The S&P 500 made an initial attempt to rally during Thursday's session, yet it continues to grapple with considerable resistance just above.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The EUR/USD initially made an attempt to rally during Thursday's trading session, only to make an about-face and exhibit signs of negativity.

The moves of the US dollar showed a lot of volatile dynamics during the initial stages of Thursday's trading session, mirroring the resilience observed on the previous day.

Top Regulated Brokers

The crude oil markets experienced a noteworthy uptick during Thursday's trading session, coinciding with the pivotal OPEC meeting.

The AUD/USD embarked on a tumultuous journey in the recent trading session, mirroring the capricious nature of market participants.

The EUR/USD enjoyed a solid month of climbs upwards for traders who were lurking with their bullish sentiment and now may feel stronger action if possible.

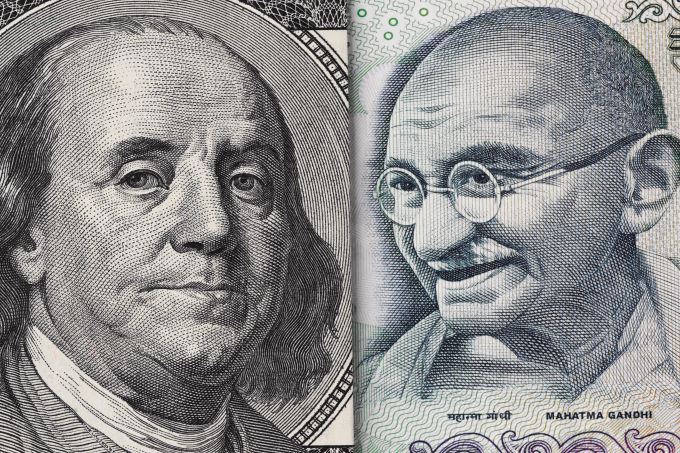

The price movement within the USD/INR has produced a rather curious move higher in a rather polite fashion, this if the currency pair’s two violent spikes during November can be forgotten.

The USD/ZAR produced a rather turbulent price range during the month of November for speculators within a known value realm; questions need to be asked about December’s outlook.

The S&P 500 has been explosive during the month of November, taking off and breaking out of a massive bullish flag pattern.

Bonuses & Promotions

The NASDAQ 100 has been explosive to the upside during the trading month of November, as interest rates have fallen quite drastically in the bond market.

December could be a pretty wild month for the crude oil markets, as we are currently waiting to find out whether or not OPEC will cut production.

The USD/MXN has seen a lot of volatility during November, ultimately dropping down toward the 17.06 pesos level, only to turn around and bounce at the end of the month.

As we enter the month of December, we are at a major resistance barrier that has caused quite a few problems in the past.

The S&P 500 once again staged a rally during Wednesday's trading session, edging ever closer to the pinnacle of overall market highs and teasing the prospect of a complete breakout.

The natural gas markets faced a significant setback in Tuesday's session, as news emerged of a potentially mild weather pattern in the United States lasting until mid-December.