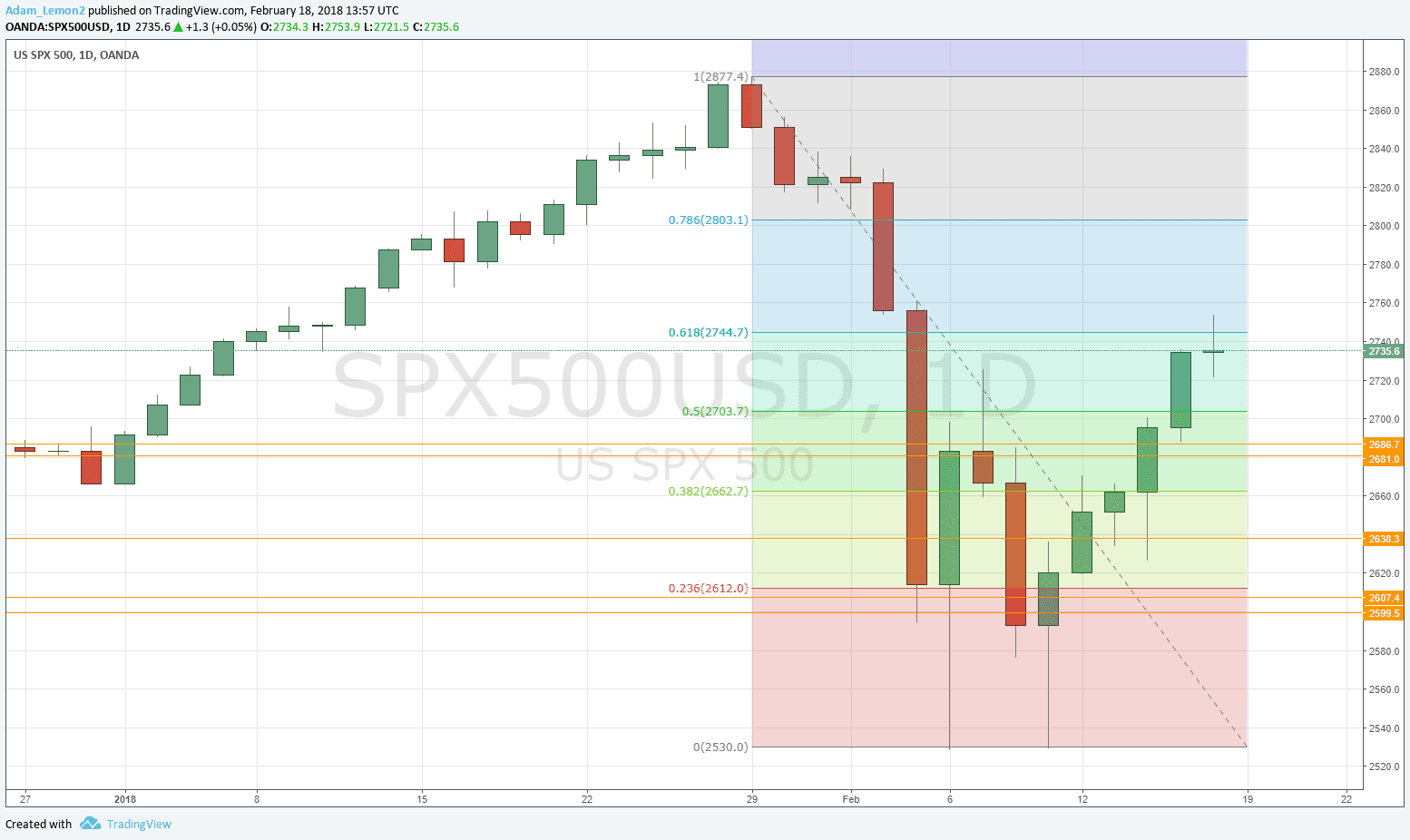

Since the U.S. stock market made a sharp correction against the long, strong bull market at the beginning of this month of February, I have been warning against buying the dip too early. I maintain I was right in theory, but wrong in practice this time, as the market has now recovered about 60% of its drop. I wrote a few days ago that recovering 50% of the correction was a good signal to wait for. So, it looks to be as if its OK to treat it like a bull market and to be buying attractive stocks again.

One item that caught my eye today, which kind of validates my call, is a survey by the private bank UBS Group AG which suggested that only about 10% to 15% of investors bought the dip, although the survey was taken on 5th February at a time when the proverbial “knife” was still falling very sharply. Maybe they were waiting for the market to exceed the 50% retracement level too! The survey said that 84% of the sample were convinced the dip was a temporary phenomenon, so I would like to think so.

One item that caught my eye today, which kind of validates my call, is a survey by the private bank UBS Group AG which suggested that only about 10% to 15% of investors bought the dip, although the survey was taken on 5th February at a time when the proverbial “knife” was still falling very sharply. Maybe they were waiting for the market to exceed the 50% retracement level too! The survey said that 84% of the sample were convinced the dip was a temporary phenomenon, so I would like to think so.

Which major stocks are bouncing back most strongly? There are several major S&P 500 companies that have risen over the past few days, although there are about 20 or so or making new 6-month highs. The bounce-back has seen the strongest rise by sector in Information Technology, closely followed by Financials, with Healthcare in 4th place not far behind. The company most in the limelight as the week ended was AbbVie (ABBV), who made a surprise announcement of a new substantial capital return program. The other standout is most arguably the streaming entertainment provider Netflix (NFLX), which has held its own since gapping up strongly almost a month ago. It closed Friday up almost 11% on the week, less than 3% off its all-time high price.