In an otherwise typically quiet Monday market, the price of Crude Oil is up almost 1.7% since this week’s open, as at the time of writing. The price of Crude Oil has been in an upwards trend ever since it bounced at a long-time low price close to $42 – a long trade opportunity that I blogged about at the time.  Unfortunately, I got out of this trade a long time ago, but the price has risen by almost 25% since then, which is a respectable rise for any long-term trade. While I’m on the subject, I’ll point out that holding Crude Oil for a long-term trade, especially with a long position, is extremely expensive: most brokers impose such high overnight financing on long Crude Oil that you end up paying something like 25% of the position size over a year, meaning that if it took a year for Crude Oil to rise by 25% and you exited a long trade held over that time, you would end up breaking even!

Unfortunately, I got out of this trade a long time ago, but the price has risen by almost 25% since then, which is a respectable rise for any long-term trade. While I’m on the subject, I’ll point out that holding Crude Oil for a long-term trade, especially with a long position, is extremely expensive: most brokers impose such high overnight financing on long Crude Oil that you end up paying something like 25% of the position size over a year, meaning that if it took a year for Crude Oil to rise by 25% and you exited a long trade held over that time, you would end up breaking even!

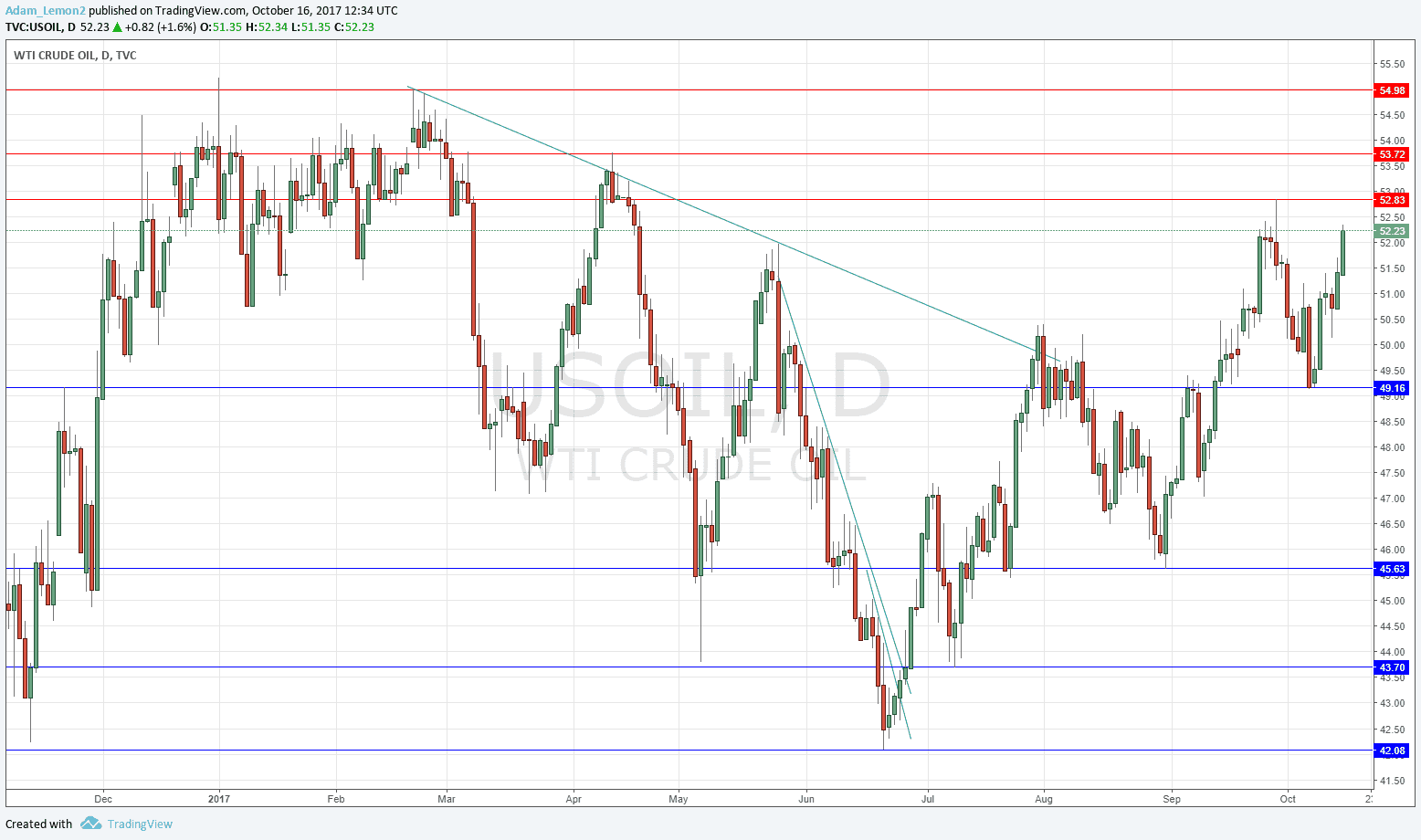

The common explanation given today by most analysts for the rise in Crude Oil is the military clash between Kurdish and Iraqi army forces near Kirkuk, an important oil producing region in northern Iraq. It seems the Americans are working hard to resolve the tension, which will probably evaporate soon. In any case, Kirkuk is not in the territorial zone of the autonomous Kurdish area, whose leaders recently won a referendum on national independence from Iraq. This is a nice theory for the rise, and it might have something to do with why the price is going up today, but I think it is just the usual story of journalists trying to fir news stories to price movements. Looking at a recent daily price chart below, it is obvious that there is nothing happening today with the price of Crude Oil which is out of the ordinary:

Pay more attention to prices than to journalists (including me!).