As you can see, we have somewhat dropped value in the WTI crude oil grade while we keep circling the 200-day EMA.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The price of bitcoin slightly declined at the $52,000 mark, which is, of course, a level at which many people have been keeping a careful eye on it.

During Thursday's trading session, silver made an initial attempt to rise and reached the 200-Day EMA.

Top Regulated Brokers

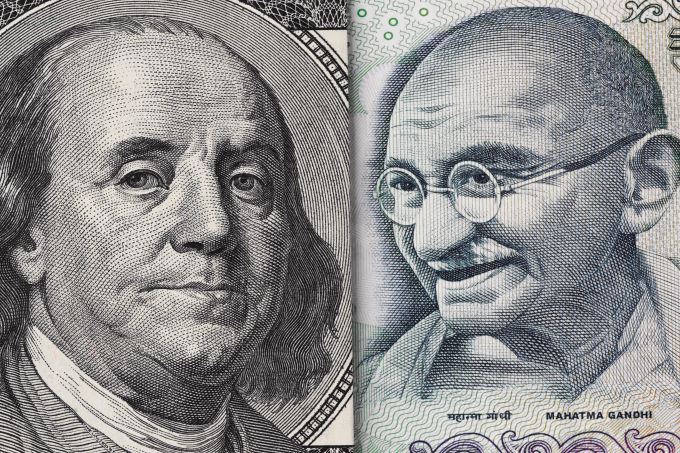

The US dollar was relatively quiet during the early hours of Thursday's trading session.

The S&P 500 experienced a large increase during Thursday's early trading session.

The Australian dollar rose to test the 200-Day EMA indication in addition to the 50-Day EMA.

The early hours of Thursday saw a large rally in the euro since there is still a lot of erratic behavior.

The NASDAQ 100 rallied during the early hours on Thursday as we continue to see bullish behavior.

Support levels for the USD/PRK recently have tested the 279.0020 earlier this morning and on Friday of last week.

Bonuses & Promotions

Recent momentum in the USD/INR has certainly shown an incremental move lower.

Gold prices are trading higher for the sixth consecutive session, riding a wave of US dollar weakness.

Attempts to rebound higher for the GBP/USD currency pair still lack strong momentum to confirm a return to the upward path.

EURUSD rises to 1.0835 post-Fed; Eyes on 1.0885, 1.0930, 1.1000 levels.

The USD/JPY currency pair remained bullish.

During the Wednesday training session, the gold market was optimistic as we continue to witness a notable rally.