Bitcoin and other risky assets like stocks pulled back modestly after the strong American non-farm payrolls (NFP) data.

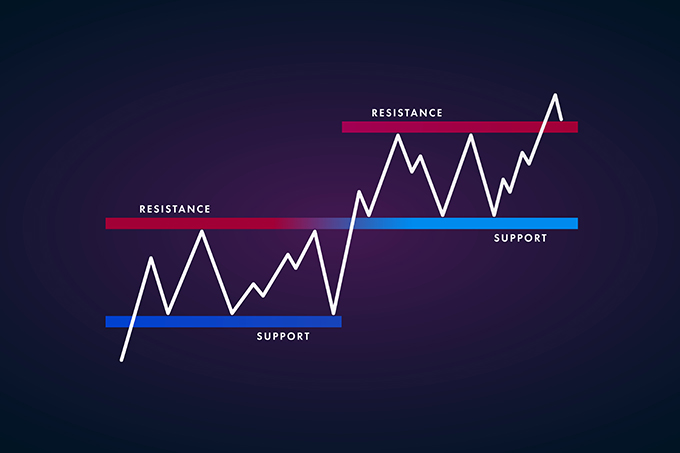

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The AUD/USD plunged below the neckline of the double-top pattern after the spectacular American jobs numbers.

Get the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of February 5th, 2022 here.

Top Regulated Brokers

Speculative traders who enjoy volatility certainly found their objective in the EUR/USD last week.

After touching the 1.24000 vicinity in the middle of last week the GBP/USD managed to essentially destroy a lot of short term bullish optimism with one sword thrust on Friday.

The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

This week I will begin with my monthly and weekly Forex forecast of the currency pairs worth watching.

The West Texas Intermediate Crude Oil market has initially fallen a bit during the trading session on Thursday, only to turn around and show signs of life again.

The USD/CHF rallied a bit during the trading session on Thursday to recover against the Swiss franc.

Bonuses & Promotions

The Thursday session was very negative for gold, as it lost 1.65% by the time New York started to close for business.

The Ethereum market has been very bullish during the trading session on Thursday, reaching the $1700 level.

The BTC/USD market has rallied a bit during the trading session on Thursday as we continue to see US dollar weakness overall.

The USD/JPY has fallen during the trading session on Thursday, and it looks as if we are going to continue to see a lot of negative pressure.

The S&P 500 has taken off to the outside during the trading session on Thursday, as we are now threatening the 4200 level.

The NASDAQ 100 has shot straight up in the air again during the trading session on Thursday, as we continue to see a lot of bullish pressure.

.jpeg)