After a lengthy period of low volatility in the market which finally came to an end a few weeks ago, traders now have a good, active market, but things are not as clear-cut as we might like. Importantly for Forex traders, there are strong long-term trends against the U.S. Dollar, and in favor of the Japanese Yen, Euro, and British Pound, which has provided good trade opportunities in the three major Forex pairs. However, making sense of it all through fundamentals and market sentiment, is not a simple job. What’s going on?

After a lengthy period of low volatility in the market which finally came to an end a few weeks ago, traders now have a good, active market, but things are not as clear-cut as we might like. Importantly for Forex traders, there are strong long-term trends against the U.S. Dollar, and in favor of the Japanese Yen, Euro, and British Pound, which has provided good trade opportunities in the three major Forex pairs. However, making sense of it all through fundamentals and market sentiment, is not a simple job. What’s going on?

Stock markets were falling and the U.S. Dollar and some other safe havens, such as the Japanese Yen, were rising, which is logical. Then higher than expected U.S. inflation data came out yesterday, which initially pushed stocks down and safe havens up, on the logic that the higher inflation would imply a faster pace of U.S. rate hikes. However, after only an hour or two, there was a complete turnaround, with stocks rising quite strongly and the U.S. Dollar falling against almost everything else. This just goes to tell that long-term trends in price tend to speak more predictive truth than any story you can concoct about what is going on, which is why I am skeptical of fundamental analysis in the Forex market.

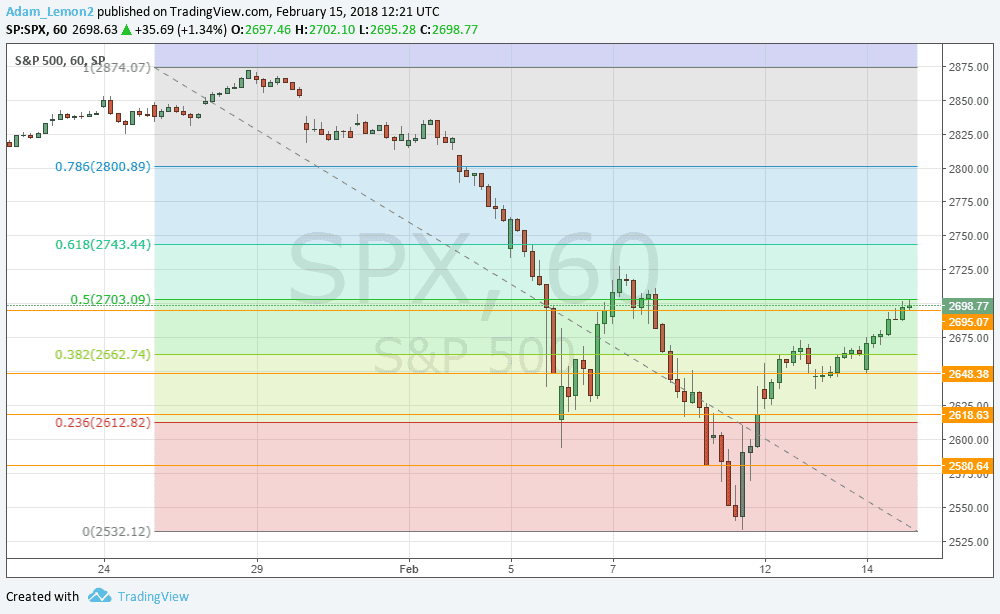

As for the U.S. stock market, it is approaching a crucial point, closing yesterday just underneath the 50% Fibonacci retracement level of its recent correction. In fact, the high of the day (during New York market hours) was bounded by the level very precisely, at 2703:

I would like to see a close later today of the S&P 500 Index above 2703, ideally above the swing high at about 2730, to become very confident that the bullish stock market is back on track