Anyone who knows me as a trader also knows that I am a strictly technical trader, meaning I base my trades off technical analysis. Rather than trade off fundamental data such as news reports, interest rates, CPIs, etc. (though I do use economic calendars to give me a general indication of the market’s direction), I primarily use price charts to find my trade entries and exits and see where a currency is going.

Particularly when you’re dealing with something so volatile and unpredictable as digital currencies, it’s important not just to have your ear to the ground regarding public sentiment or the latest tweet from Elon Musk, but also to analyze the price movements for more informed and safe trading.

There are 3 things to know before trading cryptocurrencies:

You can trade cryptocurrencies in many ways, and each method has its pros and cons:

You can buy and sell the underlying cryptocurrency through an exchange. When you do this, you own the underlying coin, like owning the underlying share of a company. This method of trading cryptocurrencies is safe and stable if you pick a reputable exchange. The drawbacks are that there’s little access to leverage, and it is not easy to go short on a cryptocurrency.

Some of the larger cryptocurrencies have futures contracts. For example, there are Bitcoin futures on the Chicago Mercantile Exchange (CME). You can access futures contracts through a futures broker. Futures have many advantages such as great leverage, the ability to go long and short, a centralized exchange for pricing and execution, and properly regulated brokers. Futures are not for everyone: most futures brokers require higher account sizes than a Forex or CFD broker, and many do not accept clients from every part of the world.

You can now trade cryptocurrencies through a Forex or CFD broker. They will allow you to go long and short, you can often trade with smaller account sizes compared to futures brokers, and there’s leverage available. Remember, if you use this method, make sure you choose a broker that is properly regulated.

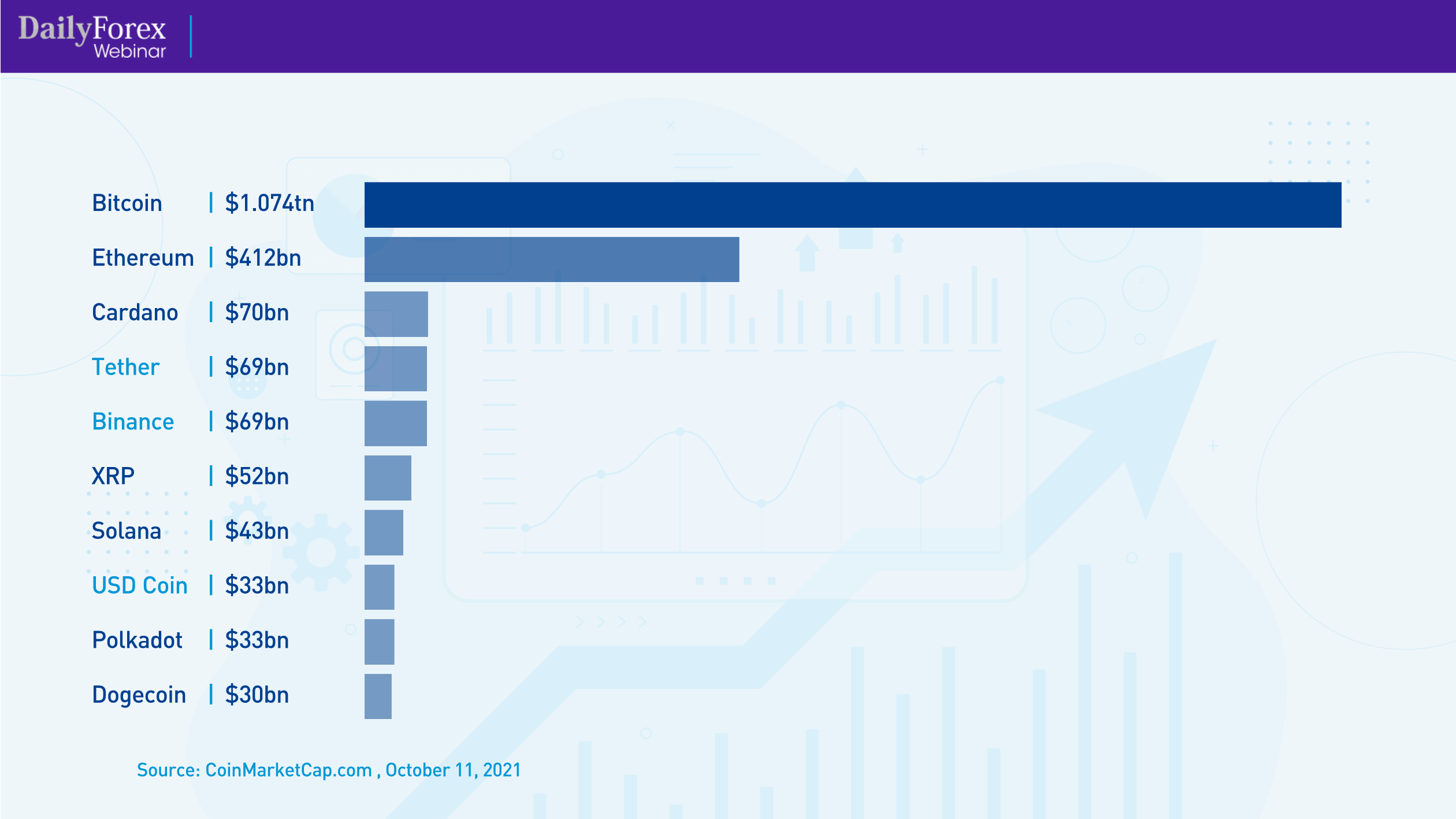

The largest cryptocurrencies today are Bitcoin and Ethereum. Others are much smaller than these two leaders.

Take a look at the market caps for the major cryptocurrencies:

Trading an instrument with high market capitalization and trading volume has lots of benefits. It often lowers the spreads, which is one of your major costs of trading, the technical patterns can be clearer, and there are usually less gaps on the chart to create slippage in your trading.

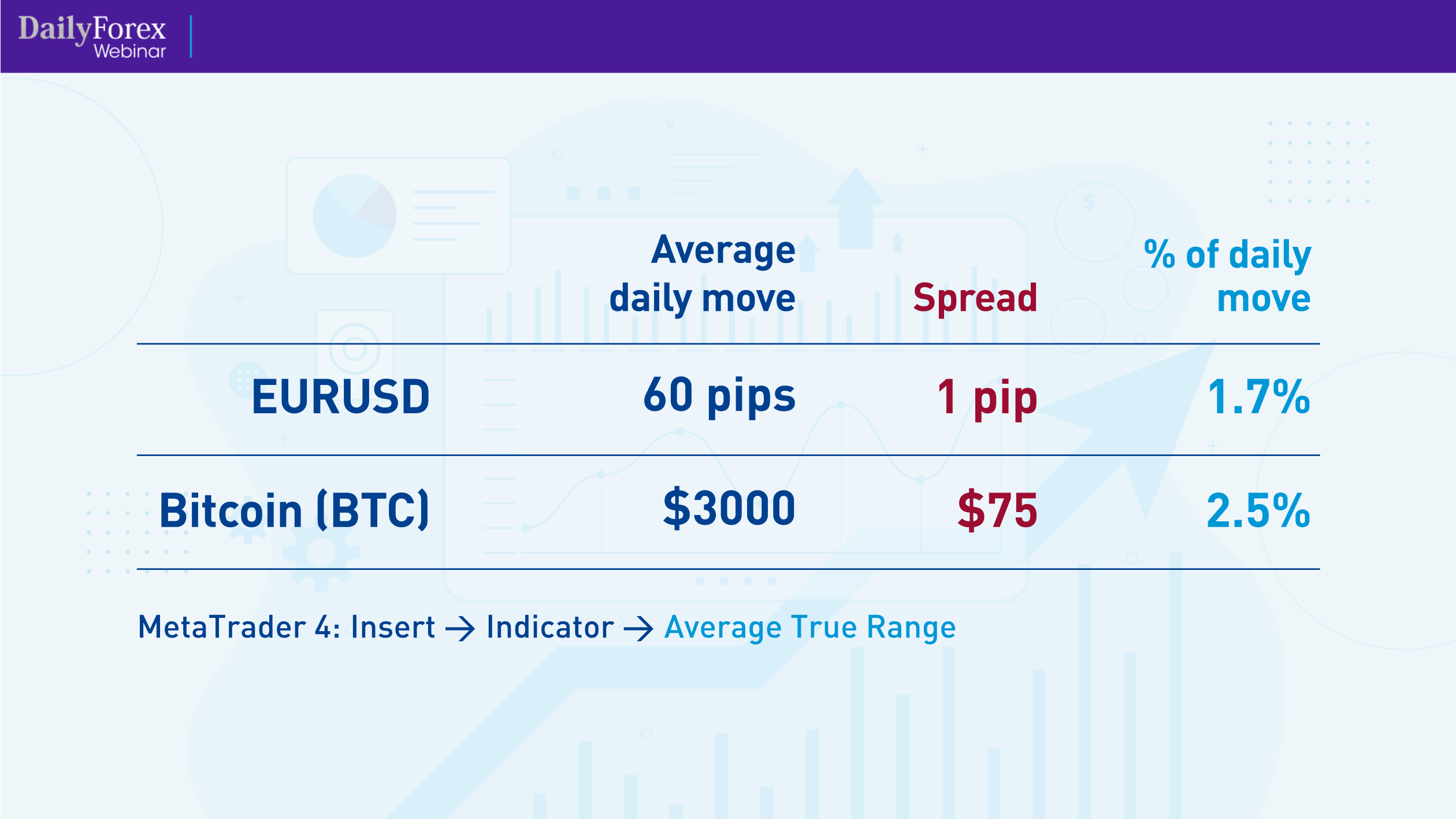

Here’s an example of how to calculate that:

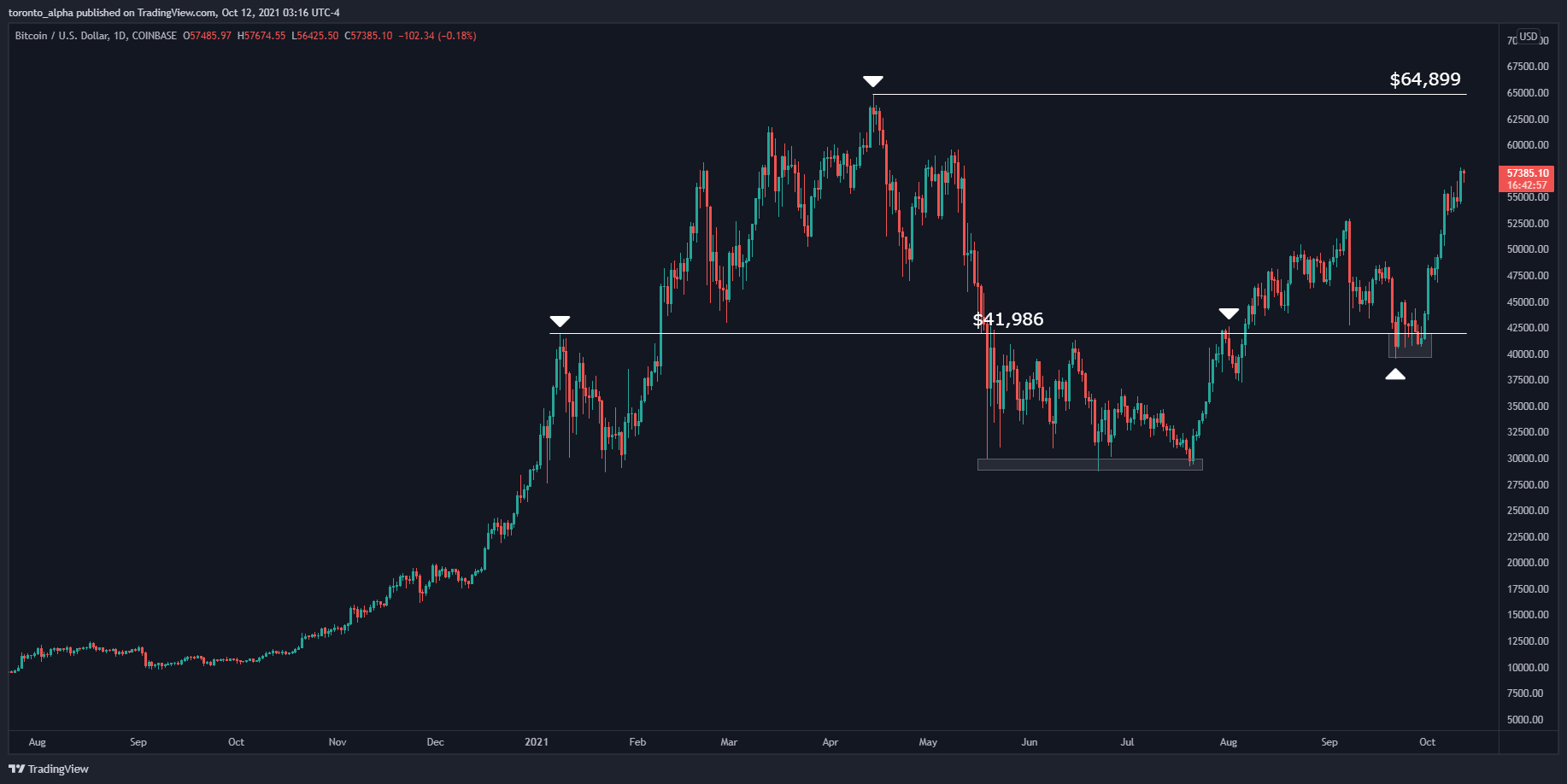

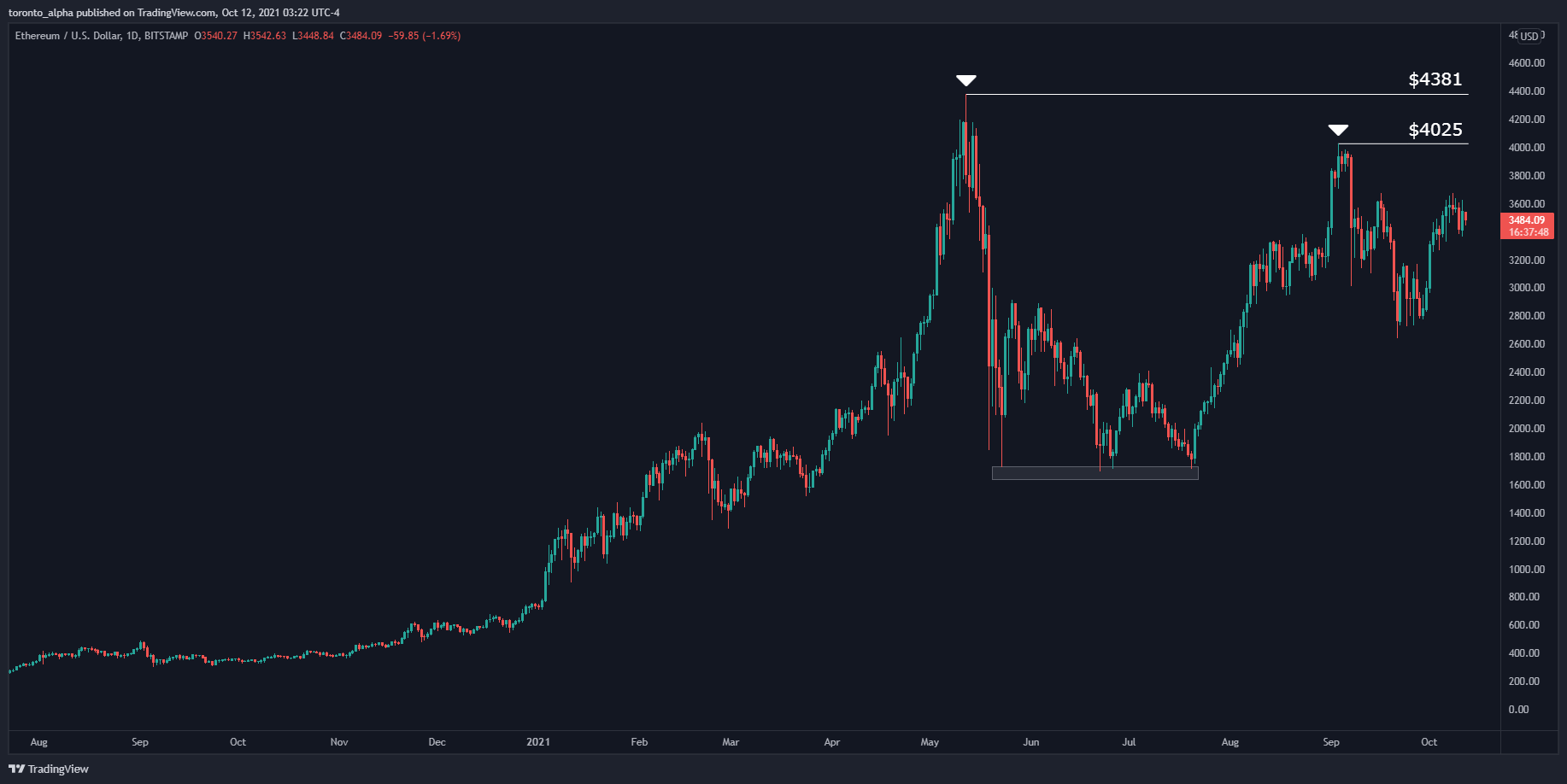

Today, both Bitcoin and Ethereum are off their all-time highs, but both have found supports and have been trending up in recent months.

BTC/USD

ETH/USD

Bitcoin’s trend looks much cleaner compared to Ethereum’s trend. Their previous all-time high prices could act as a resistance, but if successfully broken, there’s not much stopping a new sustainable uptrend. The previous highs could turn into support levels allowing for trade entries.

For more information about cryptocurrencies, go to FXAcademy.com > Learn to trade > cryptocurrency for a 4-part cryptocurrency course. Or click here: https://fxacademy.com/learn/cryptocurrency