At the beginning of this week's trading, gold futures prices rose before the important US inflation data this week.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

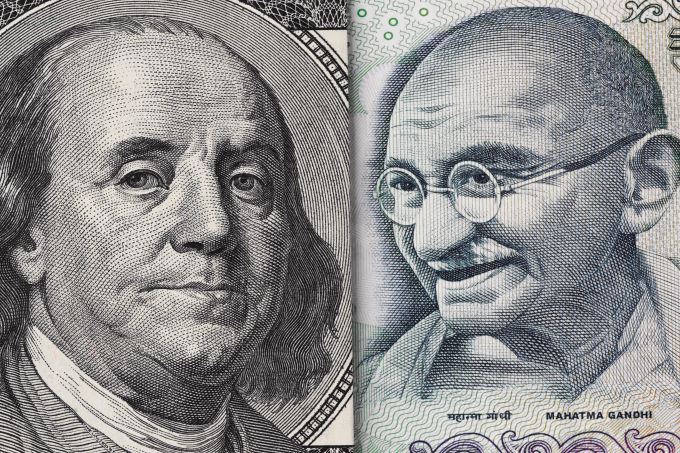

Traders of the USD/INR who have been pursuing downward momentum from the currency pair have likely been given a rude awakening this morning.

Bullish speculators of the NZD/USD likely enjoyed the trend upwards last week which developed and proved to have strength.

Top Regulated Brokers

Silver continues to show plenty of support beneath it and seems to be going sideways, waiting to gather enough momentum to continue its overall uptrend.

Natural gas markets have been rather volatile recently, with a lot of back-and-forth behavior seen during Monday's trading session.

The euro initially rallied a bit against the US dollar on Monday but has given back some of the gains since then.

The crude oil markets have seen a bit of a rebound during Monday's trading session, as they recover from the massive plunge in recent weeks.

The AUD/USD has seen a significant rally in Monday’s trading session, reaching the 200-day exponential moving average (EMA) just below the 0.68 level.

On Monday, the US dollar saw a slight rally during the trading session, with moving averages providing support.

Bonuses & Promotions

The GBP/USD has experienced significant gains again during Monday's trading session as the US dollar continues to depreciate.

On Monday, the S&P 500 saw quiet trading after digesting a significant number of economic announcements.

On Monday, the gold market experienced some stabilization, with buyers taking advantage of dips.

The GBP/JPY gained ground against the Japanese yen during the Monday trading session, with analysts predicting a continued upward trajectory.

The GBP/USD exchange rate jumped to the highest point since May 31st as the focus shifted to the upcoming US inflation data and the Bank of England (BoE) interest rate decision.

Bitcoin retreated to the lowest level since April 25 as concerns about the crypto market continued.