FXPRIMUS Editor’s Verdict

FXPrimus offers traders the out-of-the-box MT4, MT5, and cTrader trading platforms. All three support algorithmic trading and come with integrated copy trading services. High leverage and low trading costs make the Primus Zero account a competitive one traders should consider. I reviewed this broker to determine if its growing trader base of 300K+ is getting competitive trading conditions. Is FXPrimus the right broker for you?

Overview

Competitive commission-based MT4 accounts for high-frequency traders.

Review

Headquarters | Cyprus |

|---|---|

Regulators | CySEC, FSCA, VFSC |

Year Established | 2009 |

Execution Type(s) | Market Maker |

Minimum Deposit | $500 (initial), $100 (subsequent) |

Trading Platform(s) | MetaTrader 4 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 - 1.5 pips |

Minimum Standard Spreads | 0.2 pips |

Minimum Commission for Forex | $5.00-$15.00 /lot |

Funding Methods | 9(visa, trustpay, neteller, fasapay, unionpay, crypto, ecopayz, safecharge, emerchantpay) |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

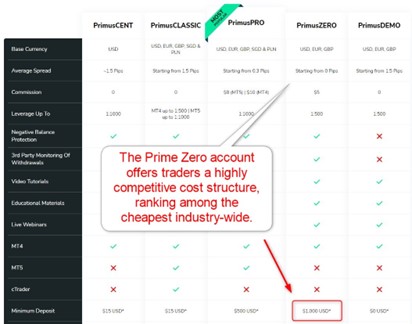

I like the Primus Zero account, as it offers high leverage and a very competitive commission-based pricing environment with raw spreads of 0.0 pips for a commission of $5.00. The minimum deposit requirement is $1,000, but I think it is well worth it for high-frequency traders.

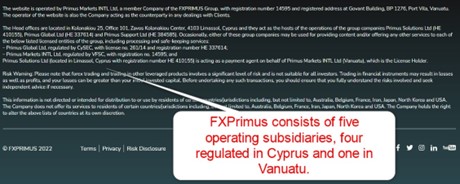

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. FXPrimus presents clients with two regulated entities and maintains an overall secure trading environment.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

Cyprus | Cyprus Securities and Exchange Commission | 261/14 |

Vanuatu | Vanuatu Financial Services Commission | 14595 |

Is FXPrimus Legit and Safe?

FXPrimus is a legit and safe broker, fully compliant with two regulators. Traders at the CySEC subsidiary get an investor compensation fund, covering up to 90% of deposits up to a limit of €20,000. FXPrimus segregates client deposits from corporate funds, offers negative balance protection, and has a clean regulatory track record with over twelve years of experience.

International clients will trade with the Vanuatu subsidiary, while EEA traders deal with the CySEC unit. Primus Global, the CySEC-licensed entity, acts as the headquarters for the group and Primus Solutions Ltd (HE 410155), Primus Global Ltd (HE 337614), and Primus Support Ltd (HE 384585). All three may provide services to Primus Global and Primus Markets INTL, the Vanuatu subsidiary.

Fees

I rank trading costs among the most defining aspects when evaluating an exchange, as they directly impact profitability. FXPrimus offers traders commission-free Forex trading with either spreads or a highly competitive commission-based alternative.

Minimum Raw Spreads | 0.0 - 1.5 pips |

|---|---|

Minimum Standard Spreads | 0.2 pips |

Minimum Commission for Forex | $5.00-$15.00 /lot |

Deposit Fee | |

Withdrawal Fee |

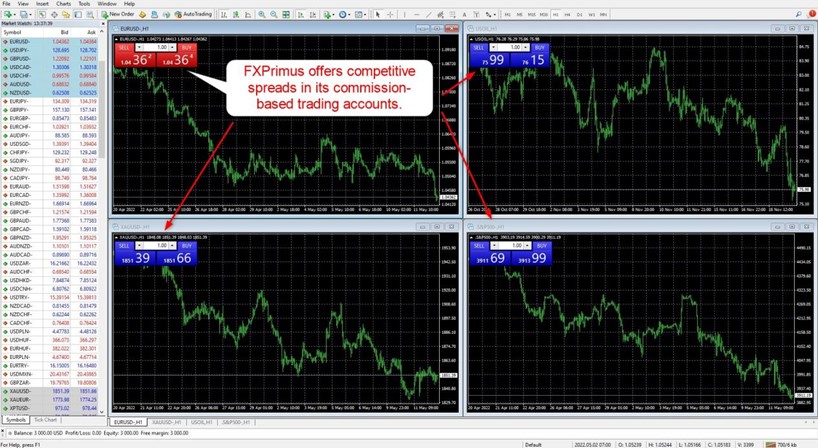

The commission-free pricing environment begins with an expensive 1.5 pips or $15.00 per round lot and is the only one that offers MT4 and cTrader. FXPrimus has two commission-based alternatives, one priced in the mid-section of the market with minimum spreads of 0.3 pips for a commission of $8.00 per lot for total fees of $11.00, and one highly competitive one with raw spreads from 0.0 pips for a commission of $5.00.

Equity trading remains commission-free, and swap rates on leveraged overnight positions remain low, increasing the cost advantage for active, leveraged traders. I highly recommend the Primus Zero account, which ranks among the cheapest ones available.

Here is a screenshot of the FXPrimus quotes in their MT4 during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The minimum trading costs for the EUR/USD in the three account types at FXPrimus:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

1.5 pips (Classic) | $0.00 | $15.00 |

0.3 pip (Pro) | $8.00 | $11.00 |

0.0 pips (Zero) | $5.00 | $5.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- FXPrimus offers a positive swap on qualifying short positions, where traders get paid money to hold trades overnight

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-based Primus Zero account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

0.2 pips | $5.00 | -$8.8205 | X | $15.8205 |

0.2 pips | $5.00 | X | $2.9580 | $4.0420 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

0.2 pips | $5.00 | -$61.7435 | X | $68.7435 |

0.2 pips | $5.00 | X | $20.7060 | -$13.7060 |

Range of Assets

FXPrimus maintains a relatively small asset selection with only 130+ assets, where Forex traders get the best sector coverage. It makes FXPrimus well-suited for traders requiring few but liquid trading instruments. Cryptocurrencies are notably missing, but I like the trading conditions for Forex scalpers

Asset List Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

ETFs |

FXPrimus Leverage

Forex traders at FXPrimus (through the Vanuatu entity) get maximum leverage of 1:1000 in the Prime Cent, Classic, and Pro accounts and 1:500 in the Primus Zero alternative. It is a highly competitive offer, providing traders with an edge. Negative balance protection exists, ensuring traders cannot lose more than their deposit.

Forex traders through the Cyprus entity get maximum Forex leverage of 1:30 according to CySEC regulation.

FXPrimus Trading Hours (GMT +3)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Not applicable | Not applicable |

Forex | Monday 00:05 | Friday 23:55 |

Commodities | Monday 01:05 | Friday 23:30 |

European CFDs | Not applicable | Not applicable |

US CFDs | Monday 16:30 | Friday 23:00 |

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

FXPrimus features four account types, including one Cent account, only available with the MT4 trading platform. The Classic account is the only one featuring cTrader. Cent and Classic are more expensive commission-free accounts, while Pro and Zero are commission-based, where the latter ranks among the cheapest ones and the account type I highly recommend at FXPrimus. A volume-based rebate program would be an improvement.

FXPrimus Demo Account

FXPrimus offers traders demo accounts and does not list a time limit on its website. Demo accounts are ideal for testing new trading strategies and bug-fixing algorithmic trading solutions. Traders can swiftly create them in MT4/MT5, but I recommend a demo account balance similar to their planned live deposit. I also want to caution beginner traders against using a demo account as an educational tool. It creates unrealistic trading expectations, and the absence of trading psychology negates the educational value.

Trading Platforms

FXPrimus offers the core MT4, MT5, and cTrader trading platforms but does not provide any MT4/MT5 plugins necessary to upgrade the out-of-the-box versions to cutting-edge trading platforms. All three fully support algorithmic trading and have embedded copy trading services. Traders may use a desktop client, a lightweight, web-based alternative, and a mobile app. FXPrimus maintains the necessary infrastructure enabling all strategies, especially if traders have proprietary tools.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

FXPrimus does not really have any unique features, as it focuses on a competitive core trading environment, which I believe it has achieved with its Primus Zero account.

Research and Education

FXPrimus does not offer research and functions as an execution-only broker. Given the wealth of free and paid-for research available online, I do not consider its absence a negative. While it creates a services gap with many competitors, FXPrimus maintains a competitive environment suited for advanced high-frequency traders who do not require research.

Education for beginners consists of videos and written content. The former has eleven video tutorials, which guide beginner traders through the account opening, verification, and funding, installing the MT4 trading platform and registering as a partner.

The written content features high-quality and well-written topics. I recommend beginners read them to understand some basics before enhancing their education with trusted third-party sources available online free of charge.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |    |

FXPrimus provides 24/5 customer support, ensuring traders have access when financial markets are open. Traders may e-mail, use a web form, or messenger apps Messenger, WhatsApp, WeChat, Zalo, Line, and Telegram.

Regrettably, phone support is unavailable, and a direct line to the finance department where is missing. I recommend the messengers for non-urgent questions. FXPrimus explains its products and services well, but an FAQ section is unavailable. This could result in beginner traders engaging with customer support more than usual.

Bonuses and Promotions

At the time this review was written, FXPrimus listed a 25% deposit bonus through its Vanuatu subsidiary, accessible from the back office after registration, as FXPrimus does not list it publicly. A partner account is available, but no details concerning the affiliate offer exist. Terms and conditions apply, and I recommend traders read and understand them before accepting any bonus.

CySEC prohibits bonuses.

Awards

FXPrimus has received nine industry awards from well-respected sources. They are a testament to the ongoing effort by FXPrimus to maintain a competitive edge for its clients.

Among the nine FXPrimus awards are:

- Best Asian Forex Support - International Investor Magazine 2019

- Most Trusted Broker SE Asia & Africa - International Investor Magazine 2020

- Best Forex Introducing Broker Program in Africa - Global Forex Awards 2020

- Best Forex Broker SE Asia - Finance Derivative Magazine 2020

- Best Partner Program Southeast Asia - Finance Derivative Magazine 2021

- Best Partner Program South Africa & SE Asia - International Investor Magazine 2021

I highlight the awards for the best partner program in Southeast Asia, a core market for FXPrimus, and South Africa.

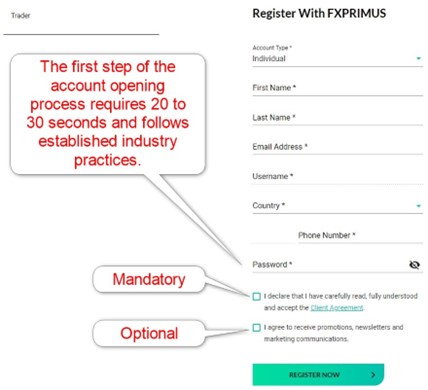

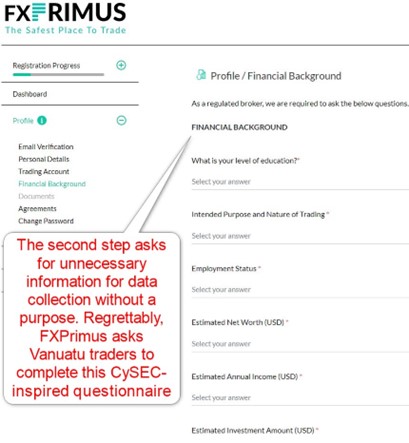

Opening an Account

A short online application form grants new clients access to the back office. It asks for a name, e-mail, username, country, and phone number. Unfortunately, FXPrimus includes unnecessary questions, which are normal for CySEC brokers, to Vanuatu clients.

FXPrimus complies with KYC/AML requirements and requires all users to pass verification. New users must submit a copy of their government-issued ID, preferably a passport, and one proof of residency document.

Minimum Deposit

The minimum deposit at FXPrimus is $15 or a currency equivalent, but the competitive Primus Zero account requires a $1,000 minimum.

Payment Methods

FXPrimus accepts bank wires, credit/debit cards, TrustPay, Neteller, FasaPay, UnionPay, Bitcoin, ecoPayz, Safecharge, and emerchantpay.

Accepted Countries

FXPrimus caters to many international traders except residents of Australia, Belgium, France, Iran, Japan, North Korea, and the USA.

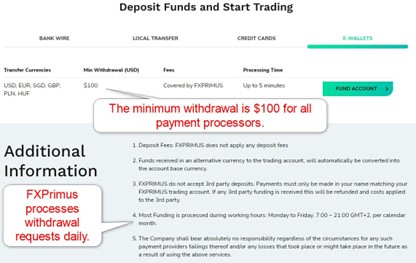

Deposits and Withdrawals

The secure FXPrimus back office handles all financial transactions.

FXPrimus notes that it covers all deposit and withdrawal fees, but third-party costs may apply, dependent on the payment processor. While the minimum deposit is as low as $15, the minimum withdrawal for all payment processors is $100. Processing times vary from up to five minutes for e-wallets to five working days for wire and local transfers.

Bank wires are available in USD, EUR, SGD, GBP, PLN, HUF, ZAR, and BRL. Local options include MYR, IDR, VND, and THB. Credit/debit cards and e-wallets support USD, EUR, SGD, GBP, PLN, and HUF. Only verified trading accounts may request withdrawals, and FXPrimus processes withdrawal requests Monday through Friday between 0700 and 2100 (GMT+2).

Is FXPrimus a good broker?

I like the trading environment at FXPrimus for high-frequency traders in the Primus Zero account, which offers highly competitive trading conditions. The asset selection is small but suits traders who require few but liquid assets, while FXPrimus provides MT4, MT5, and cTrader. Only MT4 is available for the Primus Zero account, where this broker ranks among the leading providers amid high leverage and low costs. FXPrimus is an execution-only broker focused on the core trading environment. It does not offer value-added services but caters to its core market well, making it a good broker for scalpers. The secure back office of FXPrimus handles all financial transactions, where traders have access to ten payment processors. FXPrimus is a market maker/ECN hybrid, meaning its profits from client losses where it acts as the counterparty to a position as a market maker. FXPrimus has its headquarters in Cyprus. The minimum deposit at FXPrimus is $15, but it takes $1,000 to access the Primus Zero account.FAQs

How do I withdraw money from FXPrimus?

Is FXPrimus a market maker?

Where is FXPrimus from?

What is the minimum deposit for FXPrimus?