IC Markets Editor’s Verdict

IC Markets is a prime choice for algorithmic traders and scalpers. It maintains excellent trading costs, high leverage, low latency connectivity, and superior liquidity. I reviewed this broker to determine if IC Markets delivers on their competitive trading conditions. Will they help you increase your profitability?

Overview

The Best Overall Broker for Algorithmic Traders and Scalpers.

Headquarters | Australia |

|---|---|

Regulators | ASIC, CySEC, FSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2010 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $200 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, cTrader |

Average Trading Cost EUR/USD | 0.0 pips ($0.00) |

Average Trading Cost GBP/USD | 0.0 pips ($0.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.05 |

Average Trading Cost Bitcoin | $12.47 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

More than 60% of all executed trades at IC Markets are algorithmic as IC Markets delivers the best overall trading environment for algorithmic trading and scalpers. It also caters to social traders with three copy trading services, while beginner traders benefit from a high-quality educational platform and excellent 24/7 customer support.

IC Markets Main Features

Retail Loss Rate | 75.0% |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.6 pips |

Minimum Commission for Forex | $6.00 per round lot |

Commission for CFDs/DMA | 0.10% or $0.04 per share |

Commission Rebates | No |

Minimum Deposit | $200 |

Demo Account | Yes |

Managed Account | Yes |

Islamic Account | Yes |

Inactivity Fee | No |

Deposit Fee | No |

Withdrawal Fee | Third-Party |

Funding Methods | 15 |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. IC Markets presents clients with four well-regulated subsidiaries.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Australia | Australian Securities & Investments Commission | AFSL No. 335692 |

Seychelles | Financial Services Authority | License Number SD018 |

Bahamas | Securities Commission of The Bahamas | License Number SIA-F214 |

Cyprus | Cyprus Securities and Exchange Commission | License Number 362/18 |

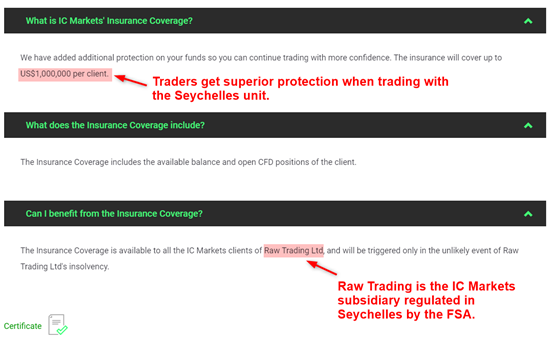

IC Markets segregates client deposits from corporate funds and offers negative balance protection. I prefer the trader-friendly regulatory jurisdiction at the Seychelles unit, where clients also get a $1,000,000 insurance policy against the unlikely event of default. IC Markets maintains a spotless operational history for over fourteen years and seeks to maintain its superb reputation.

Does IC Markets accept US clients?

No, IC Markets does not accept U.S. clients and lacks NFA/CFTC authorization to onboard US persons. Browse licensed forex brokers in the United States.

IC Markets Fees

Average Trading Cost EUR/USD | 0.0 pips ($0.00) |

|---|---|

Average Trading Cost GBP/USD | 0.0 pips ($0.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.05 |

Average Trading Cost Bitcoin | $12.47 |

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.6 pips | $0.00 | $6.00 |

0.0 pips | $6.00 (cTrader) | $6.00 |

0.0 pips | $7.00 (MT4/MT5) | $7.00 |

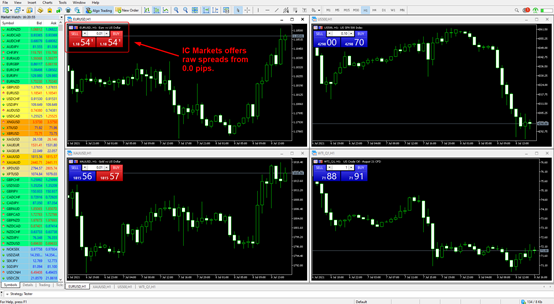

Here is a screenshot of the IC Markets MT5 trading account during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

IC Markets’ commission-free Forex costs start with mark-ups from 0.6 pips or $6 per 1.0 standard lot. As a high-frequency trader, I prefer the commission-based alternative with raw spreads from 0.0 pips. The commission is $6 per lot for cTrader and $7 per lot for MT4/MT5. The pricing difference lowers profit potential by 16.67% for MT4/MT5 traders. Since it remains at the discretion of IC Markets, it represents the only negative.

Equity traders pay a fee of 0.10% except for US-listed equities, where the cost is $0.02 per share per side. Swap rates on leveraged overnight positions apply, together with third-party payment processor costs. IC Markets does not charge an inactivity fee, which I appreciate.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-based IC Markets Raw Spread account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $7.00 | -$5.23 | X | $12.23 |

0.0 pips | $7.00 | X | -$0.47 | $7.47 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $7.00 | -$29.61 | X | $36.61 |

0.0 pips | $7.00 | X | -$3.36 | $10.36 |

IC Markets Trading hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:01 | Friday 23:57 |

Cryptocurrencies | Sunday 00:05 | Saturday 23:59 |

Commodities | Monday 01:00 | Friday 23:59 |

Crude Oil | Monday 01:00 | Friday 23:57 |

Gold | Monday 00:02 | Friday 23:57 |

Metals | Monday 01:00 | Friday 23:57 |

Equity Indices | Monday 01:00 | Friday 23:55 |

Stocks | Monday 01:10 | Friday 22:55 |

Bonds | Monday 01:00 | Friday 23:55 |

Futures | Monday 01:00 | Friday 23:59 |

What Can I Trade

Traders have 61 currency pairs and 13 cryptocurrency pairs, placing IC Markets in the middle of the competition. It shines with 1,659 equity CFDs and 25 index CFDs, offering traders an excellent selection. Completing the available markets are 22 commodity CFDs, eleven bond CFDs, and four bond CFDs. Overall, IC Markets maintains a well-balanced choice of trading instruments.

Asset List and Leverage Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Futures | |

Synthetics |

IC Markets Leverage

ASIC and CySEC cut retail leverage to an uncompetitive 1:30. As an active trader, this cuts into trading profits, which to me is not acceptable. The Seychelles and Bahamas maintain maximum leverage of 1:500.

IC Markets Trading Hours

Cryptocurrency trading is available Sunday through Thursday between 00:05 and 23:59, on Friday from 00:05 to 23:55, and on Saturday from 01:05 to 17:00. Forex traders can place orders Monday through Thursday between 00:01 and 23:59 and on Friday between 00:01 and 23:57. The same applies to commodities, except the starting times are 01:02. US equity trading is available Monday through Friday between 16:35 and 22:55. All times are server time, and the ones listed above are UTC+2.

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

I like the commission-based Raw Spread account at IC Markets, ideal for high-frequency, high-volume traders. The commission-free Standard version is best-suited for scalpers if they scalp major currency pairs.

The minimum deposit for either option is $200, which is higher than at many brokers, but I think well worth the excellent trading environment. An Islamic Account is available, where swap rates remain replaced by fixed commissions per lot.

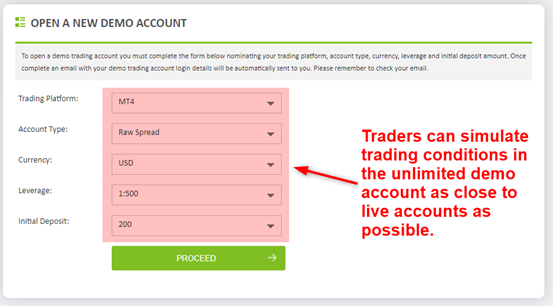

IC Markets delivers one of the best demo accounts. It is unlimited, and traders can also simulate trading conditions as close to live accounts as possible.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

I like that IC Markets offers the full suite of MT4/MT5 and cTrader trading platforms. It also presents its MT4 Advanced Trading Tools upgrade. It consists of 20 unique trading tools, ensuring traders have a competitive edge. The MAM/PAMM modules support retail account management, and VPS hosting is a tool for algorithmic traders.

IC Markets enables copy trading via Myfxbook Autotrade and ZuluTrade, while MT4/MT5 also has an integrated copy trading platform. My IC Markets VPS review found services from Forex VPS, Beeks FX VPS, and New York City Servers. Algorithmic traders with a monthly volume of 15 lots get VPS hosting of charge.

Overview of Trading Platforms

MT4 | Yes |

|---|---|

MT5 | Yes |

cTrader | Yes |

Proprietary Platform | No |

Automated Trading | Yes |

Social Trading / Copy Trading | Yes |

MT4/MT5 Add-Ons | Yes |

Guaranteed Stop Loss | No |

Negative Balance Protection | Yes |

Unique Feature One | Excellent trading tools for MT4 |

Unique Feature Two | VPS hosting and superior trade execution |

Mobile Trading

IC Markets offers all trading platforms like mobile apps. They remain ideal for portfolio management and social trading on the go. Chart trading and single-tap order execution are available. The MT4 mobile app requires Android 4.0+ and cTrader 4.1+.

Unique Features

Besides liquidity aggregation from 50 banks and dark pool liquidity providers, I find the daily trade execution stats a unique feature. With 500,000+ executed transactions, 60%+ from algorithmic trading solutions, and $29+ billion in Forex volume, IC Markets operates the largest Forex broker globally. In March 2021, IC Markets achieved trading volumes of $1.04 trillion.

One negative I want to mention is that API trading is only available for cTrader, which only impacts a small group of traders.

Research and Education

The IC Markets blog offers traders high-quality research and trading ideas. It consists of six categories, and I recommend the Fundamental Analysis and the Technical Analysis, which are excellent reads. The WebTV by Trading Central adds value to the research section at IC Markets.

IC Markets presents beginner traders with a fantastic educational platform. I recommend new traders begin with the video tutorials and then the 10-lessons Getting Started trading course. Another excellent service is webinars at IC Markets. Seven experts host them in English, Spanish, Chinese, Portuguese and Thai. The podcasts, hosted by two presenters, add value and remain very popular among a younger generation of traders.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |            |

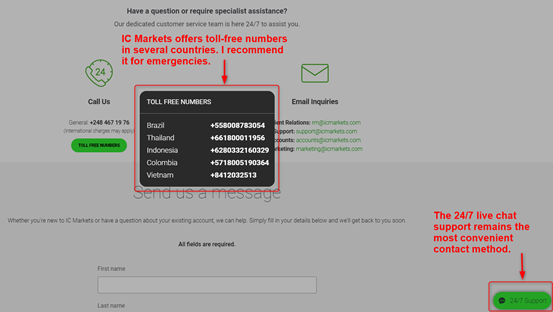

Traders have access to 24/7 customer support. I recommend the Help Center first, as it answers many questions. The live chat feature offers swift access to a representative, but I recommend phone support for critical questions. A callback request is also available. IC Markets does not specify which languages are offered besides English but explains its products and services well.

IC Markets Bonuses and Promotions

IC Markets does not offer bonuses or promotions, but I find the trading environment superior to incentives. I view it as a bonus that does not require additional incentives to attract new clients.

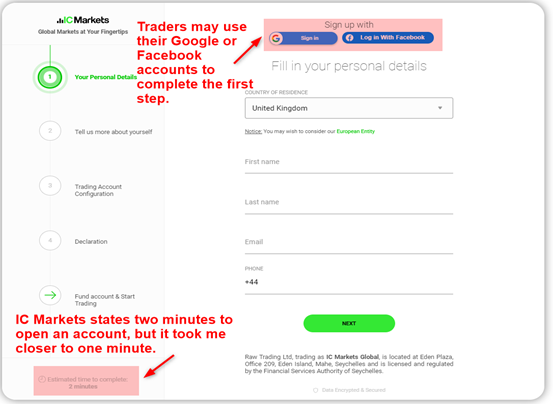

Opening an Account

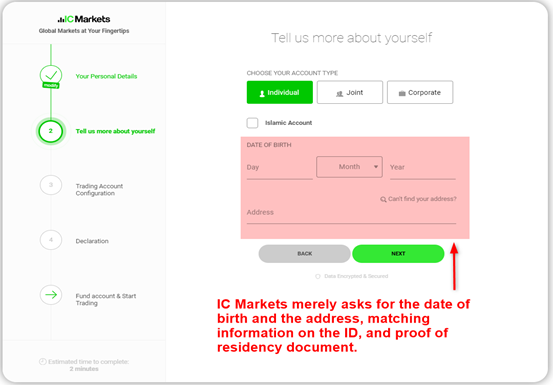

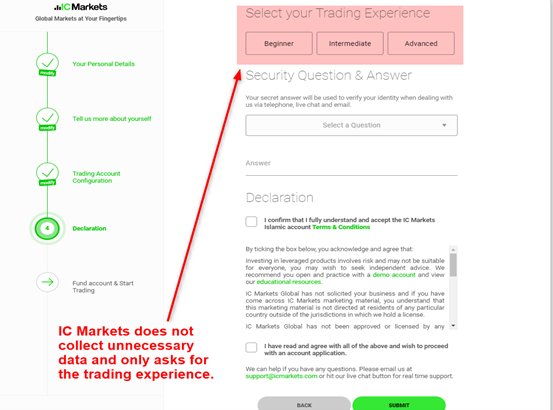

I find the account opening process at IC Markets among the best I have encountered. It takes less than two minutes, and IC Markets does not ask unnecessary questions. Traders may use their Google or Facebook accounts to complete the first step. Account verification remains mandatory, in line with KYC/AML requirements. New clients usually satisfy it by submitting a copy of their ID and one proof of residency document.

Here is the four-step account opening process at IC Markets:

Step One

Step Two

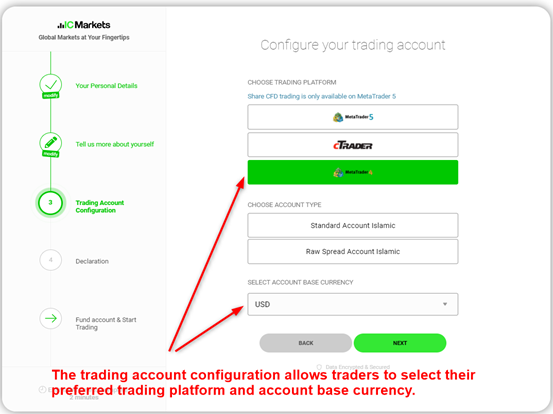

Step Three

Step Four

IC Markets Minimum Deposit

The minimum deposit at IC Markets for all three account types is $200. It is slightly higher than most brokers but within a reasonable range. I think the trading environment warrants it.

IC Markets Payment Methods

IC Markets offers bank wires, credit/debit cards, PayPal, Neteller, Neteller VIP, Skrill, Union Pay, BPay, FasaPay, Broker to Broker, POLi, Thai Internet Banking, Rapidpay, Klarna and Vietnamese Internet Banking as payment methods.

Deposits and Withdrawals

IC Markets offers an excellent choice of deposit and withdrawal methods, with only cryptocurrencies missing. There are no internal costs, except for a $20 bank wire fee, a charge levied by all brokers. Third-party payment processor costs apply, which IC Markets has no influence over.

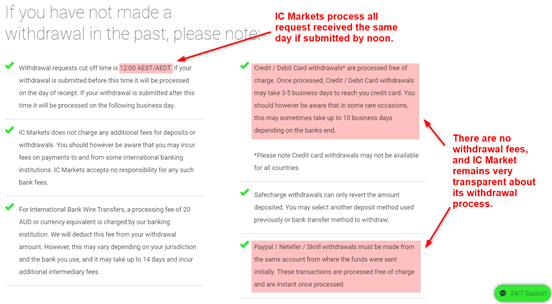

IC Markets Withdrawal Review

Traders will conduct all financial transactions from the secure back office. I like that IC Markets ensures withdrawals remain as swift as deposits. It processes all withdrawal requests received before noon AEST/AEDT the same day. No fees apply except for the $20 bank wire cost. Traders should check payment processor costs to determine the most efficient method, which varies by geographic location.

The Bottom Line

I like the trading experience at IC Markets as the trading environment is superb. I rank it among the best industry-wide due to deep liquidity resulting in raw spreads of 0.0 pips for numerous currency pairs. The execution speed is excellent, and IC Markets remains ideal for algorithmic strategies, high-frequency traders and scalpers. For a deposit of $200, traders get maximum leverage of 1:500 in one of the most secure trading environments from the Seychelles subsidiary. IC Markets remains one of the best overall brokers with a product and services portfolio with which most brokers cannot compete. IC Markets processess withdrawal requests the same day if received before noon AEST/AEDT, otherwise the next business day. It can take up to seven business days for traders to receive the funds, dependent on the payment processor. IC Markets has a commission-based Raw Spread account with costs between $6 and $7 per lot. Equity traders pay a commission of 0.10% per trade, except for the US, where the fee is $0.02 per share per side. IC Markets has regulatory oversight from the ASIC, the FSA, the SCB and the CySEC. IC Markets ranks among the best brokers for scalping due to tight spreads, deep liquidity, excellent execution speed, and high leverage. IC Markets is one of the best brokers industry-wide as it offers one of the most competitive trading environments, supplemented with superb value-added services.FAQs

How long does IC Markets withdrawal take?

Does IC Markets take commissions?

Is IC Markets a regulated broker?

Is IC Markets good for scalping?

Is IC market a good broker?