | Third-party |

Funding Methods | 3 |

IG Markets Regulation and Security

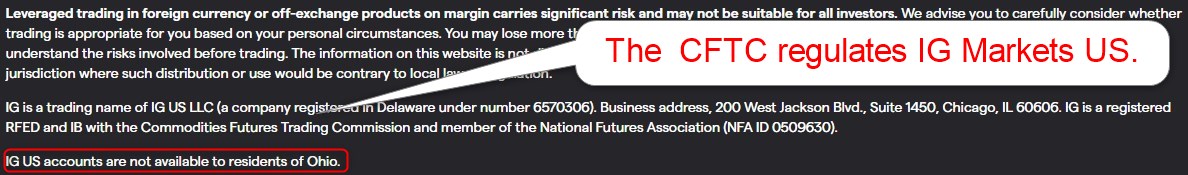

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. IG Markets presents clients with one regulated entity for US traders, which is also the only necessary regulation for Forex brokers operating out of the United States.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

US | Commodity Futures Trading Commission/NFA | NFA ID 0509630 |

IG Markets US officially launched in 2019, and the Commodity Futures Trading Commission (CFTC) regulates this broker. It is also a member of the National Futures Association (NFA), created by the CFTC. IG Markets US follows the industry standard for US regulations but has faced criticism in 2021.

In January 2021, a spike in market volatility caused outages at IG Markers US, and traders could not manage their positions, leading to avoidable trading losses. Reports from two sources indicated that IG Markets US failed to provide customer support and did not answer phone calls. At the same time, it was quick to react to commentary to protect its image and deny accusations made by clients.

Since IG Markets US is a Forex broker, it does not offer traders Securities Investor Protection Corporation (SIPC) protection, which does not cover currencies. However, since IG Markets US is part of IG Group, publicly listed in the UK on the London Stock Exchange (LSE), and a member of the FTSE250 index, I do not consider this an issue. Traders can confidently trade with IG Markets US and trust this broker with deposits and portfolios.

IG Markets Fees

Average Trading Cost EUR/USD | 0.9 pips |

|---|---|

Average Trading Cost GBP/USD | 1.4 pip |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.30 |

Average Trading Cost Bitcoin | $90 |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.8 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | $12 per month after 24 months |

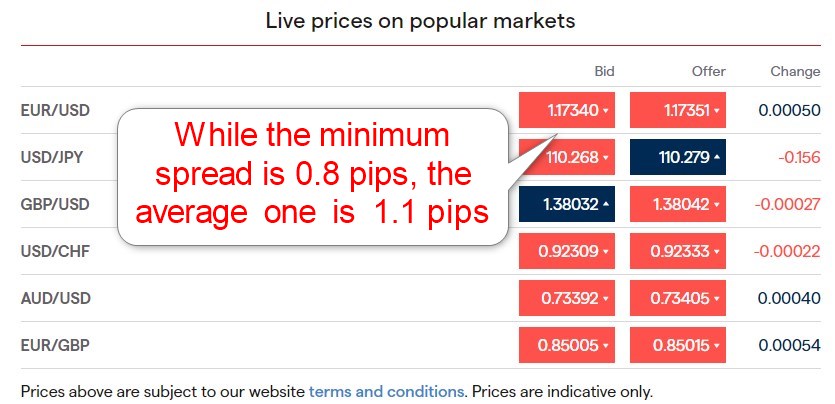

While IG Markets does not offer commission-based raw spreads, it provides traders with the best commission-free pricing environment in the US and complements it with deep liquidity. The minimum mark-up of 0.8 pips applies to the EUR/USD and USD/JPY. It is at least 20% lower versus Forex.com, Oanda, and TD Ameritrade, but I find it interesting that it is 25% higher compared with the 0.6 pips spread available to all non-US traders at IG Markets.

Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.8 pips (minimum) | $0.00 | $8.00 |

1.1 pips (average) | $0.00 | $11.00 |

While the minimum spread is 0.8 pips or $8.00 per 1.0 standard lot, the average cost is 1.1 pips or $11.00. For a US-based broker, this ranks at the top.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Usually, MT4 traders can easily access swap rates from their platform by following these steps, but IG Markets does not provide this information:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

While IG Markets US provides two examples of trading costs and how swap rates apply, I dislike the lack of complete transparency. The document available on the IG Markets US websites shows a 0.5% annual administration fee, a cost absent at most brokers, plus a 0.5% currency conversion cost.

IG Markets US also charges a £12 monthly inactivity fee after twelve months of dormancy. It is more of a nuisance than a cost most traders will face.

What Can I Trade on IG Markets

IG Markets US is a pure Forex broker, providing traders with 87 currency pairs, an excellent choice, but no other assets. I like the selection for Forex traders, but cross-asset portfolio diversification is impossible at IG Markets US.

Asset List and Leverage Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | 0 |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

IG Markets US Leverage

The maximum leverage available at IG Markets US is 1:50, but it only applies to a few currency pairs, with 1:30 and 1:20 the most frequent ones. This is not as generous as leverage offered in other jurisdictions, but is standard in the US to protect traders from extreme losses.

IG Markets US Trading Hours

Asset Class | From | To |

|---|---|---|

Forex | Monday 00:00 | Friday 24:00 |

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

IG Markets Account Types

Since IG Markets US only offers Forex trading, it maintains the same account type for all clients. The minimum deposit is $250, higher than at many brokers but well within a reasonable range. I appreciate a broker that does not upsell better trading conditions for more substantial deposits.

IG Markets US Demo Account

IG Markets US has a $10,000 demo account, and there appears no time limit. I like the unlimited duration but prefer a flexible account balance, allowing traders to select one similar to their initial deposit. Demo trading lacks real-life trading experiences, and an excessive amount makes it that much more unrealistic.

IG Markets Trading Platforms

Besides the competitive proprietary web-based trading platform at IG Markets US, traders can use ProRealTime, one of the best trading platforms available for committed traders. IG Markets US also maintains MT4 and upgrades it with 18 add-ons plus Autochartist. I like that IG Markets US supports algorithmic trading via MT4 and ProRealTime. MT4 also comes with an integrated copy trading service. I want to note that traders must place a minimum of four trades per month for free access to ProRealTime. Otherwise, a $40 monthly fee applies.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

The three unique features at IG Markets US standing out to me are deep liquidity, the extensive upgrade package for MT4, ensuring one of the best MT4 trading environments, and the availability of ProRealTime.

Research and Education

Traders get a quality selection of in-house research and trading ideas on the IG Markets US blog. I think it makes a thought-provoking read and grants a different market perspective. IG Markets US also provides trading signals generated by Autochartist and PIA-First, embedded in the proprietary trading platform.

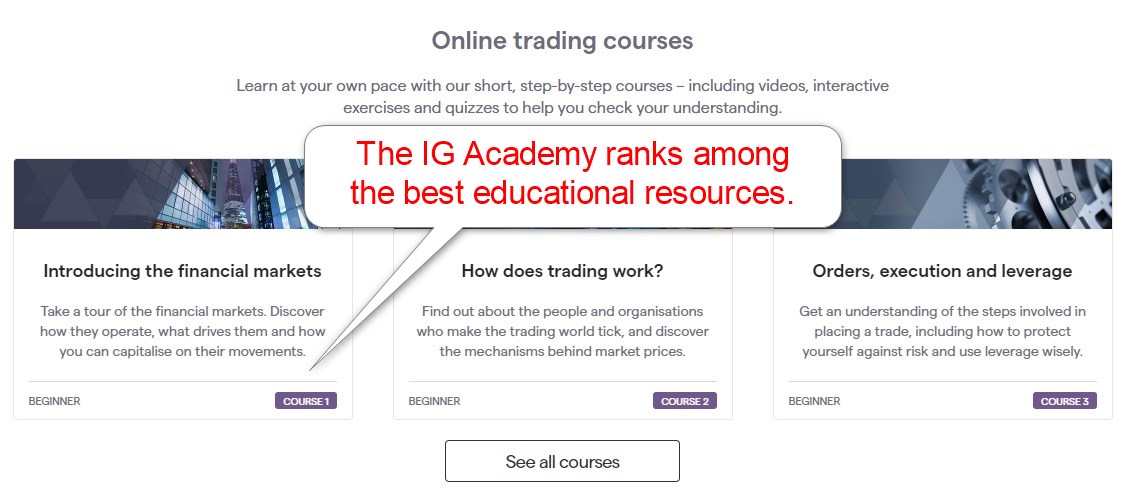

One of the best features at IG Markets US is the IG Academy, which I rank among the best industry wide. The step-by-step courses feature video content, videos, and quizzes, and I highly recommend beginner traders to take full advantage of the IG Academy. Webinars, seminars, and other educational material complement the superb educational offering at IG Markets US.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/5 |

Website Languages |           |

I am disappointed with customer support at IG Markets US and not surprised it came under heavy criticism. IG Markets US only lists two phone numbers at the bottom of most web pages, one for new clients and one for existing ones. An e-mail address is available only for marketing partnerships. IG Markets US does not provide operating hours and relies on its FAQ section for the bulk of support.

Bonuses and Promotions

Active traders can reduce spreads via a three-tier volume-based rebate program. The lowest tier requires a nominal monthly trading volume of $100 million for a 5% trading cost reduction. While I appreciate the program, as any reduction in trading costs makes a notable difference, the compensation ranks towards the bottom compared to other brokers. Terms and conditions apply, and I recommend traders read them before participating.

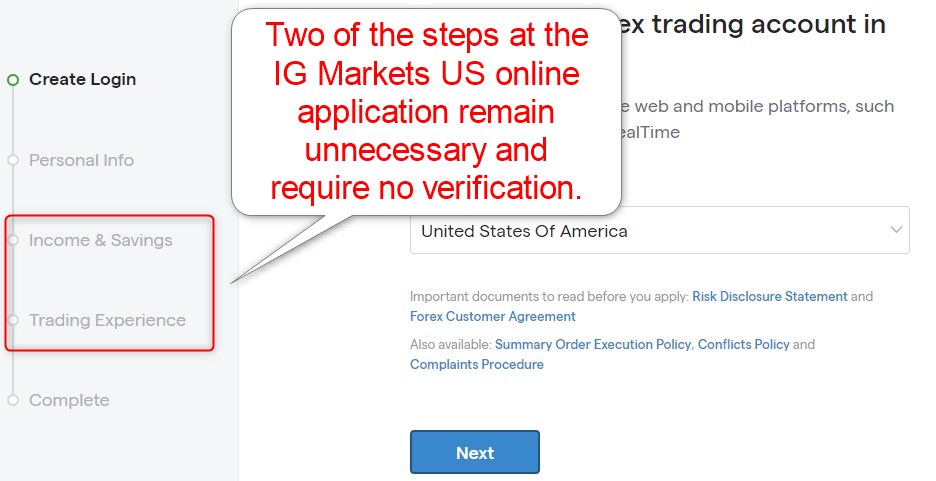

Opening an Account

The online application at IG Markets US remains swift, but I dislike two sections that collect unnecessary information. While regulators often require them, traders may fill them out at will without verification. New traders must submit a copy of their ID. They must also verify their credit/debit card or bank account before depositing.

IG Markets Minimum Deposit

The minimum deposit at IG Markets US is $250. It is higher than most brokers but within a reasonable demand.

Payment Methods

IG Markets US offers bank wires, automated clearing house (ACH), and debit cards, a limited selection typical for US-based brokers. I find the choices unacceptable and prefer third-party payment processors. They remain superior and allow traders to keep trading activities and day-to-day transactions separate.

Accepted Countries

IG Markets US only accepts traders from the US except from the state of Ohio. There is no explanation provided for this exclusion.

IG Markets Deposits and Withdrawals

The back office, also known as My IG, handles all financial transactions. IG Markets US does not levy internal fees but passes on third-party processor costs. The process itself remains straightforward, but I cannot ignore the absence of choices, which is frustrating, but not uncommon for US-based brokers. Traders can only withdraw the amount they deposited via debit card. The rest must go via bank wire, the most expensive method to transact today. It is typical for US brokers, who lack the options their international counterparts provide.

Bottom Line

I like the trading experience at IG Markets US for pure Forex traders. With 87 currency pairs, it offers a broad choice with plenty of trading opportunities. Trading costs remain at least 20% cheaper compared to Forex.com, Oanda, and TD Ameritrade. It makes a notable difference, especially for active traders. I also like the choice of trading platforms, consisting of a competitive proprietary trading platform, ProRealTime, and MT4.

FAQs

Is IG trading available in Australia?

IG caters to Australian clients from its Australian subsidiary regulated by the Australian Securities & Investments Commission(ASIC) under AFSL Number 220440 and AFSL Number 515106.

Is IG regulated by the UAE?

IG manages a subsidiary in the UAE with oversight from the Dubai Financial Services Authority (DFSA) under reference number F001780.

How long do IG withdrawals take?

IG processes withdrawal requests received before noon (UK time), but it can take up to five business days for a client to receive funds, dependent on the payment processor.

Is the IG platform safe?

IG offers traders a choice of secure trading platforms, including its proprietary web based CFD platform and L2 Dealer for investors, MT4, ProRealTime, and API trading.

What is IG leverage?

IG leverage depends on the operating subsidiary and asset, with a maximum of 1:200.

Who owns IG Markets?

IG Markets is a publicly listed company in the UK and a constituent within the FTSE 250. Therefore, investors own IG Markets.

What type of broker is IG?

IG is a market maker and liquidity provider to other brokers.

Is IG good for day trading?

IG offers day traders ideal conditions, including excellent order execution, low trading costs, and deep liquidity.

What is the minimum deposit for IG?

The minimum deposit at IG is $250, slightly higher versus many brokers, but within a reasonable range and a more-than-worthy trading environment.

Is IG trading free?

IG offers commission-free CFD trading and share dealing in US-listed equities, but leveraged traders must consider financing costs, while a competitive commission structure applies to non-US stocks. Overall, IG is one of the cheapest brokers industry-wide.

Is IG good for beginners?

IG is an outstanding choice for beginners due to its high-quality educational content, with the IG Academy at its core. It also publishes special reports, features podcasts, webinars, and seminars, has a subscription-based service, and delivers in-house trading recommendations.

Is my money safe with IG?

IG remains one of the safest brokers globally with an exceptional track record, maintaining a highly secure environment with an industry-leading infrastructure.

Is IG good for investing?

IG offers an excellent investment portfolio with direct share dealing with highly competitive costs, internally managed IG Smart Portfolios, and Flexible ISA accounts for UK-based retirements planers.