On Thursday, the gold market experienced some pullback but soon recovered and showed signs of life.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The EUR/USD took a significant fall during Thursday's trading session, almost wiping out the gains made on Wednesday against the greenback.

The DAX has shown itself to be rather resilient during the trading session on Thursday as we initially pulled back just a bit during the training session, but buyers came back in to support the German index.

Top Regulated Brokers

The GBP/JPY experienced an initial drop against the Japanese yen during Thursday's trading session, as the market continues to display volatile behavior.

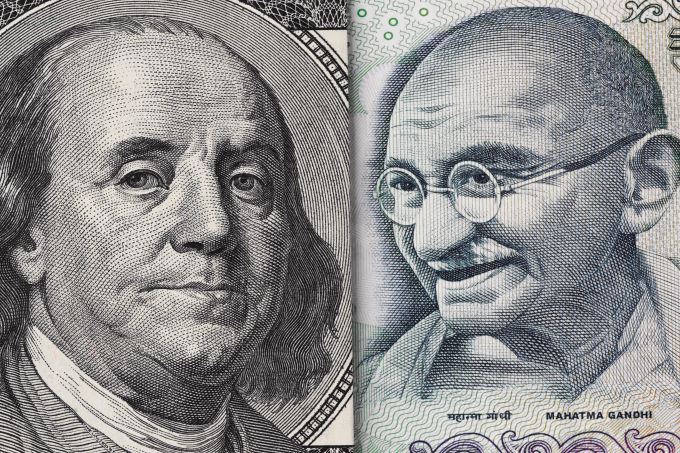

The USD/INR initially tried to rally during the trading session on Thursday but gave up some of its gains against the Indian rupee.

The S&P 500 experienced a dip during Thursday's trading session, falling below the previous downtrend line that had been established at the top of the channel for some time.

During Thursday's trading session, silver experienced a decline following a period of considerable turbulence.

The GBP/USD experienced a slight drop during Thursday's trading session as the US dollar continued to outperform most other assets.

During Thursday's trading session, the AUD/USD experienced a slight drop, as the 0.67 level is considered a potential support level in the market.

Bonuses & Promotions

The TRY/USD stabilized during early trading on Thursday morning.

Spot natural gas prices (CFDS ON NATURAL GAS) stabilized on the rise during its early trading on Thursday, recording slight daily losses until the moment of writing this report, at a rate of -1.61%.

The Dow Jones Industrial Average rose slightly during its recent trading on intraday levels, to achieve almost negligible gains in its last session by 0.02%.

The USD/SGD has turned in a mixed bag of results the past day of trading, and the nervous behavioral sentiment in Forex may provide speculators with intriguing short-term technical opportunities.

The euro was clearly outperforming at the start of the new month as it responded to another higher jump in German bond yields as investors reacted to the surprisingly strong inflation readings.

For two days in a row, the price of XAU/USD gold tried to rebound to the upside and recover from the strong and sharp selling operations.