The market has been quiet so far today, and news is a little thin, so I want to write about the trade I took for my own account yesterday as it illustrates some compound candlestick patterns which I like to use.

The first step I use in looking for trade entries is always to decide what Forex currency pair (or pairs) I should be trading, and in what direction. I try to keep it to a maximum of two. Yesterday morning, I decided that the best probability was going to be looking for long USD/JPY trades and short AUD/USD trades. This was due to the strongly bullish USD momentum we have seen over recent days, with the U.S. Dollar Index reaching new all-time high prices. The AUD and JPY have been the weakest currencies over recent days, which is why I chose them for the short counterparts.

I made two failed trade entry attempts during the early London session and lost a few pips. Later, as the New York session got going, I saw a nice set-up for long USD/JPY and made some positive pips.

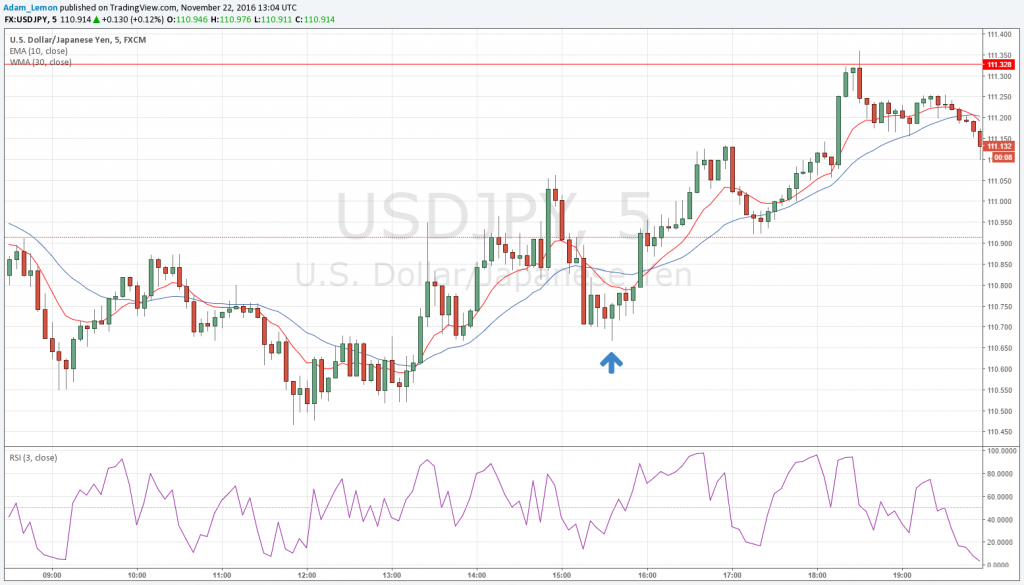

I show the trade entry set-up in the 5-minute chart below. I started looking for a long entry after the candlestick just above the blue up arrow.

Why here? Well, there were some good things about this area:

1. It is a double bottom. The last important low was made in the same area, and that can be seen a few candles to the left.

2. The key low of the day was below this double bottom, and can also be seen to the left on the chart. A higher double bottom is a bullish square root formation.

3. Note that the area of the lows of the double bottom is the same as the high of the previous area of congestion that the lowest low formed. This is a bullish “stair step” patter.

These three factors taken together convinced me that the price would be likely to rise to the next resistance level of 111.33 and maybe beyond that. It did hit 111.33 and was showing signs of going higher, but there was an earthquake in Japan that caused some volatility and turbulence which brought the set-up to a complete end. Fortunately, I took profit below 111.33 so came out ahead.