This week I will begin with my monthly and weekly Forex forecast of the currency pairs worth watching.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

Get the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of February 26th, 2022 here.

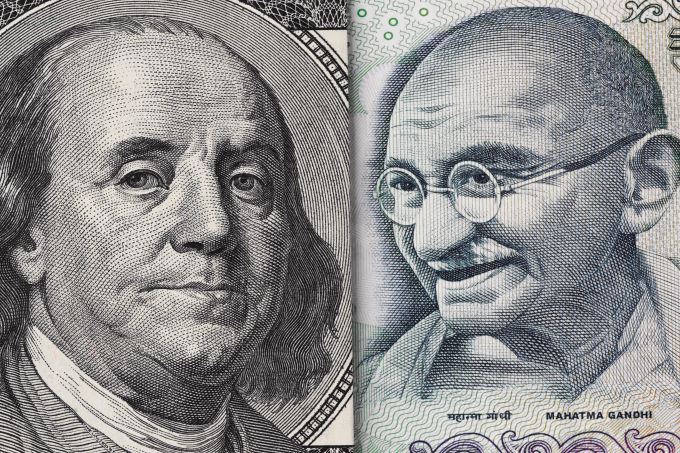

The USD/INR has pulled back a bit during the trading session on Thursday, as the ₹83 level continues to offer a significant amount of resistance.

Top Regulated Brokers

During Thursday's trading session, the S&P 500 has been slightly negative, with the market hovering around the 200-Day EMA and the 50-Day EMA moving averages.

The silver futures contract has shown weakness in the Thursday session as it gapped lower, indicating that the market is uncertain about its next move.

During Thursday's trading session, gold markets showed a lot of choppy behavior, which is consistent with the ongoing volatility in most financial markets.

The West Texas Intermediate (WTI) Crude Oil market showed some upward momentum during Thursday's trading session despite ongoing fluctuations.

The USD/JPY has rallied during Thursday's trading session as the market closely monitors the ¥135 level.

The EUR/USD has been trading around the 1.06 level, showing no clear direction in recent sessions.

Bonuses & Promotions

The GBP/USD experienced fluctuations during Thursday's trading session, as traders remain indecisive around the 1.20 level.

On Thursday, Bitcoin attempted to rally but encountered significant resistance and is now struggling to gain momentum.

The AUD/USD experienced a small rally during Thursday's trading session but continues to remain close to a significant support level.

Since the start of this week's trading, the gold price has been trying hard to breach the $1850 resistance level to avoid a further collapse.

The return of the look of the clear divergence between the future of the Japanese central bank’s policy, even under new leadership, and the policy of the US Federal Reserve.

The GBP/USD may be ready to resume its bullish trend and end its losing streak against the euro after a series of economic and political developments came together to shatter the gloomy economic consensus hanging over the UK economy.